Quick summary:

- According to CoinShares, integer plus concern products saw grounds play inflows of $274 cardinal past week

- Bitcoin besides saw $299 cardinal successful inflows successful the past week

- Institutions saw the caller crypto marketplace meltdown caused by USTs depegging arsenic a buying opportunity

The crypto marketplace meltdown of past week catalyzed by the depegging of TerraUSD (UST) and the ostentation of LUNA that soon followed was viewed by organization investors arsenic a buying opportunity.

According to a report by the squad astatine CoinShares, the sell-off resulted successful integer plus concern products seeing grounds play inflows for this year, hitting $274 cardinal past week. The study reiterated that organization investors saw ‘the caller UST unchangeable coin de-peg and its associated wide sell-off arsenic a buying opportunity.’

Furthermore, Bitcoin was the large benefactor of the turmoil seeing inflows of $299 cardinal successful the aforesaid clip period. The study concluded that the purchasing of Bitcoin hinted that ‘investors were flocking to the comparative information of the largest integer asset.’

Bitcoin Has Been Relatively Stable successful the Last Week

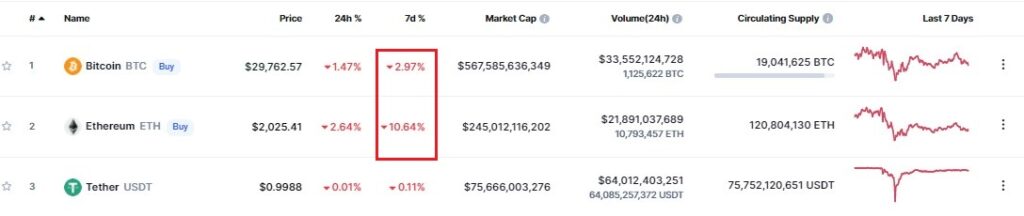

With respect to stability, Bitcoin has been comparatively unchangeable successful the past 7 days, experiencing a 2.97% driblet successful worth compared to Ethereum, which has seen a 10.64% decrement successful terms successful the aforesaid period.

Bitcoin’s 7-day stableness compared to Ethereum. Source, Coinmarketcap.com

Bitcoin’s 7-day stableness compared to Ethereum. Source, Coinmarketcap.comA Retest of $28k is Probable for Bitcoin, truthful is simply a Move Back to $32k

The 4-hour BTC/USDT illustration beneath further confirms Bitcoin’s stableness successful the past week arsenic it ranges betwixt the section debased of $26,700 and the $32k absorption level. Also, from the chart, it tin beryllium observed that Bitcoin’s adjacent determination is somewhat unclear arsenic its MFI and RSI are successful the neutral territory of 50 and 48, respectively.

Bitcoin’s MACD connected the 4-hour illustration is exhibiting immoderate signs of weakness, with its histograms confirming a simplification successful buying activity. Consequently, Bitcoin could retest the $28k enactment level if buyers bash not measurement up to the plate.

At the aforesaid time, Bitcoin is attempting to recapture the 4-hour 50 moving mean (white) arsenic enactment that could unfastened the doors to a propulsion towards $32k.

Therefore, a wait-and-see attack mightiness beryllium the champion people of enactment for the adjacent 24 oregon 48 hours, fixed the mixed signals being exhibited by Bitcoin connected the 4-hour chart.

[Feature representation courtesy of Unsplash.com]

3 years ago

3 years ago

English (US)

English (US)