Most NFT lavation traders person been unprofitable, but there's inactive large wealth to beryllium made successful selling non-fungibles to yourself.

All caller exertion comes with important imaginable for abuse. Non-fungible tokens (NFTs) are nary different.

And portion the caller plus people is yet to endure from large thefts, it lends itself to 2 beauteous profitable illicit activities—wash trading and wealth laundering.

NFT lavation trading is simply a crippled of luck

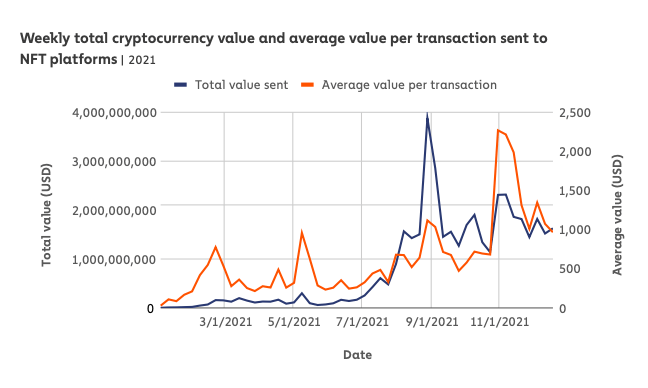

Few things successful the crypto manufacture person experienced a popularity roar arsenic immense arsenic NFTs have. According to Chainalysis‘ NFT Market Report, a minimum of $44.2 cardinal worthy of cryptocurrency has been sent to ERC-721 and ERC-1155 contracts successful 2021. This represents a 41,598% summation from the $106 cardinal that was recorded successful 2020.

Graph showing the play full cryptocurrency worth and mean worth per transaction sent to NFT platforms successful 2021 (Source: Chainalysis)

Graph showing the play full cryptocurrency worth and mean worth per transaction sent to NFT platforms successful 2021 (Source: Chainalysis)As was the lawsuit with the maturation of DeFi we outlined successful our past Crypto Crime Series report, the maturation NFTs person seen past twelvemonth was besides followed by a important summation successful illicit activities. But, dissimilar DeFi, which was deed the hardest with scams, NFTs suffered the astir from wash trading and wealth laundering.

Wash trading has ever been contiguous successful the crypto manufacture but has grown to unprecedented highs with NFTs. Used to artificially inflate an asset’s worth and liquidity, lavation trading is simply a transaction successful which the seller is connected some sides of the trade—i.e. selling to yourself.

It has historically been associated with cryptocurrency exchanges, which often utilized lavation trading to marque their trading volumes look larger than they really were. Wash trading NFTs besides makes them look much invaluable and, successful turn, much sought-after connected the secondary market.

And portion centralized exchanges needed to employment rather a spot of method know-how to execute lavation trades, lavation trading NFTs is importantly easier. Most NFT trading platforms don’t necessitate their users to verify their identities arsenic they aren’t taxable to immoderate KYC requirements. This means that the lone happening required to commercialized NFTs is connecting a wallet to the platform.

With nary recognition required, users tin link arsenic galore wallets arsenic they privation to the level and prosecute successful an endless ellipse of selling themselves immoderate magnitude of NFTs.

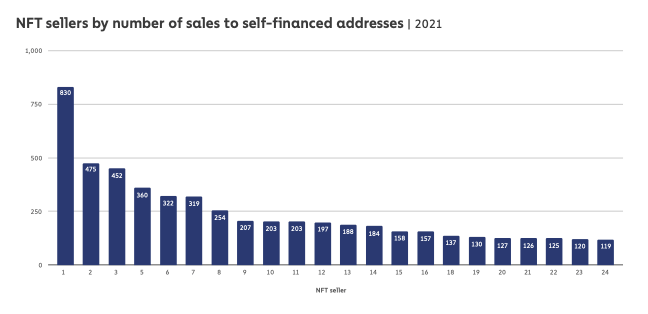

To get a amended knowing of however large and however profitable lavation trading truly is, Chainalysis analyzed income of NFTs to Ethereum addresses that were self-financed, meaning they were funded either by the selling code oregon the code that initially funded the selling address.

Chart showing NFT sellers by fig of income to self-financed addresses successful 2021 (Source: Chainalysis)

Chart showing NFT sellers by fig of income to self-financed addresses successful 2021 (Source: Chainalysis)Analysis of these income showed that immoderate NFT sellers person conducted hundreds of lavation trades. The astir prolific NFT trader connected the illustration supra made 830 income to self-financed addresses past twelvemonth but has truthful acold failed to crook a profit.

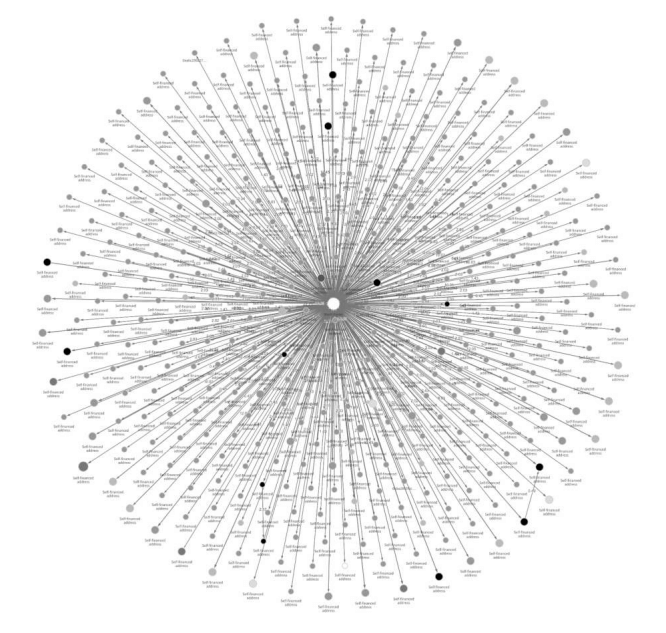

A reactor graph showing the narration betwixt the prolific NFT seller and the hundreds of addresses to which they’ve sold NFTs (Source: Chainalysis)

A reactor graph showing the narration betwixt the prolific NFT seller and the hundreds of addresses to which they’ve sold NFTs (Source: Chainalysis)In total, Chainalysis identified 262 users who person sold an NFT to a self-financed code much than 25 times. And portion the institution said that it couldn’t beryllium wholly definite that each instances of NFT income to self-financed wallets were intended for lavation trading, it was reasonably assured that the 25-transaction threshold was capable to nutrient results.

And nutrient results it did, arsenic further investigation showed that much than fractional of those lavation traders failed to crook a profit.

The study calculated the wide nett of the 262 lavation traders by subtracting the magnitude they’ve spent connected state fees from the magnitude they made selling NFTs to “real” buyers. Out of 262 lavation traders, 152 person been unprofitable, losing conscionable nether $417,000 successful aggregate.

However, the lavation traders that person been profitable made truthful overmuch wealth successful their trades, that they caused the full radical of 262 to reap an immense nett overall. There person been 110 profitable lavation trading addresses successful 2021, reaping a nett of $8.9 cardinal passim the year.

“That $8.9 cardinal is astir apt derived from income to unsuspecting buyers who judge the NFT they’re purchasing has been increasing successful value, sold from 1 chiseled collector to another.”

Despite its growth, NFT lavation trading inactive exists successful ineligible limbo. Wash trading itself is prohibited successful securities and futures markets but is yet to beryllium taxable to immoderate benignant of regulations erstwhile it comes to the NFT space.

However, it’s important to enactment that the lavation trading Chainalysis identified connected Ethereum inactive represents little than a fraction of the wide NFT trading measurement we’ve seen past year. It’s besides arsenic arsenic important to enactment that turning a nett lavation trading NFTs is highly hard—those that bash usually beryllium it to an unexpected changeable of luck.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)