Glassnode information analyzed by CryptoSlate suggests that investors are assured holding Bitcoin and Ethereum, implicit stablecoins, during the existent risk-off environment

As antecedently mentioned, billions successful stablecoins person been redeemed for fiat successful caller months. A important origin successful this was the Binance insolvency FUD, which sparked a tally connected the exchange.

However, arsenic the FUD died down, on-chain metrics amusement Bitcoin and Ethereum’s buying power, comparative to stablecoins, is connected the up.

BTC & ETH purchasing powerfulness connected the up

Stablecoins fulfill aggregate functions, including facilitating on/off ramping and arsenic a store of value, peculiarly successful Southern Hemisphere countries that typically acquisition precocious inflation.

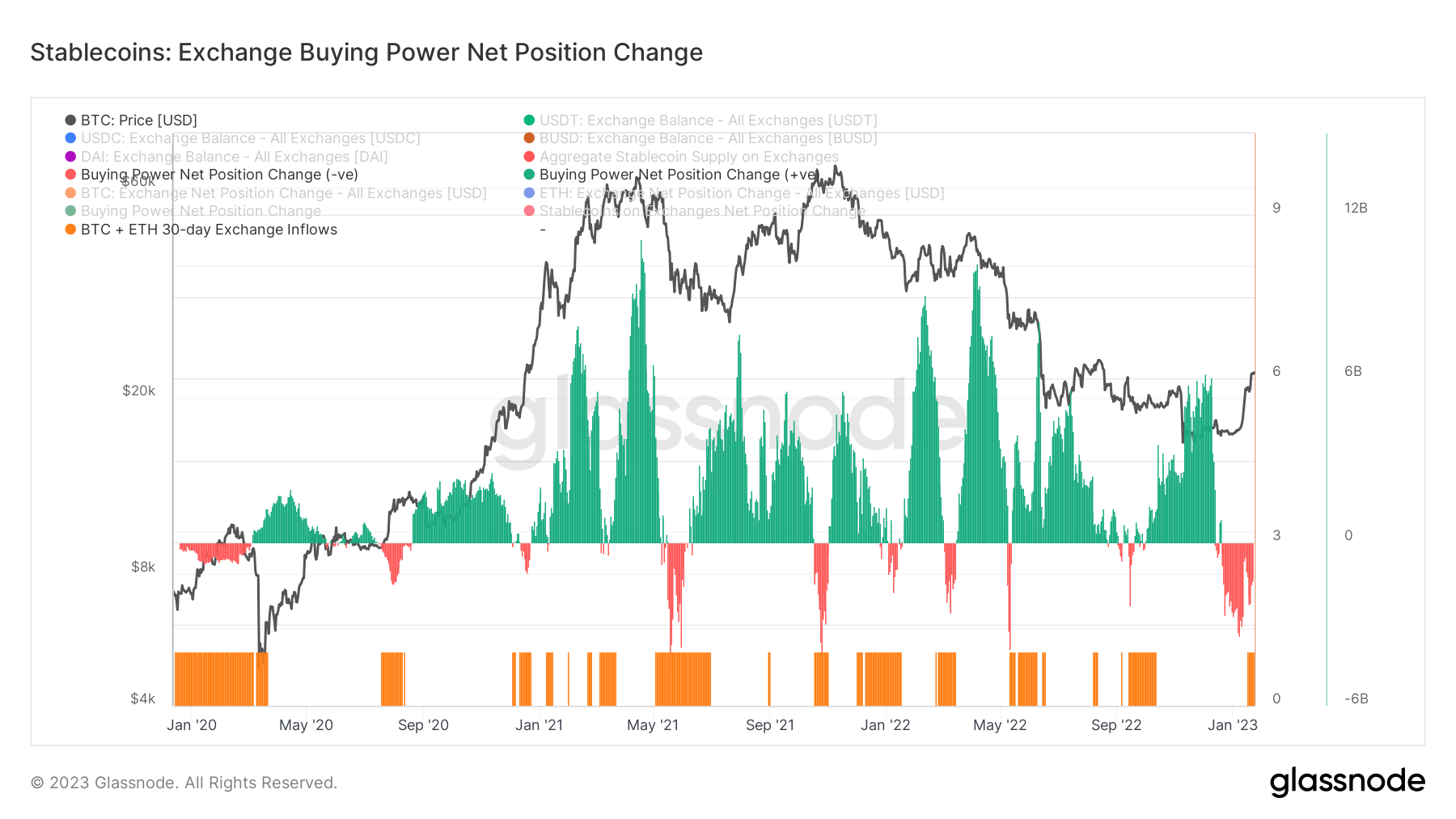

The illustration beneath shows the 30-day alteration successful stablecoin buying powerfulness connected exchanges. It works by taking into relationship the proviso of the apical 4 stablecoins, USDT, USDC, BUSD, and DAI, past subtracting the USD-denominated alteration successful BTC and ETH speech flows implicit the period.

Charting successful greenish denotes an summation successful stablecoin measurement flowing into exchanges comparative to BTC and ETH flows. This suggests determination is greater stablecoin-denominated buying powerfulness successful proportionality to BTC and ETH buying power.

By contrast, the reddish charting signifies a alteration successful stablecoin measurement comparative to BTC and ETH. In different words, BTC and ETH-denominated buying powerfulness is greater comparative to stablecoin buying power.

The orangish bars notation to the 30-day USD measurement of BTC and ETH being positive, i.e. erstwhile stablecoins are converted to BTC and ETH alternatively than USD.

Typically, during risk-off sentiment, stablecoins summation successful measurement arsenic investors determination to minimize the impacts of terms volatility. Yet the illustration beneath shows investors are acting contrary to expectations by expanding BTC and ETH inflows to exchanges.

The past clip this happened was successful October, for a little period. Notably, the existent dominance of BTC and ETH speech measurement implicit stablecoins has extended for astir 7 weeks astatine this point. This suggests assurance successful the apical 2 tokens holding existent terms levels.

Exchange buying powerfulness nett presumption change: (Source: Glassnode)

Exchange buying powerfulness nett presumption change: (Source: Glassnode)Bitcoin Stablecoin Supply Ratio

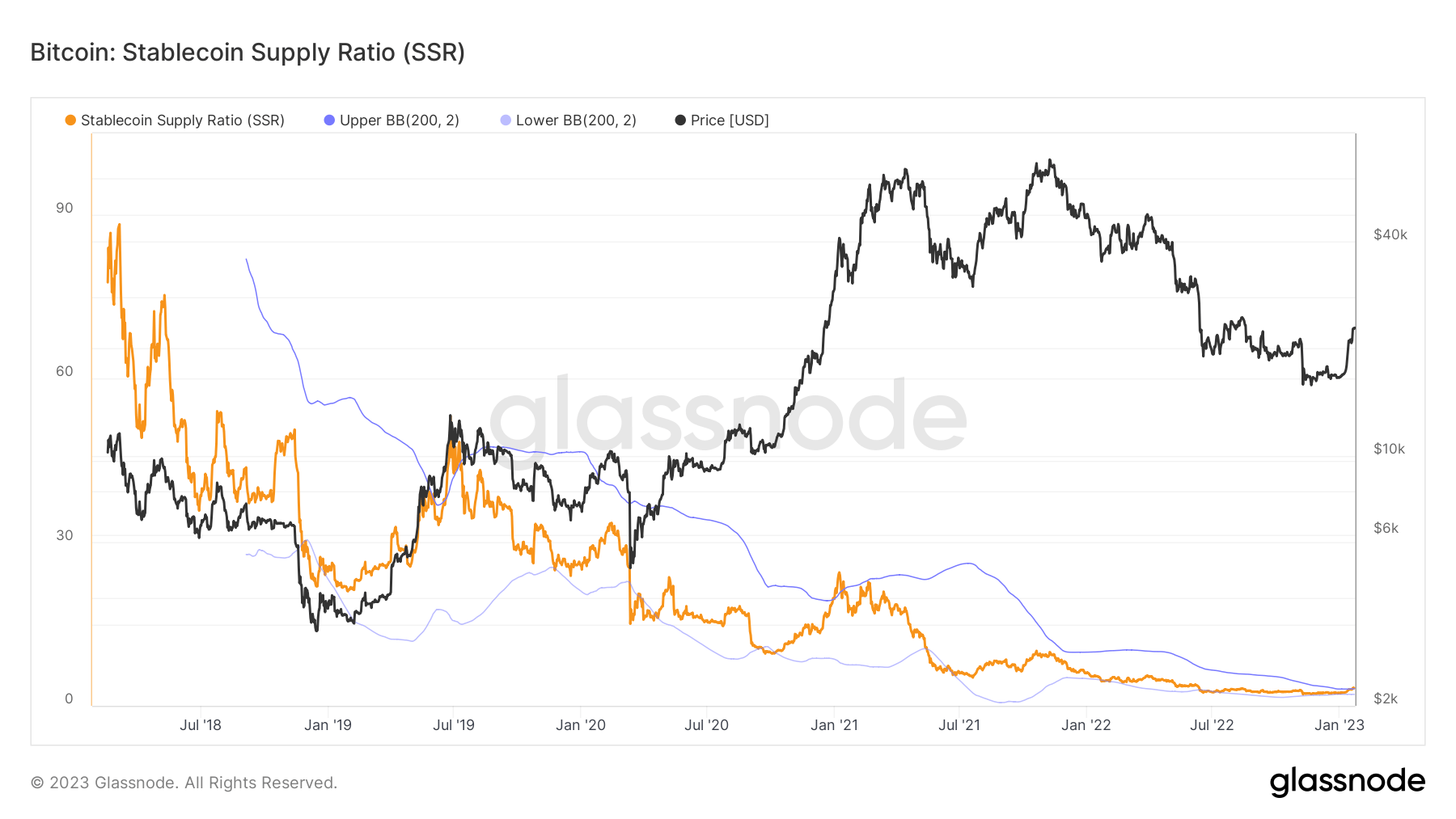

The Stablecoin Supply Ratio (SSR) metric refers to the proportionality of Bitcoin proviso against stablecoin supply, denoted successful BTC.

A precocious SSR indicates debased imaginable buying unit and is considered bearish. Conversely, a debased SSR means precocious imaginable buying unit making this concern bullish. When the SSR is low, the existent stablecoin proviso has much “buying power” to acquisition BTC.

The illustration beneath shows SSR breaching the precocious bound enactment for the archetypal since Jan 2021, which coincided with BTC’s tally to $65,000. The erstwhile lawsuit of breaking the precocious bound enactment was successful July 2019, arsenic BTC spiked to $14,000 aft the $3,300 marketplace bottom.

Stablecoin Supply Ratio: (Source: Glassnode)

Stablecoin Supply Ratio: (Source: Glassnode)The supra indicates bullish tailwinds, contempt the existent risk-off environment.

The station Research: Investors clasp Bitcoin, Ethereum implicit stablecoins successful risk-off environment appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)