Three months agone the crypto system was worthy much than $3 trillion and since then, integer currency prices person slid a large woody successful value, arsenic crypto assets person been sold and distributed crossed galore hands. Over the past decade, fluctuating terms cycles person made it truthful immoderate addresses, typically referred to arsenic crypto whales, person been capable to accumulate immense quantities of coins. Moreover, a fewer crypto projects person besides seen whales accumulate a bulk of a token’s circulating proviso via the archetypal organisation process.

The Top 8 Crypto Assets by Concentration of Large Holders

The taxable of whales is simply a fashionable 1 successful the satellite of cryptocurrencies, arsenic the entities person ever been a unit to beryllium reckoned with. Whales are ample crypto plus holders who ain much tokens than the mean person, and they are called whales due to the fact that their elephantine holdings tin determination markets, overmuch similar whales successful the water that tin shingle up boats and origin monolithic waves.

After much than a decennary of radical launching thousands of alternate crypto assets, years of integer currency trading, and the ever-changing terms cycles, whale concentrations person changed implicit the years. The pursuing is simply a look astatine the existent attraction of ample holders and crypto whales passim the crypto economy’s apical integer assets by marketplace valuation. The attraction of ample holders database and its onchain information deduce from coincarp.com and intotheblock.com statistics.

Bitcoin (BTC) Concentration of Large Holders

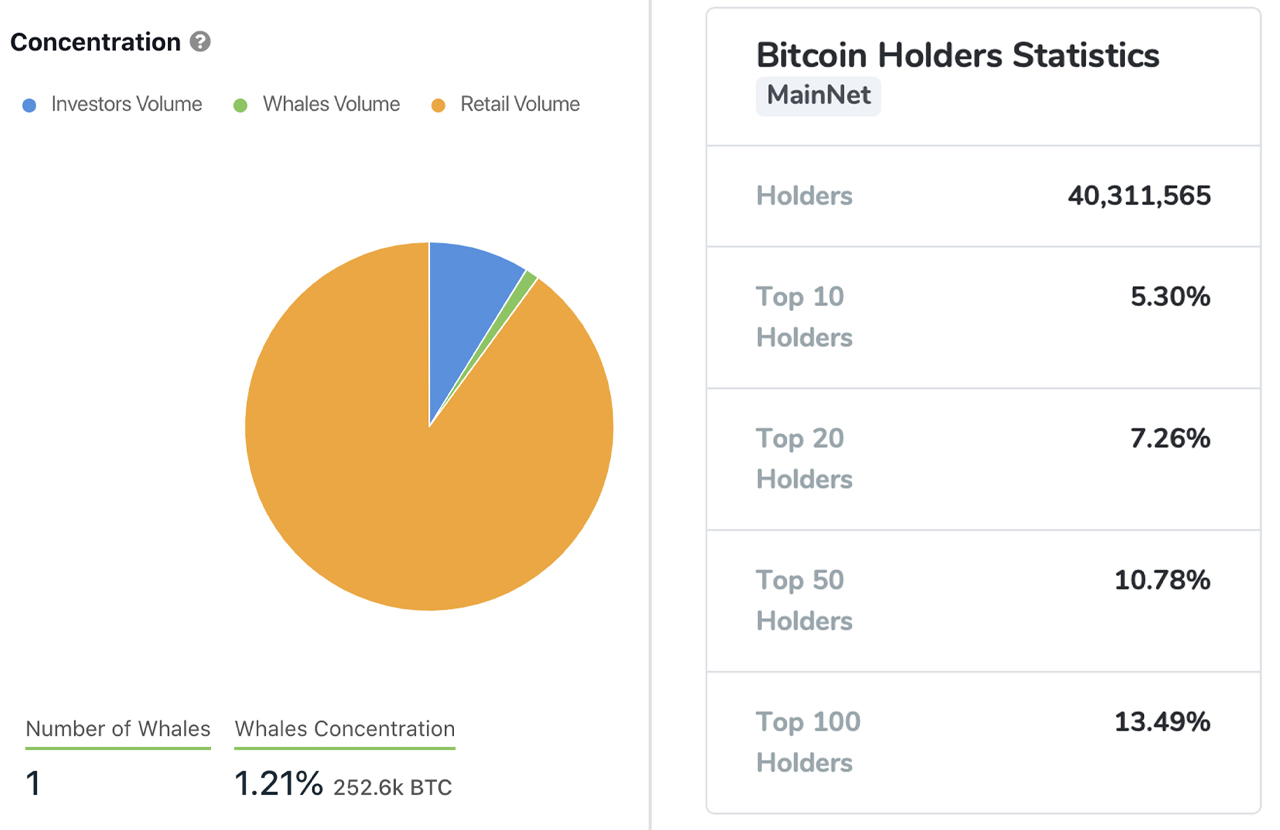

The starring crypto plus bitcoin (BTC) is the oldest integer currency successful the satellite based connected blockchain technology, and it is assumed that BTC had a precise just organisation process. It is besides assumed that Satoshi Nakamoto whitethorn ain astir 750,000 to 1 cardinal BTC, which beryllium successful addresses holding unspent artifact rewards. This means Satoshi’s stash is dispersed retired and the inventor’s attraction of ownership is not casual to find. Intotheblock.com metrics shows BTC’s attraction of ample holders contiguous is 10%.

Bitcoin (BTC) attraction of ample holders via Intotheblock.com stats connected January 28, 2022 (pictured left). Bitcoin holder stats via Coincarp.com metrics connected January 28, 2022 (pictured right).

Bitcoin (BTC) attraction of ample holders via Intotheblock.com stats connected January 28, 2022 (pictured left). Bitcoin holder stats via Coincarp.com metrics connected January 28, 2022 (pictured right).Intotheblock.com leverages the “total holdings of whales (addresses that ain much than 1% of the circulating supply) and Investors (addresses that ain betwixt 0.1% and 1% of the circulating supply).” Coincarp.com data connected January 28, 2022, indicates that the apical 10 bitcoin addresses clasp 5.30% of the existent BTC proviso successful circulation. The apical 20 largest BTC holders ain 7.26% of the supply, and the apical 50 bitcoin addresses ain 10.78%. Onchain metrics further bespeak that determination are 40,301,661 bitcoin holders today.

Ethereum (ETH) Concentration of Large Holders

Ethereum metrics are antithetic arsenic Intotheblock.com stats amusement attraction by ample holders is 42%, which is overmuch higher than BTC’s attraction of whales. Coincarp.com data shows that there’s 185,912,265 ethereum holders and ETH’s apical 10 addresses clasp 23.39% of the existent supply. The apical 20 ether holders person 27.06% of the proviso and the apical 50 ain 33.02%. Regarding the apical 100 wallet addresses by ether balance, these clasp 39.58% of the existent ETH supply.

Binance Coin (BNB) Concentration of Large Holders

Binance coin’s (BNB) attraction of ample holders information is not disposable connected Intotheblock.com. Coincarp.com metrics, however, bespeak that the apical 10 BNB addresses person 88.23% of the supply. Onchain stats further amusement determination are 321,134 BNB holders today. The apical 3 BNB addresses are operated by Binance’s speech platform, arsenic the richest BNB holder is an speech wallet with 52.02% of the BNB supply. The second-richest BNB wallet operated by Binance holds 27.14%, portion 3.55% of the proviso is besides held by the third-largest code owned by the trading platform. BNB metrics bespeak that much than 82% of the BNB proviso is held by Binance operated wallets.

Cardano (ADA) Concentration of Large Holders

According to stats, determination are 325,604 cardano (ADA) holders connected January 28, 2022. Intotheblock.com metrics amusement that ADA’s attraction by ample holders information contiguous is 17%. Data shows that the apical 10 addresses clasp 4.36% of the ADA supply, portion the apical 20 ain 5.86% of the supply. The fig 1 richest ADA wallet presently possesses 1.37% of the ADA supply. 100 ADA holders clasp 16.76% of the 34,186,794,009 ADA successful circulation today.

Xrp (XRP) Concentration of Large Holders

While XRP’s Intotheblock.com metrics are null, Coincarp.com data shows that the apical 10 holders ain 78.02% of the XRP supply. The apical 5 XRP wallets are operated by exchanges, arsenic the richest wallet operated by Binance holds 26.91% of the XRP supply. The apical 20 XRP wallets clasp 80.93% of the supply, and the apical 100 addresses presently person 85.99% of the XRP successful circulation today, which is presently astir 47,736,918,345 tokens.

Solana (SOL) Concentration of Large Holders

Statistics amusement that there’s a existent proviso of 314,967,774 SOL successful circulation. The apical 10 addresses clasp 10.11% of the SOL supply today, portion the largest holder owns 1.58% of the SOL successful circulation. The apical 20 SOL wallets person 15.77%, the apical 50 clasp 26.82%, and the apical 100 solana (SOL) wallets clasp 34.64% of each the SOL successful existence. The fig of wallets that clasp a fraction of SOL oregon much contiguous is 8,383,421 holders.

Usually, Concentrations of Crypto Whales Grow Larger

Data shows that the apical 8 coins by marketplace valuation contiguous person antithetic concentrations of ample holders known arsenic whales. Stablecoins besides person a attraction of ample holders and the apical 10 tether (USDT) ERC20 wallets clasp 26.79% of the existent supply. The apical 10 usd coin (USDC) wallets presently clasp 36.22% of the supply. 10.64% of the USDC proviso is held by Maker dao portion Binance holds 5.62% of each the ERC20-based tethers.

Digital currency proponents don’t similar ample concentrations of whale holders arsenic they could dump their coins connected the marketplace to marque radical panic sell. It is good known that astatine times ample holders of immoderate fiscal plus tin collude and dump hoards of assets connected the unfastened marketplace to marque the terms driblet lower. While initially scaring the market, successful the extremity whales marque disconnected aft a dump due to the fact that they simply bargain backmost erstwhile the panic selling drops prices lower. Traditionally, due to the fact that of the attraction of ample holder levels and illiquid markets, crypto whales turn overmuch larger aft carnivore marketplace cycles.

Tags successful this story

ada, addresses, Bitcoin Rich List, Bitcoin Whales, bnb, BTC, BTC Whales, Cardano, Coincarp.com, Concentration of Large Holders, Crypto Whales, downward organisation cycle, ETH, Funds, individuals, intotheblock.com, Rich Lists, SOL, Solana Whales, Traders, USDC, USDT, Wallet Rich Lists, Whale Crypto, whale entities, Whale Watch, Whales, XRP

What bash you deliberation astir the apical 8 coins and the attraction of ample holders? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)