Legacy concern defines a bear market arsenic a play of prolonged terms diminution successful which the plus terms drops by 20% oregon much from caller highs.

There is nary standardized explanation of a crypto carnivore market. But fixed that integer assets are overmuch much volatile, it’s argued that the percent drop, by which a crypto carnivore marketplace is determined, should beryllium -40%, possibly -60%.

Nonetheless, with the marketplace down astir 74% from its highest implicit 10 months, determination is nary uncertainty the crypto carnivore is present for Bitcoin.

On June 18, BTC posted a section bottommost of $17,700, marking a closing terms beneath the erstwhile rhythm highest for the archetypal clip successful its history. Some analysts called this the marketplace rhythm bottom. However, investigation of respective on-chain metrics suggests otherwise.

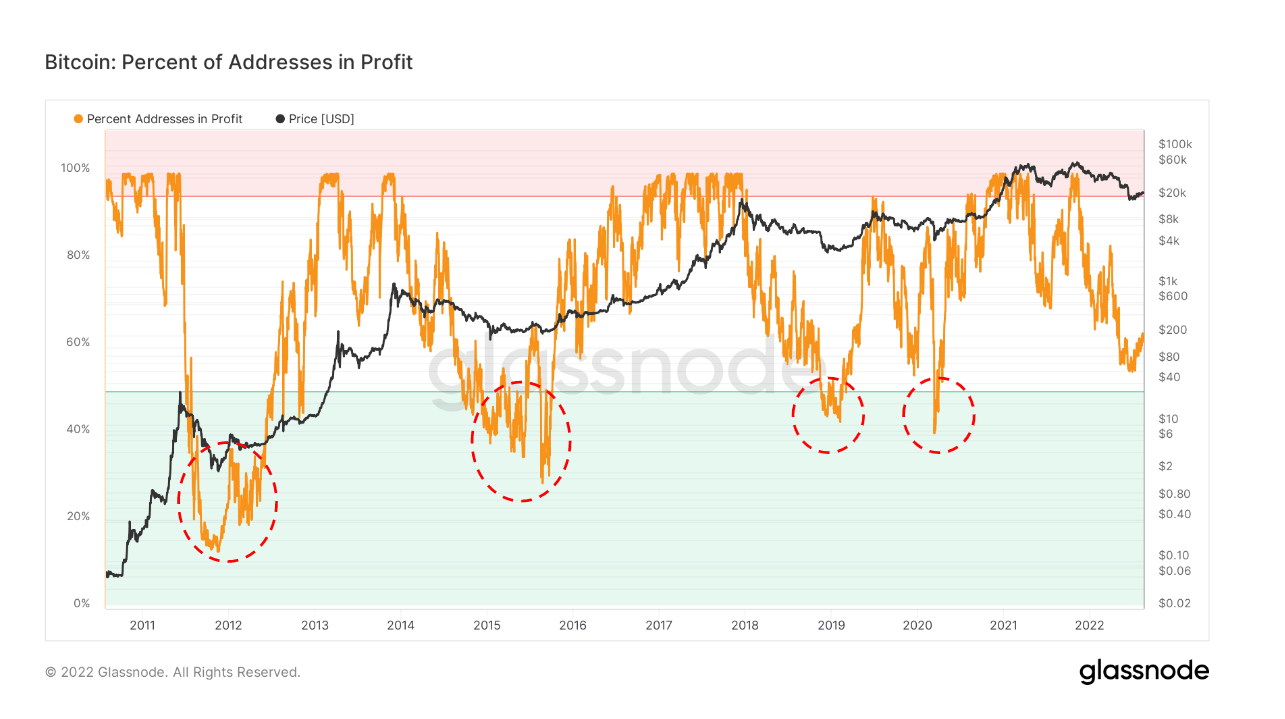

Percentage of Bitcoin addresses successful profit

The percent of Bitcoin addresses successful nett refers to the proportionality of unsocial addresses whose funds person an mean bargain terms little than the existent price.

In this case, the “buy price” is defined arsenic the terms astatine the clip of token transportation into an address.

During each erstwhile rhythm bottom, 50% oregon less Bitcoin addresses person been successful loss. The illustration beneath shows a existent speechmaking of astir 58%, suggesting the BTC terms has further to fall.

Source: Glassnode.com

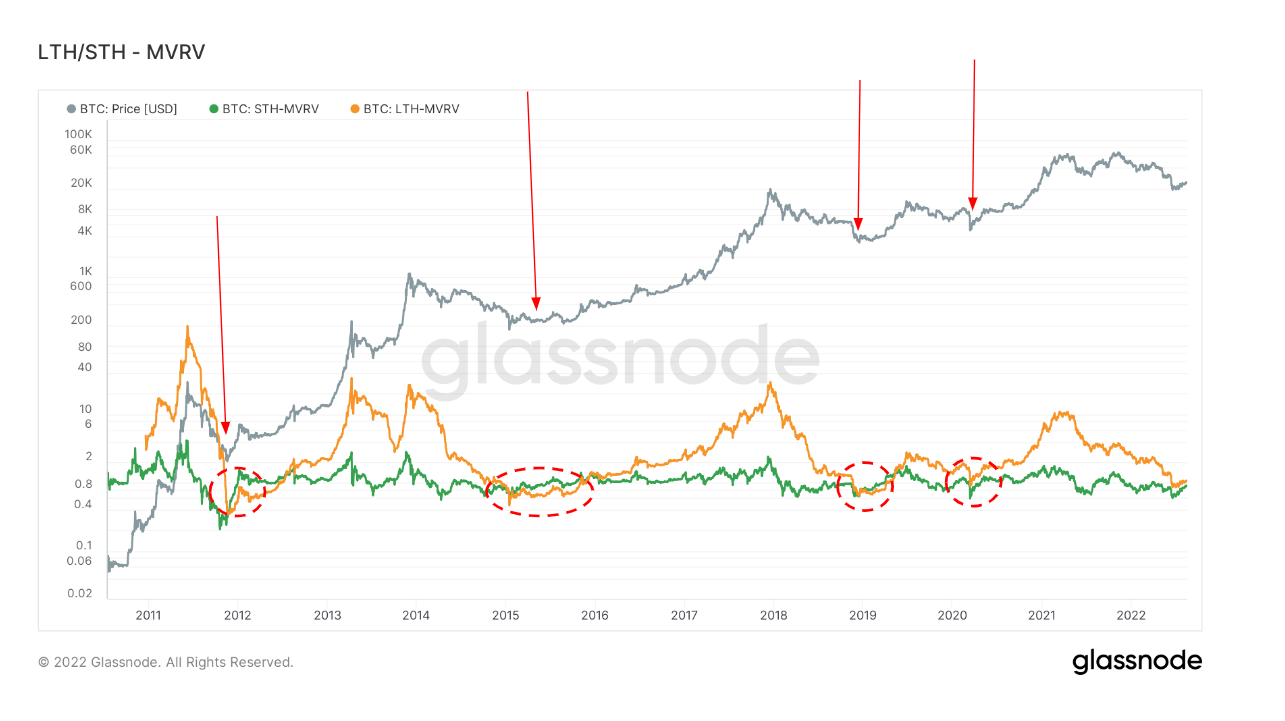

Source: Glassnode.comMarket Value to Realized Value

Market Value to Realized Value (MVRV) refers to the ratio betwixt the marketplace headdress (or marketplace value) and realized headdress (or the worth stored). By collating this information, MVRV indicates erstwhile the Bitcoin terms is trading supra oregon beneath “fair value.”

At the aforesaid time, by comparing semipermanent and short-term MVRV, it is imaginable to gauge the capitulation of semipermanent holders.

Long-term Holder MVRV (LTH-MVRV) considers lone unspent transaction outputs with a lifespan of astatine slightest 155 days. It serves arsenic an indicator to measure the behaviour of semipermanent investors.

The past 4 rhythm bottoms were characterized by a convergence of the STH-MVRV and LTH-MVRV lines. Such an intersection has yet to occur, suggesting semipermanent holders person to capitulate successful narration to short-term holders.

Source: Glassnode.com

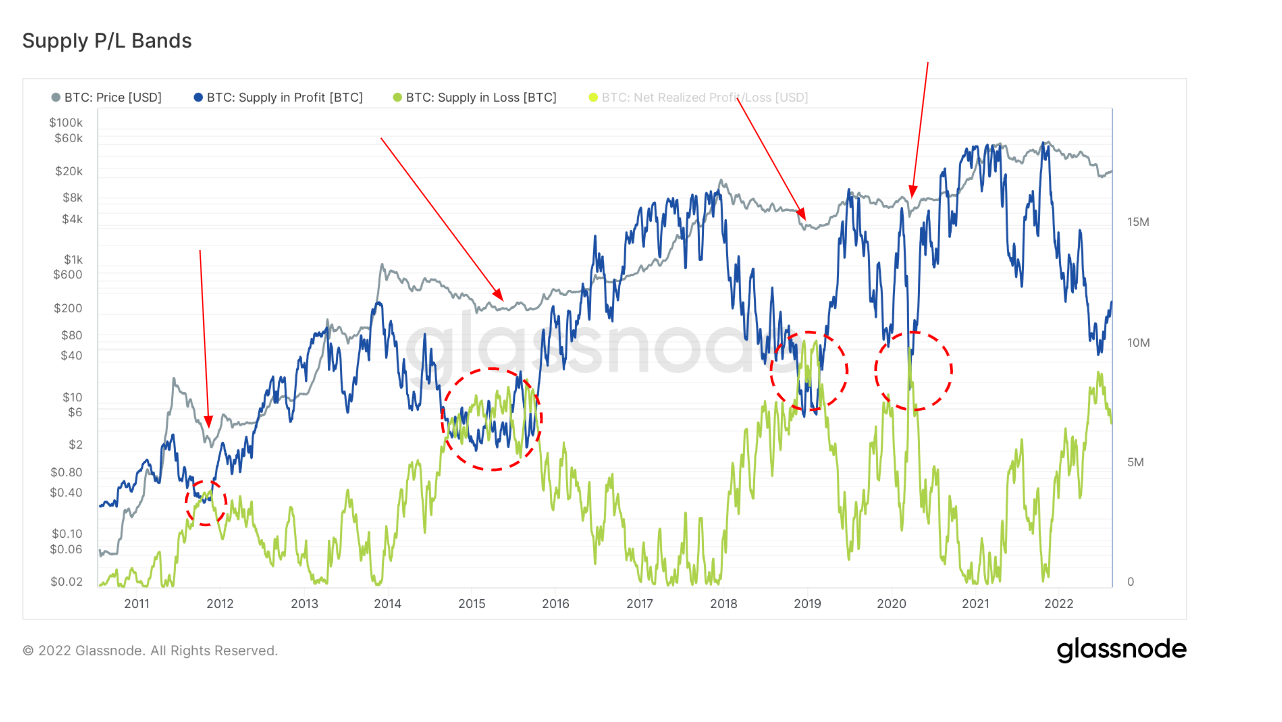

Source: Glassnode.comSupply successful profit/loss

Supply successful Profit and Loss (SPL) examines the circulating proviso successful nett and loss. In different words, it looks astatine the fig of tokens whose terms was little oregon higher than the existent terms erstwhile they past moved.

Similar to the erstwhile 2 examples, erstwhile rhythm bottoms were successful erstwhile the nett and nonaccomplishment lines converged. Currently, the nett enactment is yet to converge against the nonaccomplishment line.

Source: Glassnode.com

Source: Glassnode.comThe station Research: On-chain Bitcoin metrics suggest the bottommost is not in appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)