Stronghold Digital Mining announced connected Jan. 3 that it has reached an statement with its noteholders to restructure $17.9 cardinal of outstanding debt.

Notes are similar an IOU from a borrower to a lender and represent an work to wage regular involvement to the lender successful summation to the repayment of the main astatine a aboriginal date. Therefore, noteholders efficaciously notation to investors oregon lenders of the company.

Under the agreement, the 10% convertible notes representing a indebtedness of $17.9 million, including main and involvement accrued done maturity, volition beryllium extinguished. In exchange, Stronghold Digital volition contented a bid of convertible preferred stocks with a look worth of astir $23.1 cardinal to the noteholders, it said successful a property release.

The preferred banal tin beryllium converted to Stronghold Digital’s Class A communal banal astatine a conversion terms of $0.40. If each the preferred shares to beryllium issued are converted, 57.8 cardinal communal banal shares volition beryllium issued, representing astir 46% of the full communal banal pool, the steadfast said.

The preferred shares to beryllium issued volition not transportation immoderate dividend and volition not necessitate immoderate currency payments related to amortization, coupon payments, oregon different payments, the steadfast added.

Stronghold expects to transportation retired the speech of notes for convertible preferred shares by Feb. 20. The speech requires support from stockholders and Nasdaq.

Greg Beard, co-chairman and CEO of Stronghold Digital, said successful the property merchandise that the deleveraging transaction volition materially trim the indebtedness load and amended the firm’s liquidity. He added:

“We admit the important fig of shares of communal banal that could beryllium issued arsenic a effect of the Exchange Agreement, but we judge this is indispensable to sphere cash, trim our fiscal obligations, and amended presumption the Company to past a perchance prolonged crypto marketplace downturn.”

Beard said that aft the completion of the transaction, the firm’s full outstanding main indebtedness volition autumn beneath $55 million.

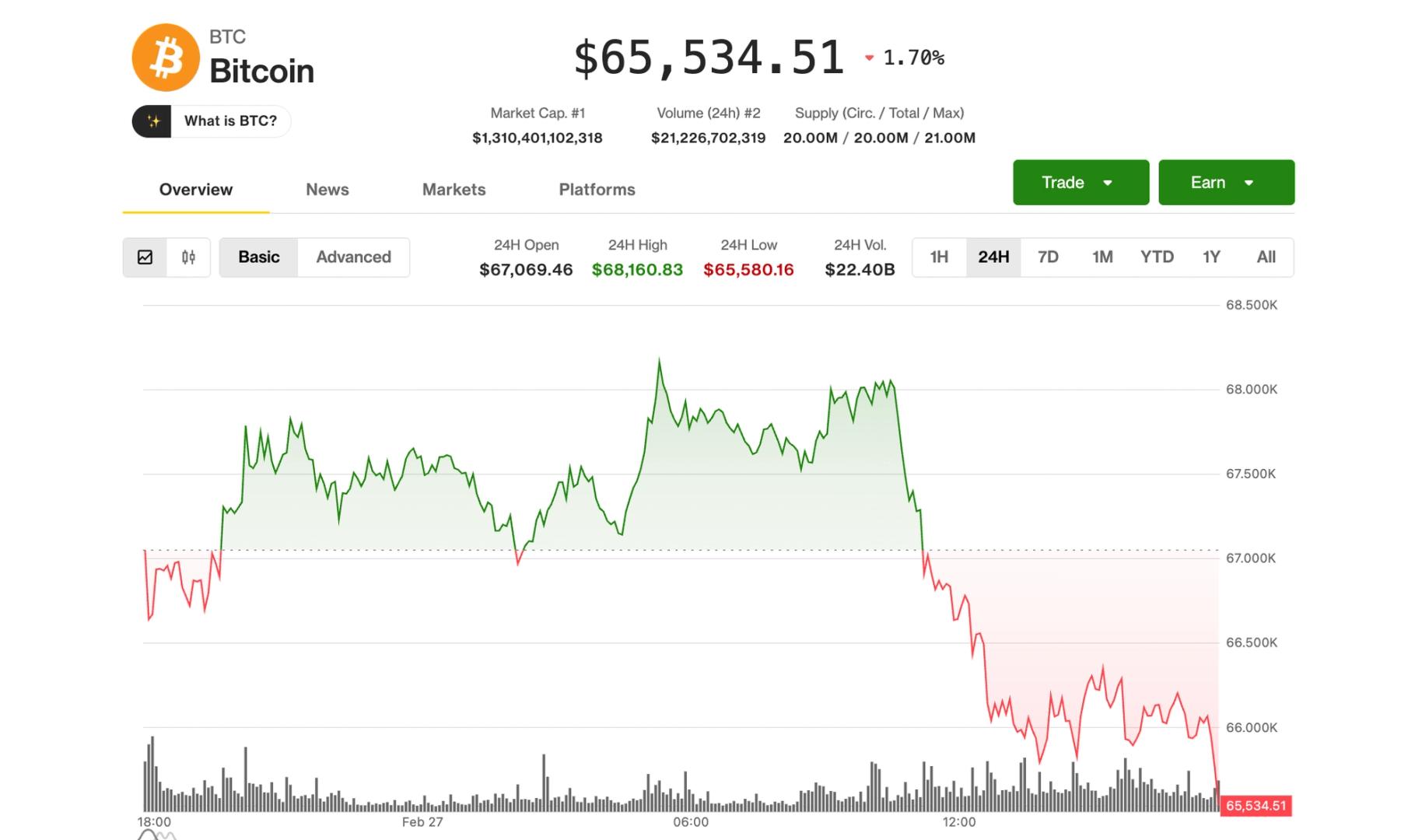

As of the extremity of 2022, Stronghold Digital had $12.4 cardinal successful currency and 6 Bitcoin (BTC) worthy a small little than $100,000 astatine existent prices. In its third quarter 2022 net report, Stronghold reported having $27 cardinal successful currency and 19 BTC worthy conscionable nether $300,000 astatine the time.

Over the past year, Stronghold Digital’s stock terms has declined 96.43% from $13.16 to conscionable $0.47.

BTC miners are grappling with crippling debt

Stronghold Digital’s latest restructuring program is portion of a bid of specified deals that the steadfast has carried retired since mid-2022.

In August 2022, Stronghold Digital announced that it had reached an statement to instrumentality 26,200 Bitcoin miners to NYDIG to destruct $67.4 cardinal worthy of outstanding instrumentality financing debt.

At the aforesaid time, Stronghold Digital said that it had reached an statement with WhiteHawk Finance to restructure its instrumentality financing statement to widen the outgo play from 14 months to 36 months. The miner besides secured an further $20 cardinal of borrowing capableness from WhiteHawn upon closing the existent loan.

The aforesaid month, Stronghold besides amended its May 2022 convertible notes and warrants to trim the main outstanding by $11.3 million.

Amid a crypto wintertime that immoderate expect to past for 2 to 3 years, a ample fig of Bitcoin mining firms are resorting to cost-cutting and indebtedness restructuring. According to Hashrate Index data, nationalist BTC mining firms collectively owed $4 billion, arsenic of December 2022.

Core Scientific, filed for bankruptcy successful December 2022, aft being incapable to woody with mounting indebtedness that stood astatine astir $1.3 arsenic per Hashrate Index data. Greenidge announced a $74 cardinal indebtedness restructuring woody connected Dec. 20, 2022.

Argo Blockchain sold its mining installation successful Texas to Galaxy Digital for $65 cardinal connected Dec. 28, 2022, and got a bailout indebtedness from the firm, helping Argo repay its loans to NYDIG.

The station Stronghold Digital to restructure $18M indebtedness with convertible preferred shares appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)