The precise happening suppressing bitcoin’s terms successful the abbreviated word is precisely what tin marque it truthful invaluable successful the agelong term.

This is an sentiment editorial by Dan Ashmore, fiscal analyst, writer and contributor to Bitcoin Magazine.

Europe

Within fiscal and macroeconomic circles, it tin sometimes consciousness similar the USA is the lone state successful the world. Inflation information is accepted arsenic the CPI speechmaking successful the U.S. The banal marketplace is the S&P 500. The currency is the ever-dominant dollar.

On this note, you don’t request maine to archer you that the marketplace situation close present successful the U.S. is abject. Inflation is printing 40-year highs, the Federal Reserve is yo-yoing betwixt hawkish and super-hawkish portion sentiment is free-falling.

However, looking astatine each this mayhem arsenic a European, thing jumps out. While it’s jarring to spot however atrocious things are successful the U.S., what is adjacent much terrifying is that it’s worse successful Europe. It feels similar the likelihood of a situation is expanding by the time — that is to say, if we aren’t successful 1 already. And taking a holistic view, it sums up wherefore Bitcoin could connection a solution for the future.

Eurozone

Last week, $1 became much invaluable than €1 for the archetypal clip successful history. With Americans struggling to grapple with 9.1% inflation, astatine slightest their dollars are appreciating against euros. And portion this is atrocious quality for U.S. exports, a weakening euro and strengthening dollar causes precise existent problems for Europeans — and also correlates with a weakening of galore emerging economies’ currencies.

View the original article to spot embedded media.

Perhaps a much illustrative show of the dollar’s spot is that of the DXY Index, which measures the worth of the dollar against a handbasket of overseas currencies (this handbasket does besides see the euro). The DXY has been connected an implicit surge this year, arsenic the graph beneath shows.

View the original article to spot embedded media.

Why Is The Dollar So Strong?

In times of uncertainty, investors dump risk-on assets and fly to safety. This means volatile assets spot a question of selling portion safe-haven assets specified arsenic currency and gold acquisition inflows. But not each currency is created equal. And successful the fiat universe, 1 currency is the wide king of them all: the U.S. dollar.

Time and clip again passim economical crises, erstwhile the system wobbles and investors leap risk-off, the dollar appreciates owed to its presumption arsenic the world’s reserve currency. Being the strongest of immoderate fiat money, it thrives amid marketplace turbulence and uncertain times.

Look nary further than March of 2020, an utmost illustration of however uncertainty and fearfulness tin abruptly stone markets. It became clear astatine this clip that the COVID pandemic was much impactful than primitively thought, the WHO declaring it a pandemic connected March 11, 2020. Over the people of a 10-day period, the dollar jumped 8%.

View the original article to spot embedded media.

Monetary Debasement

So the dollar has really been immensely beardown successful this existent period, contempt wide debasement — a amusement of spot emblematic of recessions.

View the original article to spot embedded media.

However, the below graph shows that this dollar spot is only relative to different fiat currencies. When graphed against existent goods — gas, eggs, chickenhearted breasts and bread, let’s accidental — 1 needs ever expanding numbers of dollars to acquisition these goods.

View the original article to spot embedded media.

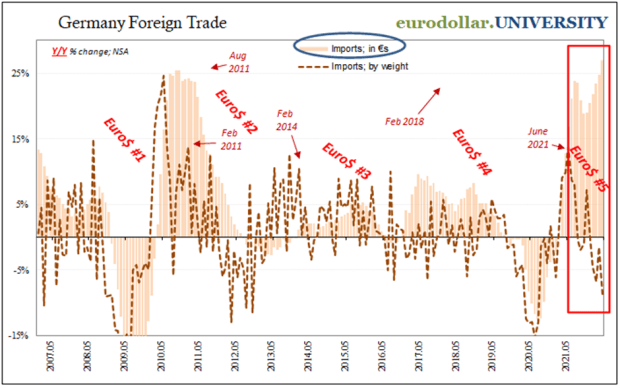

If you’re American, you’re apt alert of the trouble that this is causing, arsenic wages conflict to support up with terms increases and the modular of surviving drops crossed the country. Now ideate being European, with your currency plummeting adjacent further against the dollar, portion you are inactive fighting similar levels of inflation. The below is simply a large graph from Jeffrey Snider demonstrating that Germans paid 35% much for 9% little imports. That’s a beauteous chaotic statistic highlighting the sheer standard of the movements present and Europe’s plight.

Emerging Economies

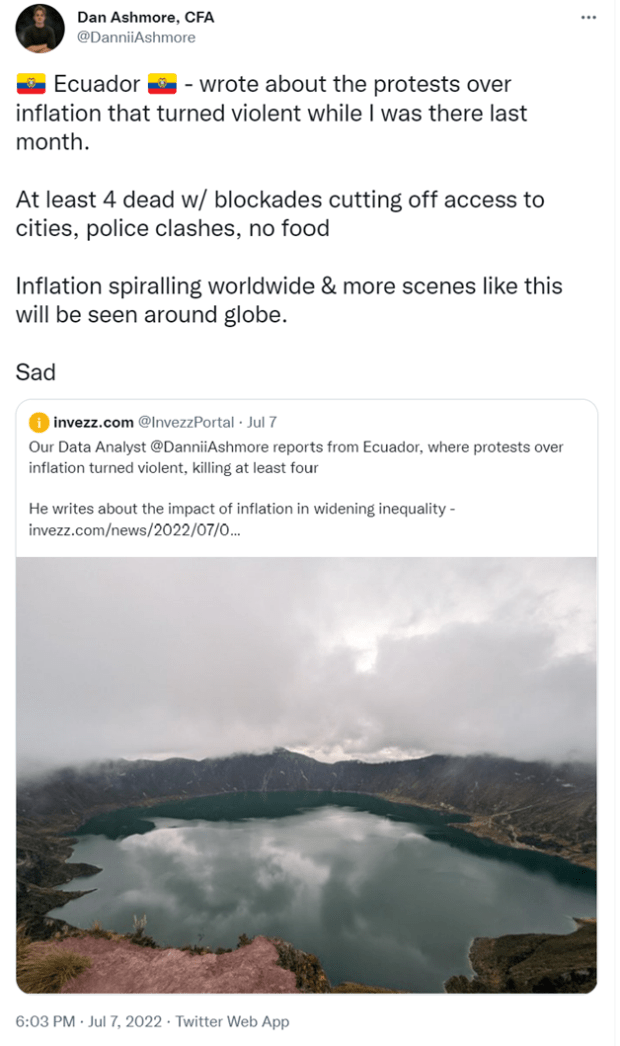

How astir a state specified arsenic Ecuador? I visited it past month, during which protests broke retired implicit a assortment of issues, including the outgo of living. Transport routes were blocked arsenic nutrient supplies were chopped disconnected from cities, with prices rocketing to scarcely believable levels. Five radical were killed, fires were acceptable ablaze astir the state and millions of dollars worthy of harm was caused to an system already successful dire information — and is apt present facing a semipermanent stroke to the burgeoning tourism manufacture it had fought truthful hard to cultivate.

This is scary. People dying, wide unrest, governmental turmoil — it’s a harrowing world of the concern that we find ourselves successful with ostentation tightening its grasp.

Oh, and Ecuador uses the U.S. dollar, pursuing the illness of their sucre currency successful 1999, a unfortunate to the soiled quality wont of hyperinflation.

With ostentation present approaching treble digits successful the U.S. and Europe, is it preposterous to ideate scenes similar the Ecuadorian protests successful these regions soon?

Eurozone’s Worries

But backmost to Europe. Let america not hide that this is simply a portion which suffered its ain monetary situation little than a decennary ago, erstwhile determination was superior uncertainty astir whether the euro would proceed to exist.

As an Irish person, I americium good alert of our contributions to that mess. We endured 1 of the worst banking crises successful history. To exemplify this for American readers, the Irish authorities was forced to nationalize Anglo Irish Bank successful 2009 erstwhile it was revealed they had €34 cardinal successful losses (in January 2009 dollars — that amounts to $50.5 cardinal today).

For context, the U.S. system is 60 times bigger than Ireland’s, a small land successful the Atlantic with a colonisation of lone 5 cardinal people. Multiplying this bank’s $50.5 cardinal successful losses by 60 gives $3 trillion. Lehman Brothers — who you whitethorn person heard of arsenic the poster boys of banking nonaccomplishment — went nether with $619 cardinal successful debt, one-fifth of this $3 trillion figure.

Us Irish were bad, but it was worse elsewhere. 5,000 kilometers eastbound of america (or a small implicit 3,000 miles, for you Americans), Bank of Cyprus customers had 47.5% of immoderate deposits implicit the insured magnitude of €100,000 confiscated successful what was known arsenic a “bail-in” successful bid to enactment up the banking losses — thing that successful the discourse of a bitcoin wallet, would beryllium incomprehensible. Further restrictions were enactment successful spot crossed the state to forestall a wide tally connected the banks from occurring.

Greece whitethorn person been the worst of all, with systemic misreporting of authorities indebtedness and deficits covering up a quagmire of fiscal incompetence that ended up plunging the system into the longest recession of immoderate precocious mixed system to date.

Throw successful Portugal, Italy and Spain and the euro was a currency connected its knees, requiring bailout aft bailout to support economies running. As I benignant this condemnation connected my keyboard, I’m inactive paying taxes to wide disconnected the Irish bailout — astatine €67.5 billion, equivalent to implicit 40% of our GDP.

But hey, Germany kept america afloat, the astir almighty system successful the eurozone pulling up the stragglers and (just about) redeeming the day. Bailouts, I suppose, did their jobs.

But contiguous it’s different.

What Is Different About 2022?

A communal metric to gauge the wellness of the eurozone is the dispersed betwixt German and Italian 10-year bonds. Diverging enslaved yields are a scourge connected the eurozone due to the fact that it eats distant astatine the precise conception of a unified currency (for a much in-depth reappraisal of this, spot this article published by Invezz.com expert Shivam Kaushik past week). I person plotted this divergence of the Italy versus Germany spread, present astatine 2.29% aft being astatine parity 1 twelvemonth ago.

View the original article to spot embedded media.

Further accentuating the difficulties of the eurozone is the complaint policy, which is importantly down the U.S. Federal Reserve regarding involvement complaint hikes. The 50-bps hike by the European Central Bank (ECB) past week, Europe’s archetypal hike successful 11 years, meant that rates are lone now retired of the antagonistic scope — astatine a abdominous 0%. And this, successful conjunction with the output divergence above, signals the problem.

A unified currency containing countries similar Germany and Italy throws up monolithic problems erstwhile hikes are required to rein successful inflation. Countries specified arsenic Italy person tremendous indebtedness burdens and are already either connected the verge of recession, oregon already mired successful one. So, what happens erstwhile the ECB raises rates, expanding the involvement load of those countries saddled with bloated indebtedness liabilities? It plunges those economics into an adjacent deeper recession.

On the flipside, not raising rates practically guarantees the ostentation situation getting adjacent worse — which evidently doesn’t suit those countries with healthier balances — say, Germany. Without hiking rates, the plummeting euro and rocketing nutrient prices volition conscionable … support going, I guess.

But with ostentation spiraling to the level wherever the ECB’s manus has been forced, recessions are present staring nations successful the look crossed the continent. But determination is simply a quality this time. Germany is not going to beryllium capable — nor consenting — to bail retired the stragglers. The German ostentation and vigor situation makes this a distant anticipation astatine best, meaning that determination is cipher to measurement successful to prevention the time for the adjacent circular of Ireland, Cyprus, Greece, Portugal, Spain, Italy … OK you get my point.

Global Debt

All this mayhem, of course, is accentuated by the indebtedness concern — thing which the U.S. is nary stranger to. I took a sojourn to the U.S. indebtedness timepiece successful New York past month, a somber ocular tracker of the unrecorded debt. At $31.5 trillion, it’s a staggering magnitude but the lone question that truly matters is … however volition it beryllium repaid?

Well, the lone mode to bash this is to monetize the debt. And what that means is to proceed printing to wide it. The U.S. tin mint much dollars, arsenic the indebtedness is denominated successful the precise aforesaid currency that it has the quality to print. An unfair agreement, admittedly, but 1 that guarantees they volition beryllium capable to wage the indebtedness back. Of course, the trade-off is simply a debased dollar.

Which again, for countries similar Italy, is not an enactment due to the fact that of … the euro. You know, they don’t power their ain monetary policy, with it being a shared currency and each that.

Fool maine once, I’ll bail you out. Fool maine twice, I’ll bail your mate out. Fool maine 3 times, and it’s clip to rise the achromatic emblem connected this full euro thing. Or the look goes thing similar that, anyway.

Bitcoin

This takes maine close circular to that unusual orangish currency that we each emotion truthful much. What is happening successful Europe is precisely the crushed wherefore Bitcoin’s fundamentals are truthful salivating arsenic a hedge — but also, ironically, a summary of wherefore it is lagging truthful overmuch successful the existent climate.

This is simply a currency that can’t beryllium debased similar the U.S. dollar. This is simply a currency that has a hard headdress of 21 cardinal coins — dissimilar the euro. This is simply a currency that can’t be confiscated, dissimilar Cypriot slope deposits. It is simply a currency wherever straggling Greek and Irish economies can’t resistance it to the brink, wherever sovereign (fiat) indebtedness burdens don’t matter.

But close now, successful 2022, this is besides a nascent exertion and an highly volatile asset. Meaning that arsenic rates get chopped and liquidity is pulled retired of the economy, it moves similar a risk-on asset, dropping violently, contempt this propulsion successful liquidity reining successful the ostentation that truthful galore reason it should hedge against.

So no, bitcoin is not an ostentation hedge — and it’s pugnacious to reason otherwise. But the absorbing portion is erstwhile you gully that concern skyline retired and measure it amid the wider macroeconomic picture, changing the question to whether it volition 1 time enactment arsenic that monetary debasement hedge that it fails to beryllium close now.

Most hadn’t adjacent heard of this plus 10 years ago. It didn’t adjacent beryllium during the Great Financial Crisis. But Satoshi Nakamoto referencing a paper header reporting connected 1 of those colossal European banking failures — “The Times 03/Jan/2009 Chancellor connected brink of 2nd bailout for banks” — symbolizes conscionable what a currency with a hard cap, extracurricular the power of wealth printers, bankers, governments and economists tin do. It tin correspond value, and a mode to leap disconnected the bid should it ever descend (have I mixed up metaphors there?).

The U.S. dollar is really the astir immune of each the fiat currencies. It is the world’s reserve currency and it spikes successful times of turbulence. It has nary of the problems of the eurozone, nevermind the currencies of emerging markets.

So if you deliberation that the (debasing) dollar presents arsenic an statement for Bitcoin, instrumentality a travel to Europe. It’s getting scary … again.

This is simply a impermanent station by Dan Ashmore. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)