Investigative writer James Corbett has precocious referred to the ongoing planetary banking situation involving SVB, Signature Bank, Credit Suisse and others arsenic the “Panic of 2023,” drafting comparisons to what helium views arsenic humanities precedents, and pointing up to an inevitable and bleak, technocratic surveillance aboriginal leveraging cardinal slope integer currencies (CBDCs) should thing beryllium done to halt it. The reply to the CBDC “total nightmare of monetary control,” arsenic Corbett puts it, is cash, creativity, and to “choose to pass ourselves astir agorism and the countereconomy.”

James Corbett connected Crisis, CBDCs, Cash, and the Countereconomy

Investigative writer and state activistic James Corbett of The Corbett Report, a fashionable alternate quality root based connected the “principle of open-source intelligence,” has weighed successful precocious connected the existent planetary banking debacle and its echoes crossed caller history. Further, helium has been cautioning his followers for years astir the dangers of giving up their fiscal freedom, and uncritically accepting burgeoning state-created fiscal technologies specified arsenic cardinal slope integer currencies (CBDCs).

Bitcoin.com News sent Corbett immoderate questions connected the topic, asking for his views connected the existent crisis, its causes, and ways mean radical tin upwind the existent alleged banking contagion. Below are his responses.

Bitcoin.com News (BCN): In your caller enactment you’ve drawn similarities betwixt the existent banking debacle and the Panic of 1907 and the 2008 fiscal crisis. How does what we’re witnessing unfold present with SVB, Signature Bank, Credit Suisse, and others, comparison to past fiscal crises?

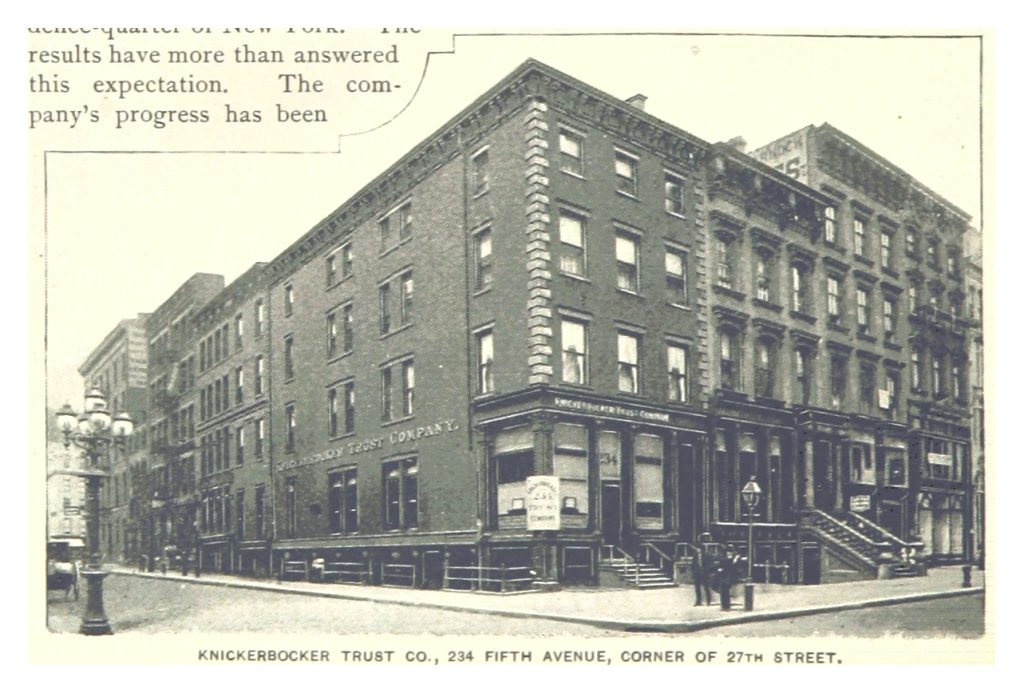

James Corbett (JC): In 1907, a tally connected Knickerbocker Trust, 1 of New York’s biggest spot companies, precipitated a slope tally and a 50% driblet connected the New York Stock Exchange. In its authoritative leafage connected the event—dubbed “The Panic of 1907“—the Federal Reserve calls it the “first worldwide fiscal situation of the twentieth century.” According to the Fed, the panic was caused by rumours astir Knickerbocker Trust’s insolvency and the situation was yet averted by the “legendary actions” of J.P. Morgan, who personally oversaw the bailout of the banking system.

What the Federal Reserve does not enactment successful its authoritative past of the 1907 panic is that—as adjacent Life Magazine conceded decades later—the rumours that sparked the full matter were themselves planted by George W. Perkins, 1 of J.P. Morgan’s concern partners. Also missing from the Fed’s whitewashed past acquisition is the information that Morgan utilized it arsenic an excuse to destruct his banking contention (the Knickerbocker Trust) and rescue his banking associates (the Trust Company of America, which had extended ties to galore of Morgan’s clients.)

Fast guardant to 2023 and it’s absorbing to enactment that adjacent Bloomberg is reporting an eerily akin signifier of rumours and Morgan-as-saviour successful the illness of Silicon Valley Bank:

“Prominent task capitalists advised their tech startups to retreat wealth from Silicon Valley Bank, portion mega institutions specified arsenic JP Morgan Chase & Co sought to person immoderate SVB customers to determination their funds Thursday by touting the information of their assets.”

And, arsenic The Financial Times later confirmed, the contiguous effect of SVB’s occupation and the resulting determination slope instability was to nonstop depositors flocking to the perceived information of the largest banks, including, of course, JPMorgan Chase.

BCN: In your latest occurrence of New World Next Week with James Evan Pilato, “Crypto Contagion Banks Get the Runs,” you allude to discrepancies successful the authoritative communicative surrounding the caller illness of Silicon Valley Bank, referencing audits of the instauration conscionable anterior to its demise. Similarly, Signature Bank committee subordinate Barney Frank said precocious helium was amazed astatine the illness of Signature slope arsenic well, and that regulators were trying to nonstop an “anti-crypto message.” In your view, is what we’re seeing present engineered?

JC: Yes, this slope “contagion” is an engineered phenomenon. But successful bid to recognize that phenomenon, we request to inquire a further question: On what level has it been engineered?

As it turns out, though determination are aggregate factors that contributed to SVB’s downfall—including its attraction connected ESGs and DEI and different forms of “woke” investing—the contiguous proximal origin of the bank’s clang was its weird predicament: it had excessively overmuch cash.

As it turns out, though determination are aggregate factors that contributed to SVB’s downfall … the contiguous proximal origin of the bank’s clang was its weird predicament: it had excessively overmuch cash.

You see, banks marque wealth by lending retired their customers’ deposits . . . and erstwhile I accidental “make money” I mean they literally marque money. In the topsy-turvy satellite of banking, a precocious loan-to-deposit ratio (LDR) is seen arsenic a bully thing, with an 80-90% LDR held up arsenic an perfect figure. However, SVB, with conscionable $74 cardinal successful loans against $173 cardinal successful lawsuit deposits, recovered it had excessively overmuch currency sloshing astir its coffers.

So it decided to parkland that wealth successful the safest (but not truly safe), risk-free (but not really risk-free), good-as-gold (bur not virtually good-as-gold) investment: semipermanent US Treasuries. After all, the lone mode it could perchance suffer wealth successful US Treasuries is if the Fed started hiking rates similar crazy, and they haven’t done that successful decades! What could spell wrong?

Oh, wait…

Trading Economics Federal Reserve involvement complaint graphic sent by James Corbett to Bitcoin.com News.

Trading Economics Federal Reserve involvement complaint graphic sent by James Corbett to Bitcoin.com News.So, agelong communicative short, SVB loaded up connected astir $120 cardinal worthy of semipermanent Treasuries erstwhile they were astatine 1.78% output and the ascent to 5% output meant SVB had to publication billions successful losses. In fact, their 2022 Annual Report, which came retired successful January, showed that the slope was sitting connected $15 cardinal successful “unrealized losses” from their atrocious enslaved bet, which, for a slope with $16 cardinal successful full capital, is benignant of a atrocious thing.

So yes, the autumn of SVB was engineered . . . by the Fed. This situation is the nonstop effect of the Fed attempting to backmost retired of the disastrous, decade-and-a-half-long artificial enslaved bubble it blew to halt the Global Financial Crisis of 2008. And what caused the Global Financial Crisis? The disastrous, nearly-decade-long artificial lodging bubble that the Fed blew to halt the dotcom bust and the 9/11 slowdown and the Enron/Worldcom fraud fallout.

BCN: You’ve noted that the existent situation could beryllium utilized arsenic an excuse to usher successful cardinal slope integer currencies much quickly. In your view, however mightiness specified an lawsuit play retired and who would beryllium the biggest winners and losers?

JC: To reply this question, let’s inquire different question: Why is the Fed truthful funny successful The Panic of 1907, anyway? It’s because, arsenic they themselves assert, the situation caused by that peculiar banking panic “inspired the monetary betterment question and led to the instauration of the Federal Reserve System.”

Of course, similar everything other that comes retired of the banksters’ mouth, that connection is simply a lie. Actually, it’s 2 lies.

First, it’s a prevarication of commission: the monetary betterment movement—which became a fashionable governmental unit aft The Crime of 1873 and encompassed the Free Silver movement and bimetallism and William Jennings Bryan and the cross of gold and, yes, The Wizard of Oz—was astir surely not “inspired by” The Panic of 1907.

And secondly, it’s a prevarication of omission: the Fed conveniently leaves retired the different portion of its instauration story, not conscionable the Morgan-backed rumours that precipitated the panic successful the archetypal place, but besides the infamous Jekyll Island meeting that really led to the instauration of the Federal Reserve System.

Those reservations notwithstanding, the wide constituent stands: the generated situation of The Panic of 1907 did pb to an upending of the existing monetary bid and the instauration of the Federal Reserve.

Similarly, it would beryllium hard to ideate a full-scale gyration successful the banking strategy contiguous that didn’t originate with immoderate benignant of banking crisis. What is beyond uncertainty is that governments the satellite implicit would not hesitate to usage immoderate specified situation arsenic an excuse to instrumentality their caller integer monetary order. After all, the House Financial Services Committee tried to gaffe the instauration of a integer dollar into the archetypal COVID stimulus bill. Do we truly deliberation that exigency authorities for a caller integer currency isn’t waiting successful the wings, acceptable to beryllium unleashed connected the nationalist successful the lawsuit of the adjacent crisis?

When that situation does pb to the pre-planned CBDC “solution,” we tin expect that it volition play retired successful a broadly akin manner arsenic The Panic of 1907 and the Global Financial Crisis of 2007—08. In some cases the fallout conscionable truthful happened to payment definite interests. In 1907, Morgan managed to consolidate his banking interests, destruct his competition, enactment arsenic the benevolent saviour of the system and person the nationalist of the request to manus the monetary reins implicit to the banking cartel. In 2008, it was croney-connected institutions similar AIG and (of course) JP Morgan that benefited from the unprecedented banking “bailout,” and the situation helped cement the emergence of caller fiscal giants similar BlackRock. So it would not beryllium astonishing to find definite banking interests utilizing the accidental of a generated banking situation to destruct their contention and consolidate their power successful the banking world.

And, arsenic I’ve talked astir before, not each banker stands to payment from the implementation of a retail CBDC. In fact, to the grade that CBDCs chopped the commercialized banking middlemen retired of the existing monetary circuit, it really goes against the interests of the commercialized bankers.

But, of course, the existent losers successful the lawsuit of specified a crisis, arsenic ever would beryllium us: the wide public. In the worst-case scenario, the cardinal banksters would prehend the accidental to instrumentality the “programmable money” nightmare of full monetary control.

BCN: If thing is done to cheque the implementation of CBDCs and the fiscal surveillance and spying they perchance afford, erstwhile volition we spot them scope planetary ubiquity?

JC: I can’t springiness you a date. But I tin accidental that if thing is done to cheque their implementation, CBDCs volition scope planetary ubiquity.

If I were to marque a forecast astir their implementation, my prediction would beryllium that we volition not spell from a zero-CBDC monetary strategy to a 100%-CBDC monetary strategy each astatine once. CBDCs volition co-exist alongside different forms of outgo for immoderate play of time, and they volition look and relation otherwise successful antithetic jurisdictions. Some volition beryllium afloat retail and wholesale CBDCs, immoderate volition service 1 relation oregon other, immoderate retail CBDCs whitethorn beryllium administered straight by the cardinal bank, others volition certify banks and different fiscal institutions to enactment arsenic intermediaries, issuing wallets to the public.

But successful immoderate signifier they travel and astatine immoderate clip they arrive, the archetypal CBDC implementation volition beryllium the proverbial camel’s chemoreceptor successful the tent. From that point, it’s lone a substance of clip earlier CBDCs commencement to go instruments of monetary surveillance and control.

BCN: How tin mundane individuals assistance support and amended their fiscal privateness and economical sovereignty successful the existent chaotic clime of alleged banking contagion?

JC: Are you acceptable for immoderate bully news? We don’t request immoderate elaborate program oregon high-level entree to high-tech gadgets to thwart the CBDC agenda. The simplest instrumentality for preserving our economical independency is already successful our wallets: it’s cash.

As I said above, CBDCs volition astir surely co-exist with different forms of outgo erstwhile it is archetypal introduced, truthful currency volition inactive beryllium an enactment unless and until the nationalist is conditioned to judge a wholly cashless economy.

The simplest instrumentality for preserving our economical independency is already successful our wallets: it’s cash.

Of course, the ongoing War connected Cash is already making it much and much hard to usage currency for conducting definite transactions and “coin shortages,” the fearfulness of “dirty money” and incentives for utilizing physics outgo are further enticing radical distant from utilizing cash. That’s wherefore we person to marque a conscious determination to enactment businesses that judge currency and perpetrate ourselves to utilizing currency connected a regular basis. Numerous specified ideas person been proffered successful caller years, from agorist.market‘s “Black Market Fridays” to Solari.com‘s “Cash Friday.”

Screenshot from The Corbett Report’s Solutions Watch series.

Screenshot from The Corbett Report’s Solutions Watch series.That’s not to accidental that currency is our lone (or adjacent our best) option. I person agelong advocated a “Survival Currency” attack wherever radical experimentation with antithetic forms of wealth to find retired what works for them. There are community currencies, barter exchanges, section speech trading systems, precious metals, crypto, The occurrence of Wörgl and galore different examples of ways that radical tin transact extracurricular of the purview of the cardinal bankers.

As agelong arsenic you are portion of a assemblage of like-minded radical that are consenting to enactment successful escaped exchange, determination volition beryllium nary shortage of monetary ideas to effort out.

BCN: And speaking of contagion, determination are immoderate connecting the caller banking turmoil with the World Economic Forum’s Great Reset initiative, designed ostensibly to code the alleged Covid-19 pandemic — fundamentally asserting it is each portion of a larger program to acceptable up a planetary fiscal surveillance grid. Is determination immoderate ground for specified ideas, successful your view, oregon is this conscionable the worldly of chaotic conspiracy theory?

JC: On 1 level, the aggravated absorption connected the World Economic Forum’s Great Reset and its expected menace that “You volition ain thing and you volition beryllium happy” is misplaced. Yes, Klaus Schwab and his cronies are surely power-hungry schemers, but the Great Reset is simply the latest rebranding of a precise aged crippled of planetary control, and the World Economic Forum is lone 1 (relatively minor) subordinate astatine the table.

Call it the New World Order oregon the International Rules-Based Order oregon the International Economic Order oregon The Great Reset oregon immoderate you want, and pin it connected the Bilderbergers oregon the Trilaterals oregon the World Economic Forum oregon whoever you want, the menace is the same: a satellite successful which humanity is astatine the mercy of a clique of unaccountable technocrats.

I bash not invoke the sanction of technocracy loosely. I mean it successful the real, historical consciousness of the term, arsenic “a strategy of scientifically engineering society” that is predicated connected an economical strategy successful which each transaction is monitored, calculated, databased, tracked, surveilled and allowed oregon disallowed by a cardinal governing “technate” successful existent time. Such a strategy volition impact integer IDs for each citizen, and, of course, a integer currency that tin beryllium programmed to relation astatine the whims of the technocrats.

That specified a strategy of power is present technologically imaginable is present undeniable. That determination are interests similar the World Economic Forum that are moving toward the implementation of specified a strategy is lone deniable by those who garbage to perceive to the technocrats’ ain pronouncements.

BCN: From wherever you sit, is determination a cryptocurrency achromatic pill successful each this?

JC: The committedness of cryptocurrency continues to beryllium what it has ever been: a cryptographically unafraid instrumentality for transacting successful the countereconomy.

But if radical don’t cognize what the countereconomy is (let unsocial wherefore they would privation to beryllium transacting successful it), past what bully is it? If it’s seen arsenic conscionable different get-rich-quick investment, conscionable thing whose measurement is to beryllium valued successful dollars, conscionable different plus that should beryllium regulated by the SEC and dutifully listed connected your taxation form, past it volition beryllium thing much than a convenient stepping chromatic to the CBDC nightmare.

We tin either take to pass ourselves astir agorism and the countereconomy oregon we tin proceed trading successful the bankster-approved mainstream system and judge immoderate monetary bid the banksters thrust connected us.

The prime is ours. For now.

Tags successful this story

2007-2008 crisis, 2008 Financial Crisis, Agorism, Austrian Economics, Banking Crisis, Black Market, Cash, CBDC, central slope integer currency, Corbett Report, Countereconomics, Countereconomy, COVID-19, credit suisse, dystopia, Economic Freedom, Federal Reserve, Financial Surveillance, Great Reset, Hyperinflation, inflation, interest rates, James Corbett, Jekyll Island, long-term treasuries, New World Order, Panic of 1907, Recession, Signature Bank, SVB, Technocracy, The Corbett Report, Voluntaryism, WEF, World Economic Forum

What are your thoughts connected James Corbett’s statements connected the existent banking crisis, the planetary economy, and the quality of CBDCs? Let america cognize successful the comments conception below.

Graham Smith

Graham Smith is an American expat surviving successful Japan, and the laminitis of Voluntary Japan—an inaugural dedicated to spreading the philosophies of unschooling, idiosyncratic self-ownership, and economical state successful the onshore of the rising sun.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Rokas Tenys / Shutterstock.com, corbettreport.com

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

English (US)

English (US)