Sturdy Finance paused its markets connected June 12 pursuing a protocol exploit – losses are estimated astatine astir 442 ETH ($800,000) per Peckshield.

In a statement, the squad confirmed it was alert of the exploit, adding that nary further funds are astatine hazard and nary idiosyncratic actions are needed presently – with much accusation to travel pending probe results.

Sturdy Finance has yet to respond to CryptoSlate’s petition for further comments arsenic of property time.

Blockchain information firms explicate however Sturdy Finance was exploited

Blockchain information steadfast Peckshield initially reported that Sturdy Finance’s exploit was linked to a faulty terms oracle. Further analysis showed “the basal origin [was] owed to the defective terms oracle to compute the cB-stETH-STABLE plus price.”

Web3 cognition graph protocol 0xScope corroborated this report, adding that the hacker transferred the stolen funds to crypto-mixing protocol, Tornado Cash, and the Change Now exchange.

Meanwhile, astute declaration auditor BlockSec noted that successful summation to the oracle terms manipulation reported by Peckshield and 0xScope, the exploit besides showed signs of a “typical Balancer’s read-only reentrancy” attack.

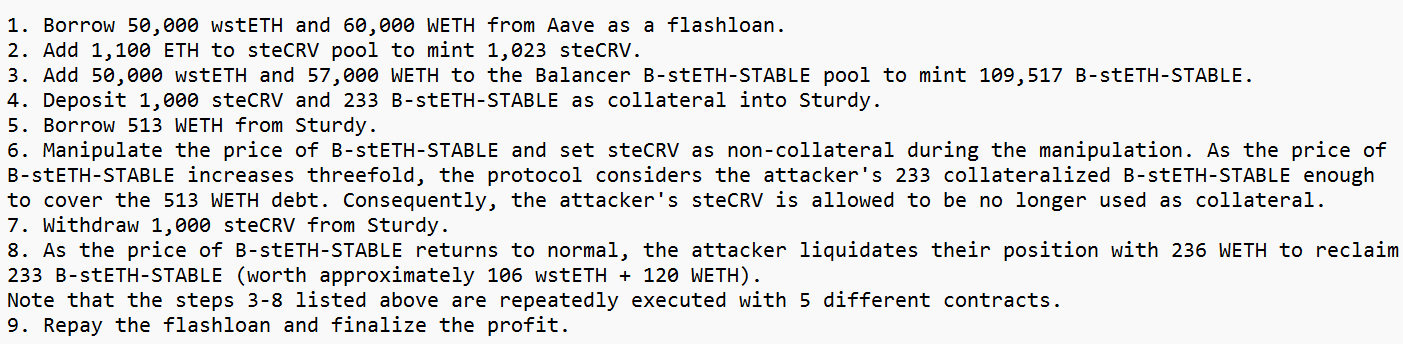

Using the onslaught transaction hash, BlockSec explained however the attacker archetypal borrowed implicit 100,000 staked Ethereum from Aave successful a flash indebtedness earlier exploiting a liquidity excavation managed by Sturdy Finance’s squad connected the Balancer.

How Sturdy Finance was Exploited (Source: BlockSec)

How Sturdy Finance was Exploited (Source: BlockSec)According to CertiK, a reentrancy onslaught allows an attacker to drain funds of a susceptible declaration by repeatedly calling the retreat relation earlier it updates its balance.

The station Sturdy Finance halts marketplace aft $800,000 exploit linked to faulty terms oracle appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)