Bitcoin’s caller correction to $92,000 came aft failing to breach the intelligence absorption astatine $100,000, a captious level expected to people a caller section successful the ongoing bull market.

While corrections of up to -30% are predominant during bull runs, the crisp diminution beneath $93,000 caused a conception of short-term holders (STHs) to recognize losses.

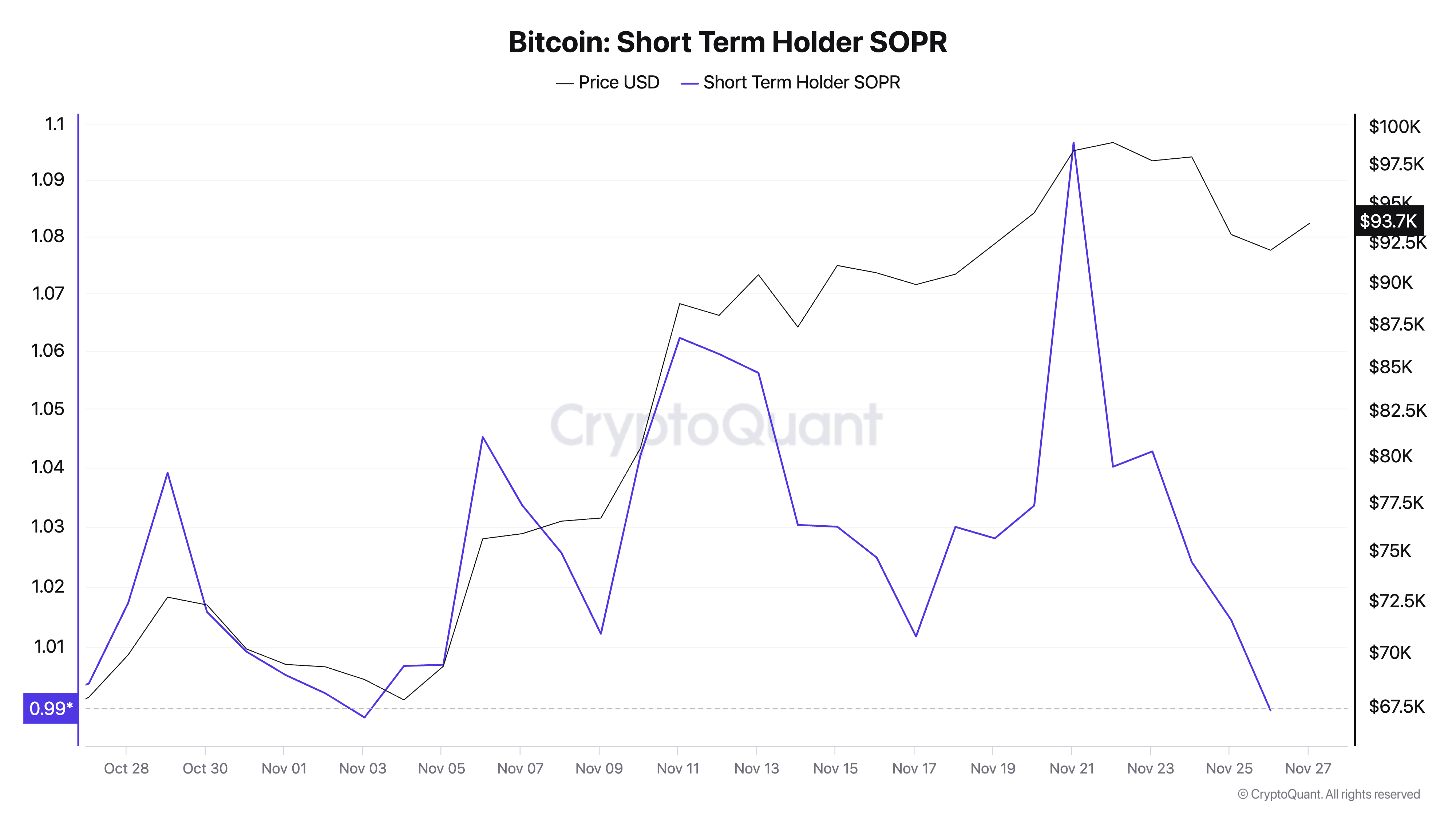

The spent output nett ratio (SOPR) measures the profitability of coins moved wrong a circumstantial timeframe. When applied to short-term holders (STHs), i.e., addresses that person held onto their BTC for little than six months, the ratio enables america to measurement the profitability of coins moved by this peculiar cohort.

Short-term holder SOPR is calculated by dividing the worth of spent outputs astatine the clip of spending by the worth of the aforesaid outputs astatine the clip they were created. A worth supra 1 indicates that coins are being sold astatine a profit, portion a worth beneath 1 signifies realized losses. When STH SOPR trends higher, it signals improving marketplace sentiment and conditions for short-term holders, whereas a declining SOPR reflects deteriorating profitability and perchance weaker sentiment among short-term investors.

On Nov. 17, arsenic Bitcoin was trading conscionable beneath $90,000, STH SOPR stood astatine 1.0117, indicating marginal profitability among STHs. By Nov. 21, erstwhile Bitcoin reached an all-time precocious of $98,430, STH SOPR surged to 1.0966, reflecting wide profit-taking arsenic prices neared six-figure territory.

However, arsenic Bitcoin’s terms dropped, STH SOPR declined to 1.0144 connected Nov. 25 and fell beneath 1 connected Nov. 26 to 0.9995. This marked a captious displacement — short-term holders, connected average, started realizing tiny losses, a stark opposition to the earlier signifier of profit-taking.

Graph showing the STH SOPR from Oct. 27 to Nov. 26, 2024 (Source: CryptoQuant)

Graph showing the STH SOPR from Oct. 27 to Nov. 26, 2024 (Source: CryptoQuant)The driblet successful STH SOPR shows the intelligence interaction of Bitcoin’s nonaccomplishment to prolong its rally supra $100,000. During bull rallies, sustained values supra 1 bespeak beardown marketplace confidence, arsenic STHs are consenting to merchantability astatine a profit, assured that others volition bargain higher.

The dip beneath 1 suggests expanding hesitancy, perchance driven by panic selling oregon forced liquidations. This is important to show arsenic it often marks the capitulation of anemic hands, cleansing the marketplace of excessive leverage and speculative positions.

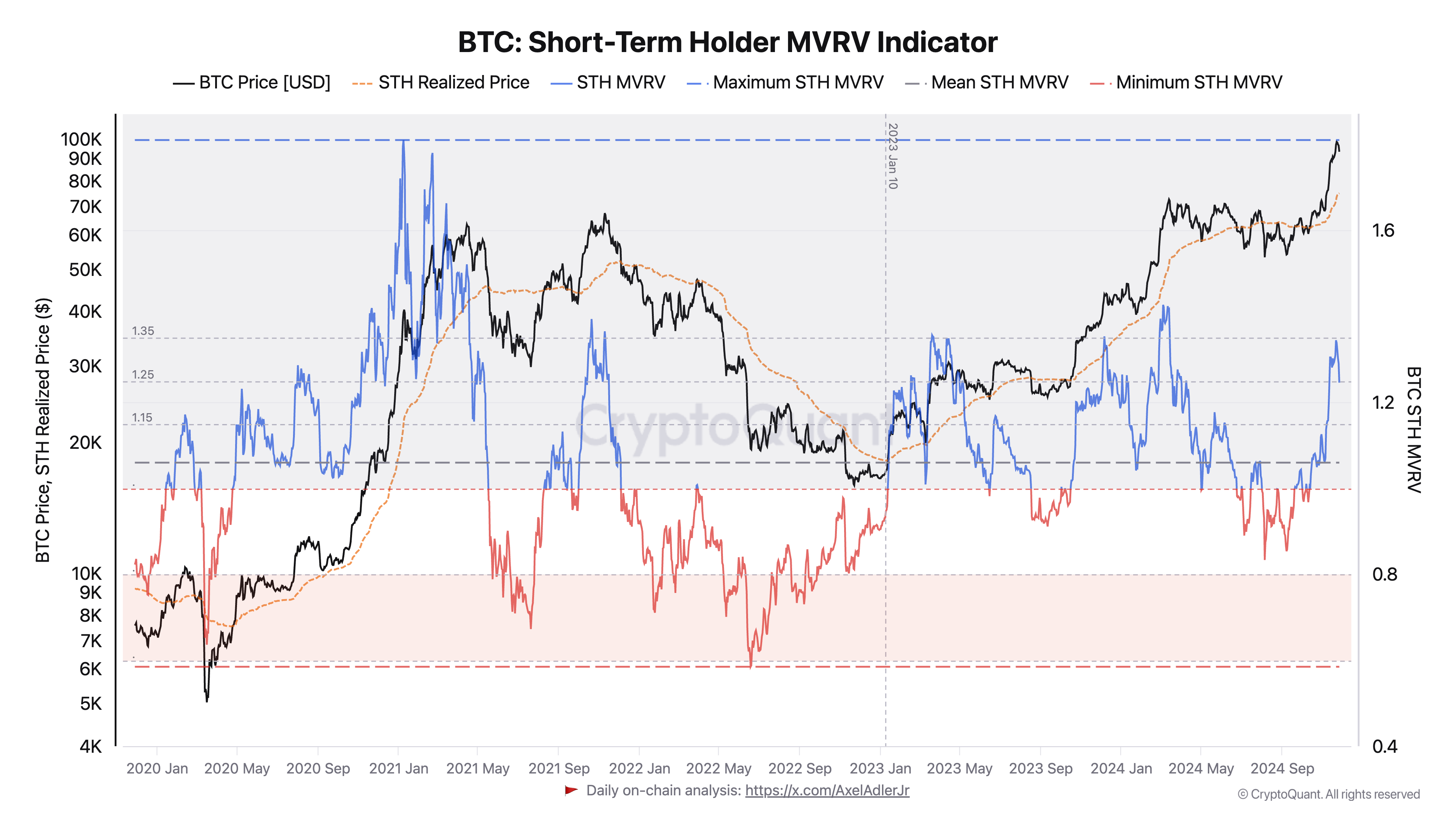

Changes successful the short-term holder marketplace worth to realized worth (MVRV) ratio further bespeak specified capitulation is taking place. MVRV measures the unrealized nett oregon nonaccomplishment of a radical of holders by comparing the marketplace worth of their holdings to their realized value. A worth supra 1 indicates that STHs, connected average, clasp coins astatine a profit, portion a worth beneath 1 suggests unrealized losses.

On Nov. 21, STH MVRV reached 1.3447, signaling that short-term holders were sitting connected a 34.47% mean unrealized nett during Bitcoin’s rally. However, by Nov.26, the STH MVRV declined to 1.2459, showing reduced profitability aft Bitcoin’s correction. The diminution successful MVRV aligns with the driblet successful STH SOPR, confirming that profitability for STHs was eroded arsenic prices fell beneath $93,000.

Graph showing the STH MVRV indicator from Nov. 28, 2019, to Nov. 26, 2024 (Source: CryptoQuant)

Graph showing the STH MVRV indicator from Nov. 28, 2019, to Nov. 26, 2024 (Source: CryptoQuant)These 2 ratios bespeak the intelligence toll accelerated terms declines person connected short-term holders. Realized losses, peculiarly among STHs, thin to exacerbate antagonistic sentiment and accelerate capitulation.

However, this signifier of capitulation whitethorn service a constructive relation successful the broader marketplace cycle. By shaking retired overleveraged positions and anemic hands, the correction could found a much coagulated instauration for Bitcoin’s adjacent limb upward. The caller diminution successful STH SOPR and MVRV appears to person reset the short-term market, perchance clearing the mode for stronger enactment levels astir $92,000 to $93,000.

However, if the diminution successful STH SOPR and MVRV persists oregon accelerates, it whitethorn awesome deeper underlying weakness successful the market. Extended periods of realized losses among STHs could undermine confidence, starring to further sell-offs and a prolonged downturn.

Additionally, the nonaccomplishment to prolong levels adjacent $100,000 could dampen the enthusiasm of organization investors and retail participants alike, creating further absorption to immoderate betterment attempts.

Ultimately, the correction beneath $93,000 and the resulting behaviour of STHs bespeak the earthy ebb and travel of a volatile market. While realized losses person shaken retired weaker participants, the broader structural communicative remains intact. Bitcoin’s humanities resilience, coupled with a imaginable reset successful leverage and speculative positions, suggests the anticipation of a renewed uptrend.

The station Short-term holders deed with losses arsenic Bitcoin fell beneath $93k appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)