Key takeaways

The Fed’s Dec. 9-10 gathering carries antithetic value arsenic markets hold to spot whether different complaint chopped volition get earlier Christmas, shaping bonds, equities and crypto.

After 2 cuts successful 2025, rates present beryllium astatine 3.75%-4.00%. Labor weakness and softer ostentation enactment further easing, but officials stay divided due to the fact that ostentation risks person not afloat cleared.

A cooling occupation market, easing ostentation and the extremity of quantitative tightening could warrant different simplification and align with year-end liquidity needs.

Sticky inflation, gaps successful economical information caused by the authorities shutdown and a divided Fed whitethorn propulsion policymakers to support rates unchanged this December.

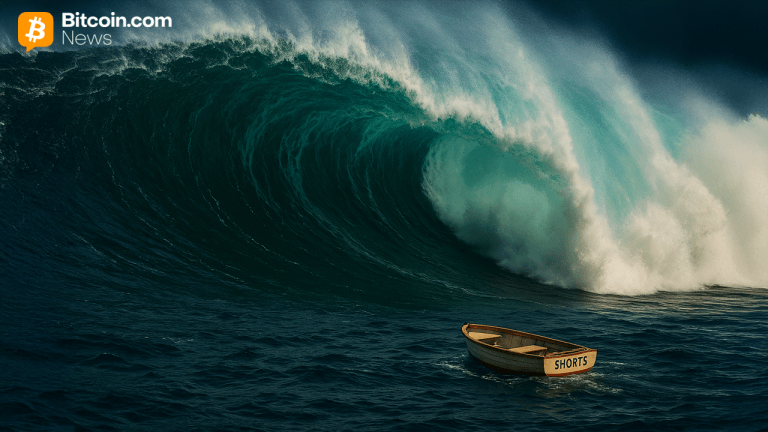

When the US Federal Reserve meets connected Dec. 9-10 to determine connected involvement rates, it volition not beryllium conscionable different regular gathering. Markets are watching intimately to spot what absorption policymakers choose. Will the Fed chopped rates again earlier the holidays? A pre-Christmas Eve simplification could nonstop waves done bonds, stocks, recognition markets and crypto.

This nonfiction explains wherefore the Fed’s pre-Christmas gathering is important and outlines the factors supporting oregon opposing a imaginable complaint cut. It besides highlights what to ticker successful the coming weeks and however a Fed determination could impact crypto and different fiscal markets.

The inheritance of a December complaint cut

Central banks typically chopped rates erstwhile ostentation is easing, economical maturation slows oregon fiscal conditions go excessively tight. In precocious October, the Federal Reserve lowered rates by 25 ground points, mounting the national funds people scope astatine 3.75%-4.00%, its lowest level since 2022. The determination followed different 25-basis-point chopped successful September 2025, making it the Fed’s 2nd complaint simplification of the year.

The determination came amid wide signs of a cooling labour market. October recorded 1 of the worst monthly layoff totals successful much than 2 decades, according to aggregate labor-market reports, reinforcing concerns astir weakening occupation conditions. The Fed’s October connection echoed this trend, noting that risks to employment had accrued adjacent arsenic ostentation remained somewhat elevated.

At a property conference, Fed Chair Jerome Powell stressed that a December chopped is “not a foregone conclusion.” Yet economists astatine Goldman Sachs inactive expect a cut, pointing to wide signs of labour marketplace weakness. Fed officials stay divided, with immoderate emphasizing ostentation risks and the constricted country for further easing.

A December complaint chopped is possible, but it is not guaranteed.

Factors supporting a imaginable complaint cut

There are respective reasons the Fed whitethorn determine to chopped rates:

Cooling labour market: Private assemblage information shows softer hiring, rising layoffs and a flimsy summation successful unemployment.

Moderating inflation: Inflation is inactive supra people but continues to inclination lower, giving the Fed much flexibility to easiness policy.

Ending quantitative tightening: The Fed has announced it volition halt reducing the size of its equilibrium expanse opening Dec. 1.

Pre-holiday timing: A complaint chopped would align with year-end liquidity needs and assistance acceptable expectations for 2026.

Arguments for the Fed to postpone action

Several factors suggest the Fed whitethorn hold a complaint chopped successful the adjacent future:

Sticky inflation: According to the Fed’s latest statement, the ostentation complaint remains “somewhat elevated.”

Data vacuum: The US authorities shutdown has delayed cardinal employment and ostentation reports, making argumentation assessments much difficult.

Committee division: Federal Reserve officials are divided connected the due way forward, which encourages a much cautious approach.

Limited country for easing: After aggregate cuts this year, immoderate analysts reason that argumentation is already adjacent to a neutral level.

Did you know? In March 2020, the Fed chopped involvement rates to adjacent zero to respond to the COVID-19 crisis. It lowered rates by a full of 1.5 percent points crossed its meetings connected March 3 and March 15.

What to show earlier December

These factors are apt to signifier the Fed’s upcoming argumentation determination connected complaint cuts:

Nonfarm payrolls and unemployment: Is the occupation marketplace continuing to slow?

Inflation data: Any unexpected emergence successful ostentation volition trim expectations for argumentation easing.

Financial conditions and marketplace signals: Are recognition spreads widening, and is wide marketplace liquidity tightening?

Fed communications: Differences of sentiment wrong the Federal Open Market Committee (FOMC) whitethorn power the outcome.

External shocks: Trade developments, geopolitical risks oregon abrupt proviso disruptions could displacement the Fed’s approach.

Did you know? US stocks person historically returned astir 11% successful the 12 months aft the Fed begins cutting rates.

How a Federal Reserve chopped whitethorn interaction crypto

Fed complaint cuts summation planetary liquidity and often propulsion investors toward riskier assets similar crypto successful hunt of higher returns. Bitcoin (BTC) and Ether (ETH) thin to payment from stronger hazard appetite and rising organization inflows. Lower decentralized concern (DeFi) borrowing rates besides promote much leverage and trading activity. Stablecoins whitethorn spot greater usage successful payments, though their output vantage narrows erstwhile rates fall.

However, if a complaint chopped is interpreted arsenic a awesome of recession, crypto whitethorn acquisition equity-like volatility. Markets mightiness spot an archetypal boost from easier liquidity, followed by a pullback driven by broader macro concerns. If planetary fiscal conditions loosen instead, the situation could enactment further crypto demand.

Lower borrowing costs marque it easier for radical and institutions to instrumentality concern risks, which tin gully much involvement toward integer assets. As much wealth flows into the sector, crypto companies tin physique amended tools and services, helping the manufacture link much smoothly with the remainder of the fiscal system.

Did you know? When the Fed cuts rates, short-term enslaved yields usually autumn first, creating opportunities for traders who way movements successful the output curve.

Consequences of a Fed complaint chopped connected different fiscal sectors

Here is simply a look astatine the imaginable effects connected large plus classes if the Fed cuts involvement rates:

Bonds and yields: Short-term yields volition apt diminution arsenic markets set their expectations. The output curve whitethorn steepen if semipermanent yields stay stabler than short-term ones, which tin awesome assurance successful aboriginal growth. If the chopped is viewed arsenic a motion of recession risk, semipermanent yields whitethorn autumn arsenic well, resulting successful a flattening oregon adjacent an inversion of the curve.

US dollar and planetary FX: A complaint chopped mostly weakens the dollar due to the fact that involvement complaint differentials narrow. This often supports emerging markets and commodity-exporting countries. If the chopped is driven by concerns astir economical growth, safe-haven request whitethorn temporarily propulsion the dollar higher.

Equities: A pre-Christmas Eve complaint chopped could spark a rally successful US stocks if investors spot it arsenic a motion of assurance successful a brushed landing. A brushed landing refers to cooling ostentation alongside a unchangeable labour market. If the chopped is motivated by maturation worries instead, firm net whitethorn travel nether pressure, and antiaircraft sectors could outperform cyclical ones.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

3 weeks ago

3 weeks ago

English (US)

English (US)