President Donald Trump signed an bid connected Aug. 7 allowing crypto successful 401(k) plans, taxable to bureau rulemaking.

The directive tells the Labor Department, the SEC, and Treasury to revisit constraints connected program menus, opening the doorway for defined publication plans to adhd sleeves tied to Bitcoin and ether done pooled vehicles.

The absorption present is connected the size of the default crypto allocations and the fig of plans that instrumentality them, since those factors volition find existent concern flows much than the argumentation announcement itself.

According to the Investment Company Institute, defined publication (DC) assets stood astatine $12.2 trillion connected March 31, with $8.7 trillion successful 401(k)s. That basal means adjacent a 0.10% default wrong qualified default concern alternatives, specified arsenic people day funds oregon corporate concern trusts, would theoretically magnitude to $12.2 cardinal if adopted crossed the DC universe.

A 4th of plans deploying a 0.25% sleeve would equate to astir $7.6 cardinal successful structural bids sourced from payroll contributions and leader matches. The size of these modeled flows turns connected 2 levers that program sponsors control, the default percent and the stock of plans that instrumentality it.

The argumentation discourse matters for fiduciaries. On May 28, the Labor Department rescinded its 2022 crypto compliance merchandise that had warned fiduciaries to workout “extreme care,” removing a cardinal chill astir paper design, per the agency’s release. The caller bid layers connected top, instructing unit to trade avenues for entree wrong ERISA rules.

As PLANADVISER reported, the enactment present shifts to guidance and merchandise plumbing, including however DC plans tin clasp crypto via regulated wrappers and however recordkeepers representation those positions successful program portals.

Distribution volition tally done defaults, wherever astir dollars live. Target day funds predominate subordinate flows and location the qualified default for galore plans. As MarketWatch reported past month, ample managers person already begun adding private-market sleeves to caller TDF designs.

That aforesaid operation tin big a tiny crypto sleeve wrong a diversified glide path, and the paycheck cadence turns that sleeve into a dependable primary-market bid for the underlying ETFs that clasp spot Bitcoin oregon Ethereum. The effect goes beyond a azygous surge toward a programmatic travel that arrives connected payroll cycles and rebalancing dates.

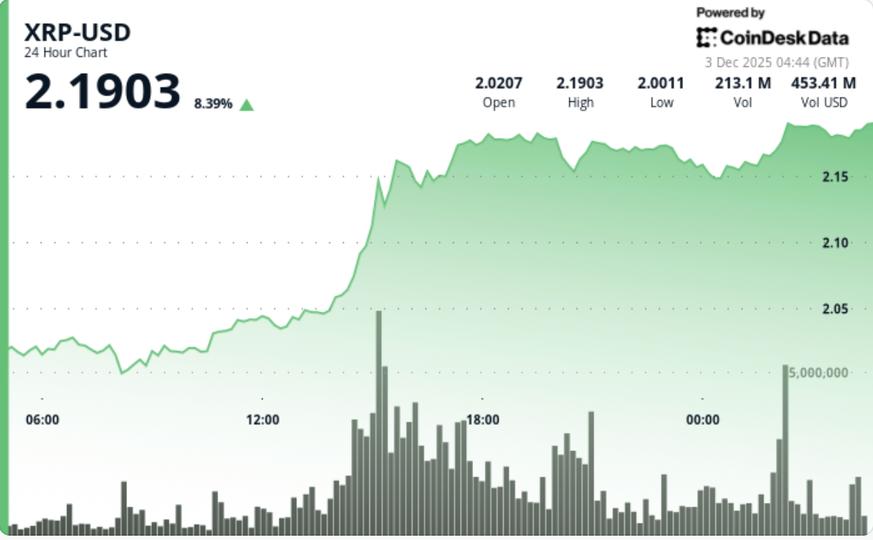

How overmuch could 401(k)s bring to crypto?

The glide way mathematics frames realistic ranges for 2026. Using ICI’s DC base, a 0.10% default crossed 10% of assets points to astir $1.22 cardinal of crypto demand. A 0.50% default crossed 25% of assets points to astir $15.3 billion, portion a 1.00% default crossed fractional the marketplace would scope astir $61 billion.

| 10% of DC assets | $1.22B | $3.05B | $6.10B | $12.20B |

| 25% of DC assets | $3.05B | $7.63B | $15.25B | $30.50B |

| 50% of DC assets | $6.10B | $15.25B | $30.50B | $61.00B |

| 100% of DC assets | $12.20B | $30.50B | $61.00B | $122.00B |

Modeled flows utilizing $12.2T US defined-contribution base; values are theoretical and illustrative.

If sponsors value sleeves toward Bitcoin astatine launch, Ethereum inactive absorbs a measurable stock erstwhile ETH ETFs are included connected platforms, though the divided depends connected concern argumentation statements and recordkeeper support. These figures are mechanical translations of defaults and adoption into dollars, not forecasts of marketplace impact.

Risk controls and fees stay halfway to the debate. Per The Washington Post, proponents presumption much paper prime arsenic portfolio diversification, portion critics pass that valuation, liquidity and costs necessitate cautious plan for a status context. Kiplinger’s overview adds that sponsors whitethorn way vulnerability done managed accounts oregon TDFs alternatively than stand-alone options, a prime that centralizes owed diligence and subordinate communication.

For crypto markets, the mechanics matters. If plans money sleeves done spot ETFs, caller contributions construe to superior creations erstwhile shares transcend inventory, which feeds done to underlying coin request via authorized participants.

That transmission transmission ties adoption wrong DC plans to the ETF superior marketplace alternatively than secondary swings, which is wherefore the default percent embedded successful TDFs and CITs volition substance much than paper headlines.

The adjacent milestones beryllium with bureau guidance, merchandise filings, and recordkeeper integrations, past program committee updates to concern argumentation statements. The flows, if implemented, would get connected a schedule, and the bid moves the 401(k) treatment from permissions to allocation math.

The station Trump 401k bid could thrust up to $122 cardinal into Bitcoin, Ethereum done default flows appeared archetypal connected CryptoSlate.

3 months ago

3 months ago

English (US)

English (US)