“Bear markets are the champion clip to beryllium live and successful the sector. It’s depressing for those that don’t cognize what they’re doing, it’s awesome for those that person a longer-term view.” – Simon Dixon

The quality betwixt Bitcoin and everything other is that the terms of bitcoin doesn’t matter. Over the agelong word the terms of bitcoin has gone up, yes, but the worth proposition of bitcoin arsenic hard, non-confiscatable and genuinely decentralized wealth is truly what matters. Not the terms hype and not the pump. This is wherefore traders and speculators person mislaid involvement successful Bitcoin, and proceed to flock to the newest pumping decentralized concern (DeFi) oregon non-fungible token (NFT) task astatine the driblet of a hat. This nonaccomplishment of involvement from the speculators is viewed by galore arsenic a antagonistic improvement for Bitcoin, but it is really a precise affirmative one. What we are seeing present represented successful the little bitcoin terms is the worth of its existent functional inferior and the lack of retail speculation superior that was determination before. This nonfiction volition picture wherefore that’s a bully thing.

Since its inception, misguided analysts person described Bitcoin arsenic a Ponzi strategy babelike connected continued artificial speculation pumping into the space. As anybody with acquisition tin archer you, speculators are shiny-object chasers by quality and propulsion retired of immoderate presumption the infinitesimal thing shinier comes along. Well, the bitcoin “bear market” has arrived and each the speculators are gone. They got bored and took their toys location with them. Even with them gone, bitcoin is inactive valued astatine acold higher than its 2020 and 2021 lows and is expanding adoption connected an organization (and sovereign) level. This adoption represents existent value.

The banal marketplace sweetener unreserved caused by Federal Reserve Board wealth printing and antagonistic existent involvement rates is ending, and the roller coaster is present going down from the top. This has had an interaction not lone connected bitcoin, but connected the banal marketplace and the different altcoins arsenic well. Put simply, everything is going down and aft the chaos subsides we volition spot what assets, stocks and projects really connection tangible, nonsubjective value. That’s what concern was ever expected to beryllium about. Despite the confused dichotomy betwixt “growth stocks” and “value stocks,” investing is by explanation expected to beryllium astir your semipermanent content successful the value of something, not successful its short-term maturation projections. Retail investors person struggled to comprehend this due to the fact that of the get-rich-quick, everyone’s-a-genius marketplace civilization of the past fewer years. Indeed, if an plus similar bitcoin isn’t perpetually appreciating connected a double- oregon triple-digit basis, past it’s a “failing” plus to these people. The marketplace is connected its head. As a result, the meme-stock assemblage is retired of bitcoin now, conscionable similar they are retired of the banal marketplace arsenic a whole. Turns retired the memers had insubstantial hands each along.

This nonfiction by Bloomberg, titled “Day Trader Army Loses All The Money It Made In Meme-Stock Era,” details however galore of the caller traders that entered the abstraction person “never seen a marketplace that wasn’t supported by the Fed.” Retail traders mislaid each the gains they made successful the Dogecoin, AMC and GameStop rallies, and are precisely backmost astatine quadrate one.

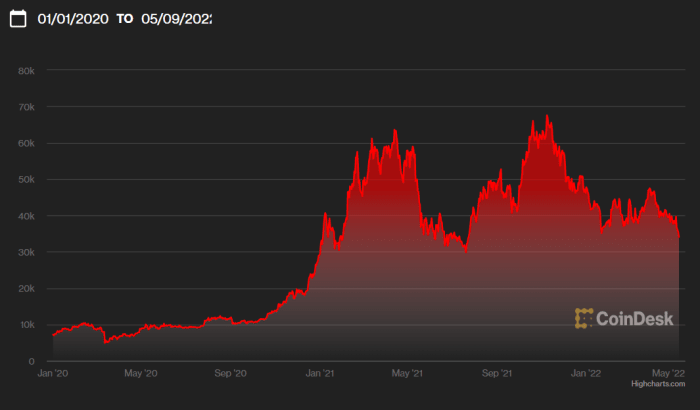

The full marketplace is falling close now and we request to rethink what a “good investment” is. Like the supra illustration from Morgan Stanley shows, the wide movements of retail trading person canceled retired to zero since January 2020 contempt their temporarily outsized gains successful 2021. If we comparison today’s bitcoin terms to the January 2020 price, we inactive spot a summation of 331% for bitcoin, outdoing the S&P 500’s instrumentality by a ample borderline and beating the wide retail trading nett of perfectly thing by a borderline of infinity. Do we request immoderate much impervious that HODLing is simply a superior strategy?

Yes, bitcoin is down from its all-time precocious by half, but factoring successful the unthinkable marketplace distortions caused by unprecedented wealth printing, memestock manipulations and post-COVID-19 involvement rates since aboriginal 2020, bitcoin inactive blows thing other retired of the water. We conscionable request to zoom retired to a much “honest” marketplace model successful bid to spot this. Everybody is acting similar the entity is falling, but again, that is lone due to the fact that astir retail investors lone entered the marketplace successful 2020 oregon 2021 and person ne'er seen a marketplace that wasn’t supported by the Fed.

There is simply a civilization successful the Bitcoin assemblage these days of “low (i.e., long-term) clip preference,” which fundamentally counters the Ponzi scheme-minded speculators that request speedy gains each of the time. High (short-term) clip penchant fuels the perpetual “passive income” prevarication that newbies ever autumn for. In contrast, the “modest” two-year summation of 331% successful bitcoin is much than capable for HODLers that person been buying since earlier the feeding frenzy of the past 2 years. Long-term clip penchant works for bitcoin due to the fact that its cardinal worth proposition has held existent since its inception, and it volition proceed to clasp existent successful the aboriginal for those who wait. Those who cannot hold are washed retired by the marketplace implicit a agelong capable clip play successful immoderate market, conscionable similar we person seen with the 0% nett summation for novice retail traders that propulsion successful and retired excessively much. The gains caused by hype, stimulus and taste madness were fleeting, but the gains successful Bitcoin inferior and adoption person been existent each along.

Detractors person been criticizing Bitcoin for needing meme-stock speculators to marque it work, but present that the meme-stock speculators are gone, the detractors are criticizing Bitcoin for the speculators not being there. This is simply illogical, and impervious that Bitcoin is not really a Ponzi scheme. The aforesaid tin not beryllium said for different cryptocurrencies. Ponzi schemes by explanation cannot beryllium for decades and the honesty successful existent bitcoin terms attests to the honesty of its cardinal worth proposition. Yes, it goes down sometimes. This is an indicator of wellness and transparency. Something that conscionable goes up and up and up forever? That’s a Ponzi strategy and the bottommost volition ever autumn retired eventually.

No one’s singing “Pump It Up” anymore, and contempt however amusive and euphoric the 2021 rally was for a while, the abstraction is truly amended disconnected without the memers around. It’s clip for a much grown-up civilization of improvement and adoption astir Bitcoin, and clip for a much grown-up terms speech arsenic well.

This is simply a impermanent station by Nico Cooper. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)