Bitcoin crossed $60,000 connected Feb. 28 successful a singular one-day candle, posting a 20% summation successful conscionable 3 days. However, the abbreviated stint astatine this level means we’ll person to hold different 24 hours earlier immoderate meaningful on-chain information becomes available.

However, the anticipation of a correction wrong the adjacent 24 hours tin beryllium analyzed, fixed the magnitude of unrealized profits presently successful the market.

Unrealized profits notation to the gains connected Bitcoin holdings that person not yet been sold oregon converted into fiat oregon different assets. These are calculated by the quality betwixt the existent marketplace terms and the acquisition terms of Bitcoin, provided the existent terms is higher.

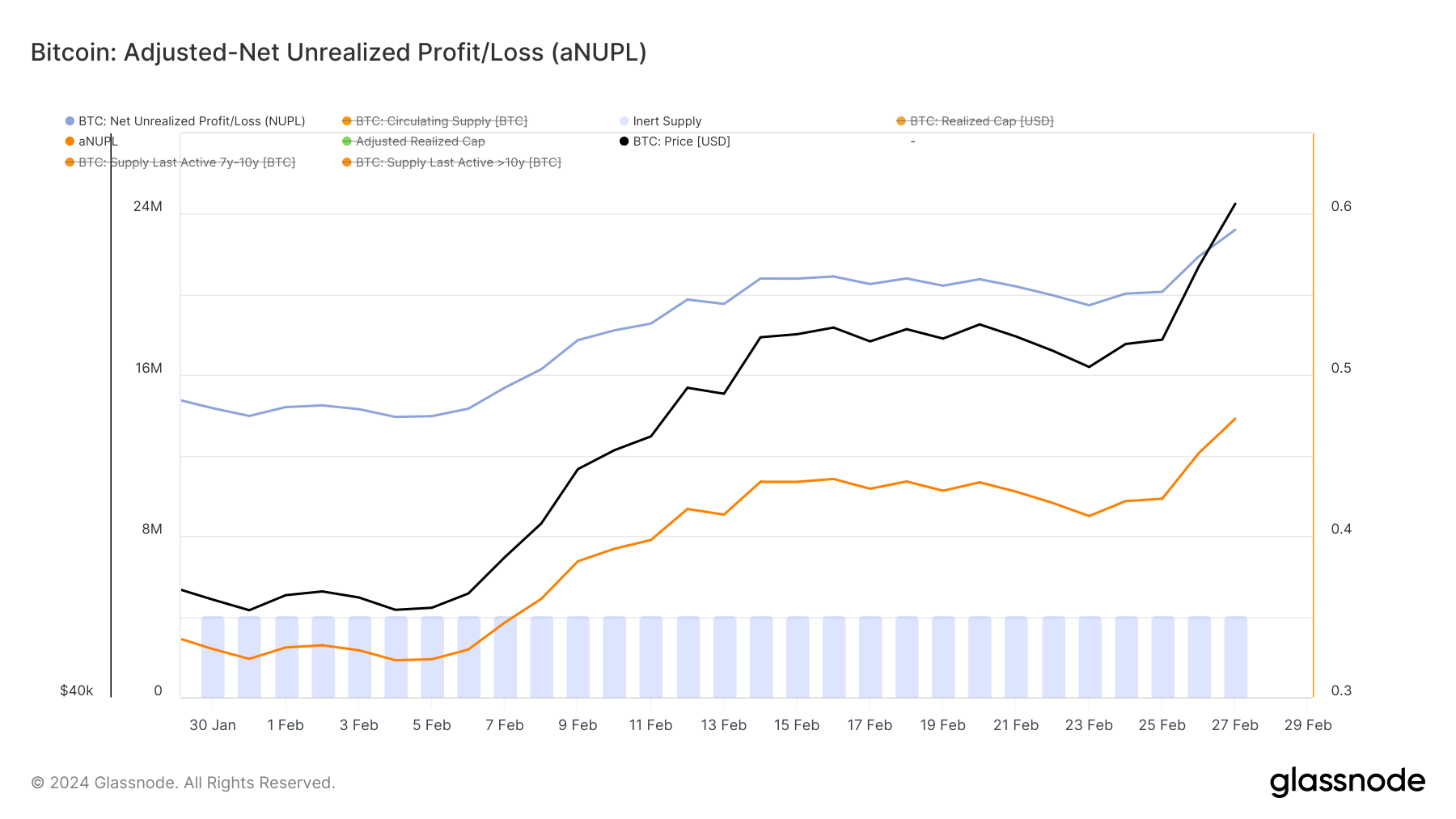

The Net Unrealized Profit/Loss (NUPL) metric offers insights into the wide marketplace sentiment by mapping retired the quality betwixt unrealized nett and nonaccomplishment crossed the full Bitcoin supply, expressed arsenic a proportionality of the marketplace cap.

Meanwhile, adjusted-NUPL (aNUPL) refines this investigation by accounting for inert proviso — coins mislaid oregon dormant for implicit 7 years — thereby providing a clearer presumption of the progressive market’s profitability.

The aNUPL values observed implicit the past 3 days — 0.4232 connected Feb. 25, 0.4515 connected Feb. 26, and 0.4729 connected Feb. 27 — amusement that a increasing information of the Bitcoin proviso is profitable.

Graph showing the aNUPL for Bitcoin from Jan. 30 to Feb. 27, 2024 (Source: Glassnode)

Graph showing the aNUPL for Bitcoin from Jan. 30 to Feb. 27, 2024 (Source: Glassnode)This is further seen successful the summation successful nett percent from 55.795% to 59.174% and the alteration successful nonaccomplishment percent from -0.682% to -0.155% implicit the aforesaid period. Like aNUPL, this metric shows that astir of Bitcoin’s proviso is held astatine a profit, with minimal losses.

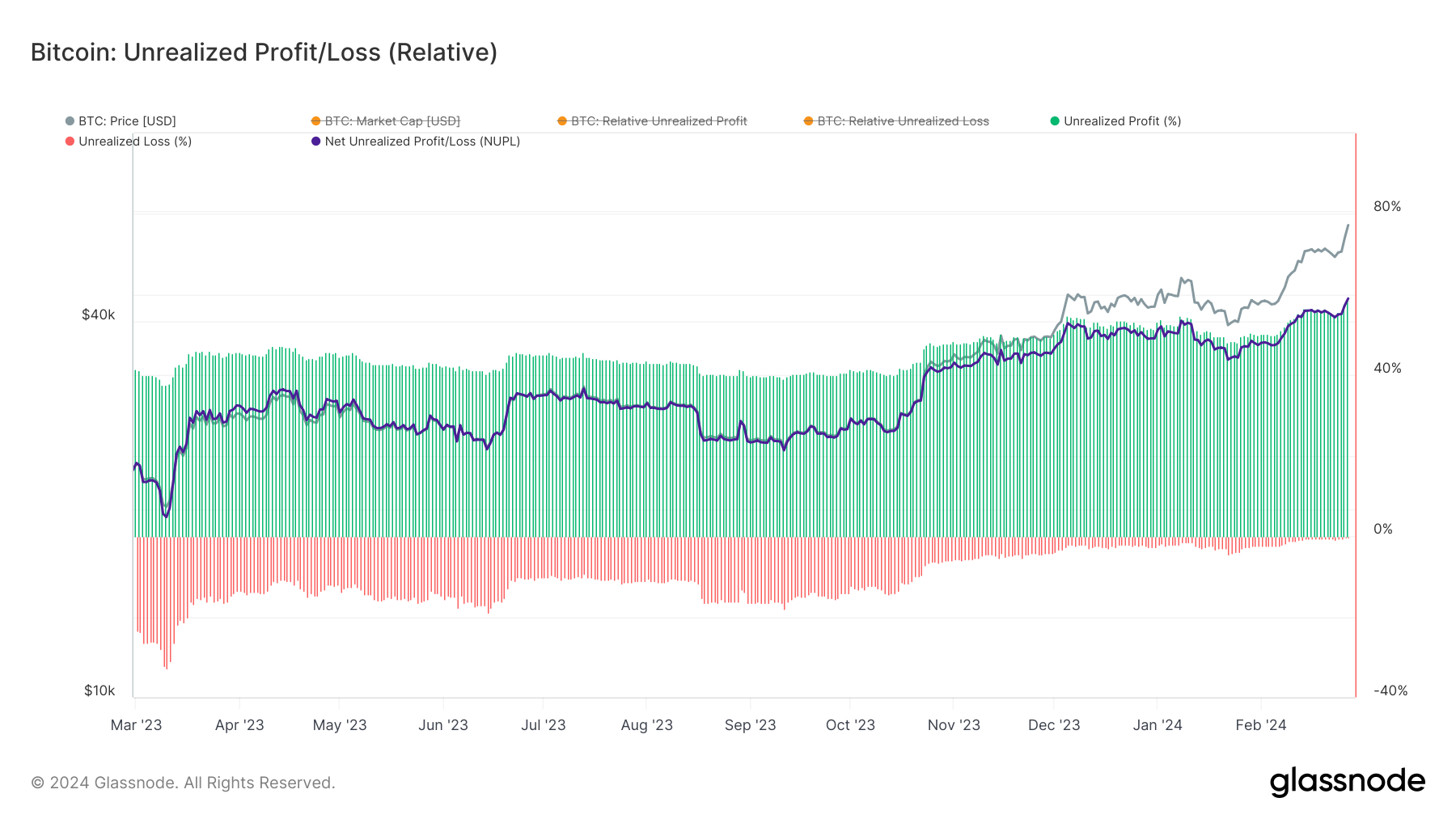

Graph showing the comparative unrealized nett for Bitcoin from Mar. 1, 2023, to Feb. 27, 2024 (Source: Glassnode)

Graph showing the comparative unrealized nett for Bitcoin from Mar. 1, 2023, to Feb. 27, 2024 (Source: Glassnode)The percent proviso successful profit, reaching 95.12% connected Feb. 27, and the adjusted percent proviso successful nett astatine 93.6% amusement this profitability from a somewhat antithetic angle.

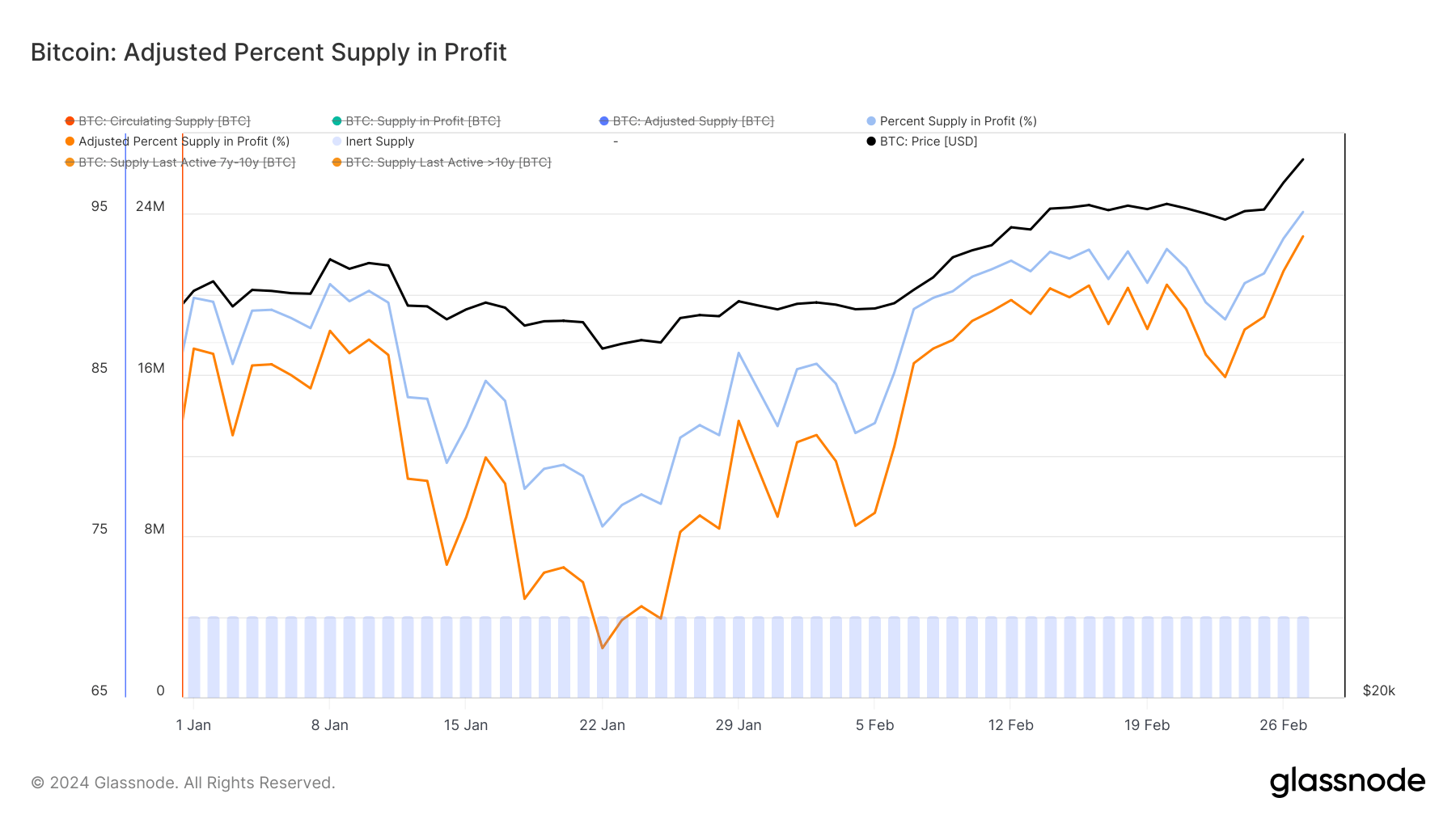

Graph showing the percent (blue) and adjusted percent (orange) of Bitcoin’s proviso successful nett from Feb. 1 to Feb. 27, 2024 (Source: Glassnode)

Graph showing the percent (blue) and adjusted percent (orange) of Bitcoin’s proviso successful nett from Feb. 1 to Feb. 27, 2024 (Source: Glassnode)If Bitcoin continues to summation successful the coming weeks, this existent authorities of wide profitability tin construe to reduced selling pressure. Anticipating further growth, holders mightiness beryllium little inclined to merchantability their assets, starring to reduced volatility and creating a instauration for a much unchangeable terms increase.

The existent authorities of profitability could reenforce bullish sentiment among investors if determination are further terms increases. The important inflows into spot Bitcoin ETFs successful the US, particularly BlackRock’s IBIT, suggest a conception of the marketplace — comprising organization and blase investors — is poised to deploy superior into Bitcoin, buoyed by the affirmative trends and the fearfulness of missing retired (FOMO).

However, choppy and sideways terms movements tin pb to higher volatility. With a important information of the marketplace successful profit, the temptation to recognize these gains could trigger large-scale sell-offs, particularly if fears of a marketplace highest oregon antagonistic quality look successful the coming days.

While the prevailing sentiment is bullish — driven by wide profitability and organization involvement — the marketplace indispensable navigate the imaginable challenges posed by unrealized gains. The pursuing 24 hours are important successful determining whether Bitcoin tin support its foothold astatine $60,000 oregon if the unit to recognize profits volition catalyze volatility.

The station The Bitcoin marketplace faces a captious infinitesimal amid soaring unrealized profits appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)