The on-chain indicator SOPR suggests that Bitcoin holders person continued to merchantability astatine a nonaccomplishment for a portion now. This behaviour is akin to what was seen during the May-June 2021 mini-bear period.

Bitcoin Investors Have Continued To Dump At A Loss For A Month Now

As pointed retired by an expert successful a CryptoQuant post, the BTC SOPR shows that holders are presently selling astatine a loss.

The “Spent Output Profit Ratio” (or SOPR successful short) is an indicator that tells america whether coins moved connected a fixed time were sold astatine a nett oregon a loss.

The metric measures truthful by looking astatine each coin connected the concatenation and checking what the terms the coin was past moved at. After that, the indicator calculates the ratio betwixt this terms and the existent price.

When the worth of the indicator is supra one, it means that holders are presently selling, connected an average, astatine a profit.

On the different hand, erstwhile the SOPR has values little than one, it implies investors are moving their Bitcoin astatine a nonaccomplishment overall.

Finally, determination is the lawsuit erstwhile the worth of the indicator is precisely adjacent to one. During specified a period, the marketplace is breaking adjacent connected BTC sales.

Related Reading | Is The Bitcoin Hashrate Recovering From Kazakhstan’s Crisis? Fear Abides

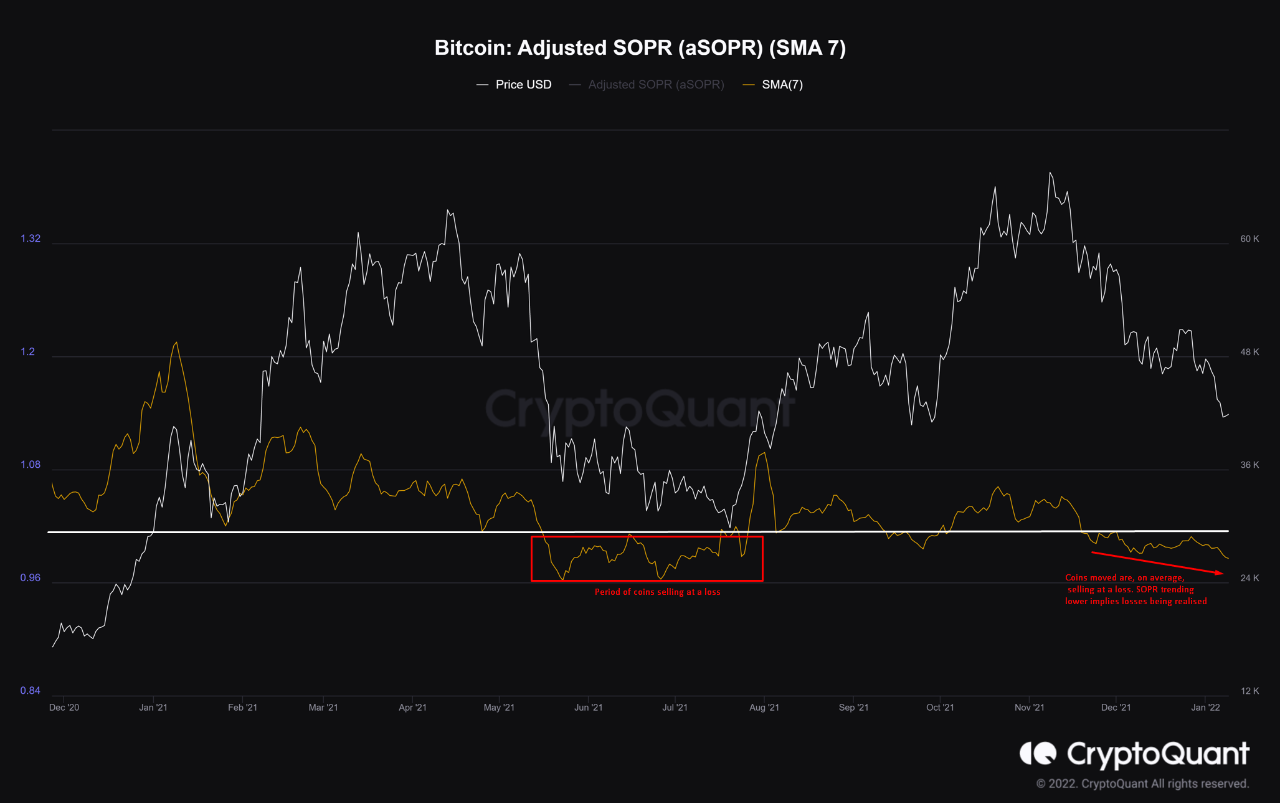

Now, present is simply a illustration that shows the inclination successful the worth of the Bitcoin SOPR implicit the past year:

As you tin spot successful the supra graph, the Bitcoin SOPR presently has a worth little than one, which means holders are selling astatine a loss.

Related Reading | Bitcoin Open Interest Continues To Rise, Short Squeeze Incoming?

Such a inclination has been determination for a period now. A akin concern was determination aft the May 2021 clang wherever the indicator stayed beneath 1 for a prolonged play of time.

It’s imaginable that the existent inclination of debased SOPR values volition proceed for a while, conscionable similar backmost then. The play astir May-June was marked by a mini-bear market, and truthful if the inclination does repeat, a akin carnivore situation could travel successful the adjacent future.

BTC Price

Yesterday, Bitcoin’s price concisely declined beneath the $40k mark, but since past has jumped backmost up. At the clip of writing, the terms of the coin floats astir $41.7k, down 10% successful the past 7 days. Over the past month, the crypto has mislaid 13% successful value.

The beneath illustration shows the inclination successful the terms of BTC implicit the past 5 days.

4 years ago

4 years ago

English (US)

English (US)