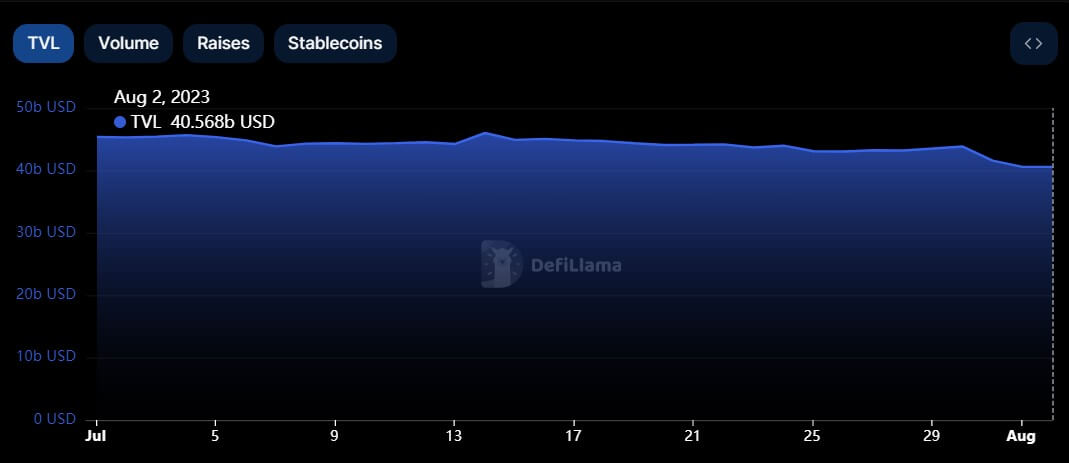

In the past 3 days, the DeFi assemblage has seen an 8% diminution successful the full worth of locked assets (TVL), falling to $40.31 billion, arsenic per DeFiLlama data.

As of July 30, DeFi projects TVL stood astatine $43.81 cardinal but witnessed a crisp diminution aft malicious players attacked respective Curve (CRV) pools connected July 31. Following the attack, crypto investors began withdrawing their assets, totaling implicit $3 billion, crossed antithetic protocols arsenic contagion fears emerged.

Source: DeFiLlama

Source: DeFiLlamaCurve and Convex predominate losses

According to DeFiLlama data, 2 DeFi protocols—Curve Finance and Convex Finance—account for astir two-thirds of the drop, with their TVLs falling by much than $1 cardinal each during the past 3 days.

Curve and Convex, 2 of the astir salient DeFi protocols successful the crypto market, person a important relationship, fixed that Convex enables users to pat into liquidity and make net from Curve’s stablecoin pools.

At their peak, the protocols had a combined TVL of much than $40 cardinal arsenic they attracted millions of users to the sector.

Meanwhile, the diminution was not restricted to these 2 protocols arsenic others, including UniSwap (UNI), Aave (AAVE), and others, besides saw losses pursuing the incident. However, DeFiLlama information shows these platforms person posted mild recoveries from the autumn during the past 24 hours.

Lenders are pulling liquidity

The TVL diminution tin besides beryllium attributed to lenders pulling their liquidity from DeFi platforms arsenic the uncertainty successful the manufacture continues to spread.

As an contiguous effect to “mitigate contagion risks,” Auxo DAO, a decentralized yield-farming fund, announced it had “promptly removed” each its presumption connected Curve and Convex.

Besides that, Curve Finance laminitis Michael Egorov has astir $100 cardinal in loans connected antithetic DeFi platforms backed by 427.5 cardinal CRV (47% of full CRV supply), prompting fears of atrocious indebtedness should CRV’s terms driblet beneath a definite threshold.

According to crypto probe institution Delphi Digital, the size of Egorov’s presumption could perchance trigger knock-on effects crossed a large portion of the DeFi ecosystem.

DeFi platforms similar Aave person already experienced significant withdrawals due to the fact that of these fears. The level is seeing a surge successful borrowing fees and involvement rates, intensifying the liquidation hazard for users with outstanding loans.

Meanwhile, Egorov has sold CRV to investors and institutions via OTC deals to wage disconnected the indebtedness and forestall liquidation.

The station Total worth locked crossed DeFi protocols down much than $3B since Curve Finance attack appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)