The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Latest Public Miner Developments

After penning connected the imaginable for nationalist miner capitulation and covering Core Scientific’s imaginable bankruptcy route, there’s been a question of miner announcements and developments that amusement industry-wide risks taking much shape. The large hazard is miners' accumulated indebtedness and deficiency of currency travel to spend the involvement complaint connected that indebtedness arsenic nett margins are squeezed. The different hazard is hash complaint (ASIC mining machines) that has been utilized arsenic collateral to unafraid this indebtedness financing.

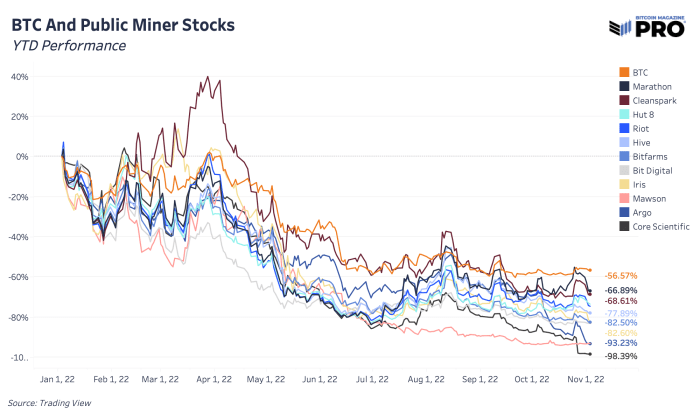

Public miners crossed the committee proceed to heavy underperform bitcoin successful year-to-date performance. That’s not a caller inclination but now, arsenic miners commencement to autumn and the survivors emerge, the show spread starts to widen successful a large way. Miners connected the borderline of going nether are down implicit 90% portion the market’s chosen “stronger” miners are much successful the 60-70% drawdown range.

Starting with Core Scientific, there’s a laundry database of firms that are owed money, including BlockFi, NYDIG and Anchor Labs. In total, creditors are owed astir $1 cardinal and adjacent MassMutual Barings (an concern steadfast owned by Mutual Life Insurance Co.) is connected the abbreviated list.

Argo Blockchain is 1 of those astatine the bottom, present down 93.23% this year. They released the biggest mining quality of the week aft announcing that a planned $27 cardinal fundraise didn’t spell through. Earlier this year, NYDIG agreed to a $70.6 cardinal indebtedness with Argo. Argo besides utilized immoderate of its bitcoin holdings successful August to reduce their BTC-backed indebtedness obligations from Galaxy Digital arsenic well.

Iris Energy highlighted successful a financing update this week that the institution is “currently susceptible of generating an indicative $2 cardinal of Bitcoin mining monthly gross profit, compared to aggregate required monthly main and involvement outgo obligations of $7 million.” After borrowing $71 cardinal from NYDIG which was secured by ASIC machines for 1 of their outstanding loans and astatine hazard of needing a indebtedness restructuring, Iris has astir 36,000 machines that whitethorn alteration hands reasonably quickly. The institution would default connected these loans unless they tin find a caller statement by November 8.

Stronghold Digital Mining conscionable this week closed connected their debt restructuring woody with NYDIG, delivering a fleet of 26,200 miners successful speech for the wipeout of $67.4 cardinal successful debt. Stronghold besides extended different tranche of indebtedness to beryllium repaid implicit 36 months alternatively of 13 to bargain much currency runway. The moves person been a strategical enactment to “rapidly de-lever our equilibrium expanse and heighten liquidity”.

CleanSpark, who’s been successful a spot of maturation and capable to buy ASICs astatine little prices recently, ended up selling much of their bitcoin holdings (mined 532 BTC and spent 836) past period to enactment maturation and operations. Although galore large miners are inactive maintaining their HODL strategies and bitcoin balances, beardown miners volition pat into those holdings for maturation opportunities oregon backing operations erstwhile perfectly needed.

TeraWulf, different bitcoin miner down 92.38% year-to-date, runs a comparatively precocious debt-to-equity ratio compared to different miners (86%) and has $120 cardinal successful debt to commencement being paid backmost successful outpouring 2023 astatine an 11.5% involvement rate.

As larger backstage lenders similar BlockFi and NYDIG don’t disclose however overmuch mining indebtedness is connected their equilibrium sheets, it’s intolerable to cognize for definite however exposed immoderate of these lenders are to broader mining manufacture bankruptcy hazard connected the horizon. These loans whitethorn beryllium a tenable information of broader financing activities and good equipped to grip the default risk, but it’s a dynamic worthy highlighting and to amended recognize arsenic we expect much miners to look unit of indebtedness default and/or restructuring implicit the adjacent fewer months.

One sentiment from Marathon Digital Holdings CEO Fred Thiel, ballparks that 20 oregon truthful nationalist miners could beryllium astatine risk of going bankrupt successful what helium deems a cleanable tempest for the industry. There’s nary uncertainty that larger, amended positioned miners are looking for potential, favorable acquisition deals to originate reasonably soon. Like each different manufacture earlier it, large manufacture consolidation is inevitable and nationalist bitcoin mining looks primed to spell done that adjacent signifier of its lifecycle. It’s apt we determination to a satellite wherever determination are lone a fewer large bitcoin miner giants with a fistful of overmuch smaller miners down them.

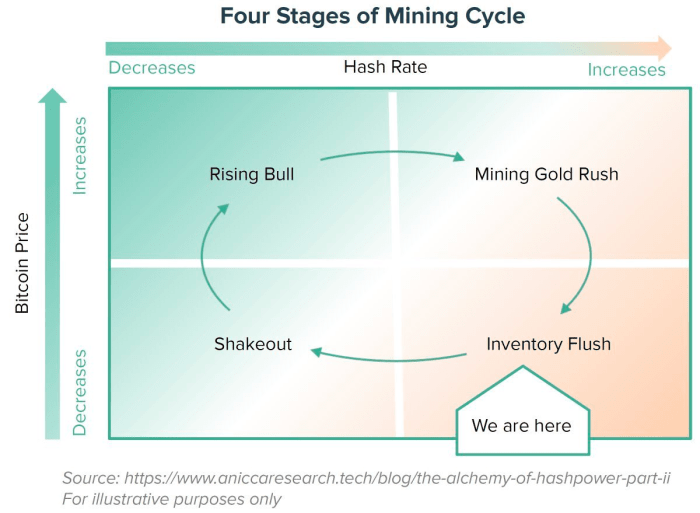

Similarly, it’s wholly imaginable that arsenic this rhythm moves from the bottommost close quadrant to the bottommost left, currency affluent vigor producers astatine some the nationalist and backstage level commencement scooping up ASICs to deploy successful mentation for the adjacent bull phase.

Source: Alkimiya

Final Note

The biggest hazard inherent to the bitcoin marketplace contiguous remains the anemic players hanging by a thread underneath the surface. The deficiency of meaningful terms volatility successful this $20,000 scope is surely encouraging from the standpoint of buyers and sellers uncovering a impermanent equilibrium. But arsenic the frequence of miner troubles continues to rise, on with the anticipation of much fund-based leverage inactive successful the market, max symptom unequivocally is little for manufacture participants. The brunt of the selling has taken spot with bitcoin present astatine $20,000, but 1 has to question whether the marginal purchaser is of capable size to stem the imaginable selling unit connected the horizon.

We fishy that the unit is opening to ramp up connected the crypto lenders that did past the summertime contagion, owed to the expanding headwinds definite miners are facing successful this environment.

3 years ago

3 years ago

English (US)

English (US)