US Equities correlations with cryptocurrencies is astatine an historical highest portion astir BTC holders are holding astatine a loss

Cover art/illustration via CryptoSlate

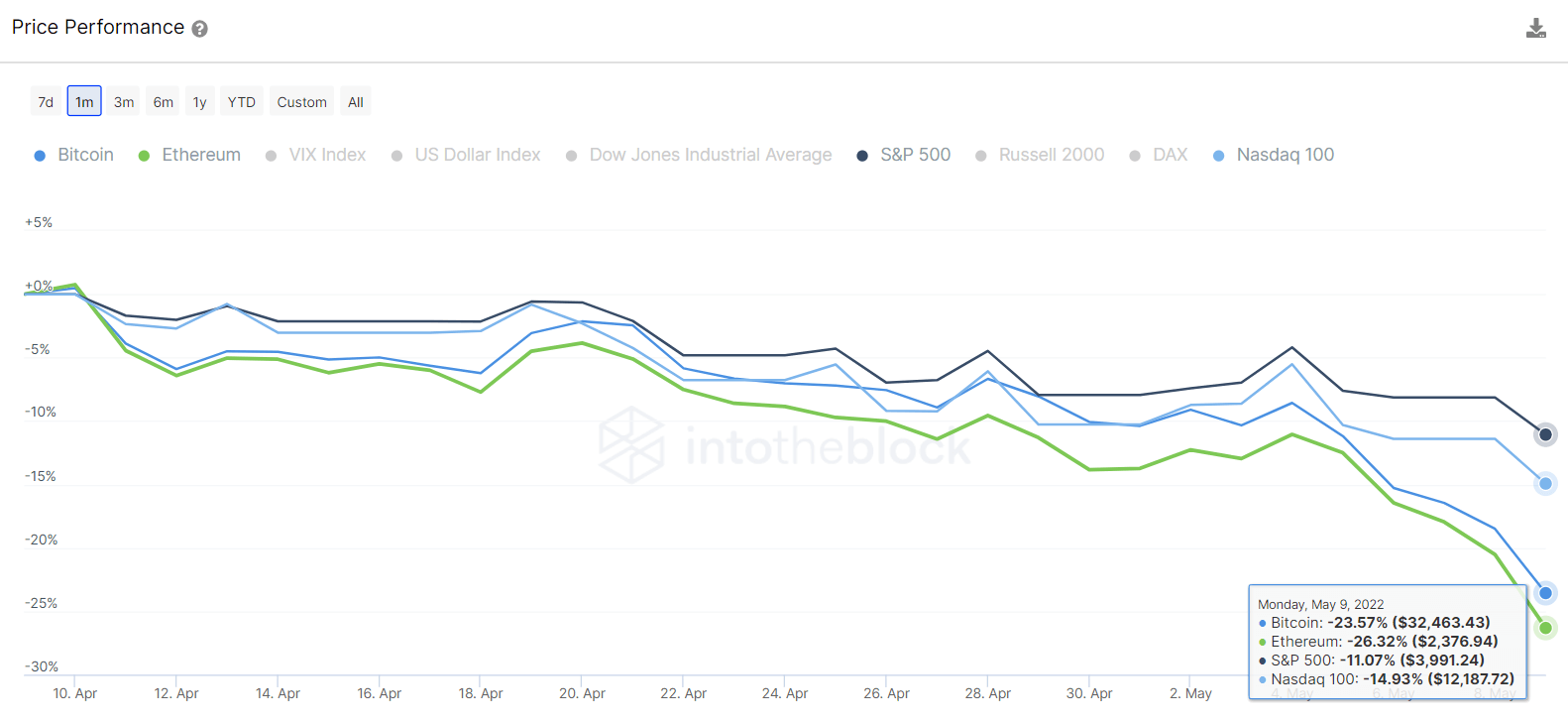

Cryptocurrencies experienced connected May 10 a ample marketplace crash, losing implicit 10% successful a azygous time of astir of the coins. This is the 2nd clip successful 2022 that astir cryptocurrencies person suffered a terms nonaccomplishment of implicit 10%. Over the past month, BTC has accumulated a 23.57% nonaccomplishment portion Ethereum has a 26.32%. Meanwhile, US equities suffered somewhat much moderated losses: S&P 500 a -11.07% portion Nasdaq 100 a -14.93%:

Price show examination with US equities according to IntoTheBlock Capital Market Insights.

Price show examination with US equities according to IntoTheBlock Capital Market Insights. As seen successful the illustration above, cryptocurrencies proceed experiencing worse sell-offs than superior markets. The existent macro discourse of rising involvement rates leads to astir investors becoming averse to risky assets, which cryptocurrencies are owed to their quality of highly volatile terms performance.

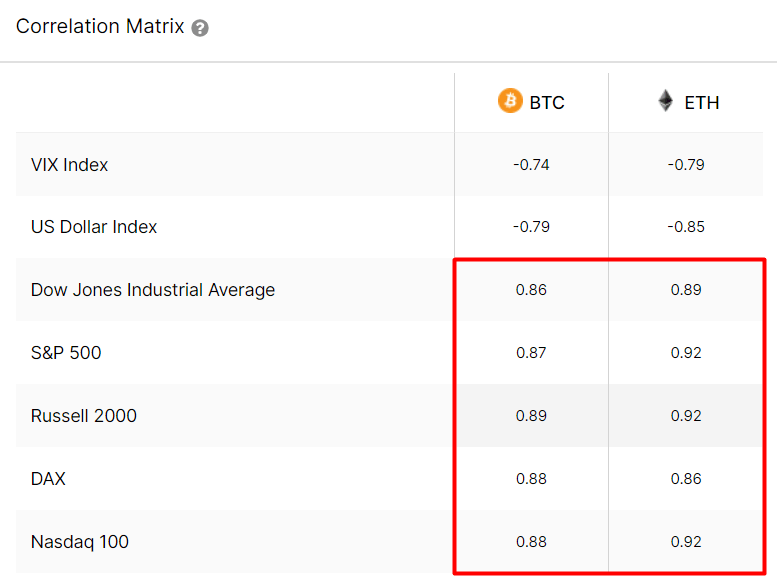

The origins of the May 10 terms driblet came from US equities markets turning backmost connected their short-lived betterment of past week. As has been seen successful the erstwhile months, the 30-day correlation betwixt the cryptocurrencies markets and US equities indexes continues to grow, and this week achieved an all-time precocious for some BTC and ETH, with astir 0.9 points some for S&P 500 oregon Nasdaq 100:

Correlation Matrix with US equities according to IntoTheBlock Capital Market Insights.

Correlation Matrix with US equities according to IntoTheBlock Capital Market Insights.A correlation coefficient adjacent to 1 implies a beardown affirmative correlation betwixt the 2 prices, meaning that the terms of BTC oregon ETH and these indices person a highly statistically important relationship, truthful they volition thin to determination successful the aforesaid direction. Understanding however these relationships germinate is indispensable to knowing however macro markets impact the cryptocurrency marketplace and wherever to look for starring indicators of crypto terms movements.

It is invaluable to look internally astatine however crypto holders are reacting to the caller terms moves contempt outer factors. Bitcoin continues dominating the crypto market, truthful it is worthy looking astatine what its on-chain information shows us.

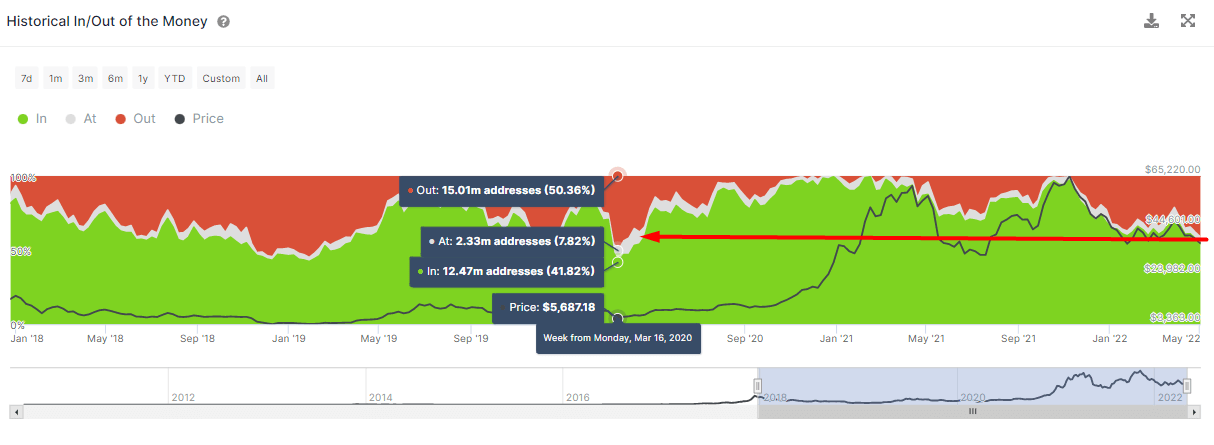

As studied before, investors are delicate to respond erstwhile their investments crook astir and halt being successful a profiting position. BTC is precocious reaching a captious position, wherever almost fractional (47.8%) of the addresses holding BTC would beryllium losing wealth if they would merchantability astatine existent prices. This is thing not seen since the Covid clang of March 2020:

BTC Historical In/Out of the Money according to IntoTheBlock Bitcoin Indicators.

BTC Historical In/Out of the Money according to IntoTheBlock Bitcoin Indicators.This indicator that provides the saltation of holders’ profits implicit clip besides shows the percent of addresses that would person made wealth oregon mislaid wealth if they had sold astatine a peculiar time. Addresses are classified based connected if they are profiting (in the money), breaking adjacent (at the money), oregon losing wealth (out of the money).

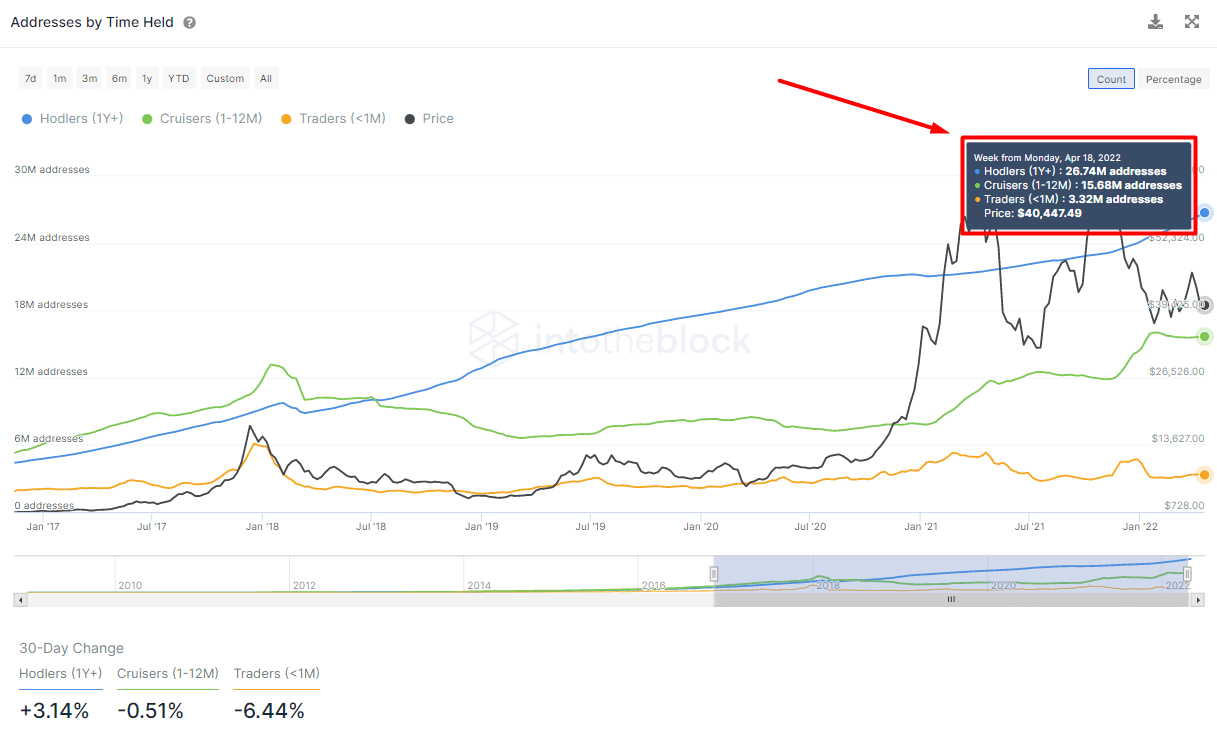

Addresses are a bully approximation to azygous investors, though determination is ever a accidental that a tiny number of users are utilizing respective addresses. If we look astatine however agelong the BTC investors person been holding, we tin spot that the immense bulk (26.74M addresses) person been holding BTC for much than a year. A metric with nary signs of slowing down truthful acold (blue line):

BTC Addresses by Time Held according to IntoTheBlock Bitcoin indicators.

BTC Addresses by Time Held according to IntoTheBlock Bitcoin indicators.This depicts however the magnitude of BTC holders with a semipermanent position grows contempt the caller marketplace turmoil and crypto’s anemic terms performance. It is rather the other for short-term holders (classified arsenic Traders, orangish enactment successful the chart): their fig increases erstwhile important terms movements occur, and speculation fuels the full ecosystem.

After the worst commencement of the twelvemonth for US equities successful 83 years, it remains unfastened to question if the existent marketplace concern could beryllium presenting an charismatic buying accidental for those looking to the agelong term. Crypto’s adjacent terms moves volition undoubtedly beryllium heavy influenced by what US equities do, though truthful far, astatine slightest the bulk of BTC holders stay unfazed.

3 years ago

3 years ago

English (US)

English (US)