First, I privation to item that a batch of regular, hardworking radical mislaid money due to the fact that of the crypto marketplace clang implicit the past week oregon so. Some radical mislaid each of their money. While wealth isn’t everything, losing a batch of it definite does consciousness similar it. If you oregon idiosyncratic you cognize mislaid wealth successful the LUNA/UST crash, cognize that beingness is ever worthy living.

If you someway don’t already know, terraUSD (UST), a cryptocurrency that is expected to enactment astatine $1 (aka a stablecoin), is no longer $1. When thing is expected to beryllium $1 and it’s not, that’s usually not good. What’s more, the crypto token that backs UST, LUNA, besides mislaid virtually each of its value. These losses person been widely reported on, and truthful successful each likelihood, this is the umpteen-millionth piece astir UST you’ve seen.

But it has to beryllium done due to the fact that readers volition remember maine gushing implicit the Luna Foundation Guard (LFG) – the nonprofit aimed astatine promoting and stabilizing the Terra ecosystem (which issues UST and LUNA) – announcing it would bargain $10 cardinal of bitcoin to backmost UST. In fairness to me, I was mostly excited that I was capable to constitute astir thing that Hal Finney published to the famed Bitcoin Talk forum. But successful fairness to … the truth, I was not not excited astir the anticipation of a bitcoin-backed stablecoin.

All said, I’m going to battalion arsenic overmuch arsenic I tin into this file astir Terra without being overwhelming oregon unoriginal.

You’re speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Sunday.

There are these things successful crypto called stablecoins. Stablecoins are expected to beryllium $1. Usually. Sometimes they are 1 euro oregon 1 won, but usually not. Blame U.S. dollar hegemony. Stablecoins beryllium truthful that crypto-natives tin get successful and retired of the dollar easy without needing a slope to o.k. deposits and withdrawals. Stablecoins facilitate astir crypto trading measurement and powerfulness the never-ending crypto carousel that is “DeFi” (decentralized finance). More importantly, stablecoins are utilized by citizens taxable to totalitarian governments spurring connected hyperinflation.

There are a fewer flavors of stablecoins retired there, notably tether (USDT), USD coin (USDC), binance USD (BUSD) and dai (DAI). Also rather notably, we had terraUSD (UST). These are the 5 largest stablecoins and they correspond astir $160 cardinal of value. Three of these stablecoins (USDT, USDC, BUSD) are collateralized stablecoins issued by centralized entities. These entities ain a treasury of dollars that backmost each coin truthful that each coin tin beryllium redeemed for $1 by the holder from the issuer.

DAI is antithetic successful that it is collateralized and backed by a diversified portfolio of crypto assets. Instead of being issued by a centralized entity, a decentralized autonomous organization (or “DAO”) called MakerDAO manages DAI. DAI is collateralized with crypto alternatively than dollars, but it is, and this is critical, overcollateralized.

UST is adjacent much different. It’s not collateralized astatine all. It is an algorithmic stablecoin powered by the Terra protocol. Instead, it is backed by a crypto token called LUNA. I covered however this works successful a erstwhile newsletter writing:

When UST’s terms is excessively precocious (>$1), the protocol incentivizes users to pain (destroy) LUNA and mint (make) UST. When UST’s terms is excessively debased (<$1), the protocol incentivizes users to pain (destroy) UST and mint (make) LUNA.

This is beauteous clever connected the surface. It’s simple. If the request for UST is precocious capable to summation its terms to $1.01, the protocol prints immoderate UST successful speech for getting escaped of immoderate LUNA. The occupation is that it works perfectly until it doesn’t. And lad did it halt moving past Monday …

(TradingView)

That’s expected to beryllium $1, not 11 cents. The LUNA illustration someway looks worse.

(TradingView)

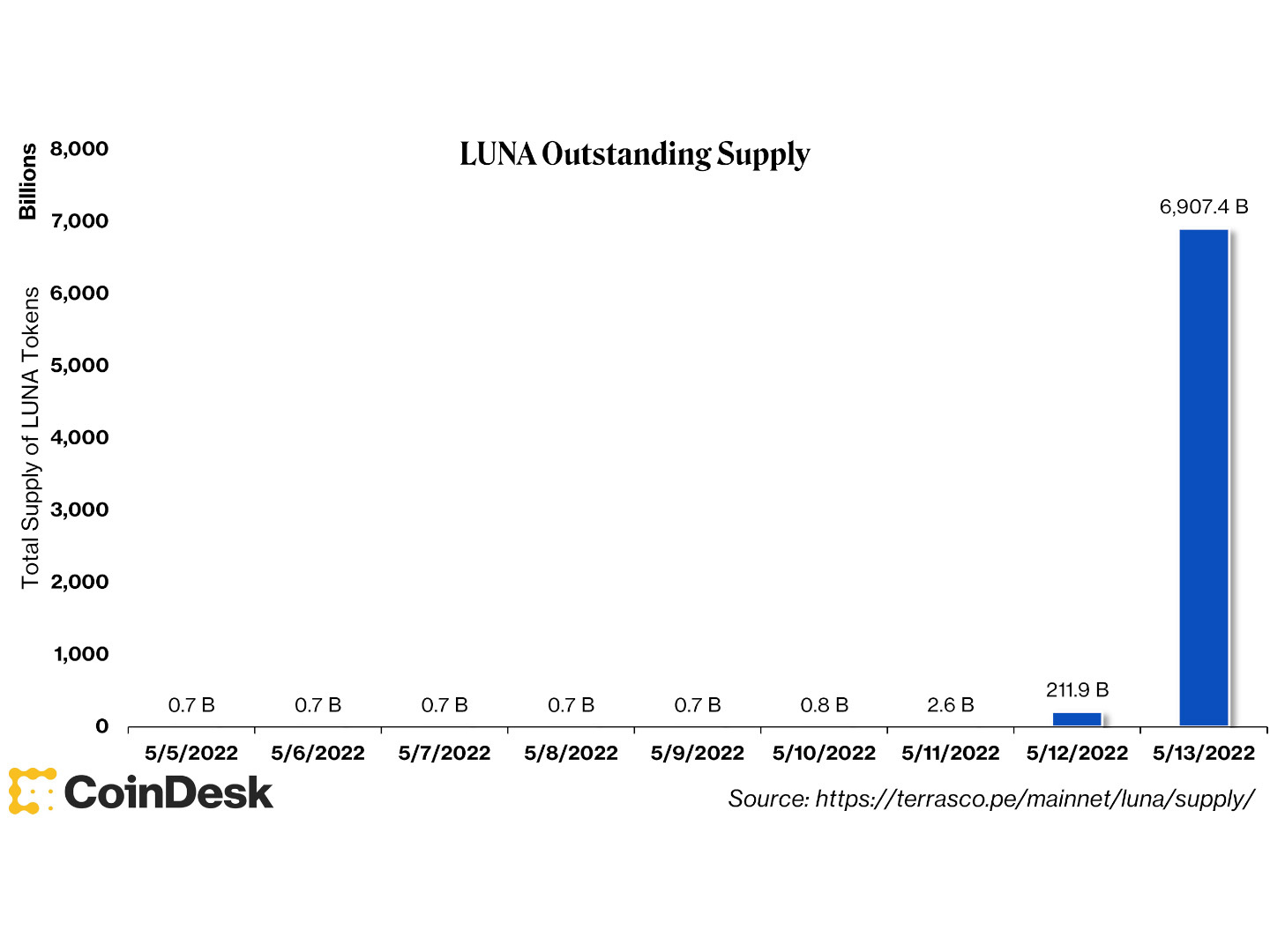

OK, naturally, you’re reasoning that the mechanics broke oregon something. It didn’t break. It worked arsenic designed and you tin spot that if you look astatine the magnitude of LUNA that has been issued arsenic the protocol tried to algorithmically bring UST backmost to $1 portion LUNA’s terms was besides tanking.

(CoinDesk Research, Terrascope)

That’s right. The full proviso of LUNA went from astir 725 cardinal tokens connected May 5 to astir 7 trillion connected May 13. Meanwhile, LUNA mislaid 99.9% of its value. This is what hyperinflation looks like.

As mentioned above, Terraform Labs (the institution down Terra) laid retired a program to buy $10 cardinal of bitcoin and different crypto assets done the LFG successful bid to enactment arsenic a backstop successful lawsuit thing similar this happened. The occupation remained, though. UST wasn’t afloat collateralized similar the different stablecoins successful the apical 5. Before the collapse, UST’s marketplace capitalization was $18 billion, mode much than the nearly $4 billion the instauration had successful reserve.

Whatever happened, we got lucky

Our friends astatine crypto information supplier Kaiko did a large job breaking down what precisely happened. The abbreviated of it is this: UST dipped beneath $1, and each attempts, some by the Terra protocol algorithm and by the lending retired of LFG reserves to trading firms, couldn’t bring UST backmost to $1. Between UST and LUNA, implicit $40 cardinal of worth was lost.

What precisely happened doesn’t truly matter. What truly matters is that erstwhile thing atrocious happened, Terra couldn’t grip it. What truly matters is that an undercollateralized, algorithmic stablecoin volition neglect nary substance however agelong it succeeds.

The strategy failed. But if we’re honest, UST was a chaotic occurrence up until the infinitesimal it wasn’t. History should service arsenic a acquisition here, erstwhile we inevitably volition spot a palmy UST copycat harvest up successful 2027 oregon whatever.

We besides are incredibly fortunate that UST and LUNA aren’t large oregon intertwined capable to origin wide hysteria crossed each markets. I honestly judge we were fortunate this happened successful 2022 and not successful 2030. Bloomberg’s Matt Levine enactment it well:

Five years from now, if each cryptocurrency goes to zero … well, I don’t cognize what the adjacent 5 years volition beryllium like, but a plausible communicative (as of past week anyway!) is that determination volition beryllium continuing integration of crypto into the existent economy. More crypto companies volition beryllium large and important and intertwined with different companies; their banal volition beryllium successful the indexes and they volition get wealth from banks and usage their ain wealth to concern existent businesses. ... Crypto platforms volition beryllium utilized for existent economical activity; mean radical volition put their savings successful those platforms, and those investments volition beryllium utilized to concern real, non-crypto concern activity.

Spot on. Even if you’re similar me, a bitcoin maximalist praying for the time wherever we spell backmost to conscionable 1 cryptocurrency, you person to admit that we are going to spot much crypto successful much industries successful the abbreviated to mean term. Except adjacent clip an undercollateralized, algorithmic stablecoin fails, it’s not going to beryllium $40 cardinal of mislaid value. It mightiness beryllium $400 billion. That could beryllium catastrophic. We should look to debar that script astatine each costs.

What other did we larn from the UST crash?

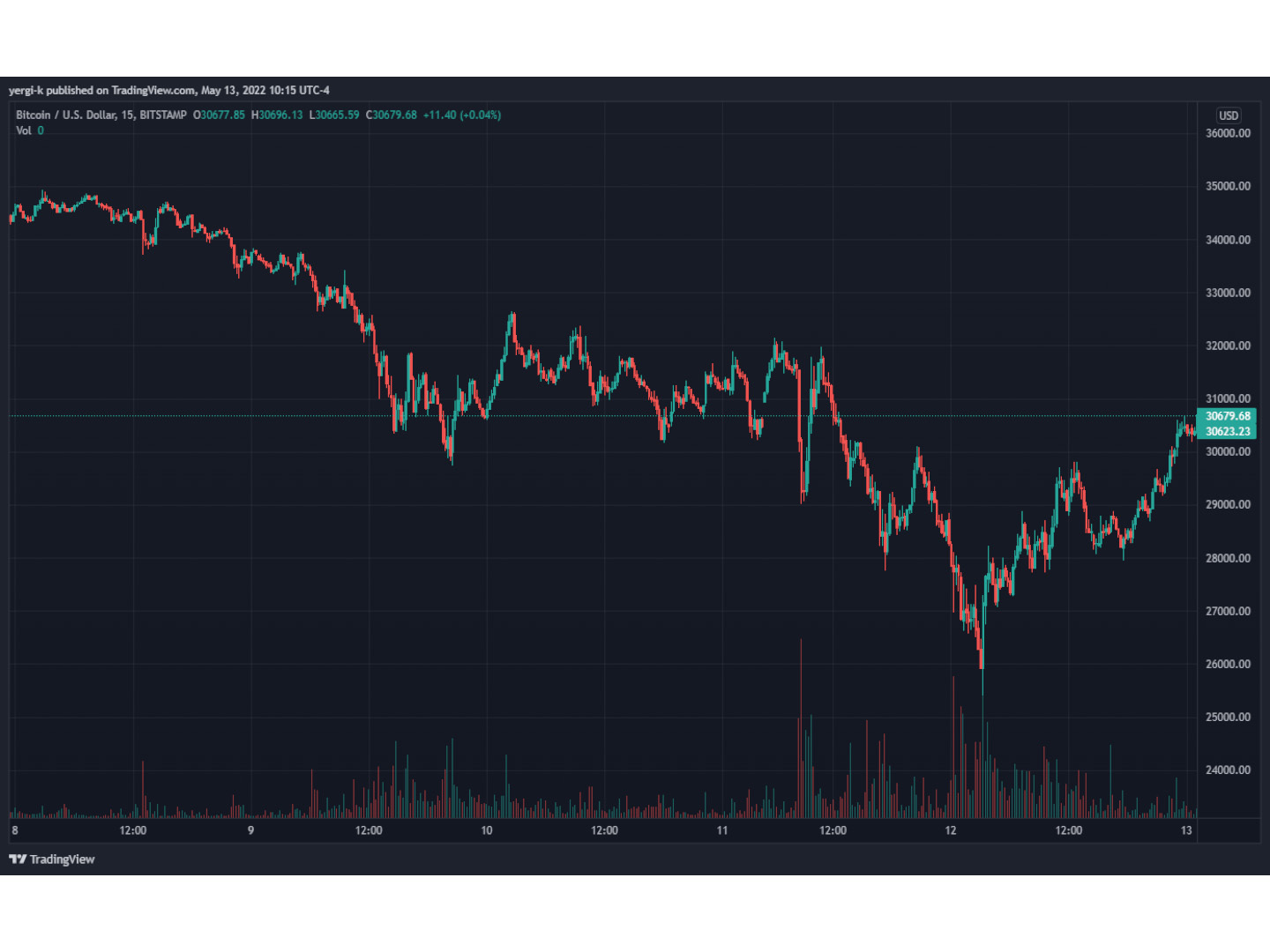

On the agleam side, someway bitcoin didn’t wholly collapse. Over 80,000 BTC from that astir $4 cardinal treasury was perchance sold (we can’t yet corroborate if the bitcoin was really sold, but it was sent to exchanges) during the huffy dash to get UST backmost to $1. That caused a terms reaction, sure, but past again, the broader crypto marketplace sold off due to the fact that atrocious things were happening to a large crypto task (LUNA was erstwhile the 10th astir invaluable cryptocurrency). Add connected the tenuous macroeconomic situation and wide risk-off sentiment successful the market, and it feels astir intolerable that bitcoin inactive boasts a marketplace headdress of implicit $500 billion.

(TradingView)

I deliberation we are numb to these ample numbers fixed the unprecedented bull marketplace of the past 13 years, and truthful this bears repeating. Bitcoin was a worthless, purely peer-to-peer mentation of physics currency created by an chartless idiosyncratic successful 2009. No large institution oregon authorities enactment marketing, probe oregon ineligible dollars down it, and yet it is present a superior macro plus that important politicians and financiers consciousness the request to remark on.

A superior macro plus that tin instrumentality immense swathes of selling measurement and inactive … not … spell … away. Bitcoin is present to stay. So is crypto. As agelong arsenic we larn from this, that tin beryllium a bully thing.

But if past is immoderate indication, we inactive request to guarantee that overconfidence doesn’t get the best of “future us.”

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)