Solana (SOL) is poised to further heighten its decentralized concern (DeFi) ecosystem with the instauration of a caller validator client. This breathtaking improvement has garnered attraction from stakeholders and manufacture experts who judge it could importantly bolster Solana’s presumption successful the highly-stacked DeFi landscape.

As optimism runs high, Solana enthusiasts eagerly expect the imaginable benefits that this innovative validator lawsuit whitethorn bring, further solidifying the platform’s aboriginal prospects.

Could this validator lawsuit beryllium the catalyst that propels Solana’s DeFi ecosystem to caller heights?

Enhanced Solana DeFi On The Horizon

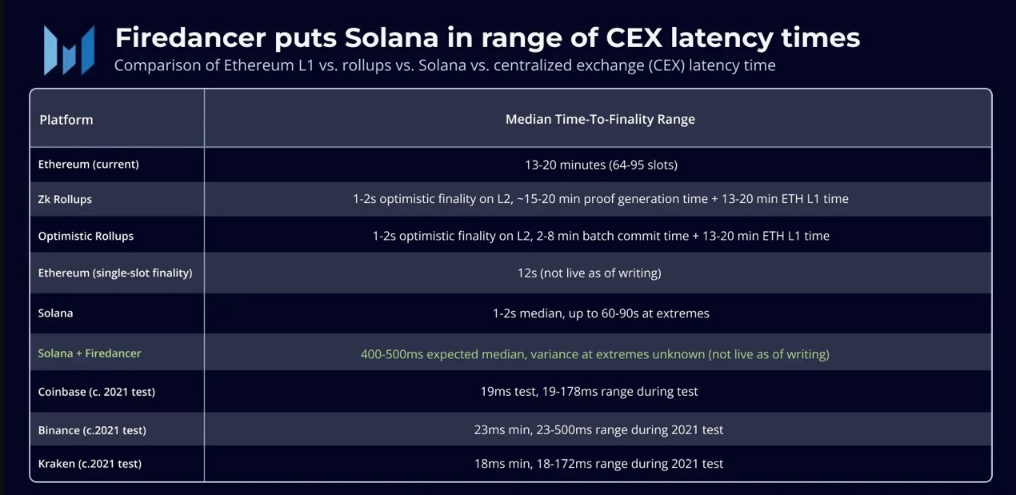

A caller report connected SOL price unveils an breathtaking improvement successful the satellite of Solana’s DeFi ecosystem. Enter Firedancer, an autarkic validator lawsuit developed by Jump, which could revolutionize the DeFi scenery by improving important aspects of the platform.

Firedancer’s superior absorption lies successful reducing latency times, efficaciously bridging the spread betwixt decentralized exchanges and their centralized counterparts.

By efficaciously mitigating latency times, Firedancer has the imaginable to unlock faster transaction processing wrong the Solana network. This transformative enhancement not lone promises a superior idiosyncratic acquisition but besides has the powerfulness to pull a greater fig of participants to the network.

The accrued ratio and streamlined operations facilitated by Firedancer are expected to elevate the scalability and usability of decentralized applications built connected Solana, paving the mode for important maturation and advancement wrong the ecosystem.

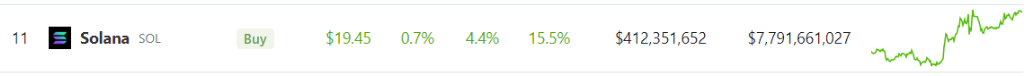

As of writing, CoinGecko’s data reveals SOL’s existent terms astatine $19.45, accompanied by an summation of 4.4% wrong the past 24 hours. Furthermore, the cryptocurrency has experienced a singular emergence of 15.5% implicit the people of the past 7 days, reflecting the prevailing marketplace sentiment and the imaginable interaction of transformative innovations specified arsenic Firedancer connected the aboriginal trajectory of Solana.

Solana’s Resilience Shines Amidst Market Volatility, Regulatory Challenges

Solana has emerged arsenic 1 of the gainers successful a mixed aboriginal trading league among the apical 10 non-stablecoin cryptocurrencies by marketplace capitalization. The rally comes arsenic a enactment of caller aerial aft a bid of bearish indicators that surfaced past week, including the closure of the Solana-based non-fungible token (NFT) protocol, Cardinal, citing “macroeconomic challenges.”

Hey Everyone, we person immoderate unfortunate quality to stock 🙁

After a batch of reflection, we’ve decided to statesman the process of winding down our protocols. Let’s dive into it 🧵 ⬇️

— Cardinal (@cardinal_labs) June 28, 2023

Additionally, the Revolut neobank and crypto speech reportedly announced the delisting of Solana, Cardano, and Polygon for its US-based users past Wednesday.

This quality comes connected the heels of the caller suit filed by the Securities and Exchange Commission (SEC) against starring exchanges Coinbase and Binance.US, wherein Solana, Cardano, and Polygon were named arsenic tokens allegedly progressive successful the amerciable issuance of fiscal securities.

Despite these regulatory hurdles and marketplace setbacks, Solana has displayed resilience and managed to stay connected a affirmative trajectory amidst the volatility.

(This site’s contented should not beryllium construed arsenic concern advice. Investing involves risk. When you invest, your superior is taxable to risk).

Featured representation from Pexels

2 years ago

2 years ago

English (US)

English (US)