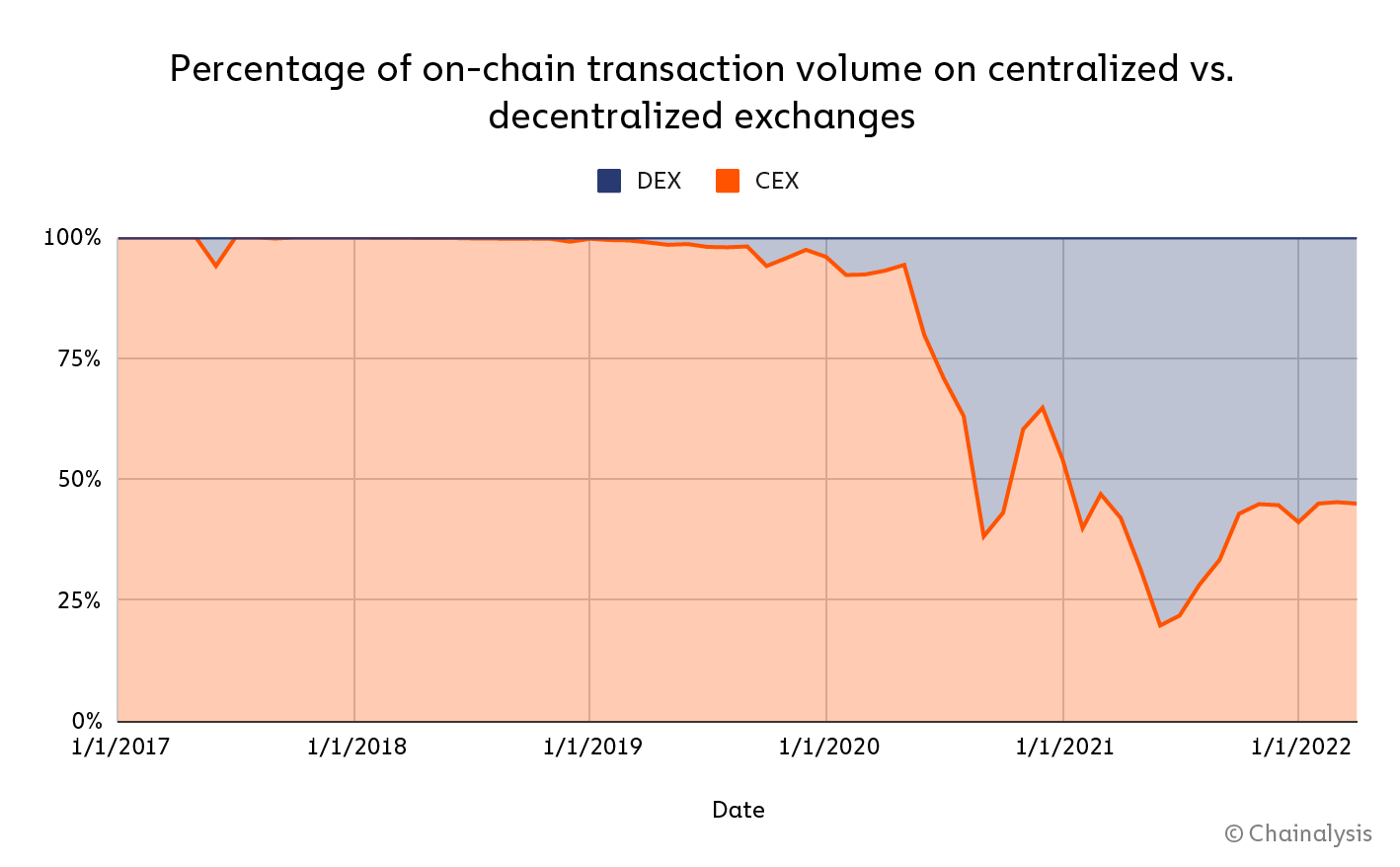

Decentralized exchanges (DEXs) person seen higher on-chain transaction volumes than centralized exchanges (CEXs) since 2020, Chainalysis’ caller report reveals.

A preview of the State of Web3 Report shows that betwixt April 2021 and April 2022, the on-chain transaction measurement of DEXs was $224 billion, which is miles up of the $175 cardinal for CEXs.

According to the report, the large crushed for DEXs starring implicit CEXs is the maturation of DeFi successful the past fewer years.

Generally, the transaction volumes connected centralized and decentralized exchanges thin to reflector the marketplace show of the crypto industry. So it is usually precocious during a bull marketplace and declines during a carnivore market.

Source: Chainalysis

Source: ChainalysisThe study pointed retired that the archetypal clip DEX trading measurement surpassed that of CEX was successful September 2020, erstwhile the on-chain trading measurement of centralized exchanges dropped by 50%.

In June 2021, DEX’s trading measurement reached its highest arsenic it facilitated 80% of on-chain transaction volumes that month. However, that fig has present dropped to 55%, showing a flimsy dominance of the transaction volume.

According to the report, since astir centralized speech transactions hap off-chain done bid books, it is intolerable to seizure each transaction. So the study focused lone connected assets sent to centralized exchanges on-chain.

5 DEXs dominate

Per the report, astir of the trading measurement connected decentralized exchanges comes from the apical 5 exchanges. However, the apical 5 centralized exchanges bash not bask this benignant of marketplace dominance.

Presently, the apical 5 DEXs are Uniswap, SushiSwap, Curve, dYdX, and the 0x Protocol supported astir 85% of each trading measurement from decentralized exchanges and aggregated DEXs.

However, the apical 5 CEXs – Binance.com, OKX.com, Coinbase.com, Gemini.com, and FTX.com – lone enactment astir 50% of each on-chain centralized speech transactions.

The reports supply the apt reasons for the dominance of these fewer decentralized exchanges. One is the caller emergence of the DeFi assemblage which means astir decentralized exchanges are yet to found themselves to support a beardown idiosyncratic base.

Additionally, DEXs trust connected liquidity, and the apical 5 person the astir liquidity. So they volition pull much users since higher liquidity guarantees terms stableness for the biggest traders.

Meanwhile, the anticipation of decentralized exchanges maintaining their dominance implicit centralized exchanges depends connected whether they tin proceed to connection cheaper trading fees portion circumventing the regulatory hurdles being faced by centralized exchanges.

The station Report: DEXs on-chain transaction measurement surpasses that of CEXs appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)