With investors inactive reeling from the Terra UST fallout, Tether seeks to guarantee investors that it is different.

Cover art/illustration via CryptoSlate

The implosion of Terra UST has damaged the estimation of stablecoins and the broader crypto industry. But successful an effort to region itself from the fallout, Tether says it is different.

In a caller blog post, Tether points retired that, being a collateralized stablecoin, “it has thing successful common” with UST, which relies connected an algorithm to support its dollar peg. Collateralized refers to the token being backed by assets, successful the lawsuit of USDT, dollars, and currency equivalents.

“While UST is referred to arsenic a stablecoin, it has thing successful communal with collateralized stablecoins similar Tether USD₮. UST is an algorithmic stablecoin.”

Billions were mislaid successful the Terra fiasco, the repercussions of which volition beryllium felt for years to come. However, tin Tether reinstate marketplace confidence?

Algorithmic stablecoins successful the firing line

The blog post mentions that, passim the years of turbulence experienced successful cryptocurrency, Tether remains the ‘primary signifier of dollar-based liquidity.’

It adds that, arsenic a collateral-based stablecoin, USDT holders tin redeem their tokens 1:1 with dollars. And since its inception, the institution has ever been capable to conscionable its redemption obligations.

“Since 2015, Tether has ne'er failed to process a redemption petition for USD₮ astatine a worth of $1 per USD₮ token.”

While USDT speech prices whitethorn alteration occasionally, determination is nary menace of de-pegging arsenic agelong arsenic Tether tin redeem tokens astatine look value.

The station further laid the footwear into algorithmic stablecoins, saying they person a mediocre way grounds and aggregate instances of failure. It besides cited a University of Calgary study, which slammed them arsenic inherently fragile and successful a authorities of perpetual vulnerability.

Bitfinex CTO says Tether ne'er de-pegged

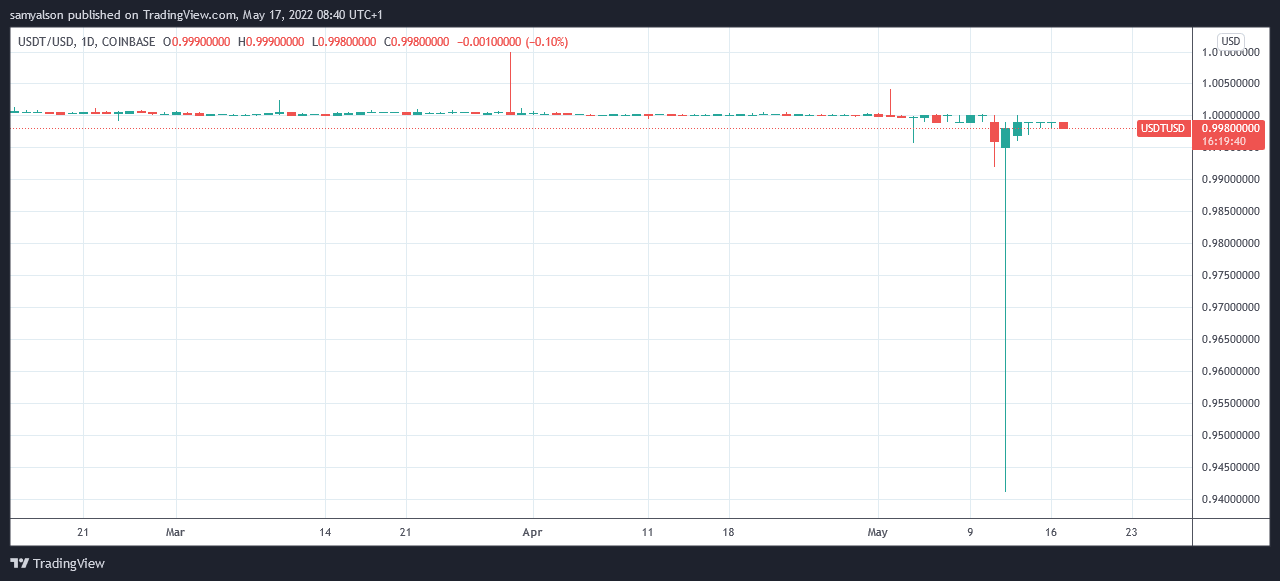

May 12 saw Tether deviate importantly below its $1 peg price. On that day, the USDT terms dropped arsenic debased arsenic $0.9409, causing panic successful the markets already reeling from the UST implosion.

Source: USDTUSD connected TradingView.com

Source: USDTUSD connected TradingView.comNonetheless, successful a Twitter Spaces chat aboriginal that evening, Bitfinex CTO Paolo Ardoino addressed the contented by reiterating the method differences betwixt collateralized and algorithmic stablecoins.

Ardoino added that adjacent during the panic selling, Tether was sufficiently liquid to conscionable redemptions astatine $1. Therefore, contempt the speech terms differences, determination was ne'er a problem.

USDT reverted to its peg terms soon aft the nationalist address.

3 years ago

3 years ago

English (US)

English (US)