The past mates of weeks person been immoderate of the astir tumultuous successful the past of crypto. As the broader cryptocurrency and equity markets person plunged into carnivore marketplace territory, the terms of ether (ETH) has collapsed to numbers we haven’t seen since 2021. Meanwhile, Terra’s hugely fashionable stablecoin ecosystem collapsed spectacularly, wiping retired implicit $40 cardinal successful worth and sending ripple effects crossed decentralized concern (DeFi).

And arsenic if each this wasn’t enough, 1 of the largest non-fungible token (NFT) collections has precocious go embroiled successful a contention that places its creator astatine the halfway of a racist online cult.

This nonfiction primitively appeared successful Valid Points, CoinDesk’s play newsletter breaking down Ethereum 2.0 and its sweeping interaction connected crypto markets. Subscribe to Valid Points here.

But, hey, it’s not each doom and gloom successful cryptoland. As markets autumn and reputations crater, Ethereum’s assemblage is inactive hard astatine enactment preparing for the Merge – its long-anticipated modulation to a proof-of-stake (PoS) network. After signs the web upgrade would beryllium delayed – yet again – past the summer, Ethereum co-founder Vitalik Buterin said astatine an lawsuit successful Shanghai past week that the Merge whitethorn yet be acceptable successful August.

The PoS Merge has been envisioned arsenic a mode to amended Ethereum information and alteration vigor consumption, each portion mounting the signifier for broader web capableness and interest improvements. But with the caller marketplace downturn comes an important question – volition a bear-market Merge blunt the upgrade’s impact?

A bear-market Merge and capitalist sentiment

First, a speedy caveat: I americium not a markets reporter. While determination are immoderate large journalists astatine CoinDesk and elsewhere who analyse prices and study connected marketplace trends, this newsletter is not going to incorporate immoderate profoundly informed penetration into however the terms of ether mightiness determination arsenic a effect of the Merge.

But I’ll hazard a conjecture anyway. For years, speculators person pointed to the Merge arsenic an lawsuit definite to boost Ethereum's token terms to sky-high levels, possibly adjacent surpassing that of bitcoin (BTC). Why this should hap has ever been vague: It’s hard to constituent to galore ether terms “fundamentals.” While PoS volition alteration immoderate of Ethereum’s tokenomics, ether’s terms – similar that of astir different cryptocurrencies – is chiefly a reflection of wide marketplace sentiment. With this carnivore marketplace seemingly poised to past done to August, marketplace sentiment erstwhile the Merge hits is apt to beryllium a resounding “meh.”

While the nitty-gritty of the Merge has not changed, this caller discourse successful which it volition hap inactive feels relevant. The information that Ethereum has entered a down marketplace volition person important implications for however the upcoming Merge is received by its assemblage and by investors.

Crypto during a carnivore market

Price shouldn’t beryllium the lone absorption of crypto’s caller marketplace downturn, and it’s not excessively hard to foretell what sour marketplace conditions mightiness mean for the crypto manufacture writ large.

With little wealth flowing into crypto (and different speculative plus classes, 1 presumes), less folks volition participate crypto successful hunt of short-term gains. Moreover, 1 expects galore of the investors and developers who entered the abstraction astatine the highs of crypto’s bull marketplace volition fly the abstraction successful hunt of greener, much unchangeable pastures.

I ideate galore of those who find jobs successful crypto successful the coming months (or years) are apt to caput toward bigger-name companies similar Coinbase (COIN) alternatively than comparatively risky DeFi bets and newer blockchains. With VC backing drying up, the nascent projects that bash past volition bash truthful connected relationship of their endowment and exertion alternatively than their quality to garner crypto-crazed valuations and short-term mercenary capital.

Of course, there’s besides a imaginable script wherever scammy NFT projects and Ponzi-esque DeFi protocols proceed to spot involvement from retail investors looking for a speedy subordinate – particularly erstwhile the banal marketplace can’t beryllium relied upon to present precocious returns. While I’m definite determination volition beryllium immoderate degeneracy mixed successful with everything else, it’s hard to ideate big-name investors volition put hundreds of millions of dollars into unproven experiments similar Terra again anytime soon.

Amid each the atrocious news, the past mates of years person been highly affirmative for the cryptocurrency abstraction successful a fig of respects. With VCs frothing astatine the rima to money thing and everything “crypto,” we’ve astir apt seen immoderate solid, albeit risky bets get backing that would person been dismissed successful much blimpish times.

Moreover, adjacent arsenic the NFT marketplace and galore DeFi protocols person been crushed nether the value of the wider marketplace downturn, a roar successful these sectors has introduced a much larger audience to crypto.

A telling, if unoriginal, examination with respect to this play successful crypto could beryllium made to the dot-com roar and bust of the aboriginal millennium. While galore of the companies funded earlier the bubble burst yet came to naught, the archetypal roar inactive paved the mode for overmuch of what emerged successful the years that followed.

As Silicon Valley sage Ben Thompson enactment it successful 1 of his 2021 newsletters:

In the earliest days of the internet, “websites proliferated rapidly, arsenic did dreams astir what this caller exertion mightiness marque possible. This mania led to the dot-com bubble, which, critically, fueled monolithic investments successful telecoms infrastructure. Yes, the companies similar Worldcom, NorthPoint and Global Crossing making these investments went bankrupt, but the instauration had been laid for wide high-speed connectivity.”

After the dot-com bubble burst, eventual Big Tech titans including Google (GOOG), Amazon (AMZN) and eBay (EBAY), which were funded alongside shallower bets similar Pets.com, went into heads-down mode. These companies wouldn’t person succeeded if not for the infrastructure funded during the net era’s archetypal ill-fated backing craze.

Looking toward the Ethereum Merge

In my eyes, this is wherever enactment connected the Ethereum Merge sits. Rain oregon shine, the Merge does look similar it’ll happen. Even if it doesn’t upwind up being a immense boon to ether’s price, it will, if developers are to beryllium believed, person lasting implications for the aboriginal of the network.

The quality that the Merge mightiness beryllium owed successful August came connected the heels of 2 much palmy Ethereum mainnet shadiness forks; 1 connected May 12 and different connected May 20. If you’ve work erstwhile issues of this newsletter, you whitethorn callback that a shadiness fork is similar a trial tally of Ethereum’s modulation to proof-of-stake. Mainnet shadiness forks – which simulate the PoS modulation utilizing the astir intense, real-word conditions – are one of the last steps of testing developers volition request to instrumentality earlier they deem the web acceptable to upgrade. Aside from a mates of precise insignificant hiccups, some of the astir caller forks appeared to spell well.

The Twitter sermon successful the Ethereum developer assemblage these past fewer weeks, portion surely cognizant of wider marketplace conditions, has been beauteous cheery with the quality that the Merge is nearing completion. Ether’s terms mightiness not bespeak this aforesaid level of enthusiasm travel the Merge, but these past fewer weeks person added to a accordant drawstring of reminders that prices are among the slightest absorbing parts of this space.

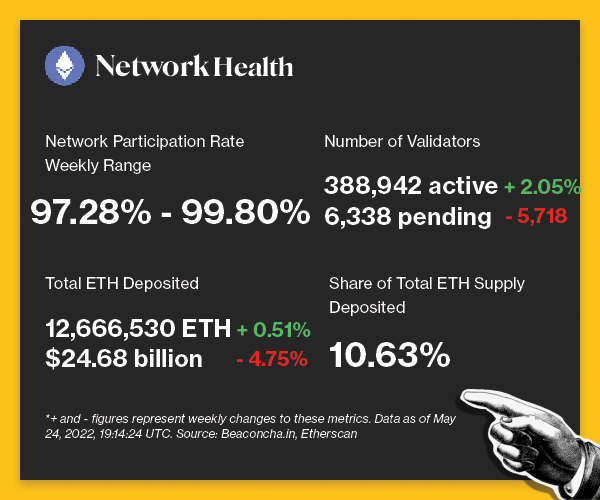

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

(Beaconcha.in, Etherscan)

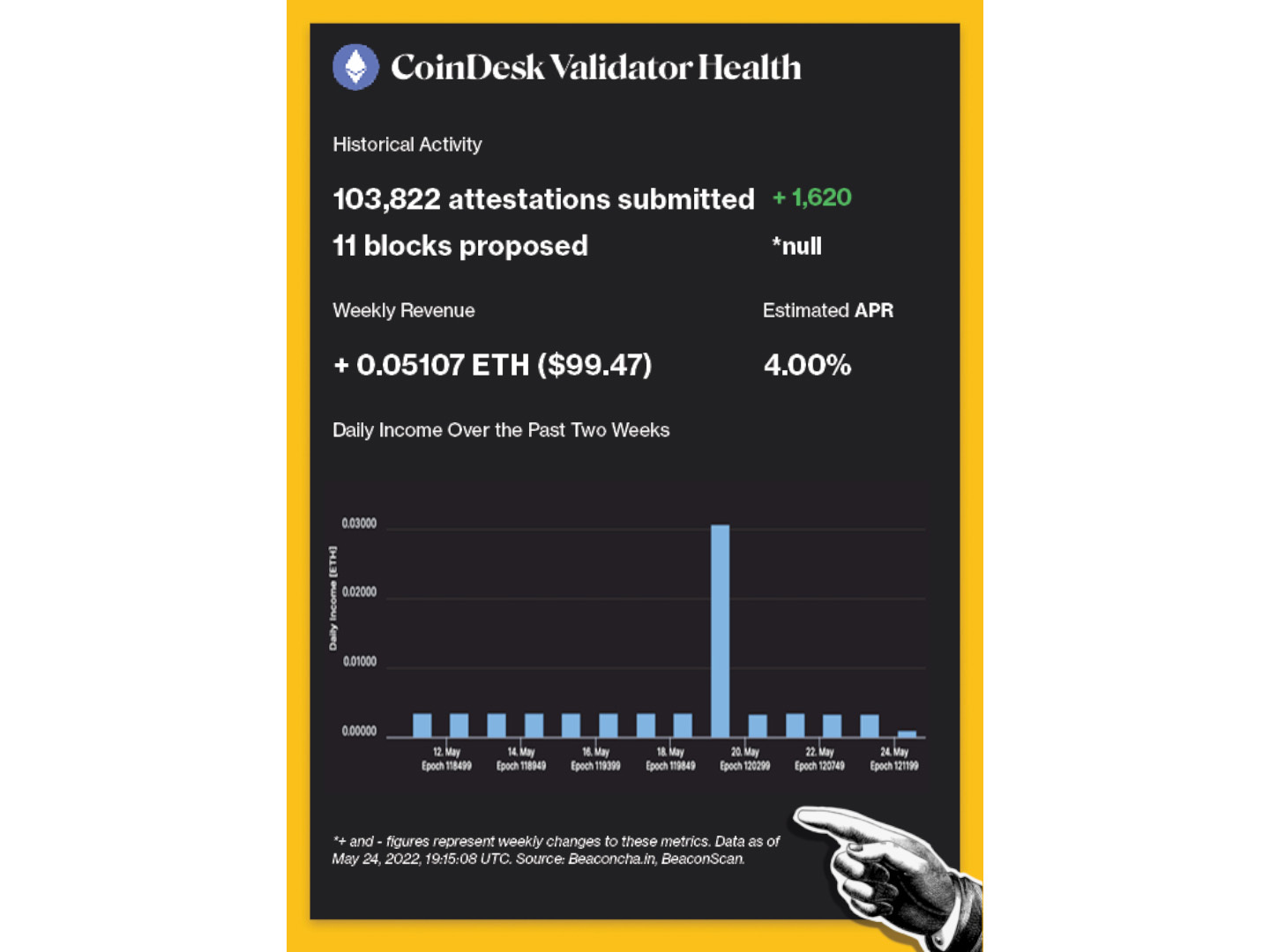

(Beaconcha.in, BeaconScan)

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

Conversations astir digital money person proliferated astatine the World Economic Forum’s yearly gathering successful Davos, Switzerland.

WHY IT MATTERS: Even though the forum’s planetary leaders person not embraced and accepted crypto, they are paying adjacent attraction arsenic the WEF is holding superior discussions astir cryptocurrencies with cardinal players from the industry. Jeremy Allaire, president and CEO astatine Circle Pay, said crypto has reached a caller level of prominence astatine the WEF, and that hopes for adjacent twelvemonth are already high. Read much here.

WHY IT MATTERS: Generating $7.8 cardinal successful 2021, the planetary crypto speech level enters the ranking of the biggest U.S. companies by gross astatine 437th place. COIN’s inclusion marks the archetypal crypto institution to articulation the Fortune 500 list. The quality follows the motorboat of Coinbase Institute, a crypto-native deliberation vessel that volition people probe connected Web 3 and clasp talks with policymakers and thought leaders crossed the industry. Read much here.

Filecoin Foundation and Lockheed Martin (LMT) are exploring hosting blockchain nodes successful outer space.

WHY IT MATTERS: On May 23 astatine Davos, the 2 organizations announced their collaboration successful trying to bring the interplanetary record strategy (IPFS) to space. Marta Belcher, wide counsel and caput of argumentation astatine the Filecoin Foundation, said the thought is to trim latency erstwhile downloading information from distant locations specified arsenic the moon. The existent program is to place a trial ngo by August of this year. Read much here.

Data shows immoderate bitcoin mining activity successful China has resumed.

WHY IT MATTERS: The Cambridge Bitcoin Electricity Consumption Index, which breaks down the geographical determination of bitcoin miners globally, showed that China’s stock of mining jumped from 0.0% successful August 2021 to 22.3% successful September 2021. Cambridge Centre for Alternative Finance said that “reported hash complaint abruptly surged backmost to 30.47 EH/s successful September 202, instantly catapulting China to 2nd spot globally successful presumption of installed mining capacity.” Read much here.

GameStop (GME) has made disposable a beta mentation of its self-custodial Ethereum wallet for users to download.

WHY IT MATTERS: The video crippled retailer is solidifying its footprint successful the crypto abstraction by unveiling a integer plus wallet up of its NFT marketplace motorboat aboriginal this year. Gamers tin nonstop and person in-game assets specified arsenic cryptocurrencies and non-fungible tokens without having to permission their web browser. Shares of GameStop were up 2.67% astatine $98.21 successful premarket trading. Read much here.

Valid Points incorporates accusation and information astir CoinDesk’s ain Ethereum validator successful play analysis. All profits made from this staking task volition beryllium donated to a foundation of our choosing erstwhile transfers are enabled connected the network. For a afloat overview of the project, cheque retired our announcement post.

You tin verify the enactment of the CoinDesk Eth 2.0 validator successful existent clip done our nationalist validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it connected immoderate Eth 2.0 artifact explorer site.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Valid Points, our play newsletter breaking down Ethereum’s improvement and its interaction connected crypto markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)