Two days ago, Bitcoin.com News reported connected the crypto hedge money Three Arrows Capital (3AC) aft reports claimed that the institution was allegedly struggling with fiscal hardship and imaginable insolvency. Now the crypto steadfast Finblox is feeling the effects of 3AC’s troubles, and a fewer integer currency companies person liquidated the hedge fund’s leveraged positions.

Speculation Concerning Financial Hardships Tied to Three Arrows Capital Continue

There’s a batch of rumors and speculation surrounding the crypto hedge money Three Arrows Capital (3AC), and it seems to beryllium affecting different crypto companies arsenic well. Arguably, 3AC’s problems started with its concern into the Terra blockchain, arsenic it purchased $559 cardinal worthy of locked LUNA (now luna classic), which is present worthy conscionable nether $700. The Twitter relationship called The Defi Edge (@thedefiedge) explained successful a Twitter thread that aft the Terra fallout, 3AC allegedly tried to get funds backmost by utilizing much leverage to gain backmost its Terra concern losses.

Although, markets shuddered adjacent much aft the Terra LUNA and UST implosion, causing a important magnitude of liquidations crossed the full crypto industry. Another relationship called Degentrading (@hodlkryptonite) said 3AC borrowed from each large lender and the steadfast faced important liquidations this week. Furthermore, there’s been speculation that 3AC was dumping a large woody of Lido’s wrapped ether merchandise called stETH, which was putting a load connected the stETH peg. Then a institution backed by 3AC called Finblox detailed that it had to intermission rewards (up to 90% APY) for each of its users, and the level upped withdrawal limits arsenic well.

Furthermore, aft The Defi Edge finished his Twitter thread, a institution (Protocol X) that 3AC invested successful and wished to stay anonymous, told The Defi Edge that 3AC was holding the project’s treasury. “3AC invests successful antithetic effect rounds of companies. The protocol raises wealth usually successful USDC / USDT. Well, the treasury is usually sitting astir doing nothing. So a communal woody 3AC did with their protocols is ‘manage’ their treasury,” The Defi Edge wrote. The Twitter relationship added:

3AC’s Treasury Management. 3AC gave an 8% APR warrant connected the treasury. So protocols would parkland the funds raised by 3AC + further parts of their treasury. The protocols felt harmless due to the fact that well…it’s 3AC. Protocol X has mentioned that the ghosting is real. They’ve talked to 2 different protocols who besides mentioned that they’re being ghosted excessively by them. 3AC present holds portion of their treasury, and they person nary thought what’s the authorities of their cash.

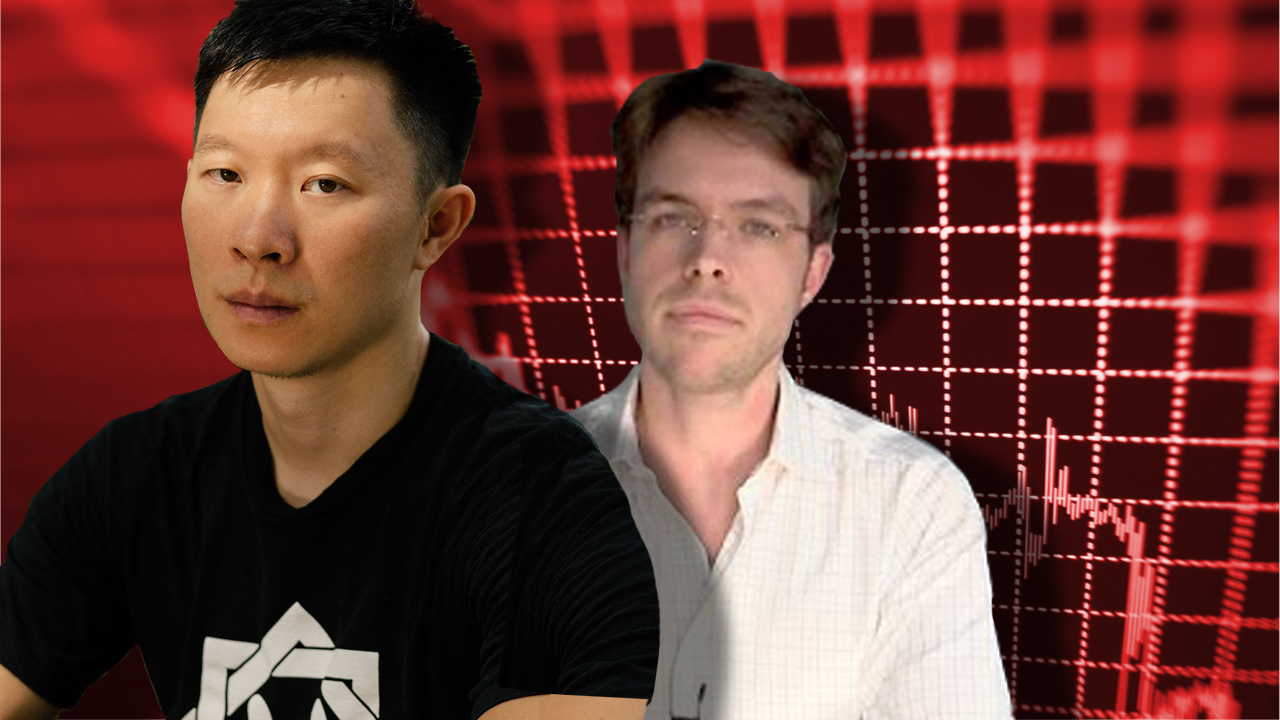

Bitmex and Deribit Liquidate 3AC Positions, Co-Founder Kyle Davies Says the Hedge Fund Is ‘Finding an Equitable Solution for All Constituents’

Additionally, a report published by The Block notes that Bitmex liquidated 3AC’s positions but did not disclose however overmuch was liquidated. “This was collateralised indebtedness and did not impact immoderate lawsuit funds,” a Bitmex spokesperson told The Block. “We are not going to beryllium similar different brands and wax poetic astir our constricted vulnerability and beardown superior presumption — instead, we volition show it by providing our users a reliable and liquid trading venue each day, nary substance the situation.” On Twitter, the crypto derivatives speech Deribit besides disclosed accusation astir 3AC’s concern dealings.

“We tin corroborate that Three Arrows Capital is simply a shareholder of our genitor institution since February 2020,” Deribit said connected Thursday. “Due to marketplace developments, Deribit has a tiny fig of accounts that person a nett indebtedness to america that we see arsenic perchance distressed. Even successful the lawsuit that nary of this indebtedness is repaid to us, we volition stay financially steadfast and operations volition not beryllium impacted. We tin corroborate each lawsuit funds are harmless and the afloat security money volition stay intact arsenic is. Any imaginable losses volition beryllium covered by Deribit,” the speech added.

The aforesaid study published by The Block notes that the editorial’s writer contacted some FTX and Bitfinex astir 3AC dealings arsenic well. FTX told The Block writer Yogita Khatri that they bash not remark connected their customers, and Bitfinex explained that it “had closed its positions astatine a nonaccomplishment without having to beryllium liquidated,” Khatri’s study details. According to the Bitfinex statement, 3AC has removed each of its funds from the company’s exchange. Since the rumors and speculation started to swirl astir 3AC’s concern dealings, truthful far, the nationalist has lone heard from the company’s co-founder Su Zhu erstwhile connected Twitter.

The cryptic tweet doesn’t truly get into immoderate specifics, but says: “We are successful the process of communicating with applicable parties and afloat committed to moving this out.” 3AC’s co-founder Kyle Davies has not tweeted since June 9. Davies, however, did talk with the Wall Street Journal (WSJ) and said: “We person ever been believers successful crypto and we inactive are. We are committed to moving things retired and uncovering an equitable solution for each our constituents.” The WSJ study noted that 3AC was looking for assistance from “legal and fiscal advisers” successful bid to quell the company’s fiscal burdens.

What bash you deliberation astir the alleged fiscal issues surrounding the crypto hedge money 3AC during the past week? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)