Recent analytical insights from FireCharts 2.0 are indicating important maneuvers by large stakeholders of Bitcoin—often referred to arsenic “whales”—which are impacting the cryptocurrency’s terms movements. These stakeholders are altering liquidity patterns successful a mode that suggests a strategical propulsion towards a much tightly controlled trading range.

What Bitcoin Whales Are Up To

According to Material Indicators, an precocious trading analytics, determination has been a noticeable accommodation successful the organisation of liquidity wrong Bitcoin’s bid book. Specifically, determination is simply a alteration successful inquire liquidity astatine higher terms points, coupled with an summation successful bid liquidity starting from $60,000 to $67,000. This dynamic is acceptable to compress Bitcoin’s terms into a narrower range, a script anticipated by the level since the integer plus escalated supra $52,000.

The discussions astir Bitcoin’s terms trajectory person been rife with speculation astir a imaginable pump to $73,000, particularly pursuing its bounce from a debased of $52,000. Despite a recent precocious adjacent $70,600, which ended successful a crisp rejection, the sentiment remains cautiously optimistic. “There has been a batch of chatter since precocious past week calling for a pump to $73k, and determination are morganatic reasons wherefore that is simply a adjacent word target, and wherefore it is inactive imaginable contempt the rejection from $70.6k we saw connected Monday,” noted Material Indicators.

From a macroeconomic perspective, Bitcoin’s prospects look exceedingly bullish. “The outlook for Bitcoin is virtually arsenic bullish arsenic it’s ever been,” said a typical from Material Indicators during a caller livestream. They refrained from reiterating the specifics, urging viewers to revisit the erstwhile week’s investigation for a deeper understanding.

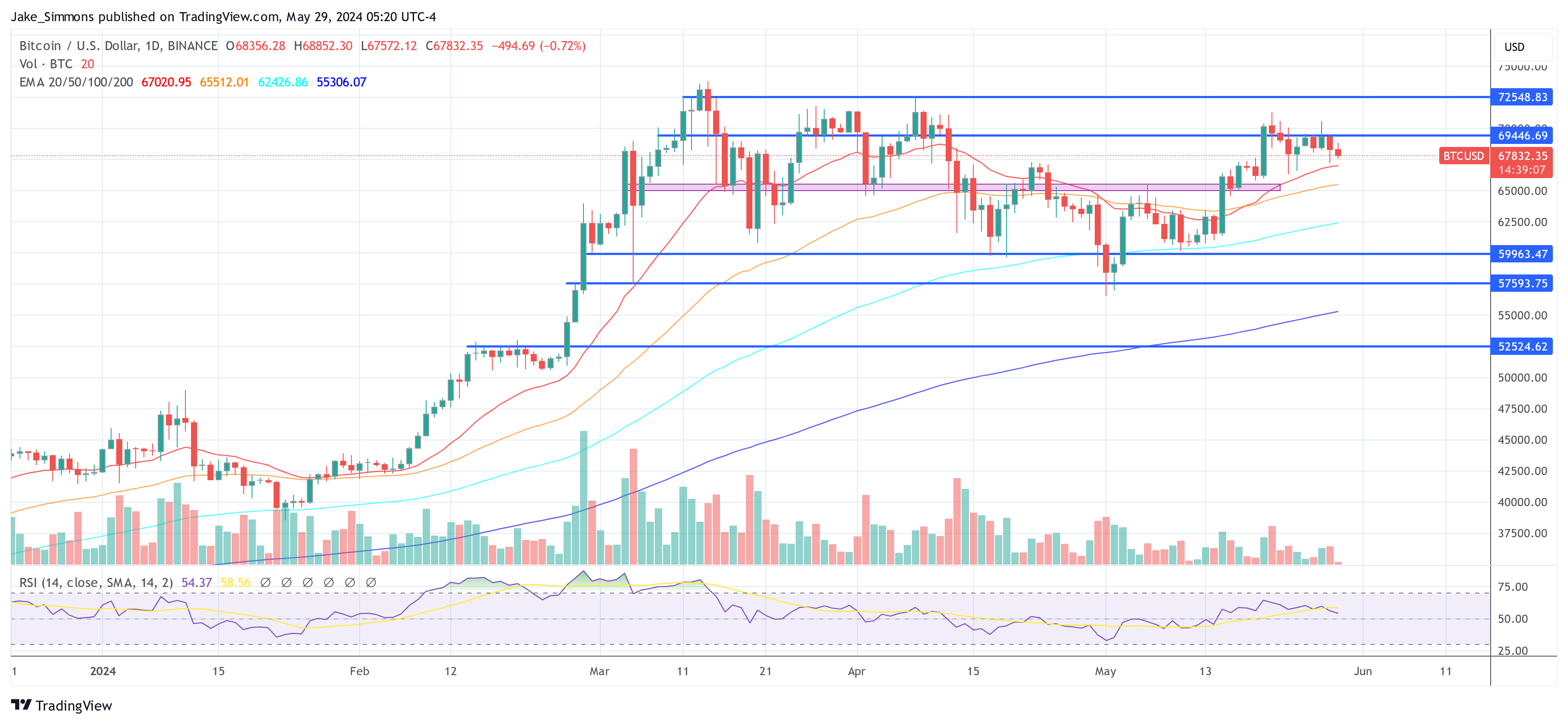

In contrast, the method investigation paints a much nuanced picture. Despite the favorable macro outlook, Bitcoin has continuously failed to corroborate a resistance/support (R/S) flip astatine $69,000—a important level for confirming bullish momentum. This ongoing nonaccomplishment is emblematic of the bulls’ conflict to support upward unit and unafraid a caller all-time precocious (ATH). By integrating bid publication information with method indicators, analysts person observed a progressive downward question successful blocks of inquire liquidity, from archetypal placements astir $75,000-$76,000 to caller figures adjacent $70,000-$71,500.

Looking forward, the pivotal question is: however debased tin Bitcoin realistically spell earlier uncovering important support? To code this, analysts astatine Material Indicators crook to a operation of method investigation and real-time bid publication data. The convergence of Bitcoin’s 21-Day, 50-Day, and 100-Day Moving Averages astir $65,000-$66,000 offers a compelling lawsuit for imaginable support. The 21-Day MA, successful particular, is favored for its humanities reliability arsenic some absorption and support.

Order publication information corroborates this analysis, showing a strengthening of inquire liquidity absorption supra $70,000, portion bid liquidity is strategically placed down to arsenic debased arsenic $58,000. The largest concentrations of bid liquidity bespeak the strongest enactment astatine $60,000 and $65,000, with somewhat lesser enactment astir $66,000 and $67,000.

Despite the analyzable interplay of factors successful the adjacent term, the semipermanent position remains overwhelmingly bullish. The indispensable query for the marketplace is when, not if, a morganatic breakout volition instrumentality place. Observations from the bid publication amusement much than $200 cardinal successful asks stacked from $71,000 to $75,000, juxtaposed with astir $90 cardinal successful bids betwixt $65,000 and $67,000. If inquire liquidity does not bladed out, bid liquidity volition request to fortify importantly to trigger a sustainable interruption into the $70s.

According to Material Indicators, the astir favorable script would spot Bitcoin found a firm consolidation range supra $65,000, validate an R/S Flip astatine $69,000, and stabilize supra this level earlier aiming for a caller ATH. Such a improvement would not lone corroborate the bullish inclination but besides pave the mode for sustained upward momentum based connected the existent bid publication trends and method analyses. This trajectory, they suggest, would supply the healthiest marketplace progression successful airy of the existing conditions.

At property time, BTC traded astatine $67,832.

Bitcoin terms hovers beneath cardinal resistance, 1-day illustration | Source: BTCUSD connected TradingView.com

Bitcoin terms hovers beneath cardinal resistance, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)