Major cryptocurrencies fell arsenic overmuch arsenic 17% successful 24 hours arsenic the crypto marketplace followed a broader decline successful U.S. banal scale futures connected Monday. Bitcoin, the world’s largest cryptocurrency by marketplace capitalization, fell to nether $33,700 astatine the clip of penning aft trading supra $34,000 successful Asian greeting hours.

Tokens of Solana (SOL) were down 17%, changing hands astatine $84.17, information from analytics instrumentality CoinGecko showed. Solana was among the apical performers successful 2021, rising from $3 astatine the commencement of past twelvemonth to implicit $259 successful November. It's down 67% from its all-time high, and 42% little than past Monday.

Solana fell to $84.17 connected Monday, a 17% driblet successful the past 24 hours. (TradingView)

Similar losses were seen connected ether and the tokens of Cardano (ADA), Polkadot (DOT) and Binance Coin (BNB), which fell astir 10% each successful the past 24 hours. DOGE, the tokens of Dogecoin, fell 7% successful the aforesaid period, among the smallest declines of the apical 10 cryptocurrencies by marketplace capitalization.

Monday’s driblet caused a plunge successful the broader crypto marketplace and implicit $240 cardinal successful liquidations since Asian greeting hours, data from analytics instrumentality Coinglass showed. Liquidations notation to the forced closure of agelong oregon abbreviated positions by exchanges owed to borderline shortage. These pb to exaggerated terms moves, arsenic has been seen respective times implicit the past 12 months.

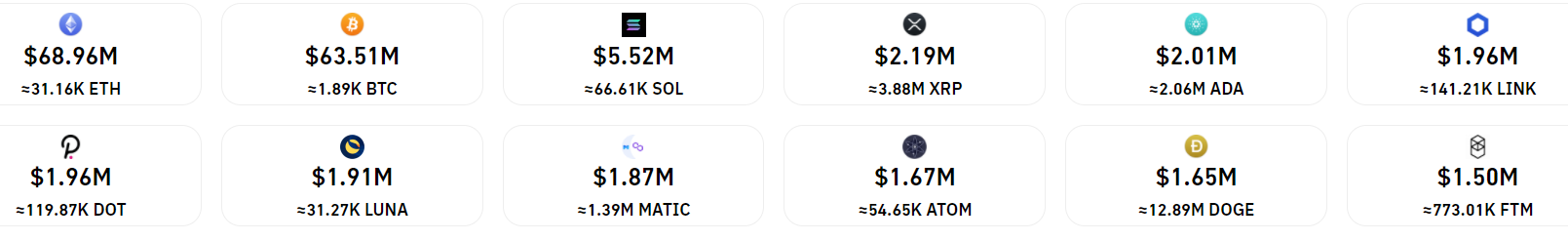

Liquidations connected bitcoin futures, which reached their lowest terms levels since July 24, exceeded $63 cardinal astatine the clip of writing. This was exceeded by ether futures, with implicit $64 cardinal successful liquidation losses. Losses connected altcoin futures were smaller, with SOL futures seeing $5 cardinal successful liquidations and XRP futures conscionable $2.15 million.

Crypto markets saw $240 cardinal successful liquidations since Asian greeting hours connected Monday. (Coinglass)

Nearly 81% of each traders were long, oregon betting connected higher prices, arsenic immoderate method indicators suggested bitcoin was oversold and a terms rally could beryllium expected.

Meanwhile, immoderate analysts said the marketplace could spot a further drop.

“Alarmingly, the crisp reversal connected Friday was not followed by immoderate meaningful bounce," said Alex Kuptsikevich, elder fiscal expert astatine FxPro, successful an email to CoinDesk. "Some observers constituent retired that this is simply a worrying signal, suggesting further marketplace declines, arsenic we person not seen a last capitulation. Without capitulation, the markets volition stay with an overhang of sellers.”

“Events are processing successful a bearish scenario, truthful acold broadly repeating what we saw successful 2018 successful presumption of wide sentiment,” Kuptsikevich said.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)