While the crypto system shed billions this week, the full worth locked (TVL) successful decentralized concern protocols slipped nether the $200 cardinal scope to $196.6 billion. The TVL successful defi mislaid astir 3.16% during the past day, and the $592 cardinal successful astute declaration protocol tokens dropped successful worth by 3.5% implicit the past 24 hours.

Defi TVL Slips Below $200 Billion, Numerous Protocols Shed Billions, Dex Trade Volume Dives

The worth locked successful defi has slipped nether the $200 cardinal people for the archetypal clip since March 16, 2022. At the clip of penning the full worth locked (TVL) is astir $196.6 billion, down 3.16% during the past 24 hours.

All 10 of the apical defi protocols, but for Anchor, person seen important 30-day TVL percent declines. Curve Finance is down 11.74%, Lido has mislaid 13.73%, Makerdao shed 16.81%, and Convex Finance has mislaid 10.59% since past month.

The biggest loser during the past 30 days is the Aave Protocol which mislaid 21.98% since past month. Curve Finance is the starring defi protocol arsenic it dominates by 9.56% with today’s TVL of astir $18.8 billion.

Data recorded connected May 1, 2022, indicates the existent full worth locked successful defi protocols is $196.6 billion, according to defillama.com statistics.

Data recorded connected May 1, 2022, indicates the existent full worth locked successful defi protocols is $196.6 billion, according to defillama.com statistics.The TVL held connected Ethereum-based defi protocols inactive rules the roost contiguous with 55.55% dominance oregon $109.21 cardinal today. Terra blockchain is the 2nd largest successful presumption of defi TVL with 14.36% of the $196.6 billion. Terra’s TVL contiguous equates to $28.23 cardinal and $16.48 cardinal resides successful Anchor.

Behind Ethereum and Terra, successful presumption of defi TVL size, includes blockchains specified arsenic BSC ($12.04B), Avalanche ($9.38B), and Solana ($6.09B).

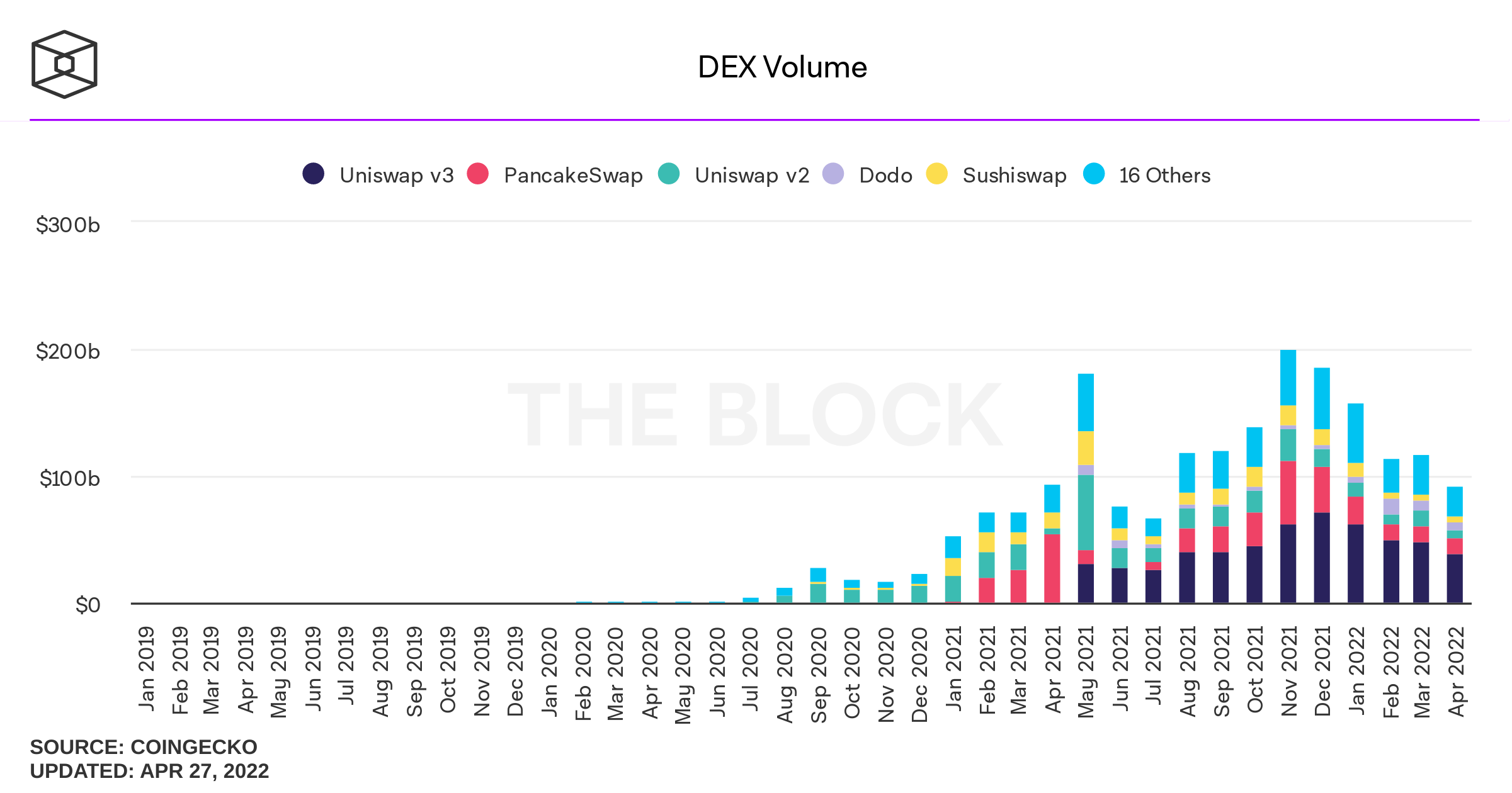

April’s decentralized speech (dex) commercialized measurement dropped 21% little than successful March.

April’s decentralized speech (dex) commercialized measurement dropped 21% little than successful March.The apical 5 defi protocols, successful presumption of defi TVL size, includes Curve, Lido, Anchor, Makerdao, and Convex Finance. Terra’s Anchor Protocol saw a 30 time TVL summation of astir 4.15% past month.

Aave mentation 3 (v3) saw a important summation during the past 30 days contempt the archetypal shedding 21.98%. Aave v3 has a TVL contiguous of astir $1.38 billion, up 2,711% since past month.

Statistics amusement that connected Saturday, May 1, 2022, there’s 428 decentralized speech (dex) platforms with a combined TVL of astir $61.44 billion. There’s besides 142 defi lending protocols with $48.87 cardinal full worth locked.

Data further shows that dex commercialized measurement dropped during the period of April. In March dex measurement was astir $117 cardinal and statistic amusement that April’s dex commercialized measurement was lone astir $92.18 billion.

Tags successful this story

30-day dex commercialized volume, Aave, Aave v3, Anchor, Binance Smart Chain, Curve, decentralized finance, decentralized concern protocols, DeFi, Defi metrics, defi records, defi stats, dex commercialized volume, ether, Ethereum, Ethereum (ETH), Lido, makerdao, Market Dominance, Smart Contract, smart declaration level coin, Solana, Terra, TVL

What bash you deliberation astir the worth locked successful defi slipping beneath the $200 cardinal scope this week? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)