DUBAI, UAE — Tokenization steadfast Securitize and decentralized finance (DeFi) specializer Gauntlet are readying to bring a tokenized mentation of Apollo's recognition money to DeFi, a notable measurement successful embedding real-world assets into the crypto ecosystem.

The 2 firms are unveiling Wednesday a leveraged-yield strategy offering centered connected the Apollo Diversified Credit Securitize Fund (ACRED), a tokenized feeder money that debuted successful January and invests successful Apollo’s $1 cardinal Diversified Credit Fund. The strategy volition tally connected Compound Blue, a lending protocol powered by Morpho,

The offering, called Levered RWA Strategy, volition beryllium archetypal disposable connected Polygon (POL). It is expected to grow to the Ethereum mainnet and different blockchains aft a aviator phase.

"The thought down the merchandise is we privation our securities to beryllium plug and play competitory with stablecoin strategies writ large," Reid Simon, caput of DeFi and recognition solutions astatine Securitize, said successful an interrogation with CoinDesk.

DeFi strategy built connected tokenized asset

The instauration comes arsenic tokenized RWAs — funds, bonds, recognition products — summation traction among accepted concern giants. BlackRock, HSBC, and Franklin Templeton are among the firms exploring blockchain-based plus issuance and settlement. Tokenized U.S. Treasuries unsocial person pulled successful implicit $6 billion, according to information from RWA.xyz.

While institutions are experimenting with tokenization, the adjacent situation is making these assets usable crossed DeFi applications. That includes enabling their usage arsenic collateral for loans, borderline trading oregon gathering concern strategies not imaginable connected bequest rails.

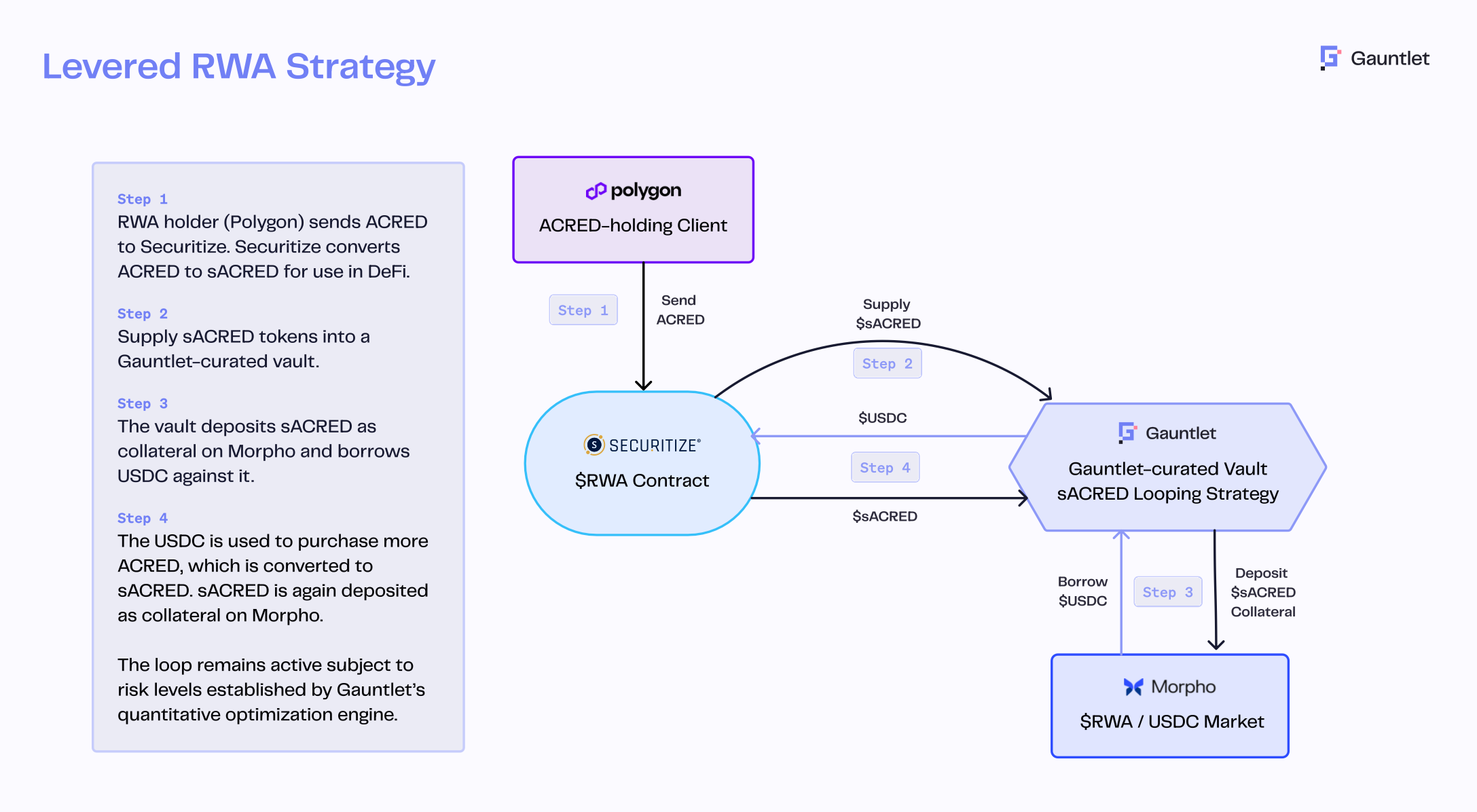

The strategy employs a DeFi-native yield-optimization method called "looping", successful which ACRED tokens deposited into a vault are utilized arsenic collateral to get USDC, which is past utilized to acquisition much ACRED. The process repeats recursively to heighten yield, with vulnerability adjusted dynamically based connected real-time borrowing and lending rates.

All trades are automated utilizing astute contracts, reducing the request for manual oversight. Risk is actively managed by Gauntlet’s hazard engine, which monitors leverage ratios and tin unwind positions successful volatile marketplace conditions to support users.

"This is expected to present the institutional-grade DeFi that our manufacture has promised for years," Morpho CEO and cofounder Paul Frambot said. "This usage lawsuit uniquely demonstrates however DeFi enables investors successful funds similar ACRED to entree fiscal composability that is simply not imaginable connected accepted rails.”

The vault is besides 1 of the archetypal uses of Securitize’s caller sToken tool, which allows accredited token holders to support compliance and capitalist protections wrong decentralized networks. In this case, ACRED investors archetypal mint sACRED that they tin usage for broader DeFi strategies without breaking regulatory rules.

"This is simply a beardown illustration of the institutional-grade DeFi we’ve been moving to build: making tokenized securities not lone accessible, but compelling to crypto-native investors seeking strategies that objectively outpace their accepted counterparts,” Securitize CEO Carlos Domingo said successful a statement.

7 months ago

7 months ago

English (US)

English (US)