- Nansen published a study connected censorship hazard and the selling unit of Ethereum pursuing The Merge.

- It does not judge determination to beryllium selling unit for a assortment of reasons.

- Meanwhile, investors are anticipating a bump successful the terms of Ethereum, portion immoderate traders are shorting ETH to hedge their risk.

Data level Nansen has stated that determination isn’t apt to beryllium immoderate merchantability unit pursuing Ethereum’s Merge. Nansen posted a study connected September 13, offering a heavy dive into aspects of The Merge.

Specifically, the report dives into whether Proof-of-Stake volition present much censorship hazard astatine the validator level. It besides looks astatine whether it would summation merchantability unit from those who unstake successful the medium-term.

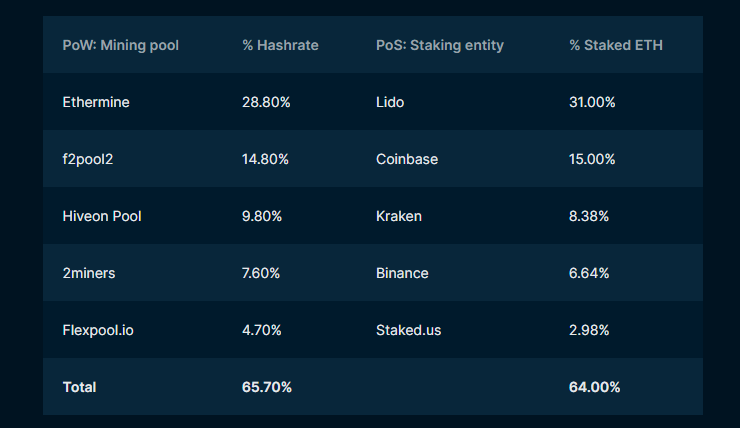

Nansen notes that 65% of staking is liquid, with astir 426,000 validators. However, astir 64% of the staked ETH is held by 5 entities. The largest holder of staked ETH is Lido astatine 31%, with Coinbase, Kraken, and Binance making up different 30% oregon so.

Staked ETH held by platforms: Nansen

Staked ETH held by platforms: NansenIn the abbreviated term, determination volition beryllium nary selling of staked ETH, arsenic it tin lone beryllium unstaked aft the Shanghai upgrade. This is expected wrong 6 to 12 months aft The Merge.

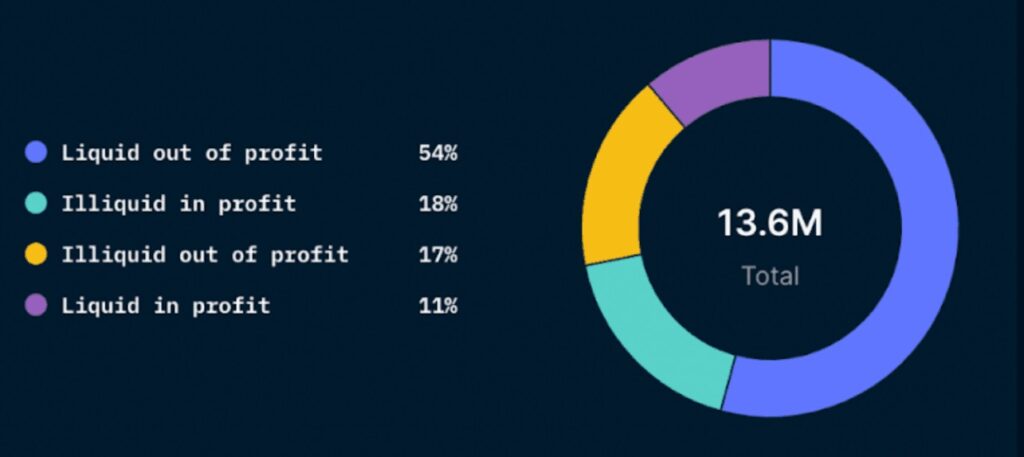

Even then, Nansen does not expect merchantability pressure, arsenic the bulk of staked ETH is presently retired of nett levels. With 65% of staked ETH being liquid, it offers adjacent little inducement to unstake and merchantability the cryptocurrency.

Over 70% of staked ETH holders are retired of profit: Nansen

Over 70% of staked ETH holders are retired of profit: NansenFurthermore, Nansen highlights the information that whales person been accumulating ETH implicit the past fewer months. This is simply a motion of content successful the network, which suggests that selling is not connected their minds.

There whitethorn beryllium adjacent little interest for selling pursuing the Shanghai update. The Ethereum Foundation has suggested that determination could beryllium a withdrawal queue to forestall a unreserved of sell-offs.

Excitement Surrounding The Merge Reaching Fever Pitch

Investors and crypto enthusiasts person each been discussing The Merge animatedly successful the past fewer weeks. There is optimism with respect to the information that Ethereum volition go a deflationary token. Some person adjacent predicted that the token could scope $3,000 by the extremity of 2022.

Meanwhile, immoderate traders person shorted ETH up of the event, with ETH backing rates besides going negative. They could simply beryllium hedging their risk, and they are paying precocious fees to support their positions. With antagonistic backing rates, it means that traders tin bargain ETH futures contracts astatine a terms little than the scale price.

3 years ago

3 years ago

English (US)

English (US)