The beneath is simply a full, escaped excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Public Miner Equities Versus Bitcoin

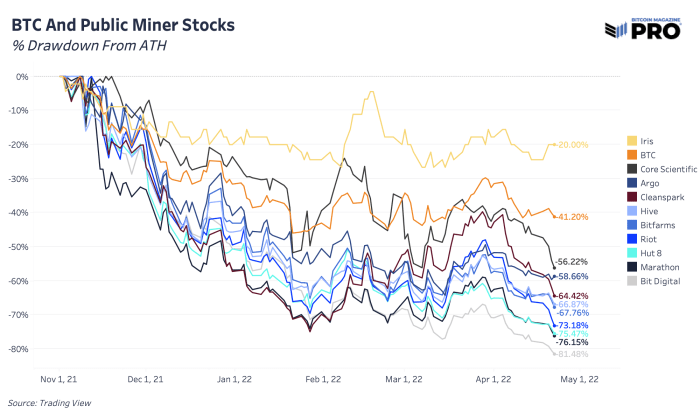

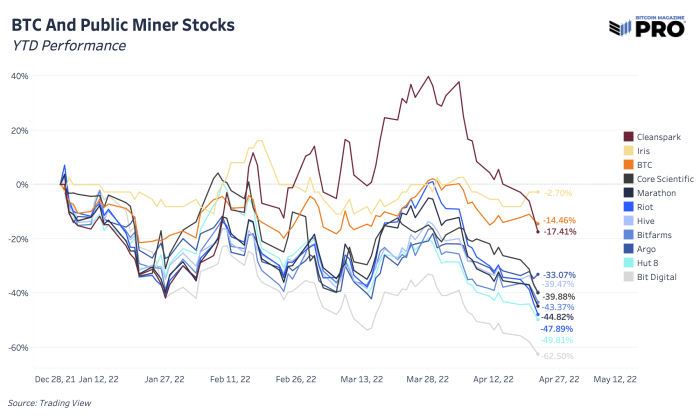

As for astir risk-on assets, including bitcoin and nationalist bitcoin mining equities, the drawdowns from all-time highs person been substantial. As bitcoin has fallen 41.20% from its November all-time high, the full bitcoin mining manufacture has performed overmuch worse, facing an mean drawdown of 64.10%. Public bitcoin miner stocks person acted arsenic further concern vehicles for indirect bitcoin vulnerability with accidental for outperforming bitcoin implicit the past fewer years — astatine slightest until the marketplace shifted successful November 2021.

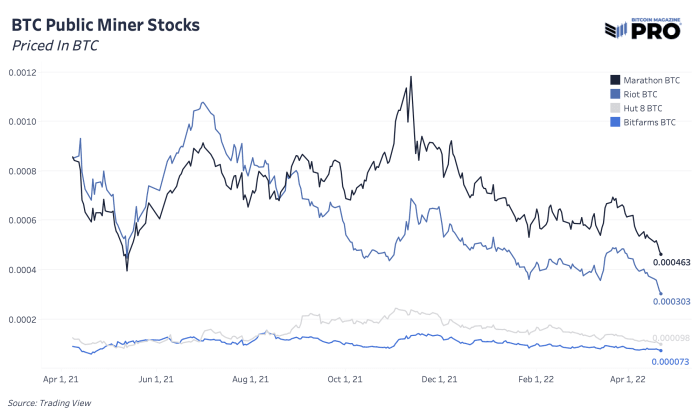

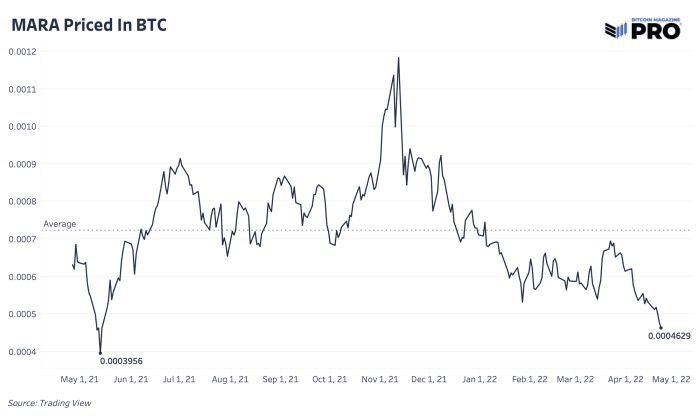

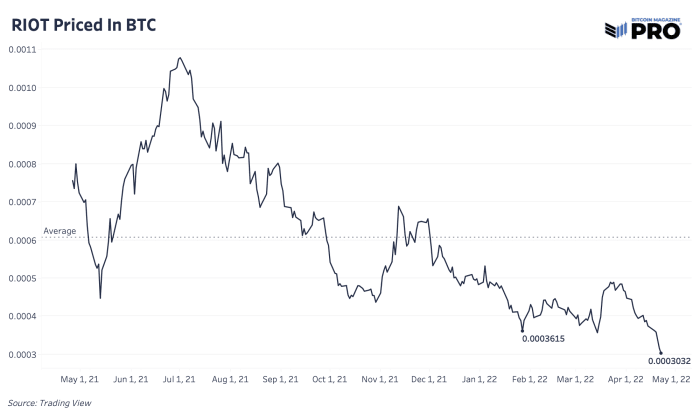

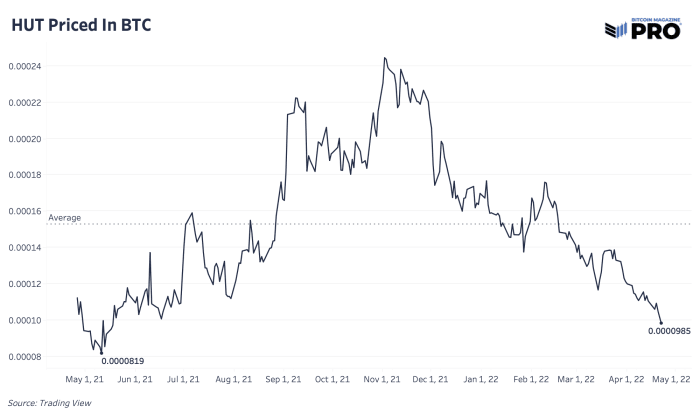

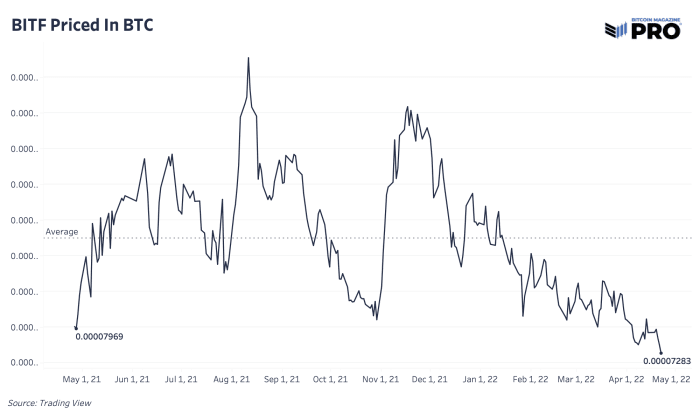

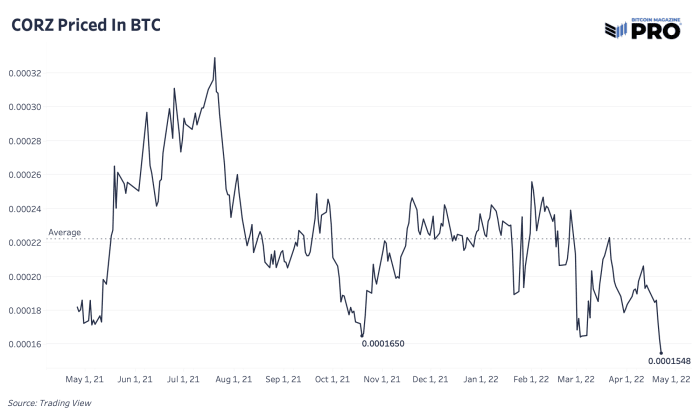

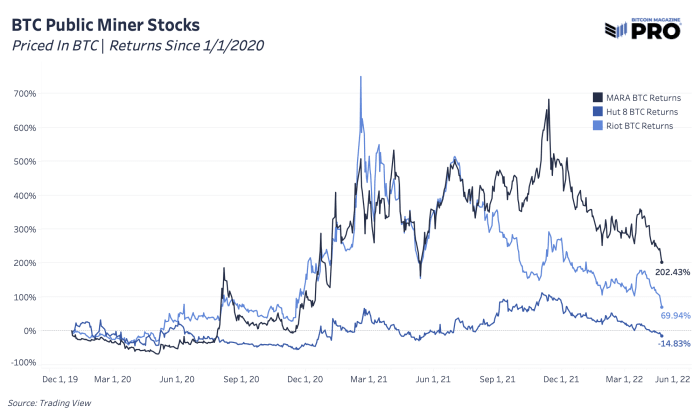

Apart from pricing miners successful USD terms, however good bash they execute priced successful bitcoin? Those utilizing bitcoin arsenic a portion of relationship volition people look for opportunities that volition outpace bitcoin successful an effort to turn their wide bitcoin presumption and stock of a constricted supply. With the latest drawdowns, bitcoin miners are starting to look comparatively inexpensive erstwhile priced successful BTC terms, arsenic galore of these stocks are nearing oregon making caller 12-month lows.

Although our basal lawsuit is that the broader equities marketplace (and apt bitcoin) has much downside to travel this year, idiosyncratic mining stocks could beryllium person to a bottommost than the remainder of the market, with astir down 60% to 70% already. Below are immoderate of the apical nationalist miners priced successful BTC implicit the past year, good beneath their yearly averages.

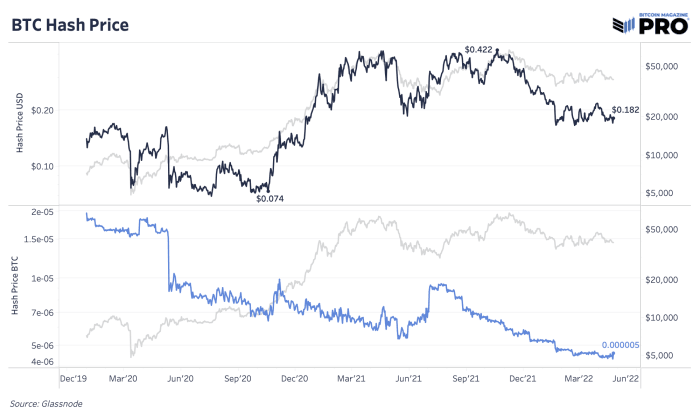

The show diminution comparative to bitcoin is much caller implicit the past six months. Select miners person had beardown outperformance comparative to bitcoin since 2020 with bitcoin’s hash terms rising from $0.07 to $0.42 astatine its caller peak. As terms exploded and hash complaint was lagging behind, miners person been successful a aureate play making much gross per hash starring to a play of higher profits, higher net and higher marketplace valuations.

Since 2020, present were immoderate of the miner equity returns erstwhile priced successful bitcoin crossed the apical marketplace capitalization miners. This hash terms roar mixed with rising capitalist request and speculation led Marathon and Riot stocks to outperform bitcoin by 202% and 70% respectively. Picking and timing the close miner banal (or handbasket of miner stocks) to outperform is besides crucial, which makes self-custody bitcoin the champion attack for most.

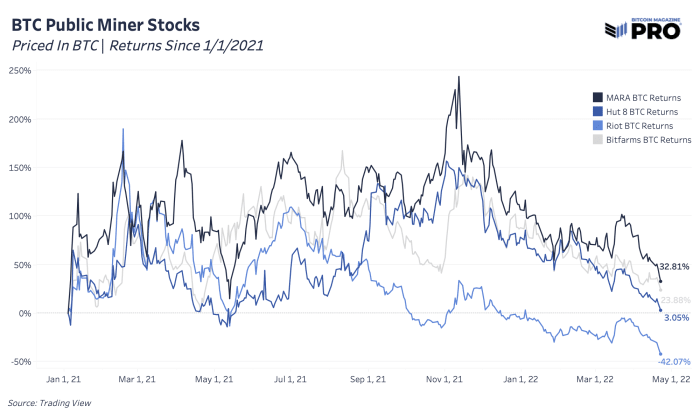

Since 2021, those returns and outperformance are much muted (or adjacent negative), showing however hard it’s been for miners to outperform bitcoin with hash terms peaking during a broader macro pivot to a risk-off marketplace regime.

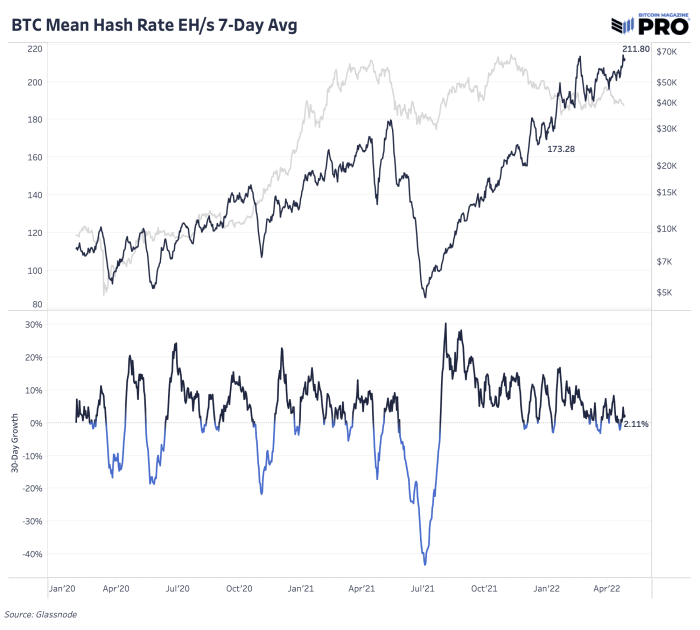

Hash terms (miner gross per terahash) present sits astatine astir $0.182 and continues to autumn from its higher short-term inclination arsenic terms stagnates and hash complaint maturation diverges, down 14.46% and up 22.23% year-to-date respectively. At a astir annualized 66.69% maturation complaint astir done April, that would enactment the full hash complaint adjacent to 289 EH/s by the extremity of the year.

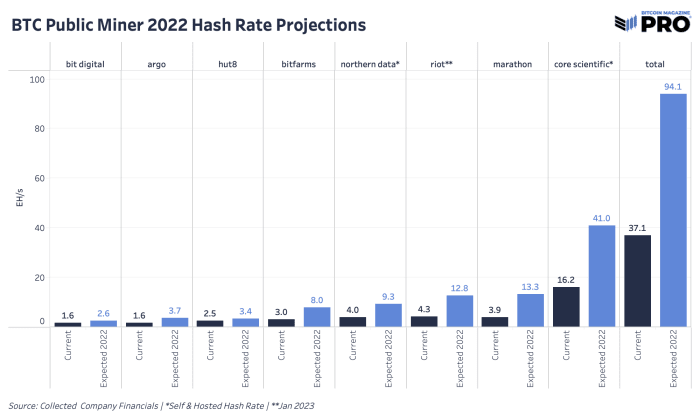

Although it is simply a monolithic task to bring that overmuch hash complaint and powerfulness online this twelvemonth amid ASICs proviso concatenation delays, powerfulness capableness issues and rising vigor costs, prime apical nationalist miners are inactive readying to turn their hash complaint by 154% done 2022 — from 37.1 EH/s to 94.1 EH/s. This maturation (table below) includes each announced 2022 plans crossed self-mined and hosted hash rate.

Without a bullish terms catalyst successful the abbreviated term, expect the network’s hash complaint enlargement to continue; higher trouble adjustments volition proceed to propulsion hash terms lower. Hash terms is people trending towards zero implicit bitcoin’s beingness arsenic the marginal outgo of producing a bitcoin becomes much competitory implicit time, but determination volition beryllium lucrative periods wherever terms appreciation outpaces hash rate’s capableness to turn successful the abbreviated term.

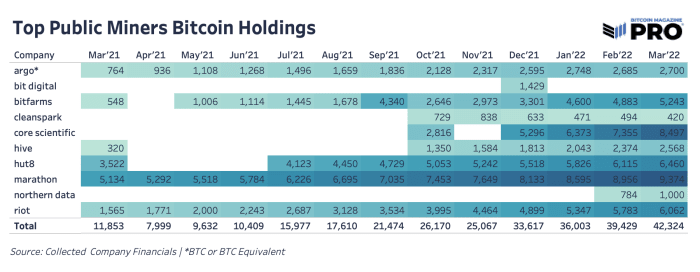

Despite the caller autumn successful valuations, we’ve seen small alteration successful nationalist miners to curb their hash complaint enlargement plans for 2022 and 2023 oregon downsize their BTC holdings. Reported bitcoin holdings grew 7.3% month-over-month successful March, showing signs that bitcoin miners aren’t yet facing large capitulation oregon selling unit to reverse this caller manufacture inclination of rising bitcoin accumulation.

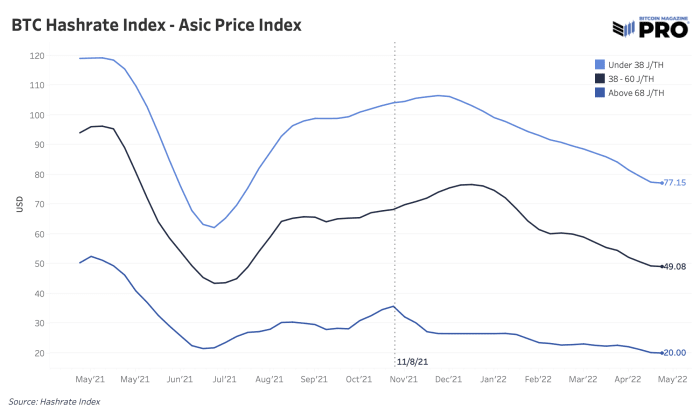

The inclination of falling hash terms volition unit weaker miners to unplug machines, find much businesslike vigor sources and/or merchantability disconnected those machines oregon bitcoin holdings successful the worst case. Some of those marketplace dynamics tin beryllium tracked via a mining rig terms scale successful USD with information from Luxor and their Hashrate Index.

Overall, USD prices of ASICs crossed ratio tiers person been falling importantly aft a section highest successful November 2021. This could marque ASICs much appealing astatine little prices for buyers but volition besides bring down plus values for holders of ample fleets. Like hash price, Hashrate Index is expecting prices to proceed trending towards post-China prohibition lows.

3 years ago

3 years ago

English (US)

English (US)