A look astatine the Bitcoin transactions and accumulation among assorted groups utilizing the Accumulation Trend Score (ATS) shows that this is the 3rd astir assertive dumping by Bitcoin (BTC) whales successful history.

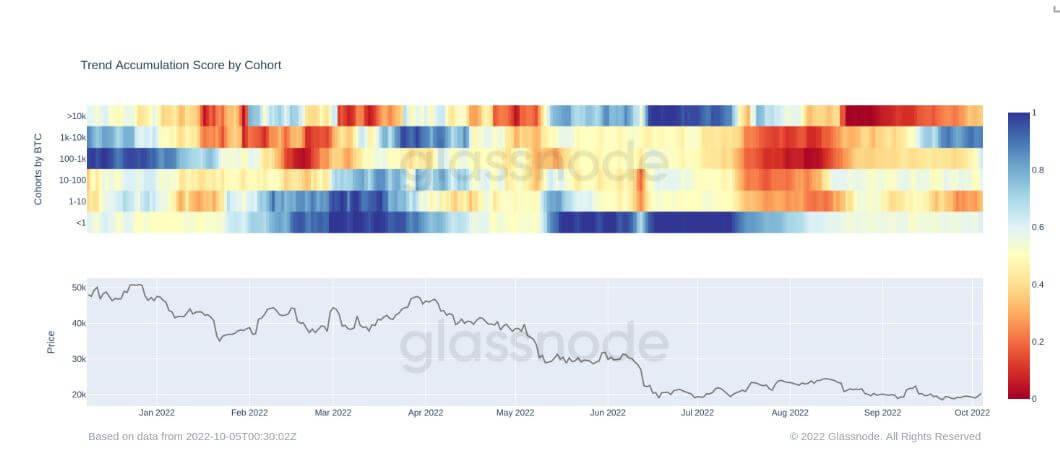

The accumulation inclination people is simply a metric that gauges the behaviour of assorted Wallet cohorts. It measures the comparative spot of accumulation for each entity by looking astatine the size of the entities and however overmuch they person acquired oregon sold successful the past 15 days.

Where the worth is adjacent to 1, it indicates that the entity is accumulating, and erstwhile it is adjacent to 0, it means the radical is distributing. For Bitcoin, the metric excludes miners and exchanges from that group, focusing connected whales and shrimps.

According to the ATS, whales, i.e., those with much than 1000 Bitcoin successful their wallet, person been the nett sellers successful caller times and for astir of 2022. However, shrimps, i.e., wallets with 1 Bitcoin oregon less, person been rather progressive regarding accumulation.

Bitcoin Accumulation Trend Score (Source: Glassnode)

Bitcoin Accumulation Trend Score (Source: Glassnode)The illustration shows that portion whales relationship for astir Bitcoin purchases since inception, their acquisition complaint has declined and is presently astatine its lowest.

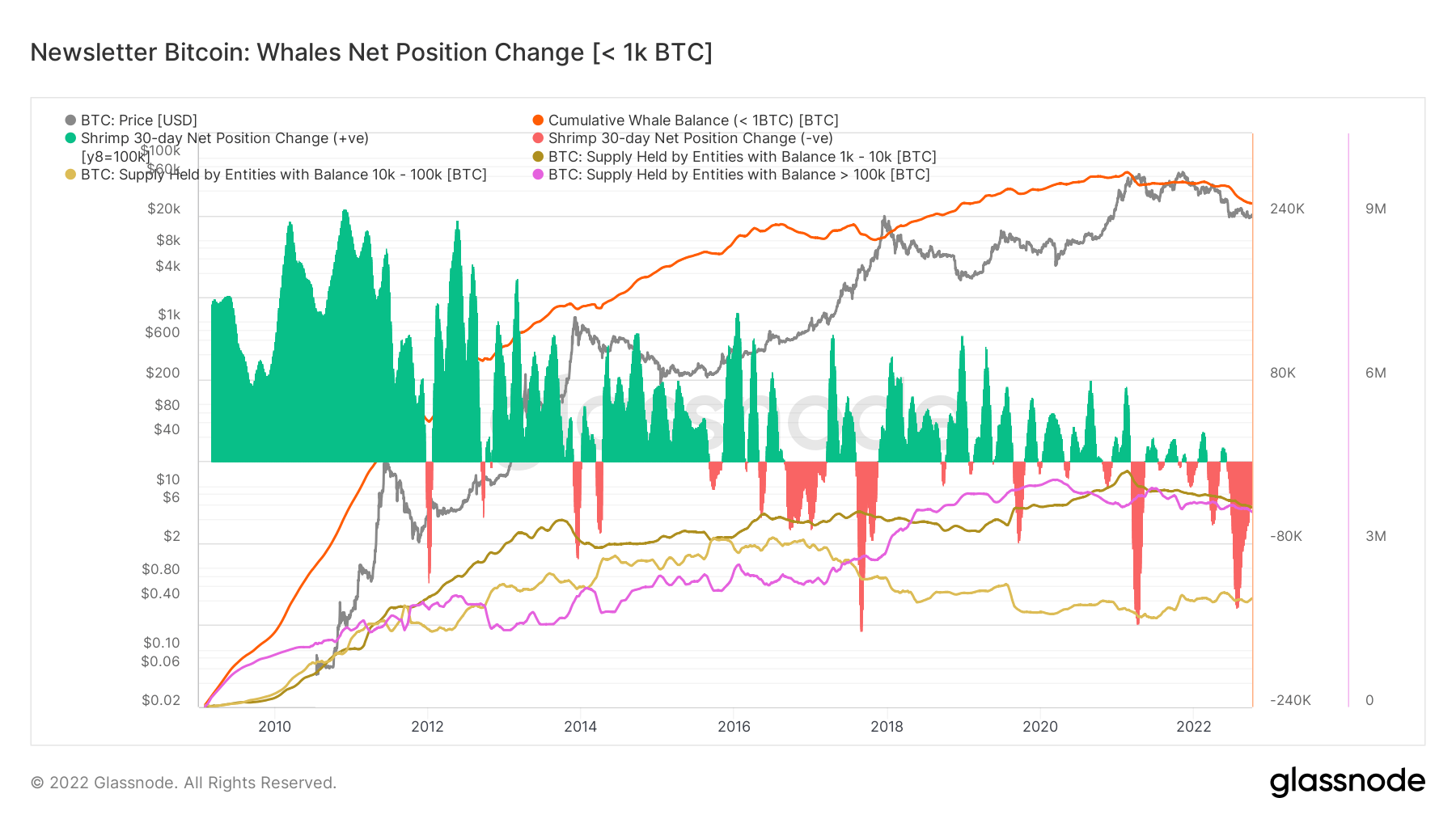

The whales’ nett presumption alteration illustration identifies the 30-day nett presumption alteration of whales buying and selling BTC. Green denotes that whales are buying and that behaviour has trended downward since BTC’s inception.

Bitcoin Whales Net Position Change (Source: Glassnode)

Bitcoin Whales Net Position Change (Source: Glassnode)By comparison, the complaint of organisation is astatine its 3rd highest. In 2 cases of the 2017 and 2021 bull run, whales were selling for profit. But the 2022 organisation is owed to a diminution successful prices.

Whales are present selling to hedge their losses. This means they are taking vantage of immoderate affirmative crook successful the marketplace to offload the integer asset.

Although not each whales are selling, a fewer whales, specified arsenic Microstrategy, are accumulating. But the information that astir of the whales are selling does not bode good for BTC successful the abbreviated term.

However, the shrimps are inactive accumulating, and a caller radical of short-term hodlers is forming. With the terms scope mostly betwixt $17,000 and $22,000, astir tiny hodlers are taking vantage to summation their holdings.

The information that astir caller hodlers person unrealized losses suggests they volition not merchantability anytime soon.

The station Research: Whales selling astatine the 3rd astir assertive complaint successful BTC history appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)