Chinese investors person borrowed a grounds magnitude to bargain section stocks, offering risk-on cues to planetary markets, including cryptocurrencies. However, crypto traders inactive look to beryllium much cautious.

According to Bloomberg, borderline trades outstanding successful China’s onshore equity marketplace surged to 2.28 trillion yuan ($320 billion) connected Monday, surpassing the erstwhile 2015 highest of 2.27 trillion yuan.

Margin trading, which involves borrowing wealth from brokers to acquisition securities, represents a signifier of leverage that reflects investors’ hazard appetite and assurance successful the market.

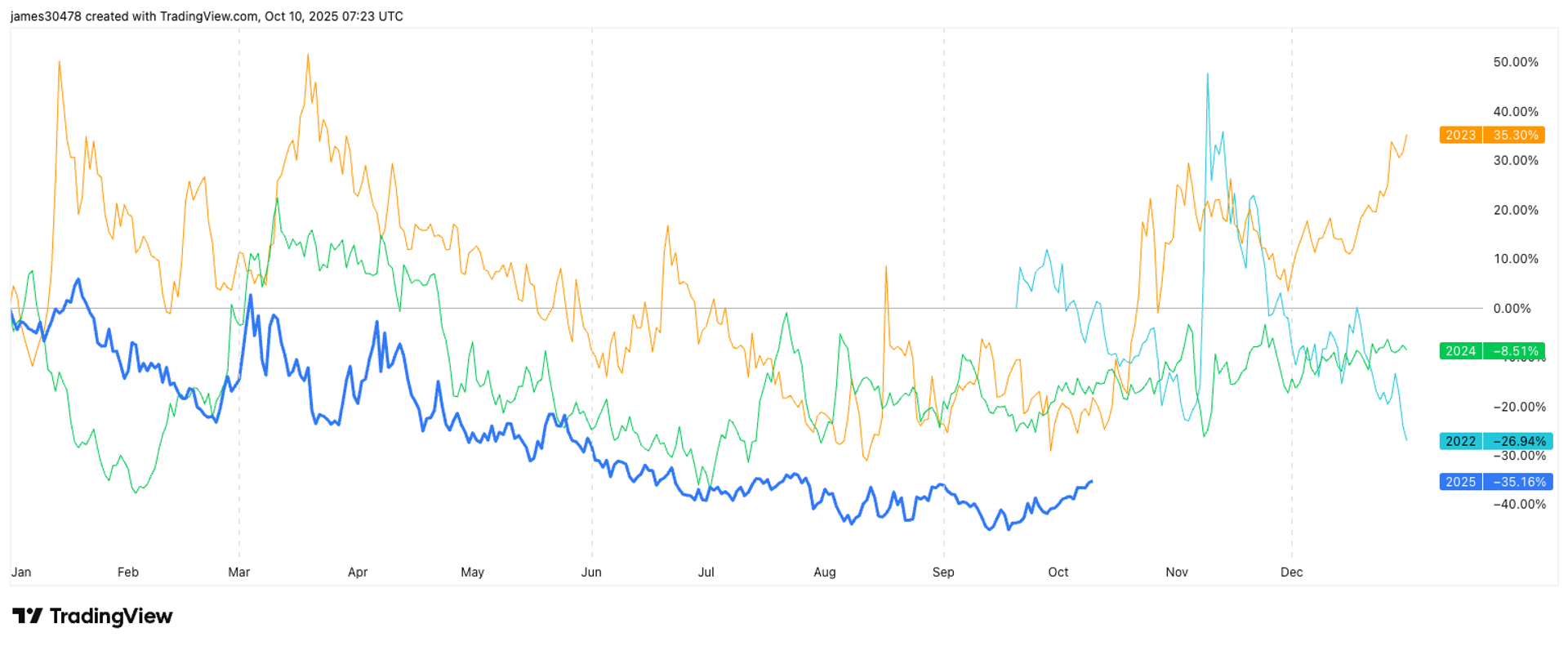

This grounds surge successful borderline trades underscores a beardown risk-on sentiment amid the ongoing banal rally. The Shanghai Composite Index has climbed 15% this year, outpacing the S&P 500’s astir 10% gain, portion the broader CSI 300 Index has precocious 14%.

However, arsenic MacroMicro points out, this caller precocious is occurring against a backdrop of slowing economical growth, dissimilar 2015 erstwhile China’s GDP was comparatively stronger.

"CSI 300 astatine decennary highs. Borrowed wealth chasing stocks successful a shrinking economy," information tracking steadfast MacroMicro noted connected X, adding that the existent rally appears much measured than 2015’s, with broader assemblage information beyond AI and chips, and a larger deposit basal providing immoderate support.

"Yet deflationary pressures proceed to erode firm pricing power—forward net are down 2.5%—making debt-funded positions riskier erstwhile companies cannot rise prices," the steadfast noted.

The imaginable unwinding of the grounds precocious borderline indebtedness successful Chinese stocks could trigger important volatility, with imaginable spillover effects crossed planetary markets.

Moderate risk-on successful crypto

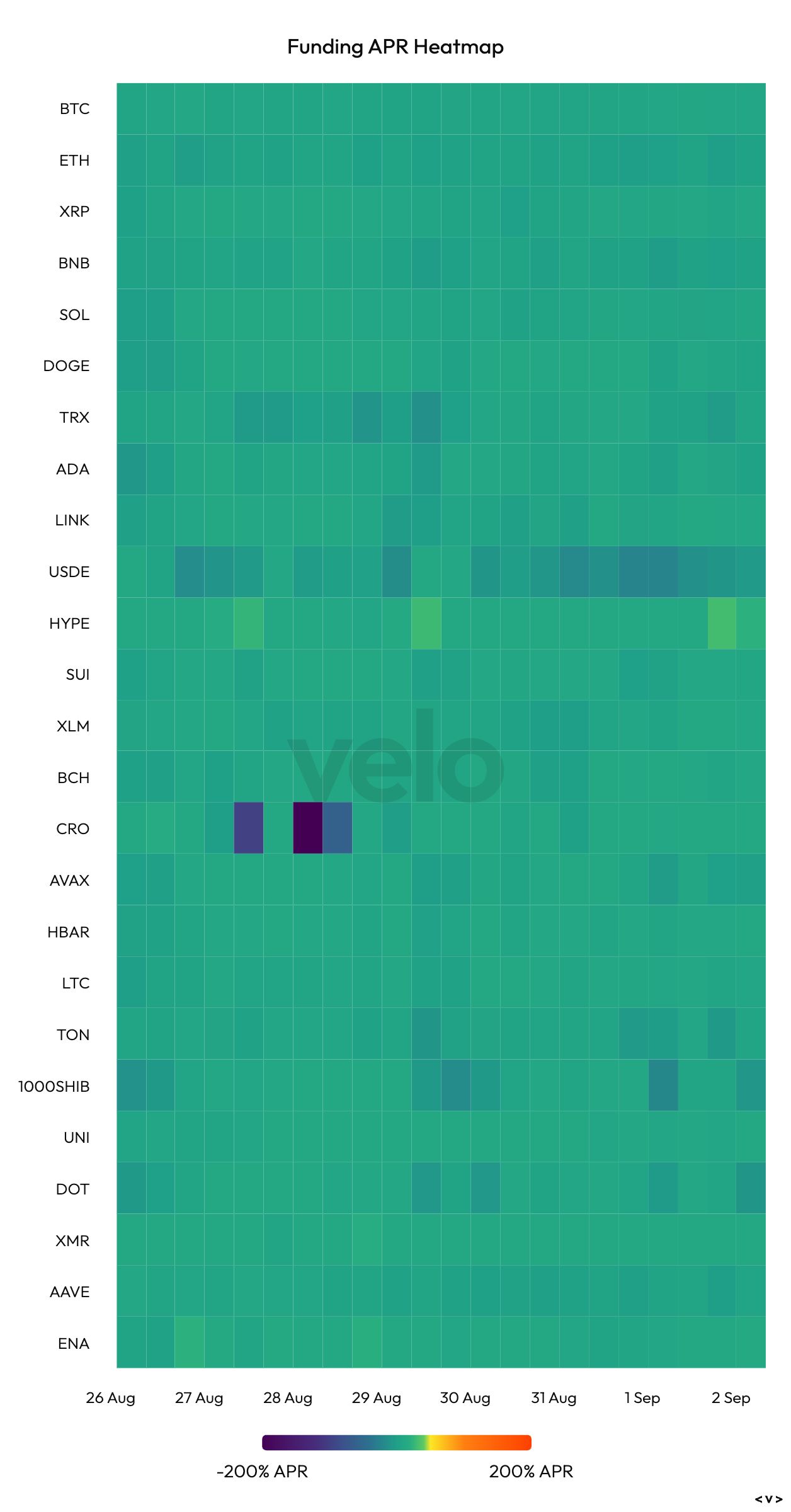

While determination is nary standardized metric to measurement borderline indebtedness crossed the full crypto industry, traders often usage perpetual backing rates arsenic a proxy to gauge wide request for leverage. These rates bespeak the outgo of holding leveraged positions and bespeak marketplace sentiment toward risk.

Currently, backing rates for the apical 25 cryptocurrencies are hovering betwixt 5% and 10%, signaling a mean level of bullish leverage among traders. This suggests that portion determination is request for leveraged agelong positions, marketplace participants stay cautious, striking a equilibrium betwixt optimism and hazard management.

Read more: Bitcoin Floats Around $110K arsenic Traders Look Towards Friday Data for Upside

1 month ago

1 month ago

English (US)

English (US)