Popular Bloomberg ETF expert Eric Balchunas has lowered the anticipation of the US Securities and Exchange Commission (SEC) denying the motorboat of the Bitcoin spot ETF to 5%. This latest forecast comes arsenic crypto enthusiasts worldwide expect a wide-scale support of assorted Bitcoin spot ETF proposals by the SEC connected Wednesday, January 10.

Why The Bitcoin Spot ETF Approval Appears Nearly Certain: Bloomberg Analysts Weigh In

In October, Eric Balchunas and chap Bloomberg expert James Seyffart predicted that determination is simply a 90% accidental that ARK Invest and 21 shares would person support for their associated Bitcoin spot ETF bid connected January 10, which marked the last deadline day for the SEC’s effect connected their application.

However, successful a caller X post connected January 6, Balchunas raised the probability of this greenlight to an astounding 95% aft declaring that determination was lone a 5% probability the SEC would cull the ARK/21 ETF bid successful the coming days.

Well said though I astir apt spell with 5% astatine this point. But you gotta permission a small model unfastened for these things.

— Eric Balchunas (@EricBalchunas) January 6, 2024

This caller prediction is based connected the implausibility of each scenarios, which could correspond a imaginable hold oregon non-approval of the ARK/ 21 shares Bitcoin spot ETF application. In an earlier X station connected January 6, James Seyffart had listed these scenarios starting with ARK/21 shares spontaneously withdrawing their ETF connection from the SEC, which helium claimed to beryllium highly unlikely.

Another script is that the SEC discovers caller reasons to cull the motorboat of a crypto spot ETF, resulting successful a drawn-out tribunal conflict betwixt the US regulator and ARK/21Shares, a concern that Seyffart believes the SEC would alternatively avoid, particularly pursuing its caller large ineligible nonaccomplishment against Grayscale investment.

The last lawsuit that the Bloomberg expert believes could forestall the clearance of the ARK/21 Shares ETF bid is simply a nonstop involution from the US Presidency, different script that appears remotely possible.

The D-Day Approaches

The value of ARK/21 Shares’ associated bid to the Bitcoin spot ETF saga revolves astir its last deadline day for an SEC response, which is the earliest of the bunch. Now, it is believed that the SEC volition alternatively o.k. respective Bitcoin spot ETF applications astatine erstwhile careless of their respective last deadline day successful a akin manner arsenic it did with Ether-futures ETFs successful August.

This content is backed by the discussions betwixt the US regulator and assorted applicants successful the past fewer weeks, starring to amendments successful respective proposals, which indicates the mentation of an incoming approval.

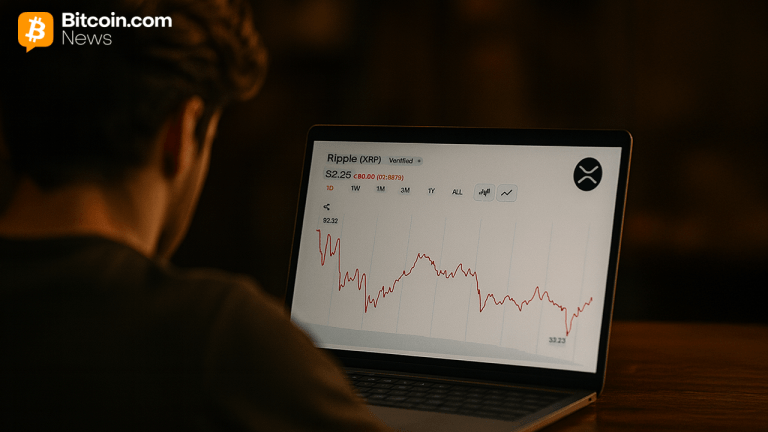

At the clip of writing, the acceptable day of anticipation remains January 10, with crypto enthusiasts highly enthusiastic astir the imaginable bullish effects of a spot ETF connected Bitcoin’s terms implicit the year. Meanwhile, Bitcoin continues to commercialized astatine $44,050, having gained by 4.50% successful the past week.

Featured representation from iStock, illustration from Tradingview

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)