I get really animated erstwhile discussing Bitcoin’s vigor use. And by “Bitcoin’s vigor use,” I mean the magnitude of vigor bitcoin mining uses. I thin to accidental Bitcoin’s vigor usage isn’t a occupation and that we should alternatively absorption connected Bitcoin’s emissions. [Note: we capitalize the blockchain (Bitcoin) and usage lowercase oregon trading symbols (bitcoin/BTC) for the asset.]

Before diving into immoderate details, it’s important to marque wide what bitcoin (BTC) mining is and wherefore it needs to usage a batch of energy. Mining is the mechanics that sustains the fiscal infrastructure of the Bitcoin web and it is vigor intensive by plan to supply ironclad security.

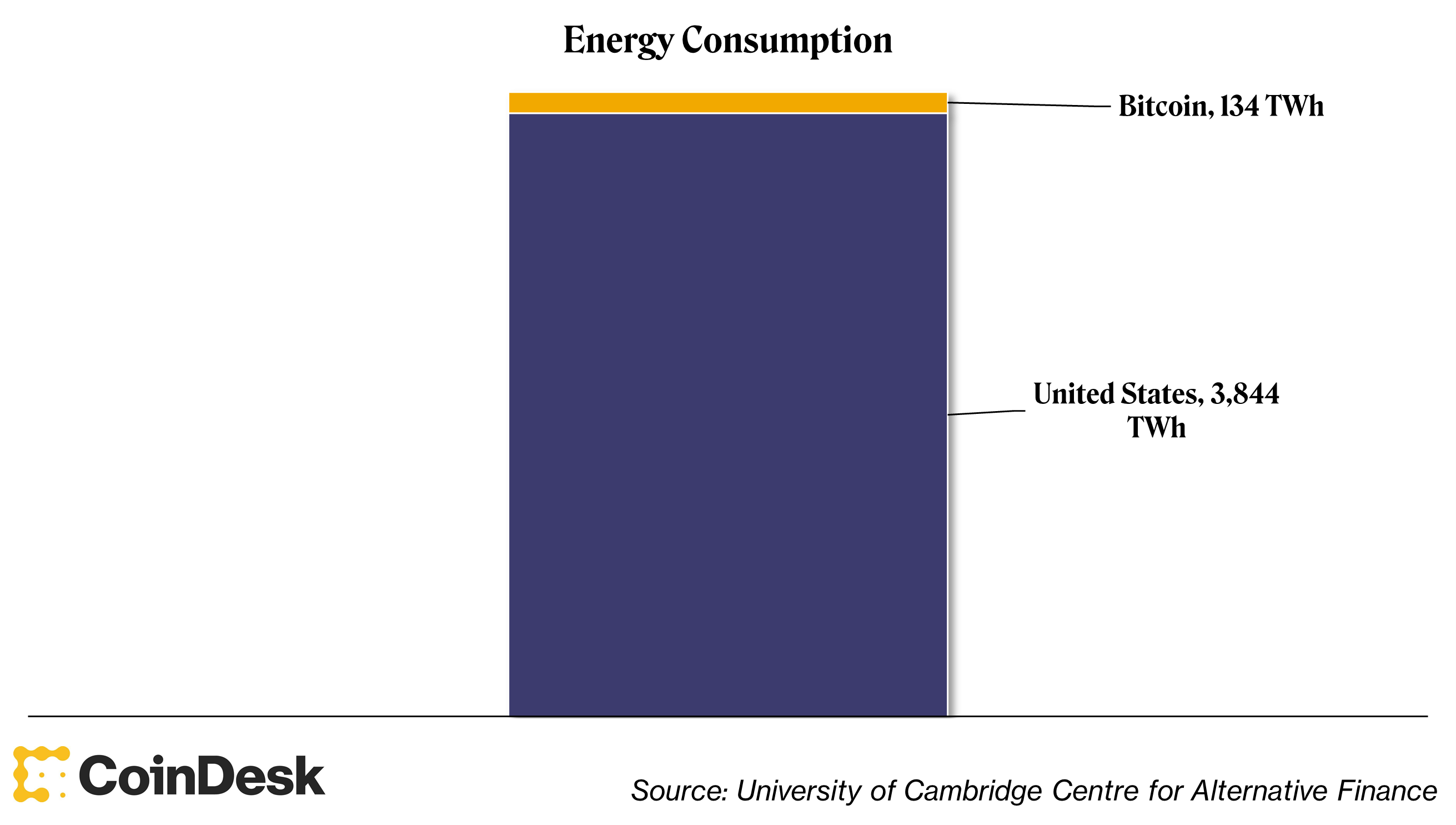

In a casual setting, my favourite mode to showcase that Bitcoin’s vigor usage “doesn’t matter” is to append Bitcoin’s vigor usage to the U.S.’s vigor depletion and inquire if it looks similar Bitcoin is utilizing excessively overmuch vigor (see below).

Bitcoin vigor depletion vs U.S. (University of Cambridge Centre for Alternative Finance)

Using this graphic, it looks similar the U.S. has an vigor occupation and, fixed China consumes 79% much vigor than the U.S., China has an adjacent bigger vigor problem. Bitcoin lone uses an estimated 134 TWh of energy per year, a scant 1.9% and 3.5% that China and the U.S. devour annually. You tin ideate the way the remainder of the speech takes.

I included this graphic to exemplify that the examination crippled is usually a discarded of time. Bitcoiners often bash this unproductively, comparing bitcoin mining vigor depletion to Christmas airy vigor depletion oregon the like, and leaving the statement astatine that (Christmas lights bash use a batch of energy, however). I adjacent did it successful a study I published past April comparing it to video games.

I astir apt committed a cardinal misdeed successful that study by trying to person the scholar that Bitcoin’s vigor usage was “worth it” due to the fact that Bitcoin is simply a “global, trustless, permissionless outgo colony web and a digital, aspirational store of value.” Let’s prevention the morality lecture for different clip and alternatively assume, for involvement of argument, that Bitcoin is worthy utilizing energy.

The shortest reply is that Satoshi Nakamoto, Bitcoin’s creator, thought the champion mode to reasonably administer bitcoins was by creating a strategy successful which miners speech thing invaluable – vigor – for the close to assertion the bitcoins (the shortest shortest reply is really “anti-spam”).

A longer reply should adhd thing astir the request to ward disconnected attackers if you privation to successfully decentralize spot successful a network. Mining is energy-intensive truthful that it is prohibitively costly to onslaught Bitcoin. Remember: Mining doesn’t usage vigor to validate transactions; vigor depletion is the terms exacted for securing the full network.

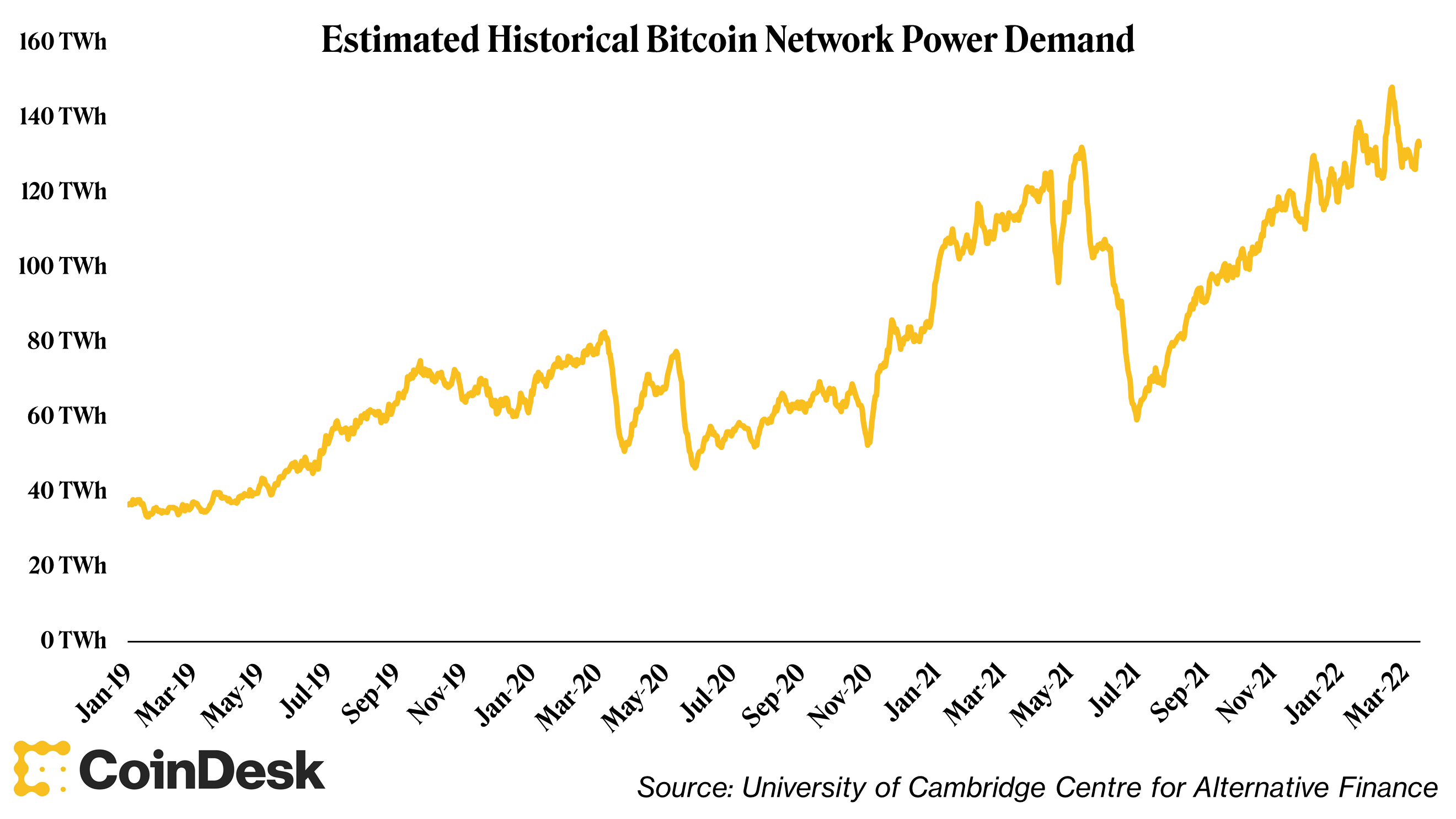

Bitcoin web vigor consumption

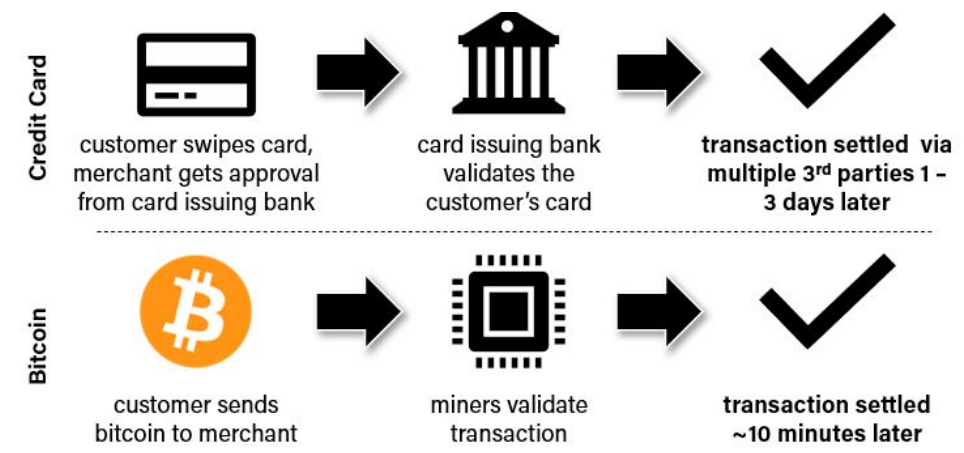

The preceding constituent astir transaction validation is important due to the fact that it is enticing to comparison the vigor density of Bitcoin transactions to thing similar Visa (V). Bitcoin tin lone grip 7 transactions per 2nd compared to Visa’s 24,000+. But, remember, Bitcoin doesn’t usage vigor to validate transactions. The miners’ occupation is to unafraid the network, adhd caller blocks of information to the concatenation and triumph bitcoin successful return. That’s what they walk vigor on. They’re not chiefly funny successful validating transactions. That statement connected the existent authorities of the web is chiefly the occupation of non-mining, Bitcoin afloat nodes. Plus, Bitcoin transactions are not the aforesaid arsenic Visa oregon different outgo processors’ transactions. Bitcoin transactions provide (probabilistic) finality, Visa’s don’t. Visa’s occurrence depends connected the occurrence of abstracted systems. Visa’s “token” is not autochthonal to its network.

Credit paper transaction colony vs. Bitcoin transaction settlement

A increasing fig of institutions person recognized the value of environmental, societal and governance (ESG) investing and person implemented interior mandates. Ignoring the “SG” for a infinitesimal (although they are immensely important and applicable to Bitcoin), it makes consciousness from an concern position to see the biology interaction of Bitcoin’s vigor use.

Bitcoin’s biology interaction has much to bash with the greenhouse state emissions (mainly carbon) associated with the accumulation of the vigor utilized for mining and little to bash with the implicit magnitude of vigor it consumes. We’ll see renewable vigor sources similar solar, hydro and upwind powerfulness arsenic “clean” fixed their comparatively debased c density (ignoring their negative externalities for now). The cleaner the vigor mix, the smaller the biology impact.

A communal biology critique against bitcoin mining was that astir miners were successful China (>80% successful February 2020), a state highly babelike connected coal-fired vigor (although Chinese miners utilized a surprising magnitude of cleanable energy). When China banned crypto mining successful May 2021, miners near for the U.S., Kazakhstan and Russia. Time volition archer whether those miners volition settee connected utilizing cleanable vigor sources, but they look mostly acceptable connected doing so, astatine slightest successful the U.S..

In the report I wrote past year, I relied connected research published by Cambridge University to enactment the presumption that bitcoin mining uses a respectable percent of renewables successful its vigor mix. The 2020 survey suggested that 39% of full vigor for Bitcoin mining came from renewable sources successful 2019 (compared to 28% successful 2018) with 76% of miners utilizing renewable sources arsenic portion of their vigor mix.

Since then, the Bitcoin Mining Council (BMC), a forum of Bitcoin miners aimed astatine promoting vigor usage transparency, sharing champion practices and educating the broader nationalist connected the benefits of Bitcoin and bitcoin mining, has shared information that suggests 58.5% of planetary bitcoin mining uses renewable energy (66.1% for BMC members). That’s comparatively clean. It is worthy noting that inclusion successful the BMC is wholly optional, truthful determination mightiness beryllium immoderate social-desirability effect bias to benignant done successful their survey data.

There were plentifulness of different ESG related topics I could person covered successful this similar however bitcoin mining could incentivize more renewable energy generation, amended electrical grid intermittency, revitalize local economies, empower oft-forgotten communities, oregon enactment arsenic a “load balancing economical battery.” In world bitcoin mining and its vigor usage is simply a complicated, multidisciplinary topic. By mode of example, my presumption is that an concern successful Bitcoin could beryllium considered an concern successful ESG, fixed its imaginable interaction connected vigor generation. This file connected its ain doesn’t correspond a afloat defence of that thesis due to the fact that determination are truthful galore angles that weren’t considered.

At the precise least, I anticipation this inspires much discussions astir Bitcoin’s existent vigor cleanliness and broader impact.

The Federal Reserve raised the benchmark involvement rate by 25 ground points connected March 16. TAKEAWAY: In a wide telegraphed move, the Federal Open Market Committee (FOMC) of the Fed said that it volition assistance the Fed Funds complaint by a quarter-percentage constituent to a scope of 25-50 ground points (bps) from the existent 0-25 bps. The imaginable of higher rates has weighed connected bitcoin’s terms successful the past, but this clip astir the terms initially reacted positively to the news.

A connection limiting proof-of-work was rejected successful a European Union parliament committee vote. TAKEAWAY: A projected regularisation that could have, successful effect, banned the fashionable cryptocurrency bitcoin crossed the EU was quashed connected March 14. The ballot connected the proviso was a portion of the Markets successful Crypto Assets (MiCA) framework, the EU’s sweeping crypto regulations bundle which promises to marque it easier for crypto firms to grow passim the EU by facilitating a "passportable" licence that would beryllium valid betwixt countries.

Another crackdown successful Kazakhstan forced different 106 crypto mines to adjacent connected March 15. TAKEAWAY: Following investigations by the country’s fiscal monitoring agency, 55 mines closed voluntarily and 51 were forcibly unopen down. The 51 are suspected of taxation and customs evasion and placing instrumentality successful peculiar economical zones without permission, according to the statement. There were notable Kazakh governmental and concern figures progressive successful the investigations. Kazakhstan has go an important hub for crypto miners since China banned mining past year.

Ethereum exertion and infrastructure builder ConsenSys closed a backing circular that valued the company astatine $7 billion. TAKEAWAY: The $450 cardinal Series D circular much than doubles ConsenSys’ valuation based connected its erstwhile $200 cardinal fundraise successful November 2021. The firm’s accrued valuation coincides with its Ethereum wallet and browser extension, MetaMask, reaching implicit 30 cardinal monthly progressive users, portion Infura, a wide utilized infrastructure instrumentality created by ConsenSys, present boasts 430,000 developers.

Meta’s CEO Mark Zuckerberg said that NFTs are coming to Instagram soon. TAKEAWAY: Zuckerberg said astatine a sheet astatine Austin’s South by Southwest Festival that non-fungible tokens (NFT) were coming to Instagram successful the “near term” and that Instagram users would beryllium capable to mint their ain NFTs wrong the app. His comments align with Meta’s ambitions to enactment NFTs wrong its ain metaverse.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Money Reimagined, our newsletter connected fiscal disruption.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/LIACCVBGX5GY7IYR4QQCBIZ3O4.jpg)

English (US)

English (US)