Gradually, alongside the cryptocurrency industry, stablecoins are increasing successful spot and popularity. Their maturation results from the stableness they connection against cryptocurrency volatility.

At the moment, USDT remains the largest stablecoin by marketplace cap, arsenic USDC, Binance USD, and DAI marque up the apical 4.

Prominent stablecoins aft FTX collapse

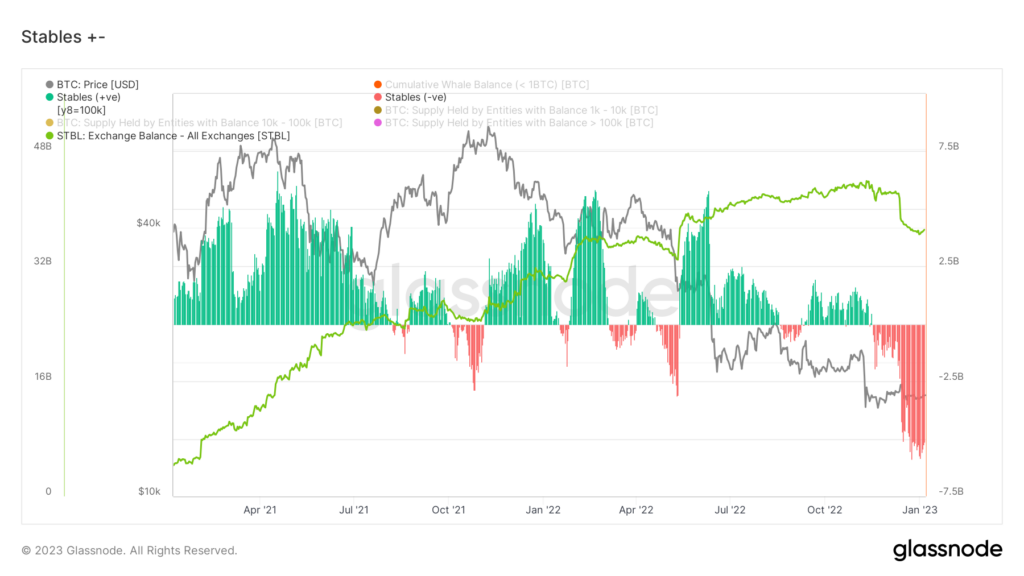

The entirety of the stablecoin assemblage has a marketplace headdress of $138 billion, according to CoinMarketCap. The large 4 stablecoins lend much than $130 cardinal to the figure, dominating the stablecoin market. Despite their maturation and popularity, lone a minimal magnitude of stablecoins are connected cryptocurrency exchanges.

Presently, astir 37 cardinal stablecoins are held successful reserves of cryptocurrency exchanges. Binance is the highest contributor to this figure, with astir $24 cardinal successful stablecoins successful its reserve. Coinbase has much than $973 million, Huobi $709 million, Bitfinex $145 million, Gemini 98 million, and Gate.io $78 million.

Stablecoin balances successful centralized exchanges (Source: Glassnode)

Stablecoin balances successful centralized exchanges (Source: Glassnode)Due to marketplace uncertainty and debased spot successful centralized exchanges aft the illness of FTX, astir 3.93 cardinal stablecoins person near exchanges successful the past 30 days.

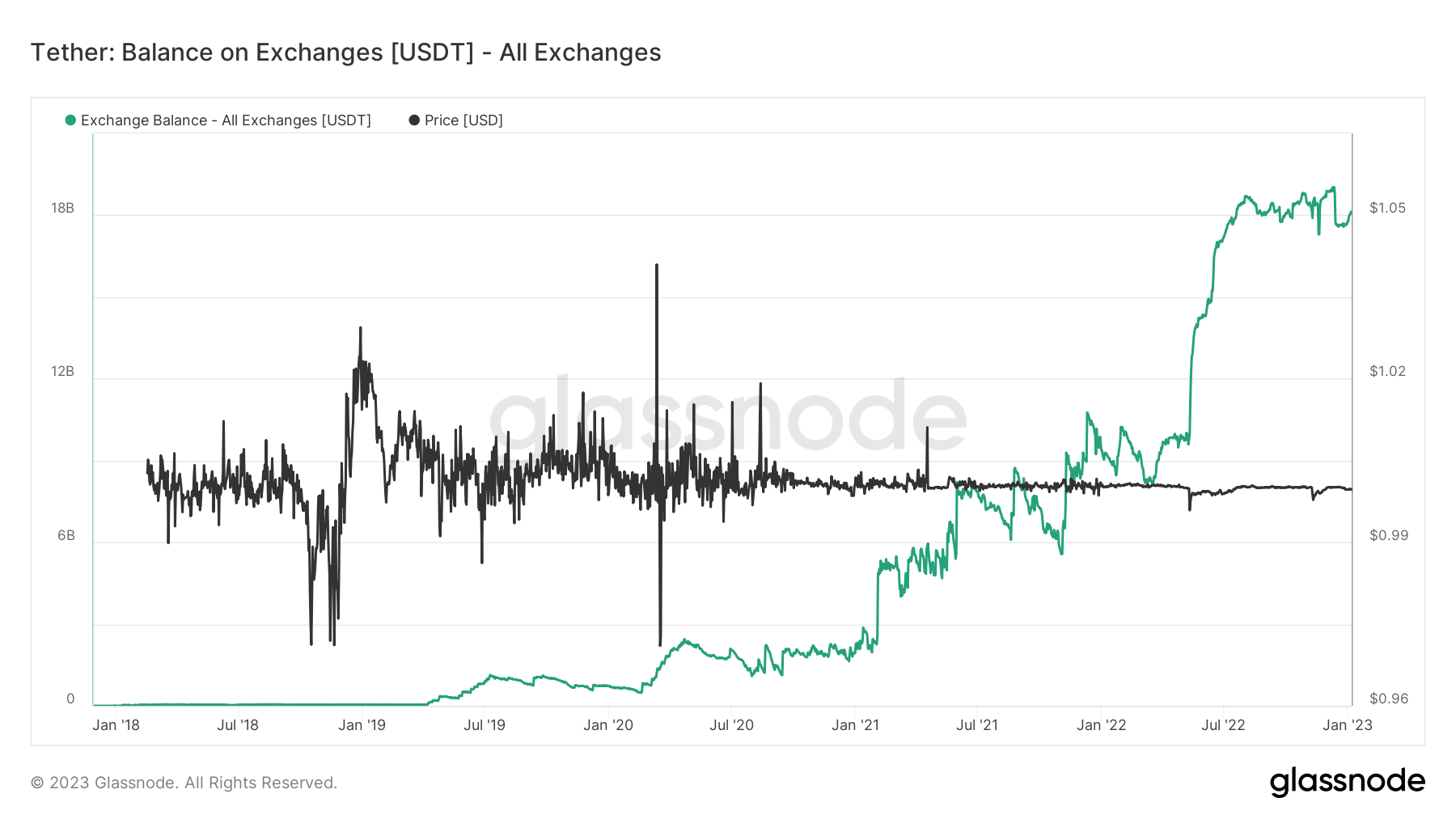

Despite the prevailing crypto winter, USDT has enjoyed much of a unchangeable beingness successful the reserve of cryptocurrency exchange. Since August 2022, USDT has mostly stayed level astatine $18 cardinal successful the reserve of cryptocurrency exchanges.

USDT balances connected exchanges (Source: Glassnode)

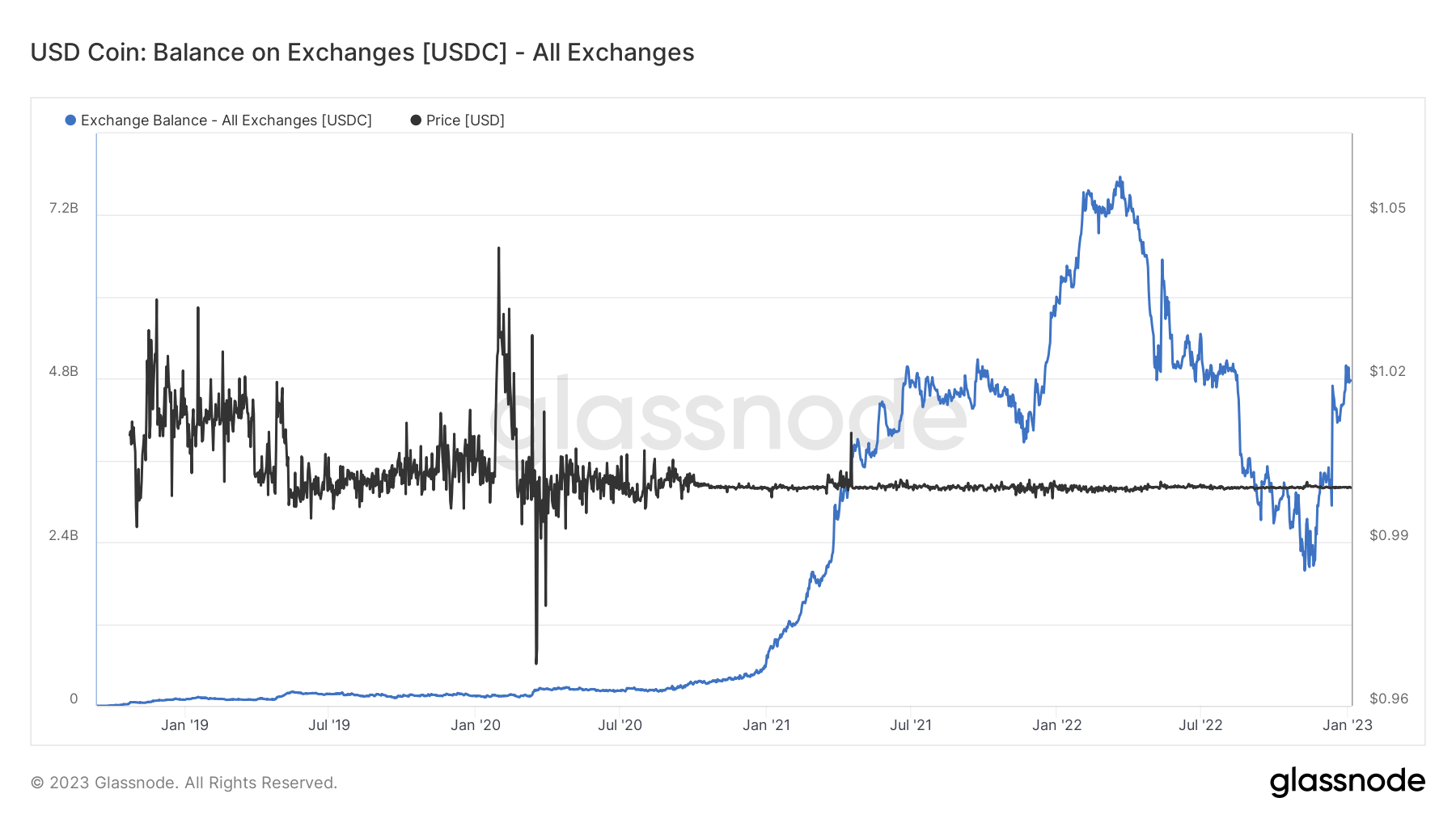

USDT balances connected exchanges (Source: Glassnode)USDC, connected the different hand, has enjoyed immoderate maturation portion trying to curb USDT’s dominance successful the stablecoin market. Since the illness of FTX successful aboriginal November 2022, the magnitude of USDC successful the reserve of cryptocurrency exchanges doubled to $5 billion.

USDC balances connected exchanges (Source: Glassnode)

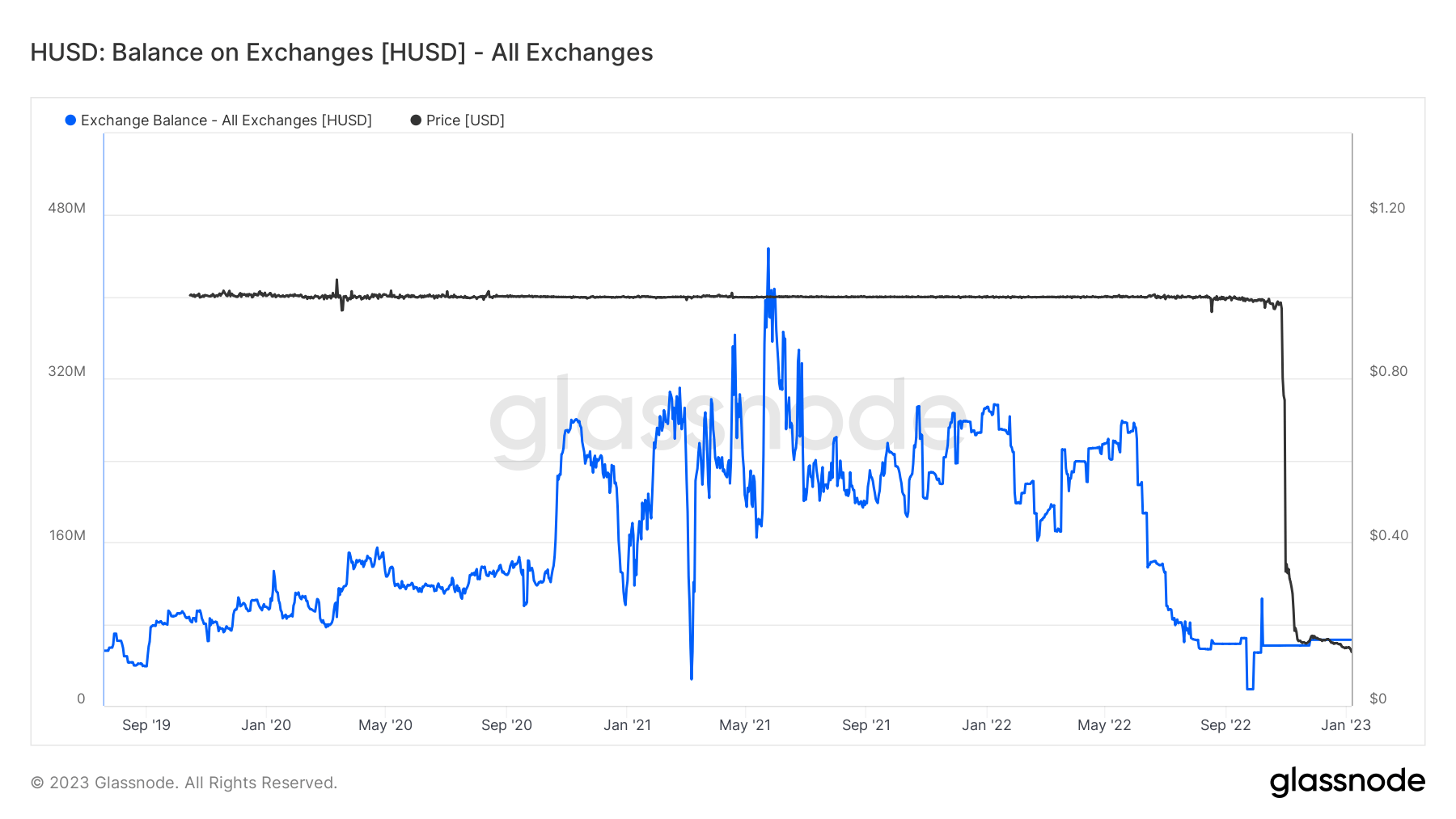

USDC balances connected exchanges (Source: Glassnode)However, the resilience the stablecoin assemblage has been enjoying since the illness of Terra Algorithm stablecoin UST is somewhat nether threat. Following the announcement of Huobi Global to delist the HUSD stablecoin, the token has suffered a monolithic decline.

Shortly aft the announcement, the stablecoin fell 72% disconnected its dollar peg, and present HUSD is trading astatine 13 cents. In a crisp dip, the magnitude of HUSD successful cryptocurrency speech reserves is astir to surpass its all-time debased of $65 million.

HUSD balances connected exchanges (Source: Glassnode)

HUSD balances connected exchanges (Source: Glassnode)Stablecoin reserve successful centralized exchanges

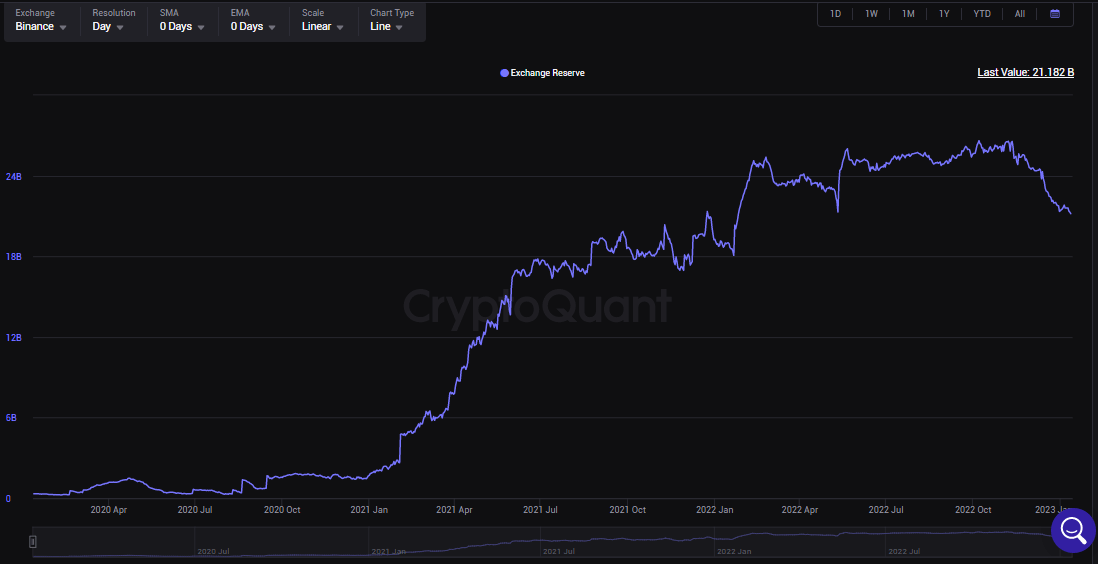

Following the illness of FTX, investors began to uncertainty the reliability of Centralized exchanges. As of January 12, Binance recorded astir $5.202 cardinal outflow of stablecoin since the illness of FTX.

Binance stablecoin balances (Source: CryptoQuant)

Binance stablecoin balances (Source: CryptoQuant)Likewise, wrong 2 months aft the demise of FTX, Coinbase Pro saw a nett outflow of $690 million, Huobi $277 million, Bitfinex $125 million, Gemini $398 million, and Gate.io $42 million.

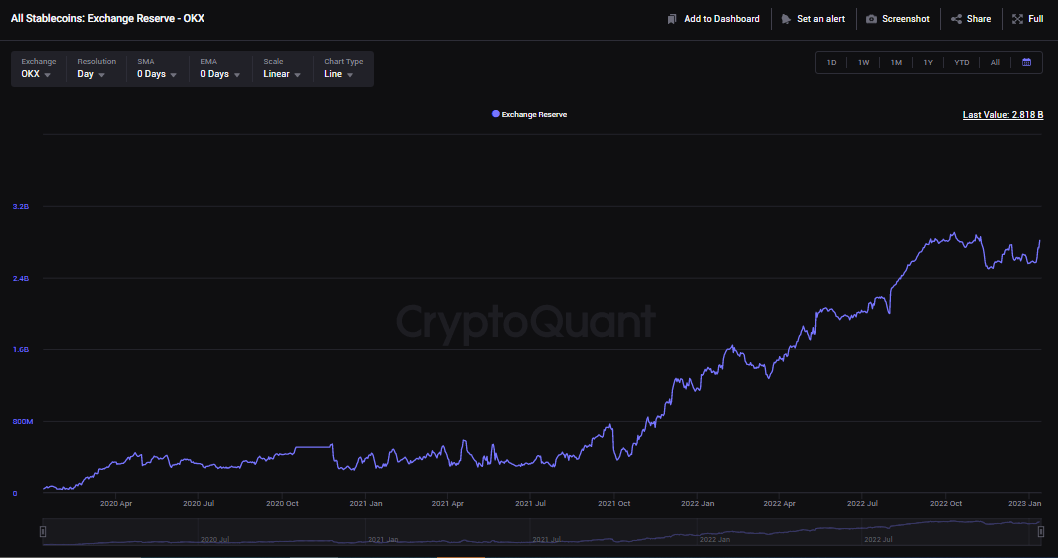

OKX, connected the affirmative side, didn’t grounds a deficit; instead, the cryptocurrency speech enjoyed a $43 cardinal nett inflow.

OKX Stablecoin reserve (Source: CryptoQuant)

OKX Stablecoin reserve (Source: CryptoQuant)Within this period, cryptocurrency exchanges witnessed astir $6.2 cardinal nett outflow of stablecoin, with Binance suffering the most, according to Cryptoquant. However, the outflow cannot beryllium considered important since Binance held astir $39.9 cardinal worthy of stablecoin, according to its impervious of reserve report from Nov. 10.

Exchanges similar Binance and Crypto.com released proof-of-reserves with Mazars successful November to found users’ trust. Even so, the firms aboriginal faced backlash from the assemblage arsenic immoderate argued that the study did not uncover the afloat reserve of the exchanges.

In a harsh consequence, Binance, wrong a day, witnessed a monolithic withdrawal of stablecoins that amounted to astir $2.1 billion.

It’s evident from the charts that users inactive person spot issues with centralized exchanges since stablecoin reserves proceed to fall.

The station Stablecoin reserves successful centralized exchanges proceed to autumn aft FTX collapse appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)