The two-year day of the archetypal of 3 coronavirus economical interaction payments (aka, stimulus “stimmy” checks) deposited successful U.S. taxpayers’ slope accounts came and went connected April 11, and headlines astir monetary inflation, imaginable economical recession and mostly grim fiscal tailwinds are everywhere.

The ethos of Bitcoin stands diametrically opposed to the perceived reckless spending and wealth printing that characterized the past 2 years, specifically with Bitcoin miners tasked with issuing caller units of bitcoin astatine predetermined, unmalleable intervals. So, astatine this point, possibly it’s due to look backmost connected the returns that individuals who received stimulus checks would person enjoyed if they invested their dollars into bitcoin mining and the alternate fiscal satellite it supports.

Bitcoin’s Stimulus Check Narrative

Before parsing mining-specific data, it’s adjuvant to retrieve however rapidly the communicative that supported investing stimulus wealth successful bitcoin exploded crossed each societal media channels earlier the archetypal checks were signed oregon mailed. So ample was the enactment for this meme that aggregate polls were later conducted to quantify precisely however galore Americans really exchanged their escaped fiat wealth for bitcoin oregon different cryptocurrencies.

Coinbase, the largest U.S.-based bitcoin exchange by volume, fueled the caller bitcoin by sharing information that showed a surge successful stimulus-check-sized bitcoin bargain orders connected its level arsenic checks were being mailed.

Bitcoin’s capped and predictable proviso acted arsenic the cleanable foil for the inflationary, unpredictable monetary argumentation being created successful existent clip arsenic a effect to the coronavirus situation. The aforesaid period that the archetypal checks were mailed, a Twitter account was created that tracked the dollar worth of the archetypal stimulus cheque ($1,200) if it was invested wholly into bitcoin. The relationship inactive tweets updates today.

But beyond bitcoin itself, what returns would stimulus cheque recipients person received if they spent their escaped wealth connected mining stocks?

Mining Stock Price Performance

Dumping the stimulus dollars sent by the U.S. Treasury into bitcoin mining stocks would person returned a reasonably handsome nett implicit the past 2 years. Through 2020 and 2021, Americans received 3 rounds of stimulus checks in April 2020, December 2020 and March 2021 that totaled $3,200.

The biggest question is, of course: What mining stocks to buy?

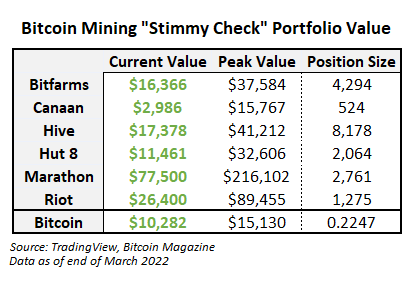

In the array below, highest and existent values of what could beryllium called a “stimulus cheque portfolio” are compared based connected investments successful 1 of a fewer starring nationalist bitcoin mining companies (i.e., Bitfarms, Canaan, Hive, Hut 8, Marathon oregon Riot). At their peak, immoderate of these investments was worthy implicit $15,000, with a mates successful oregon adjacent six digits. But the stimulus portfolio’s existent values are down on with bitcoin itself.

Peak and existent “stimulus cheque portfolio” values vs. investments successful starring nationalist bitcoin mining companies

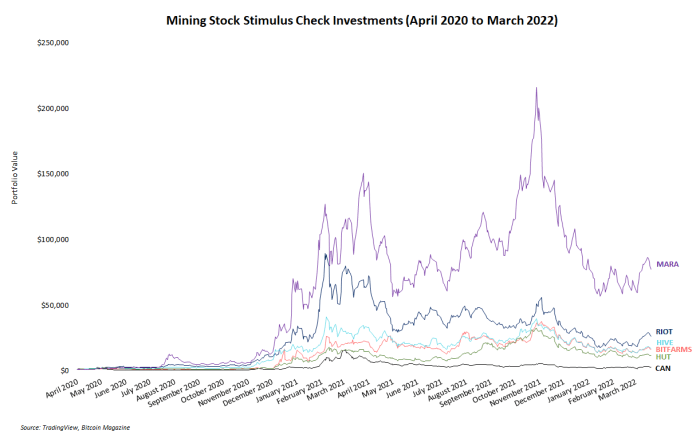

Perhaps immoderate stimulus-check investors would person invested successful a handbasket of mining stocks, alternatively of conscionable one. But for simplicity’s sake, this nonfiction lone considers investments successful 1 of a fewer starring stocks. The enactment illustration beneath visualizes the clip bid information for the issuance of each of 3 checks and the fluctuations successful worth for each of the companies included successful the array supra from April 2020 to the clip of this writing.

Issuance of each stimulus cheque to U.S. taxpayers vs. worth of nationalist bitcoin mining companies

Even though astir of these investments are sitting beneath their highs, their stimulus-check-funded investors sat connected triple- and quadruple-digit percent returns astatine antithetic periods implicit the past 2 years. And to date, these investors are inactive heavy successful the achromatic connected these orangish coin stocks. Overall, not bad.

Why Mining Stocks?

Instead of conscionable buying bitcoin, immoderate investors similar to besides ain mining stocks to get adjacent much vulnerability to the bitcoin marketplace and perchance outperform bitcoin itself. Mining stocks person a beardown positive correlation to bitcoin’s terms movement, which means erstwhile bitcoin and different apical cryptocurrencies are successful bullish trends, it’s not astonishing to spot marketplace tailwinds boost prices for shares of nationalist mining companies. And erstwhile bitcoin drops, mining stocks autumn too.

But mining stocks are mostly considered arsenic a leveraged play connected bitcoin, truthful erstwhile bitcoin goes up oregon down, mining stock prices travel the aforesaid absorption but with larger moves of their own. So, if a peculiar bitcoin capitalist is exuberantly bullish, buying mining stocks with the hopes of outperforming bitcoin itself is simply a tenable strategy.

Besides utilizing mining stocks to speculate connected bitcoin, these investments besides connection casual vulnerability to the mining industry. Mining is simply a precise capital-intensive activity, and overmuch of the industry’s processes and frameworks person yet to afloat mature and beryllium standardized. Bitcoin bulls who privation vulnerability to this manufacture without the headaches of sourcing machines, gathering a mining tract oregon maintaining the cognition often opt to simply bargain shares of mining companies.

Similarly, mining stocks besides connection strongly-principled bitcoin investors an accidental to diversify their portfolios and perchance outperform their superior concern (BTC) without allocating superior to alternate cryptocurrencies. Without derailing this nonfiction with the authorities of altcoins, the superior extremity of astir progressive bitcoin investors is to find a mode to outperform the terms of BTC. Most altcoins characteristically bash outperform bitcoin successful dollar-denominated returns, but galore bitcoin holders cull altcoin investments connected principle, if thing else. Mining stocks are bitcoin-centric investments that tin outperform bitcoin successful bullish marketplace cycles without compromising the ideals of immoderate bitcoin holders.

In short, wherever the terms of bitcoin volition spell adjacent isn’t ever clear. But immoderate absorption it takes, mining stocks volition astir surely follow.

If You Invested Your Stimulus In Bitcoin Mining Stocks, You Aren’t Disappointed

For galore Americans, the stimulus funds were spent connected things arguably overmuch much important than bitcoin mining stocks (e.g., rent payments, inferior bills, groceries, exigency savings). But for different recipients who weren’t importantly affected by the economical turmoil pursuing coronavirus effect measures, the information visualized successful this nonfiction shows the escaped wealth was an accidental to put successful indispensable infrastructure supporting the Bitcoin network. And the short-term returns connected these investments were not disappointing.

This is simply a impermanent station by Zack Voell. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)