Where’d that $3.5 cardinal go?

Unless you’ve been disconnected the grid for the past mates weeks, you apt already cognize that the $3.5 cardinal of bitcoin that was created, successful part, to support and enactment the TerraUSD (UST) stablecoin, which proved to beryllium thing but. However, portion it’s wide that untold billions successful worth and wealthiness were mislaid erstwhile those reserves proved inadequate to forestall a depegging, what nary 1 knows is what happened to those reserves and wherever they are now.

Terra Labs CEO Do Kwon has said via Twitter that documentation regarding the usage of the reserves during the depegging lawsuit would beryllium forthcoming. Where the Bitcoin is held and however it was utilized volition beryllium captious for investors seeking to recoup losses suffered done their vulnerability to UST, according to Tom Robinson, co-founder and main idiosyncratic of Elliptic, a blockchain analytics firm.

While it’s uncertain erstwhile Terra volition merchandise that documentation, Robinson said his steadfast has been pursuing the money: immoderate 80,394 BTC, worthy $3.5 cardinal erstwhile purchased by the Luna Foundation Guard, the non-profit enactment acceptable up to beforehand the maturation of the Terra ecosystem, betwixt January and May this year.

When the worth of UST began to driblet astatine the commencement of past week, LFG announced that it would statesman to dispose of its bitcoin reserves and acquisition UST. On the greeting of May 9, LFG announced that it would “Loan $750M worthy of BTC to OTC trading firms to assistance support the UST peg.” Terra creator Do Kwon aboriginal clarified that the bitcoin would beryllium “used to trade”.

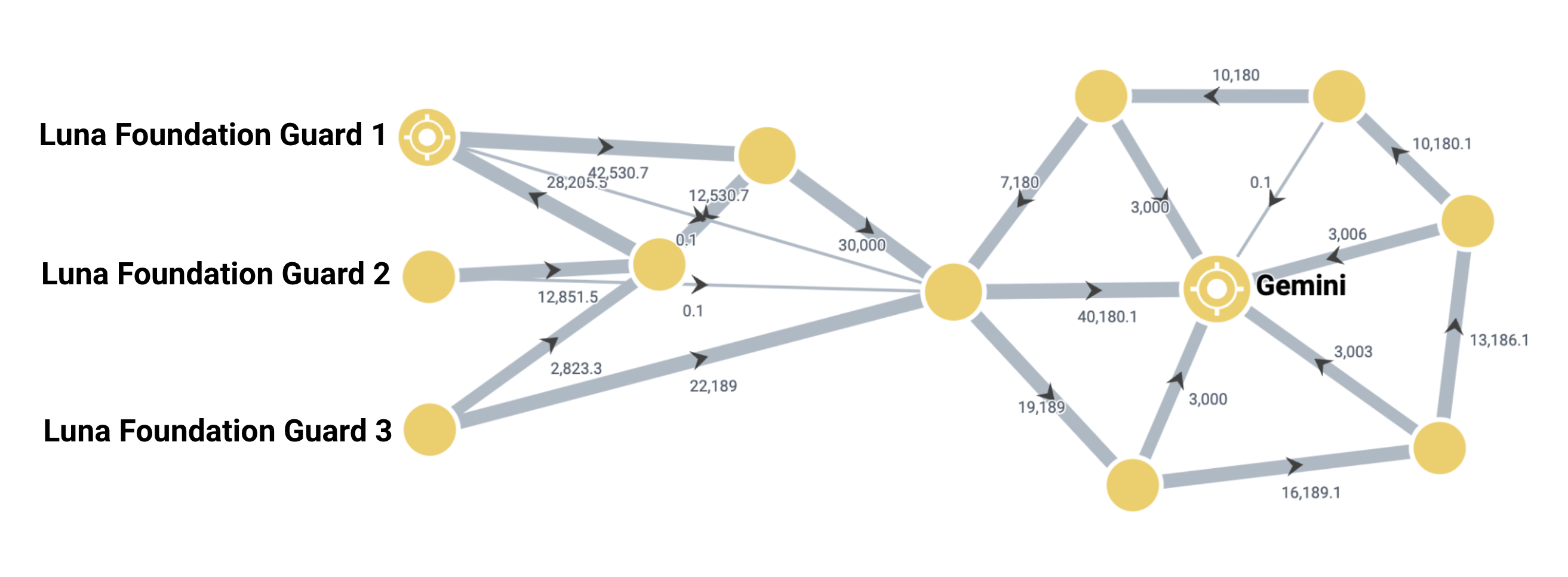

At astir the aforesaid time, 22,189 BTC (worth ~$750 cardinal astatine this time) was sent from a Bitcoin code linked to LFG, to a caller address, Elliptic pointed retired successful a blogpost. Later that evening a further 30,000 BTC (worth ~$930 cardinal astatine the time) was sent from different LFG wallets, to this aforesaid address.

LFG/ Gemini (Elliptic)

Within hours, the entirety of this 52,189 BTC was moved to a azygous relationship astatine U.S. crypto speech Gemini, via respective bitcoin transactions, according to Elliptic.

The intent of having a precise ample reserve of Bitcoin was perchance to acquisition UST to propulsion the terms backmost up toward $1, which is astir apt the crushed it was sent to exchanges, but it’s not imaginable utilizing the blockchain unsocial to place whether it was sold to enactment the UST price, Elliptic’s Robinson said.

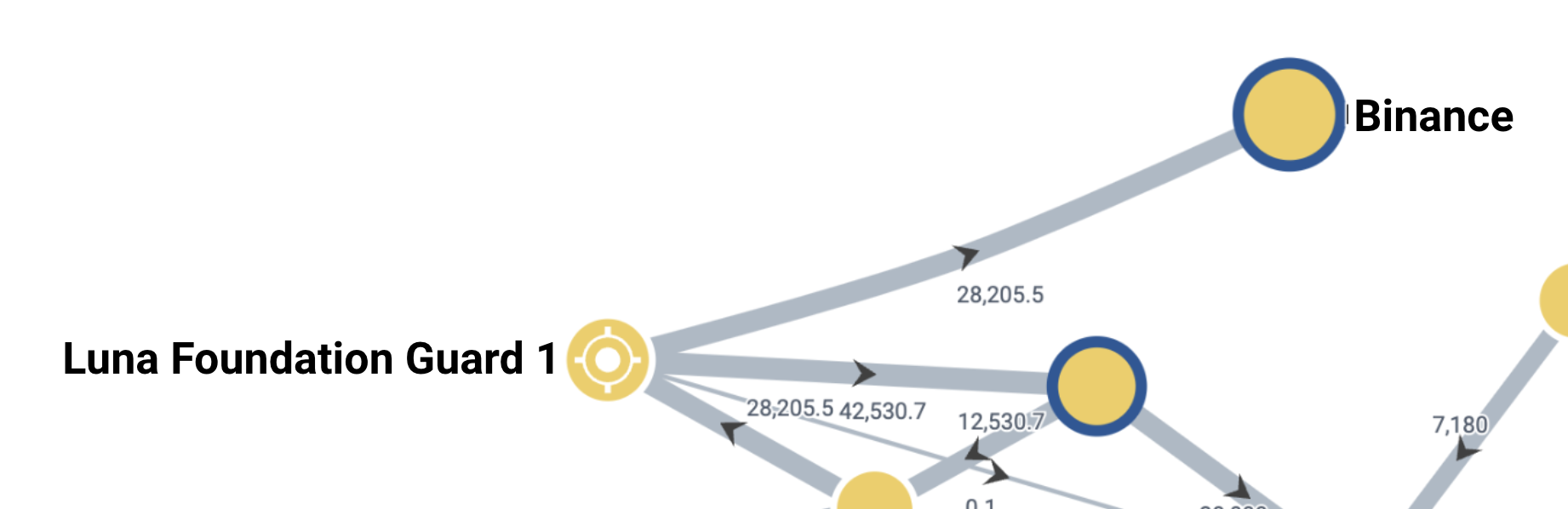

This near 28,205 BTC successful Terra’s reserves. At 1 a.m. UTC connected May 10, those remaining reserves were moved successful their entirety, successful a azygous transaction, to an relationship astatine the cryptocurrency speech Binance. Again it is not imaginable to place whether these assets were sold oregon subsequently moved to different wallets, Robinson said.

LFG/Binance (Elliptic)

“All we tin spot is it going into these exchanges,” Robinson told CoinDesk. “We can’t truly spot however it’s been used. It mightiness person been sold, it mightiness beryllium being stored connected the exchanges, it mightiness person been withdrawn again, and mightiness beryllium an unhosted wallet.”

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for The Node, our regular newsletter bringing you the biggest crypto quality and ideas.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)