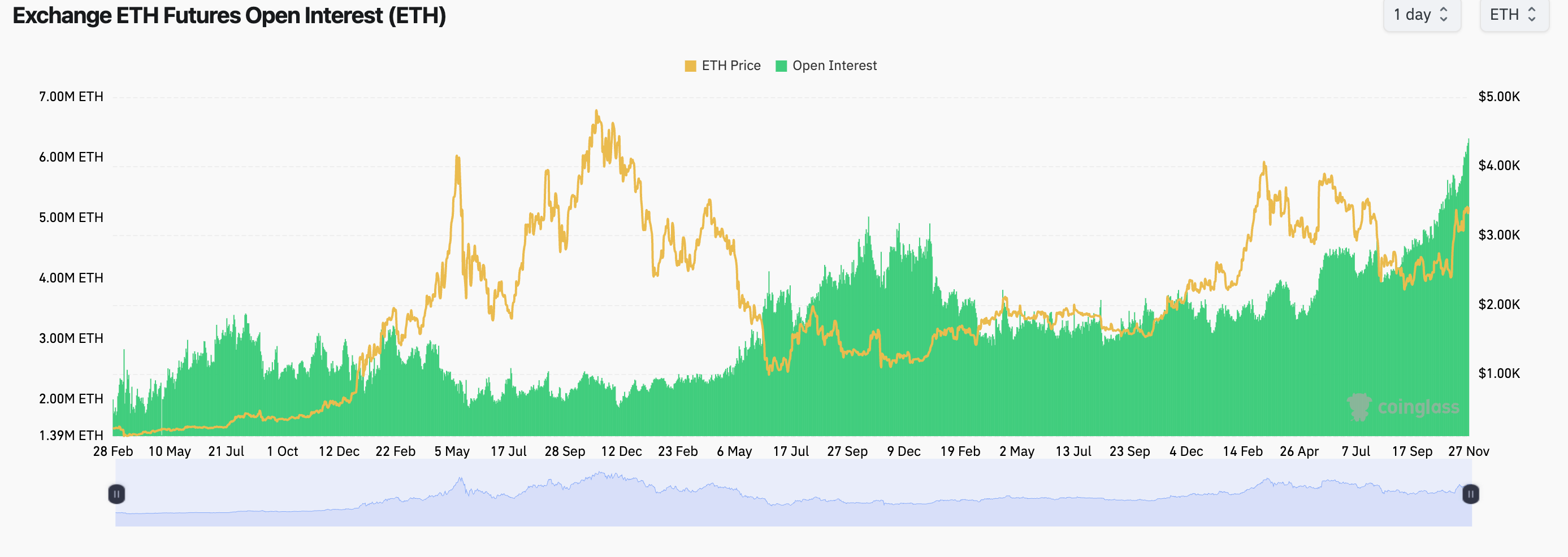

The overwhelming chatter connected societal media, particularly Crypto Twitter is that Ethereum’s ether (ETH) is dead, a narrowly moving token. Still, the marketplace is betting connected higher ETH prices arsenic traders heap into derivatives tied to the cryptocurrency alongside a roar successful Ethereum's blob usage. Cumulative unfastened involvement successful perpetual and modular futures contracts has surged to a grounds 6.32 cardinal ETH, worthy implicit $27 billion, registering a 17% month-to-date gain, according to information root CoinGlass. An uptick successful unfastened involvement alongside a terms is said to validate an uptrend, and ether's terms has surged 35% to $3,400 this month, matching the manufacture leader's bitcoin's terms gain. According to information root Velo, the spread betwixt three-month ETH futures and spot prices, the alleged premium, has expanded to an annualized 16% connected offshore exchanges Binance, OKX and Deribit. Meanwhile, the front-month premium connected the Chicago Mercantile Exchange has risen to 14%.

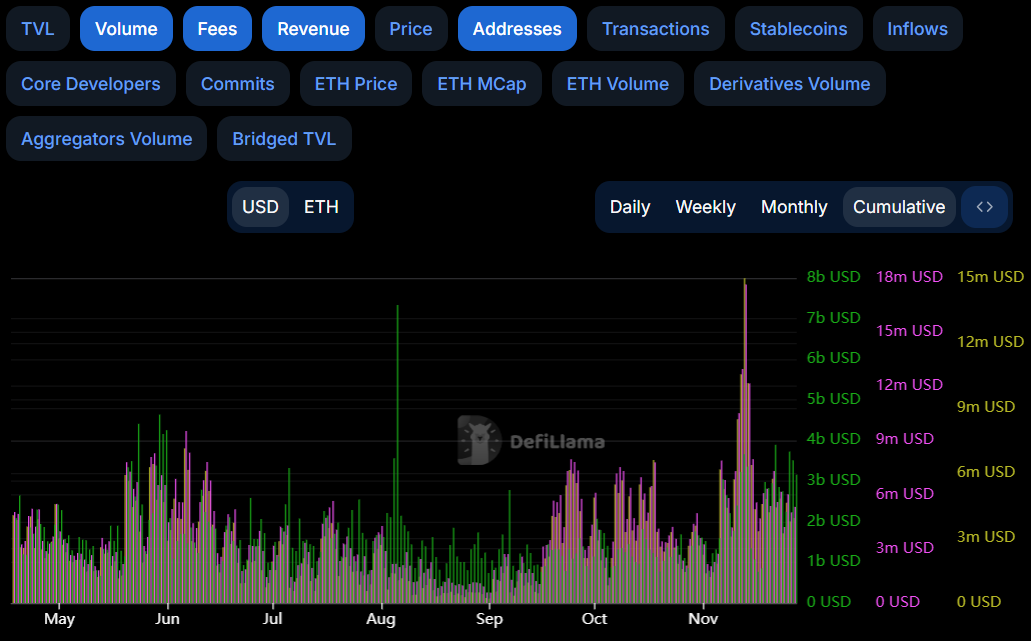

That's noteworthy due to the fact that an elevated premium could make greater involvement successful currency and transportation trades utilized to seizure the terms differential betwixt the 2 markets, starring to accrued inflows into the U.S.-listed spot ETH ETFs. The strategy comprises a agelong presumption successful the spot ETF with a simultaneous abbreviated successful the CME futures. Activity successful the ether options marketplace listed connected Deribit is besides picking up, with implicit 2 cardinal contracts progressive oregon unfastened astatine property time, the highest since precocious June. In notional terms, the unfastened involvement stands astatine $7.33 billion, according to Deribit Metrics. The terms uptick has further driven up the worth of assets locked connected Ethereum-based applications to $65 cardinal arsenic of Wednesday, a fig past seen successful May 2022. A large chunk of those, however, are held connected 3 applications. Liquid staking protocol Lido holds implicit $32 cardinal successful locked ether, Aave, a lending protocol, holds $26 cardinal successful assorted assets, and restaking level EigenLayer holds $14 billion. Data shows a bump successful revenue, fees, caller wallets and on-chain volumes connected Ethereum, with the past period showing elevated levels of enactment compared to the play from May to September. (The metrics are nary wherever adjacent to an year-to-date highest seen successful March, erstwhile involvement astir ETH ETFs was astatine a high.) The Solana web and its applications proceed to predominate DeFi activity, however, owed to its broader retail entreaty and inexpensive fees.

Stablecoin data further shows that Ethereum has much USDT hosted than Tron, with $60.3 cardinal connected Ethereum compared to $57.94 cardinal connected Tron, for the archetypal clip since June 2022. Among sentiment factors, president-elect Donald Trump’s triumph has brought backmost hopes of a decentralized concern (DeFi) bull market, astatine slightest among immoderate investors, and with it request for ETH. The run indicated a determination toward reducing the regulatory load connected crypto, perchance making it easier for DeFi platforms to run wrong the U.S — a committedness that has spurred growth successful ETH and large DeFi tokens since aboriginal November.

1 year ago

1 year ago

English (US)

English (US)