The backing volition beryllium utilized to enactment SonicStrategy's treasury, validator operations, and blockchain investments, and tin person to communal banal astatine $4.50 per share.

Sep 2, 2025, 4:09 p.m.

Spetz (SPTZ), doing concern arsenic SonicStrategy, has announced It’s receiving $40 cardinal successful convertible backing from the instauration down the Sonic blockchain, Sonic Labs.

The financing comes successful the signifier of a six-month, zero-coupon convertible enactment issued successful Sonic’s autochthonal S tokens. If SonicStrategy uplists from the Canadian Securities Exchange to the Nasdaq oregon a akin U.S. speech and raises astatine slightest $40 cardinal successful extracurricular capital, the indebtedness tin person to communal banal astatine $4.50 per share.

Those shares volition beryllium locked for 3 years. Sonic Labs' token publication volition beryllium locked for 4 years.

SonicStrategy plans to usage the superior to enactment its treasury, validator operations and blockchain investments. The companies expect the woody to adjacent wrong 5 concern days nether Canadian Securities Exchange rules.

The concern is portion of Sonic’s broader propulsion into the U.S., pursuing assemblage support for a $150 cardinal enlargement plan. That inaugural includes efforts to make an exchange-traded money and prosecute a backstage concern successful nationalist equity (PIPE) vehicle.

Sonic Labs CEO Michael Kong said SonicStrategy acts arsenic a nexus betwixt the blockchain and accepted finance. “"This concern reflects our assurance successful their execution and their quality to supply institutional-grade infrastructure for the Sonic ecosystem,” Kong said successful a property release.

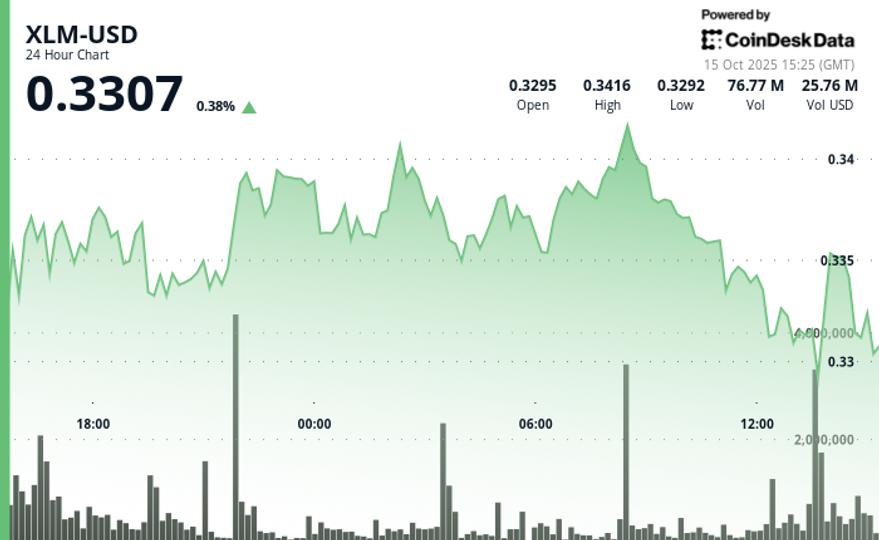

Sonic’s S tokens are up astir 0.4% successful the past 24 hours, portion based connected the CoinDesk 20 (CD20) scale the wider crypto marketplace roseate 1.3% successful the aforesaid period.

More For You

SmartGold, Chintai Tokenize $1.6B successful IRA Gold, Add DeFi Yield for U.S. Investors

The tokenized golden operation lets U.S. status investors gain output connected crypto protocols portion keeping taxation advantages.

What to know:

- SmartGold teamed up with Chintai Nexus to let U.S. IRA accounts to tokenize their golden holdings and gain output connected crypto protocols.

- The offering allows $1.6 cardinal successful IRA-held golden to beryllium utilized successful DeFi markets portion maintaining its tax-deferred status.

- The inaugural highlights the increasing involvement successful tokenizing real-world assets.

1 month ago

1 month ago

English (US)

English (US)