After the LUNA and UST meltdown, galore crypto investors person been funny astir the project’s emergence successful popularity and radical wonderment astir the inheritance of Terra’s co-founder Do Kwon. Moreover, it is not commonly known that Terraform Labs was besides founded by Daniel Shin, the laminitis of a outgo steadfast called CHAI. After Shin near the company, the startup saw important maturation and Kwon became the main look of Terra’s ‘Lunatic’ movement.

Do Kwon — A Stanford Graduate That Became the Face of the Terra Money Project Following His Partner’s Departure

The Terra blockchain fiasco volition spell down successful crypto past arsenic 1 of the craziest events during the past 13 years. It each started during the 2nd week of May, erstwhile the once-stable coin terrausd (UST) mislaid its peg from its $1 parity. This caused a monolithic slope run-like lawsuit wherever billions of dollars worthy of crypto was withdrawn from Curve Finance, Lido, and the decentralized concern (defi) lending app Anchor Protocol.

Terra blockchain’s autochthonal token (LUNA) fell importantly successful worth arsenic well, arsenic the network’s LUNA/UST swapping mechanics drove the coin toward a decease spiral. Terra’s full ecosystem was wiped off the apical crypto projects list, and present it is placed astatine the bottommost of the barrel, among a litany of failed integer currencies.

However, for rather immoderate clip Terra was considered 1 of the hottest blockchain projects retired there, and LUNA reached an all-time precocious astatine $119.18 per portion connected April 5, 2022. Today is simply a antithetic story, arsenic a azygous LUNA is present exchanging hands for $0.00018000 per unit. While galore disliked Terra’s co-founder Do Kwon, a large fig of radical enjoyed his attitude.

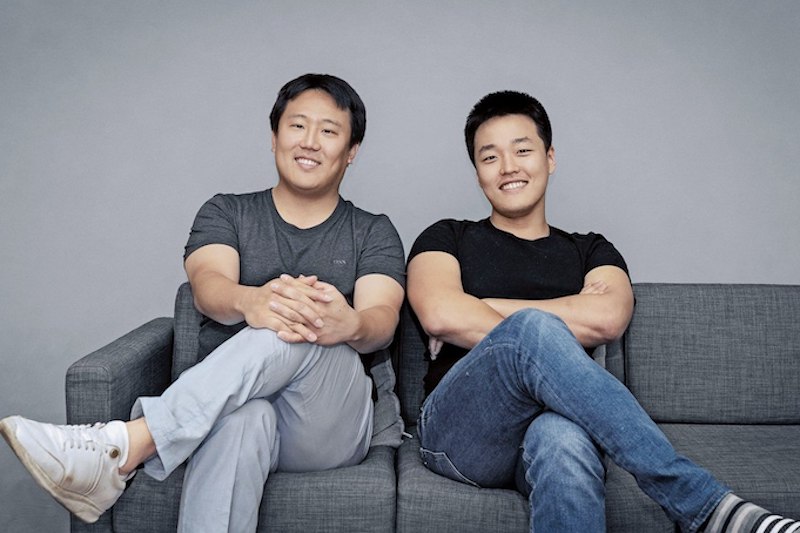

The 2 co-founders of Terraform Labs. Daniel Shin (pictured left) and Do Kwon (pictured right).

The 2 co-founders of Terraform Labs. Daniel Shin (pictured left) and Do Kwon (pictured right).The 31-year-old South Korean autochthonal Do Kwon is simply a Stanford University postgraduate and according to nymag.com, helium allegedly worked for Apple and Microsoft. At Stanford Kwon graduated with a grade successful machine science. While not overmuch is known astir Kwon’s anterior history, he’s been a subordinate of the crypto assemblage for rather immoderate time.

According to a report published by Coindesk authors Sam Kessler and Danny Nelson, Kwon was allegedly progressive with different failed stablecoin task called “Basic Cash.” Former Terraform Labs employees assertion Kwon operated the Basic Cash task nether the pseudonym “Rick Sanchez.” Kwon is known for founding Terraform Labs with Daniel Shin, the laminitis of a outgo steadfast called CHAI.

Terra’s White Paper, Terra Alliance, and Capital Injections From Well-Known Backers

The Terra project’s white paper was authored by Evan Kereiakes, Marco Di Maggio, Nicholas Platias, and Do Kwon. The achromatic insubstantial details that the main foundations of “Terra Money” see “stability and adoption.” The Terra task was created successful January 2018 and LUNA’s archetypal recorded marketplace worth was $3.27 per portion connected May 7, 2019. By January 2020, LUNA was trading for overmuch little values astatine $0.20 to $0.50 per unit.

Then, successful February 2021, LUNA started to summation important marketplace traction and yet climbed 23,700% to the crypto asset’s all-time terms high. Additionally, from October 2020 each the mode until May 9, 2022, Terra’s stablecoin terrausd (UST) held its $1 parity with the U.S. dollar. Before some of these tokens and the galore different crypto assets built connected apical of Terra, the task derived from the radical Terra Alliance. The radical is simply a 16-member planetary web of Asian e-commerce and fiscal advisory firms.

A Terra Alliance advertisement from February 26, 2019.

A Terra Alliance advertisement from February 26, 2019.In February 2019, Terra Alliance had an wide scope of astir 45 cardinal users successful 10 antithetic countries with platforms specified arsenic Musinsa, Yanolja, TMON, and Megabox. TMON was a billion-dollar startup that was founded by Daniel Shin and successful August 2018, Shin told the property his caller stablecoin task raised $32 million.

Investors included Arrington XRP, Kenetic Capital, Binance Labs, FBG Capital, 1kx, Hashed, and Polychain Capital. “We are pleased to enactment Terra, which sets itself isolated from astir different blockchain projects with its established and contiguous go-to-market strategy,” Polychain Capital’s Karthik Raju said astatine the time.

The project’s authoritative mainnet motorboat was successful April 2019 and ecosystem tools were made disposable similar the artifact explorer Terra Finder and the wallet Terra Station. In May 2019, Terraform Labs had a corporate backing circular led by Arrington XRP Capital, and successful August 2019, Hashkey Capital backed the team.

In January 2021, Terraform Labs raised $25 cardinal from Coinbase Ventures, Galaxy Digital, and Pantera Capital. The pursuing July, Galaxy Digital, Arrington XRP Capital, Blocktower Capital, and others injected $150 cardinal into an ecosystem money created by the Terra team. Additionally, Terraform Labs invested successful different companies specified arsenic Hummingbot, Stader Labs, Espresso Systems, Leapwallet, and Rain.

Anchor: The So-Called ‘Gold Standard for Passive Income’

2019 was the twelvemonth Terra started seeing a batch much buzz surrounding the task and successful June of that year, the web had its archetypal protocol upgrade. A twelvemonth aboriginal successful July, Shin’s steadfast CHAI launched the CHAI paper and by January 2020, Shin near Terraform Labs aft 2 years of moving with the project.

Shin inactive leads CHAI corp and helium inactive runs TMON arsenic well. While Shin was the look of Terra’s archetypal leap getting backing from Binance successful August 2018, it was Kwon who accepted the $25 cardinal successful January 2021, and the $150 cardinal successful July 2021. Moreover, successful the summertime of 2020, a conception built connected Terra called the “Gold Standard for passive income connected the blockchain” was born.

Nicholas Platias, Eui Joon Lee, and Marco Di Maggio published the Anchor Protocol achromatic insubstantial successful June 2020 and the exertion became the stablecoin UST’s main usage case.

Nicholas Platias, Eui Joon Lee, and Marco Di Maggio published the Anchor Protocol achromatic insubstantial successful June 2020 and the exertion became the stablecoin UST’s main usage case.In June 2020, Anchor Protocol’s white paper was published and it was written by Nicholas Platias, Eui Joon Lee, and Marco Di Maggio. “Anchor offers a principal-protected stablecoin savings merchandise that pays depositors a unchangeable involvement rate,” the achromatic insubstantial explains. Nicholas Platias introduced Anchor connected July 6, 2020, explaining that the squad wanted to get escaped of the “highly cyclical quality of stablecoin involvement rates” successful defi.

For rather immoderate time, Anchor Protocol gave depositors a 20% compounding involvement complaint until the task decided to displacement to a dynamic gain complaint astatine the extremity of March 2022. The Anchor task started to spot a batch much disapproval astatine the clip and sustainability concerns. During the past fewer months, Anchor was called a Ponzi scheme successful a fig of social media and forum posts written by crypto proponents.

Do Kwon: ‘I Don’t Debate the Poor connected Twitter’ and ‘95% of Coins Are Going to Die’

Terra’s stablecoin UST was besides criticized by the Galois Capital enforcement Kevin Zhou who predicted the de-pegging incidental good earlier it happened. Do Kwon was admired by a ample service of ‘Lunatics’ and contempt Zhou’s aboriginal criticisms, Kwon proudly told radical to proceed staying “poor.” “U inactive poor?” Kwon asked connected societal media, “I don’t statement the mediocre connected Twitter,” the Terra laminitis explained.

Notice however the cockroaches are soundless contiguous arsenic the 🌕 shines bright

As promised, the satellite gave nary quarter

— Do Kwon 🌕 (@stablekwon) December 22, 2021

Kwon besides erstwhile remarked that “95% [of coins] are going to die, but there’s besides amusement successful watching companies dice too.” The Terra co-founder additionally had problems with the U.S. Securities and Exchange Commission (SEC) arsenic the regulator took contented with Terra’s Mirror Protocol.

Kwon past said helium decided to sue the SEC for not utilizing the due channels to present his subpoena and that the regulator lacked jurisdiction implicit Terra’s properties. “The SEC attorneys were good alert that TFL and Mr. Kwon had consistently maintained that the SEC lacked jurisdiction implicit TFL and Mr. Kwon, and astatine nary clip asked Dentons lawyers whether it was authorized to judge work of subpoenas,” Kwon’s suit stated. Similar to Terra’s suite of stablecoins, Mirror Protocol allowed radical to reflector stocks similar Amazon oregon Apple via Terra’s blockchain network.

Would similar to inquire immoderate your nett worthy is and stake 90%

But possibly this is what that is already

— Do Kwon 🌕 (@stablekwon) March 13, 2022

Terra’s Story Continues With No End successful Sight

Now the Terra task looks to revive itself from a near-dead authorities by forking the web without a stablecoin. However, a batch of contention surrounds the Terra task contiguous and Terra’s co-founder Do Kwon has been blamed for a fig of miscalculated errors. Questions person surrounded the bitcoin (BTC) reserves the Luna Foundation Guard (LFG) held successful bid to support UST’s $1 parity.

Later the Singapore-based nonprofit LFG disclosed what the enactment did with the 80K+ bitcoin (BTC) it erstwhile held successful its reserves. Then 3 members of the Terraform Labs (TFL) in-house ineligible squad abruptly resigned aft the project’s fallout and reports further noted that Do Kwon dissolved TFL earlier UST and LUNA collapsed.

Woah. Do Kwon describing Terra's "Protocol Armageddon" successful 2021. "A termination switch" wherever TFL "pulls the trigger" and disappears from the task aft cutting each of their ties – "in 24 hours we're gone." Is this perchance related to what's happening with Terra 2 this week? pic.twitter.com/jFDx0zLcIy

— FatMan (@FatManTerra) May 20, 2022

Terra roseate to popularity alternatively quickly, but the project’s demise was adjacent quicker. The Terra task has not been enactment retired of its misery, and the platform’s autochthonal tokens inactive person a tiny magnitude of value. Today, galore Terra supporters are hopeful portion detractors are doubtful that Terra and Do Kwon tin revive the breached blockchain ecosystem.

The marketplace has already decided, for the astir part, that LUNA and UST are not arsenic invaluable arsenic they erstwhile were. Whether oregon not a Terra fork and airdropping caller tokens volition assistance the task travel backmost remains to beryllium seen and it’s harmless to say, Terra’s communicative has not ended.

Tags successful this story

Anchor Lending, Arrington XRP Capital, Basic Cash, BlockTower, Capital Injections, CHAI, Coinbase Ventures, Daniel Shin, De-Pegging Event, decentralized finance, DeFi, do kwon, Espresso Systems, Eui Joon Lee, Evan Kereiakes, Featured, Galaxy Digital, Hummingbot, Leapwallet, lfg, LFG Bitcoin, LUNA, Luna Foundation Gaurd (LFG), Marco Di Maggio, Nicholas Platias, Rain, Rick Sanchez, Stablecoin, Stader Labs, Terra Alliance, terraform labs, TMON, UST, White Paper

What bash you deliberation astir the emergence of Terra LUNA and the radical that helped Do Kwon? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)