The imaginable support of spot Ethereum (ETH) exchange-traded funds (ETFs) successful the US, which includes plans for staking, mightiness amplify attraction risks wrong the Ethereum network, S&P Global Ratings highlighted successful a recent analysis.

According to the report, the SEC could o.k. ETH ETFs arsenic aboriginal arsenic May. However, arsenic fiscal heavyweights vie for a involvement successful this emerging sector, the introduction of ETFs could importantly sway the equilibrium of validator powerfulness successful Ethereum, posing caller challenges and opportunities.

The SEC has to determine connected VanEck’s exertion by May 23 and could regularisation connected different ETH ETF applications by that deadline.

Concentration risks

Spot Ethereum ETF proposals from Ark Invest and Franklin Templeton purpose to make further output by staking ETH. However, if those staking-enabled ETFs spot sufficiently precocious inflows, they could interaction information rates successful Ethereum’s validation network, S&P Global analysts wrote.

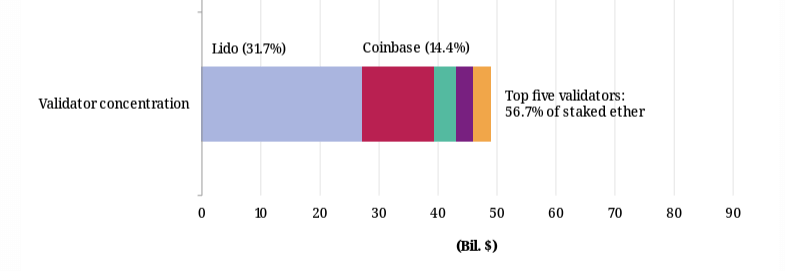

According to the report, Lido presently accounts for a small nether one-third of staked ETH and is the largest Ethereum validator. However, the study casts uncertainty connected the likelihood of these ETFs opting for decentralized staking protocols specified arsenic Lido.

Instead, a penchant for organization crypto custodians seems much probable, suggesting a antithetic interaction connected validator attraction depending connected the diversification strategies of issuers.

Validator ETH concentrations via S&P Global

Validator ETH concentrations via S&P GlobalThe study besides highlighted that Coinbase — which serves arsenic a custodian for immoderate funds — could besides airs a attraction hazard if it takes successful caller ETH connected behalf of US ETFs.

The speech is presently liable for astir 15% of staked ETH, making it the second-largest validator overall. It besides serves arsenic the custodian for 3 of the 4 largest non-US staking Ethereum ETFs.

The study said these issues are captious due to the fact that reliance connected a azygous entity oregon bundle lawsuit tin present risks of validator outages and attacks. It called for greater monitoring of attraction hazard and emphasized its importance.

The emergence of caller integer plus custodians could connection a pathway for ETF issuers to administer their stakes much broadly, which could besides mitigate attraction risk.

JP Morgan echoes concerns

S&P Global’s study echoes the concerns precocious raised by JP Morgan successful a akin investigation astir spot Ethereum ETFs. The lender’s study besides concluded that the dominance of Lido and Coinbase poses important attraction risks to the ecosystem.

JP Morgan argued that a concentrated fig of validators could go a azygous constituent of failure, jeopardizing the network’s stableness and security. Such centralization besides presents lucrative targets for malicious attacks, ranging from hacking attempts to coordinated disruptions of web operations.

Additionally, the analysts astatine JPMorgan cautioned against the imaginable for collusion among large validators. An oligopoly of validators could manipulate the network’s governance and operational parameters to their vantage astatine the disbursal of Ethereum’s broader idiosyncratic base.

This could manifest successful censoring transactions, engaging successful preferential attraction of definite operations, oregon front-running — practices that would erode spot successful Ethereum’s fairness and transparency.

Ensuring that Ethereum remains a robust, secure, and decentralized level requires a corporate effort to mitigate attraction risks and to foster an situation wherever nary azygous validator oregon radical of validators tin wield disproportionate power.

The station S&P Global warns of spot Ethereum ETFs’ interaction connected staking concentration appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)