Being the 3rd largest stablecoin by marketplace cap, wherefore did the algorithmic stablecoin UST acquisition specified a terrible terms de-anchoring?

Cover art/illustration via CryptoSlate

TerraUSDT (UST) is (though “was” mightiness beryllium better)an algorithmic stablecoin whose stableness mechanics stemmed from the committedness of a payout with LUNA. Having traders mint and pain tokens arsenic needed to guarantee the stableness of UST retired of spot successful the Terra blockchain.

However, betwixt the 9th and 10th of May, the UST’s terms crashed, falling beneath 10 cents and wholly losing its peg. Before its decoupling from USD, UST was the third-largest stablecoin by marketplace cap. This makes the illness 1 of the astir concerning developments successful crypto and thing that everyone absorbing successful blockchain needs to understand.

Why did UST, which has been truthful unchangeable for truthful long, decouple? What are the consequences?

Algorithmic Stablecoins Are Different from Other Stablecoins

Before analyzing UST’s decoupling, let’s look astatine however it differs from the ineligible and over-collateralized stablecoins.

- Algorithmic stablecoins bash not necessitate immoderate collateral. They alternatively set the fig of tokens held by users done currency terms fluctuations.

- Fiat and over-collateralized coins necessitate collateral. For example, Tether (USDT) holds collateral successful fiat USD. Hyper-collateralized coins usage BTC and ETH arsenic collateral. Because of the precocious terms volatility of BTC and ETH, the collateral indispensable beryllium over-collateralized.

UST is simply a stablecoin anchored to $1, but without capable collateral assets. Once the token terms fell beneath $1, its full ecosystem, including LUNA and the Anchor protocol, were dragged down with it.

UST’s Decoupling: Before and After

UST token terms unchangeable astatine $1

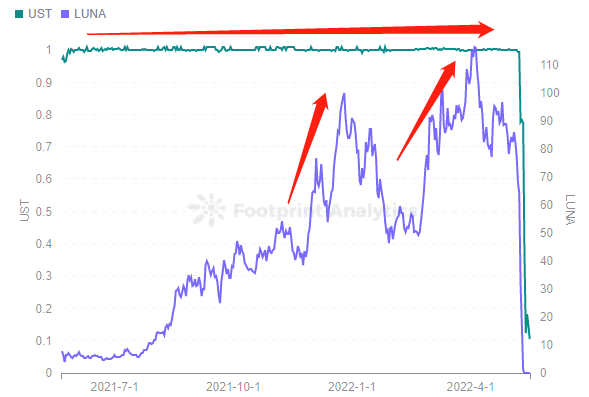

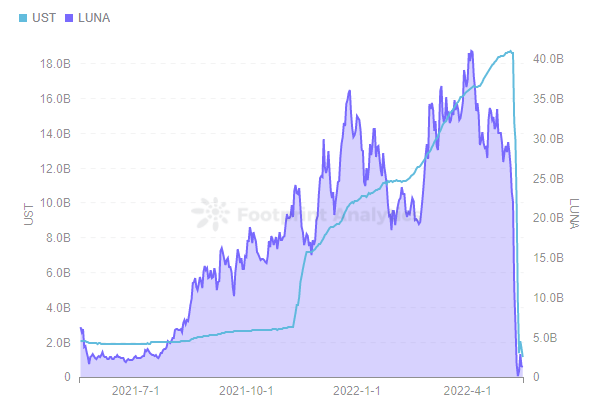

Footprint Analytics information shows that UST was unchangeable astatine astir $1 for astir 1 year, from May 27, 2021 to May 8, 2022. During this time, LUNA’s terms has seen 2 large increases, peaking astatine $116.32.

Footprint Analytics – Token Price: UST vs LUNA

Footprint Analytics – Token Price: UST vs LUNAThe stableness of UST astatine the $1 anchor was the driving unit down the maturation of Terra’s ecosystem.

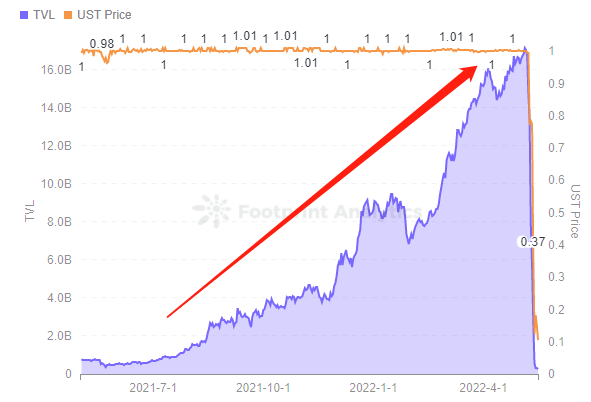

- The liquidity of the Anchor protocol successful the past accounted for 50% of Terra TVL, and the unchangeable retention income supported the stableness of UST astatine $1. It provided much than $267 cardinal successful UST net reserves, which allowed users to gain 20% APY by depositing UST connected the protocol—much higher than returns from different stablecoins. High yields are a large origin driving stablecoin request and also led to Anchor attracting $17.2 cardinal successful TVL.

Footprint Analytics – Anchor TVL vs UST Price

Footprint Analytics – Anchor TVL vs UST Price- The Luna Foundation Guard (LFG) was established successful January 2022 to enactment the stableness of the UST and facilitate the improvement of the Terra ecosystem. In February, it raised $1 cardinal successful financing from aggregate VCs done the merchantability of LUNA, backed by BTC to assistance anchor UST and make the Terra ecosystem.

However, these mechanisms and reserves were not capable to prolong the stableness of UST.

Why did UST decouple?

The terms of UST fell from $1 connected May 8 to astir $0.18 connected May 14. It concisely bounced backmost up, teasing that possibly the mechanics would beryllium resilient enough, but past resumed its crash.

As of May 16, UST appears to beryllium dormant and has killed the market’s assurance successful algorithmic stablecoins arsenic well.

What happened?

- A elephantine whale sold $285 cardinal worthy of UST connected May 7. This was the trigger that prompted the decoupling of the UST from the dollar.

- As UST mislaid its peg, LUNA started printing. This is because users wantonness the decoupled USTs successful their hands, resulting successful much minting of LUNA, which triggers a deeper driblet successful LUNA.

- However, the devaluation of LUNA happened truthful rapidly that it was simply incapable to bargain backmost capable UST to repeg it to $1.

- Both LUNA and UST crashed to cents.

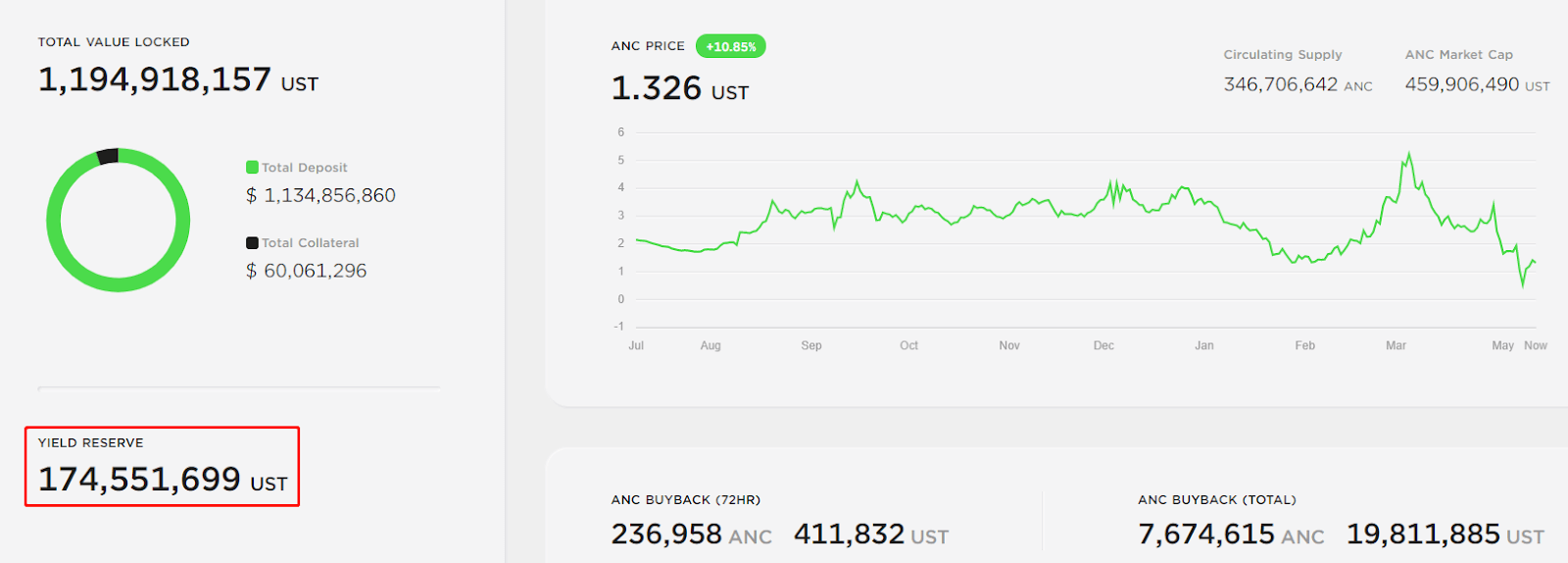

- Anchor, which relies connected the Terra Fund to continually replenish its reserves to screen the 20% APY besides crashed.

Screenshot Source – Anchor Website Yield Reserve

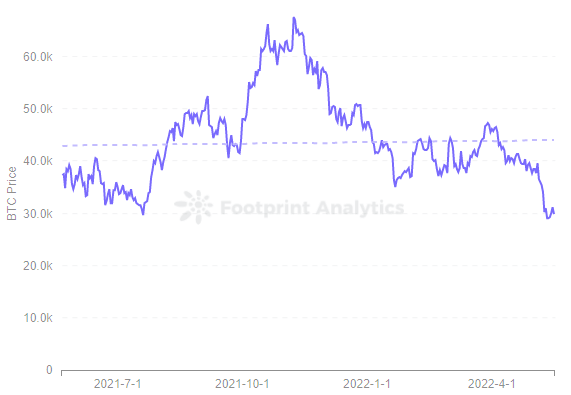

Screenshot Source – Anchor Website Yield Reserve- LFG’s reserve of BTC was expected to service arsenic a backstop to assistance anchor the UST. However, the terms of BTC has been falling since its highest successful November past year. As of May 16, the terms of BTC has fallen beneath $30,000.

This has a antagonistic interaction connected the anchoring of UST and the improvement of the Terra ecosystem.

Footprint Analytics – BTC Price

Footprint Analytics – BTC Price- UST is antithetic from fiat currency stablecoins and does not person capable collateral assets.

How the Collapse of UST Price Drop Affects the Terra Ecosystem and Crypto

With its precipitous collapse, the Terra ecosystem appears to beryllium dead.

With UST beneath $1, the terms and marketplace assurance successful Terra’s autochthonal token, LUNA, collapsed. Footprint Analytics information shows that the driblet successful LUNA’s token terms and the accelerated abandonment of UST by UST holders led to much Minting of LUNA, which triggered an adjacent deeper driblet successful LUNA. As of May 16, LUNA’s token terms fell beneath $0.11 from a highest of $116.32, a 99.9% driblet successful little than a month.

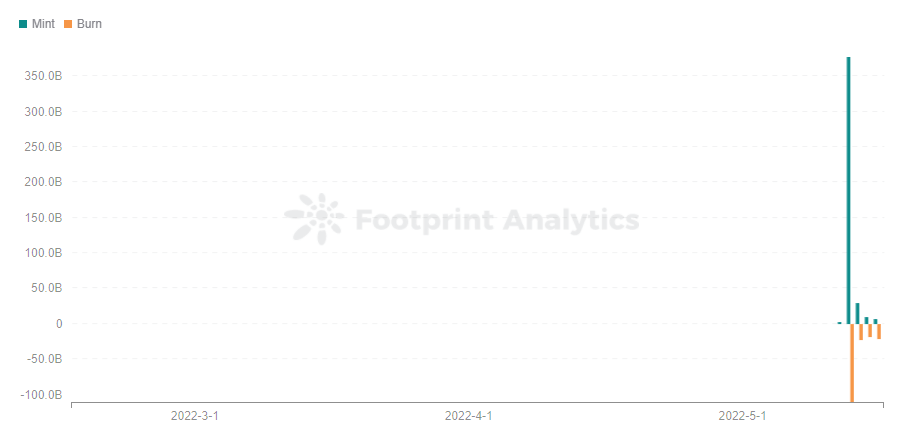

Footprint Analytics – Daily Mint & Burn: LUNA

Footprint Analytics – Daily Mint & Burn: LUNAThe marketplace headdress of UST and LUNA has inverted, with LURA’s marketplace headdress being smaller than UST’s. When LUNA falls, capable liquidation abstraction is mostly reserved to debar utmost situations of insolvency.Now the marketplace headdress has fallen disconnected a cliff to $1.2 cardinal for LURA and $1.15 cardinal for UST. This driblet could easy origin assurance to illness and a decease spiral to occur.

Footprint Analytics – UST vs LUNA of Market Cap

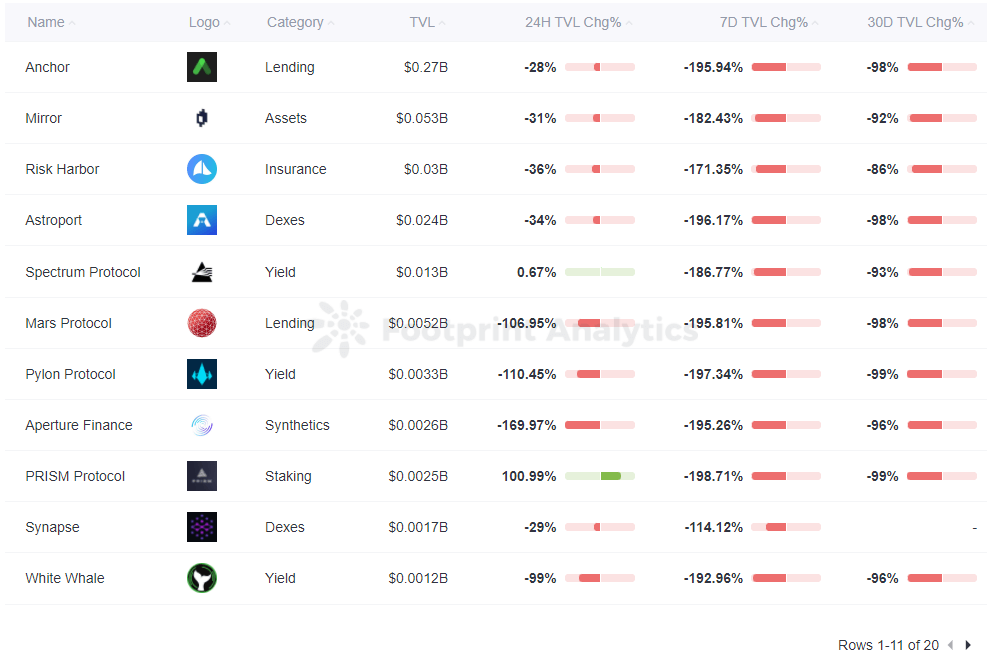

Footprint Analytics – UST vs LUNA of Market CapOf course, successful summation to the currency price, marketplace headdress and different indicators being affected, determination are besides Terra ecosystem protocols TVL showing antagonistic growth. Especially for protocols specified arsenic Anchor and Lido, TVL has dropped by much than 100%. Anchor is the astir affected by the algorithm unchangeable currency UST, portion Lido is affected by the driblet successful the terms of LUNA.

Footprint Analytics – Terra Top 10 Protocols TVL Change

Footprint Analytics – Terra Top 10 Protocols TVL ChangeSummary

The existent marketplace panic is inactive spreading, the algorithmic stablecoin UST is severely unanchored, and the LUNA token terms has seemed to instrumentality a catastrophic hit. While its endurance doesn’t look likely, brainsick things tin hap successful the crypto world.

Date & Author: May. 2022, Vincy

Data Source: Footprint Analytics – Algorithmic Stablecoin Analysis

This portion is contributed by Footprint Analytics community.

The Footprint Community is simply a spot wherever information and crypto enthusiasts worldwide assistance each different recognize and summation insights astir Web3, the metaverse, DeFi, GameFi, oregon immoderate different country of the fledgling satellite of blockchain. Here you’ll find active, divers voices supporting each different and driving the assemblage forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one investigation level to visualize blockchain information and observe insights. It cleans and integrates on-chain information truthful users of immoderate acquisition level tin rapidly commencement researching tokens, projects, and protocols. With implicit a 1000 dashboard templates positive a drag-and-drop interface, anyone tin physique their ain customized charts successful minutes. Uncover blockchain information and put smarter with Footprint.

3 years ago

3 years ago

English (US)

English (US)