When analyzing the Bitcoin market, it’s arsenic important to recognize the behaviour of antithetic marketplace participants arsenic it is to recognize the method foundations of Bitcoin’s terms movement. On-chain investigation often analyzes short– and long-term holders, arsenic their behaviour is inherently different. However, Bitcoin’s maturity enables america to differentiate betwixt ample and tiny entities, arsenic hundreds of institutions person populated the abstraction and go a ascendant unit successful the market.

Large entities thin to marque strategical moves based connected semipermanent outlooks and important marketplace analysis. In contrast, tiny entities, typically retail investors, are much reactive and driven by short-term speculation and sentiment.

The comparative enactment of tiny and ample entities is an fantabulous metric for distinguishing betwixt these 2 cohorts. Although relying solely connected this metric has limitations — specified arsenic oversimplifying the analyzable behaviour of a divers scope of investors — it inactive offers a straightforward, binary cheque of marketplace conditions. Glassnode’s metric differentiates betwixt the median transaction volumes of tiny entities and the mean transaction volumes of ample entities to uncover trends that suggest imaginable shifts successful the market.

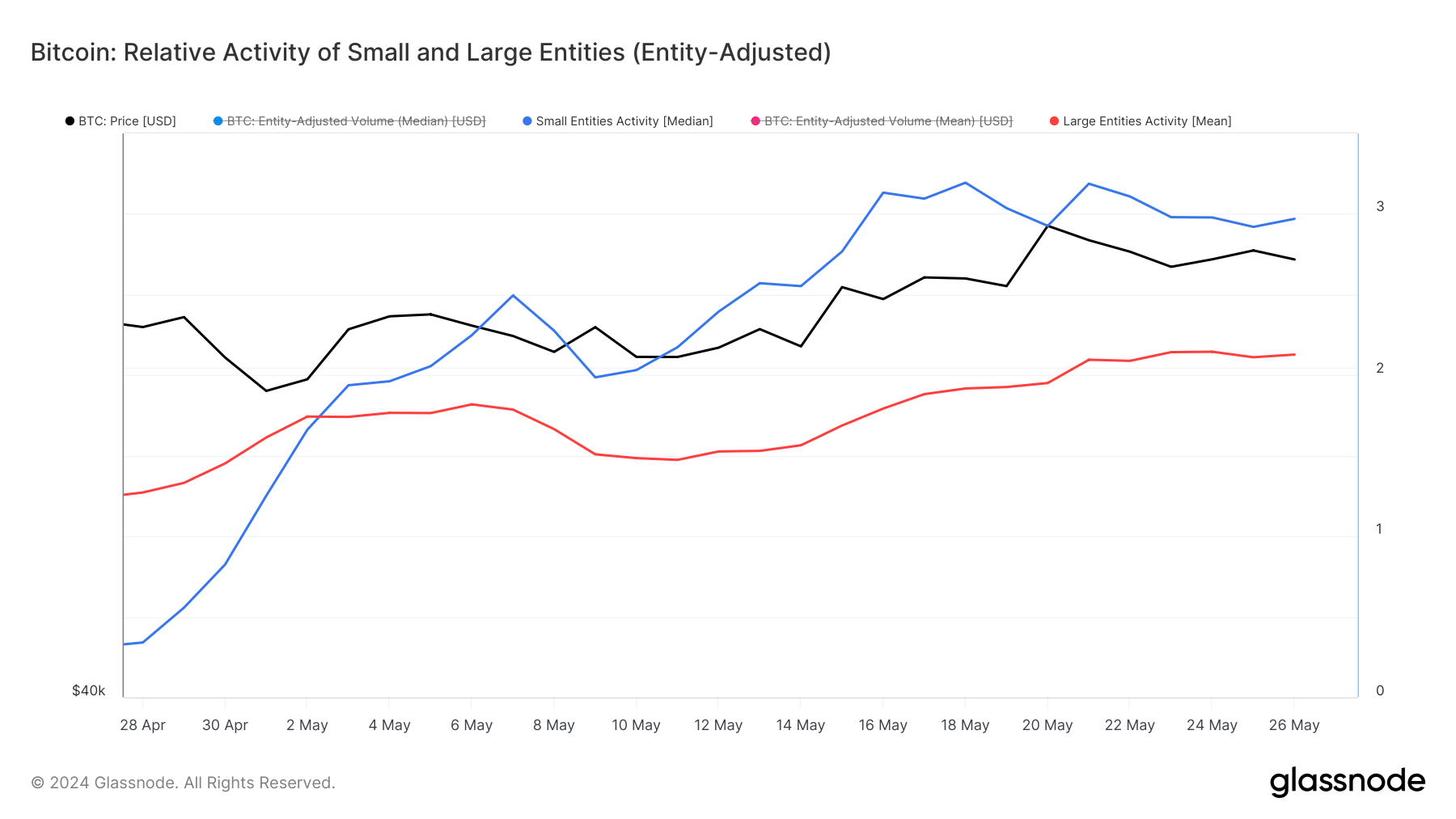

Since May 3, the enactment levels of tiny entities, represented by the median transaction volumes, person consistently outpaced those of ample entities.

Graph showing the comparative enactment of tiny (blue) and ample (red) entities from April 28 to May 26, 2024 (Source: Glassnode)

Graph showing the comparative enactment of tiny (blue) and ample (red) entities from April 28 to May 26, 2024 (Source: Glassnode)The skewness successful transaction volumes, wherever the mean transaction size (mean) is larger than the emblematic transaction size (median), indicates that galore tiny transactions hap frequently. This signifier is emblematic successful Bitcoin markets and shows beardown engagement from retail investors, who mostly marque smaller trades. When the enactment of tiny entities is higher than that of ample entities, it usually means the marketplace is driven by retail investors’ excitement and speculation, often seen astatine the opening of a bull market. On the different hand, if this enactment decreases, it tin suggest that retail involvement is fading and the marketplace mightiness beryllium stabilizing oregon consolidating.

On May 18, the median transaction measurement of tiny entities reached a highest enactment ratio of 3.194, portion the mean transaction measurement of ample entities was astatine 1.916. This divergence shows a overmuch larger basal of smaller transactions, indicating accrued request and speculative enactment among retail investors.

The continuous summation successful tiny entities’ activity, particularly during important terms volatility, specified arsenic the highest of $71,400 connected May 20, shows important retail enthusiasm. Retail-driven request similar this tin often summation marketplace volatility, arsenic smaller investors respond much swiftly to marketplace changes than ample organization players. Glassnode’s information for May 26 further confirms this trend, with tiny entities maintaining a precocious enactment ratio of 2.969 compared to ample entities’ 2.127, contempt a terms correction to $68,500.

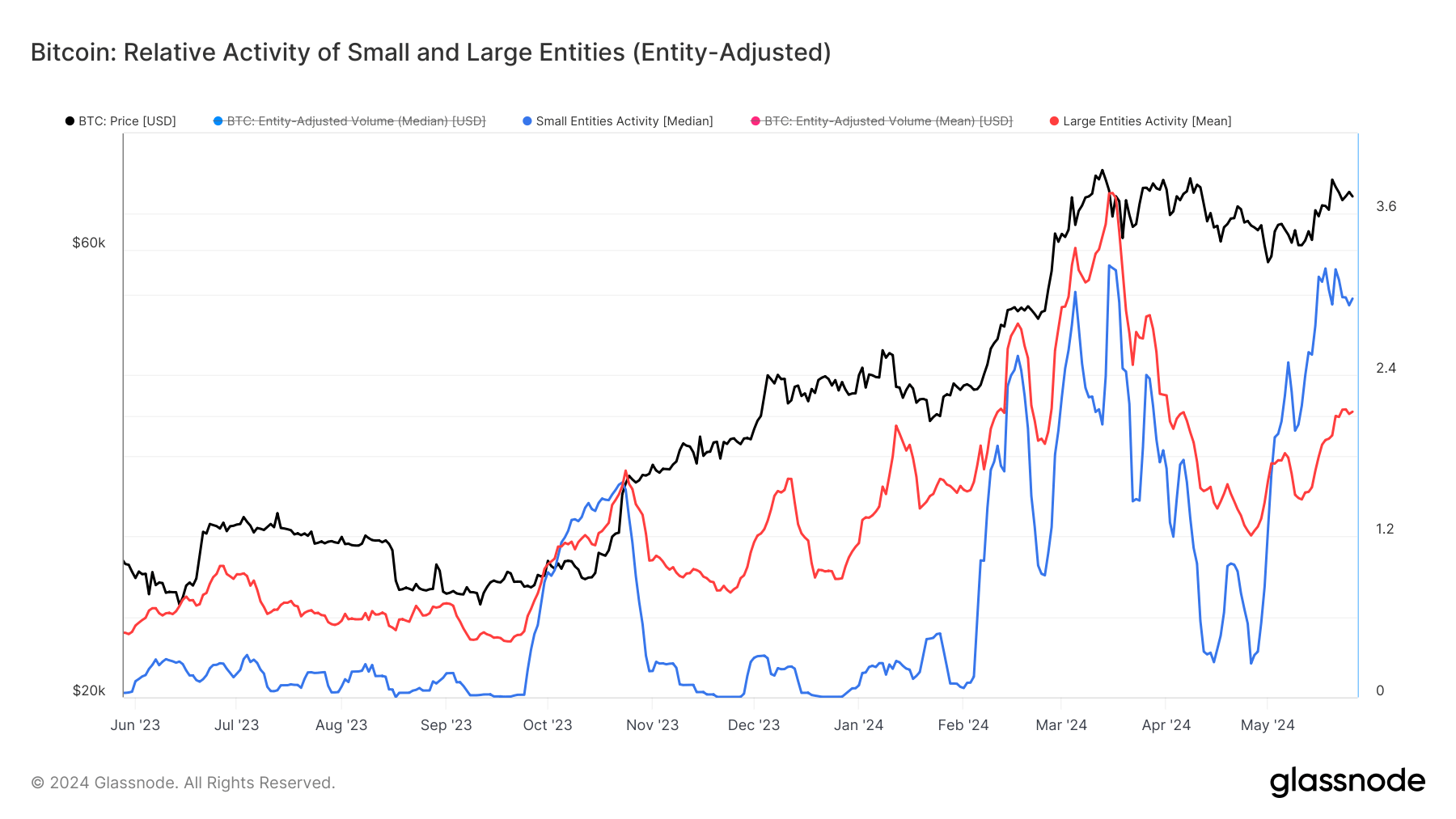

Given that this is the archetypal clip tiny entities’ enactment has outpaced ample entities since October 2023, it’s harmless to accidental that the marketplace has go progressively bullish.

Graph showing the comparative enactment of tiny (blue) and ample (red) entities from May 29, 2023, to May 26, 2024 (Source: Glassnode)

Graph showing the comparative enactment of tiny (blue) and ample (red) entities from May 29, 2023, to May 26, 2024 (Source: Glassnode)The accrued enactment among tiny entities indicates beardown grassroots enactment for Bitcoin’s terms movements, which could prolong upward momentum successful the abbreviated to mean term. A alteration successful enactment from ample entities during this clip would beryllium a informing sign, arsenic markets driven solely by retail speculation are incredibly unstable and prone to volatility.

However, determination has besides been a continuous summation successful ample entity activity. The influx of ample investors into the space, driven mostly by the popularity and accessibility of spot Bitcoin ETFs successful the US, has kept enactment consistently high. The information that tiny entities had a higher complaint of enactment during the past period shows that astir of the volatility came from retail, while foundational maturation was fueled by institutions.

The station Retail enactment dominates Bitcoin, overshadowing organization moves appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

![Crypto News Today [Live] Updates On Feb 14, 2026](https://image.coinpedia.org/wp-content/uploads/2025/10/10162458/Crypto-News-Today-Live-Updates-October-10-1024x536.webp)

English (US)

English (US)