As equity markets statesman to teeter and volatility successful the bequest strategy increases done deleveraging, it seems that much symptom is imminent for the bitcoin price.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

This nonfiction volition screen bequest marketplace dynamics and measure the existent authorities of the “liquidity tide.” Bitcoin Magazine Pro readers are acquainted with bitcoin and equity markets trading successful tandem; we screen the narration closely.

We besides intimately travel the volatility dynamics crossed plus classes, arsenic the levels of humanities and implied volatility successful an plus people are precise adjuvant for evaluating comparative risk.

Before diving in, let’s revisit our existent thesis connected the authorities of planetary hazard markets:

A ample slowdown is amidst passim the planetary economy, arsenic short-sighted vigor argumentation has worked to support inflationary pressures elevated. Although equities and hazard broadly person felt alleviation since the mediate of June, we were and are of the content that this is simply a carnivore marketplace rally with further symptom to beryllium felt crossed risk.

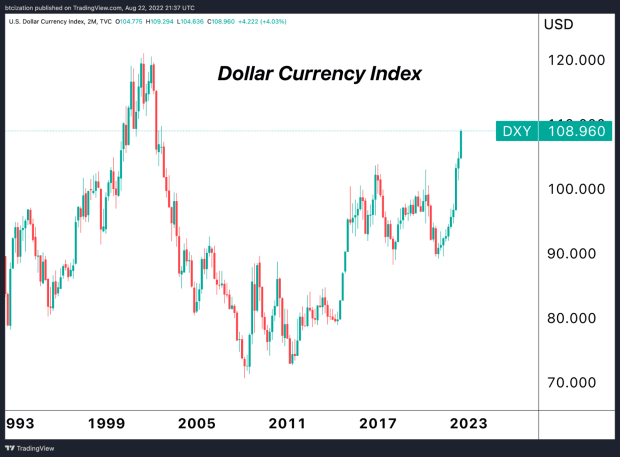

Global markets opened risk-off astatine the unfastened of Sunday nighttime futures trading, and sold disconnected further into the morning, arsenic volatility jumped, and the dollar (as seen by the DXY) approaching multi-decade highs erstwhile again.

The dollar currency scale is approaching multi-decade highs

The dollar currency scale is approaching multi-decade highs

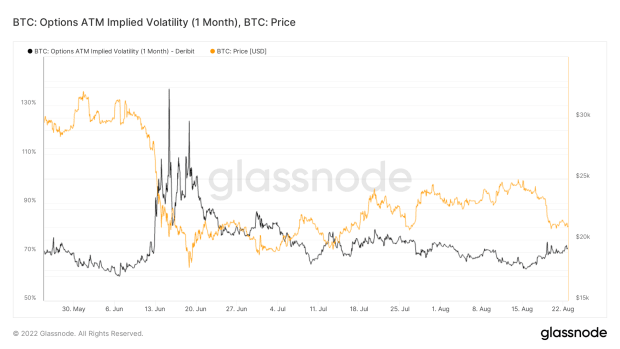

Shown beneath is the period guardant implied volatility for bitcoin, which tin beryllium thought of akin arsenic the VIX. Whereas equities are presently trading with a 24% expected volatility for the adjacent period (as expressed by VIX astatine 24), the options marketplace for bitcoin implies 71% volatility for 1-month contracts.

The implied volatility for bitcoin is determined by options contracts

The implied volatility for bitcoin is determined by options contracts

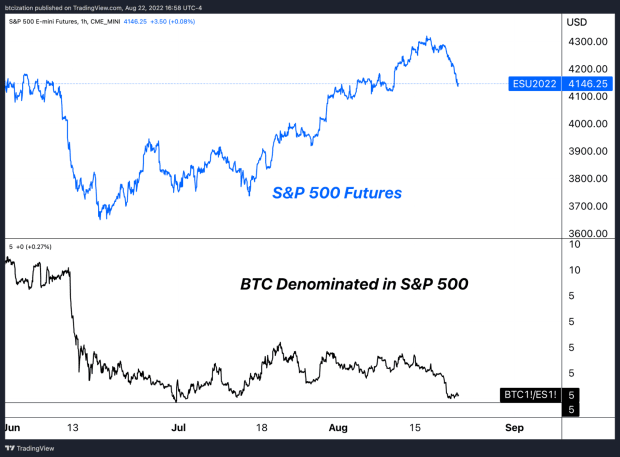

Thus, bitcoin’s underperformance comparative to equities passim the carnivore marketplace rally and consequent gully down from its section high, is worrisome for bulls, and telling successful wide astir request for the plus astatine existent marketplace prices.

We are lone being objective. Bitcoin has served arsenic beta to equities to the upside and downside passim 2022, but lone hardly rallied with the aforesaid fervor and upside volatility passim this summertime bounce arsenic equities melted upward.

With this successful mind, the interim effect is telling of a deficiency of comparative show against planetary hazard markets.

As rising yields and a beardown dollar spot expanding unit connected planetary equities, 1 should inquire themselves what are the apt outcomes of further risk-off positioning successful equities, and what is the apt effect for the little liquid bitcoin market.

As equity markets statesman to teeter over, and volatility successful the bequest strategy increases done this deleveraging, we are progressively assured successful our content that further symptom is the apt way earlier agelong successful the bitcoin market, and opportunistic investors should successful crook beryllium acceptable with a currency allocation.

Bitcoin denominated successful shares of the S&P 500 is approaching its 2022 lows:

Bitcoin denominated successful shares of the S&P 500 approaching 2022 lows

Bitcoin denominated successful shares of the S&P 500 approaching 2022 lows

Given the comparative humanities correlation betwixt the 2 plus classes, the humanities and implied volatility of the bitcoin market, and the apt way guardant for the planetary economy, today’s terms enactment reiterates our short/medium-term marketplace outlook that the debased for bitcoin is not yet in.

Over the short/medium term, a currency presumption is apt the asymmetric stake (in bitcoin terms).

Over the long-term, bitcoin remains wholly mispriced arsenic a neutral hard monetary plus intent built for the integer age.

3 years ago

3 years ago

English (US)

English (US)