The information of letting governmental interests power supposedly neutral information and subject is evident erstwhile presumption are made subjective to acceptable the existent narrative.

Watch This Episode On YouTube Or Rumble

Listen To The Episode Here:

“Fed Watch” is simply a macro podcast with a existent and rebellious Bitcoin nature. Each episode, we question mainstream and Bitcoin narratives by examining existent events successful macro from crossed the globe with an accent connected cardinal banks and currencies.

In this episode, I’m joined by Q and Chris Alaimo of the Bitcoin Magazine livestream unit to speech astir the “recession” versus “not a recession” versus “depression” debate. I besides dive into knowing the impermanent effects of fiscal spending by governments and the ceramic partition facing the planetary economy, demonstrated done output curves. We decorativeness up with a Q and Ansel (question and answer) from the guys and community.

You tin find the slide platform for this occurrence here.

Recession Debate

In caller days, galore radical person started to announcement the National Bureau of Economic Research (NBER) has changed the explanation of what constitutes a recession. Outrage astatine the blatant sleight of manus has travel to a fever pitch. Common sentiment is, “How situation they alteration the explanation to prevention the estimation of an unpopular president?”

Few radical recognize that the explanation had already changed backmost successful 2020 with the COVID-19 recession. It was the shortest recession connected record, lone lasting from March to April 2020. The explanation changed to beryllium much subjective successful bid to constrictive what a recession is and to spot 1 connected the erstwhile president’s record. Now, this much subjective measurement is being utilized to broaden the explanation to support a recession disconnected this president’s record.

Once again, the information of letting governmental interests power supposedly neutral information and subject is plainly obvious.

Leading america into a treatment astir the U.S. user and the anemic authorities of the economy, I work from a Walmart fiscal release, which is important due to the fact that they are the largest retailer successful the satellite by a agelong margin.

“Operating income for the second-quarter and full-year is expected to diminution 13 to 14% and 11 to 13%, respectively.”

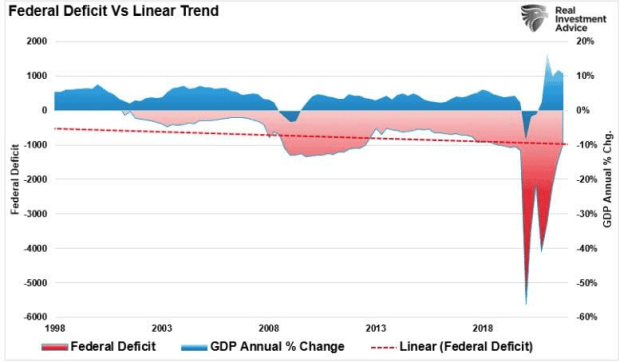

Lance Roberts enactment unneurotic immoderate excellent charts to refute the apparatchiks’ caller enactment line: that determination is nary recession. First is shortage spending. On the podcast, I utilized this illustration to amusement however fiscal spending is not wealth printing, it simply pulls request forward. If it is not sustained, determination is simply a gaping spread of request coming down it.

(Source)

(Source)

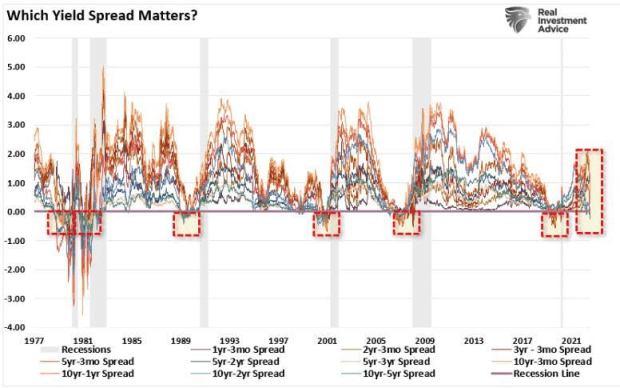

We tin spot the system racing toward this gaping spread successful the output curves. The archetypal illustration beneath goes each the mode backmost to the 1981-1982 recession, showing galore selected output curves. Notice the dependable cascade toward inversion (negative connected the chart) that usually characterizes the march into recession. However, this illustration shows an astir contiguous dive into inversion arsenic if hitting a ceramic wall.

(Source)

(Source)

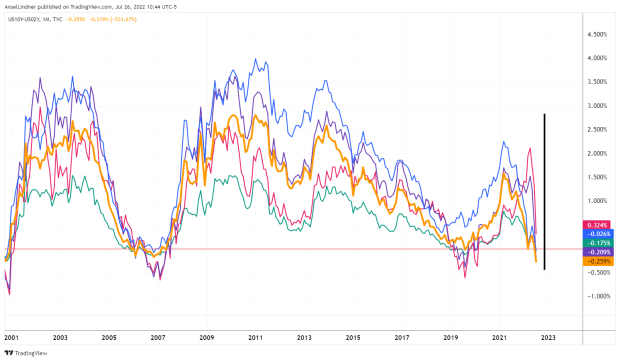

Below is simply a zoomed-in illustration that we looked astatine connected the podcast. I selected a fewer output curves for the 10-year and five-year Treasurys. Again, the abrupt quality of the existent clang is similar hitting a ceramic wall.

(Source)

(Source)

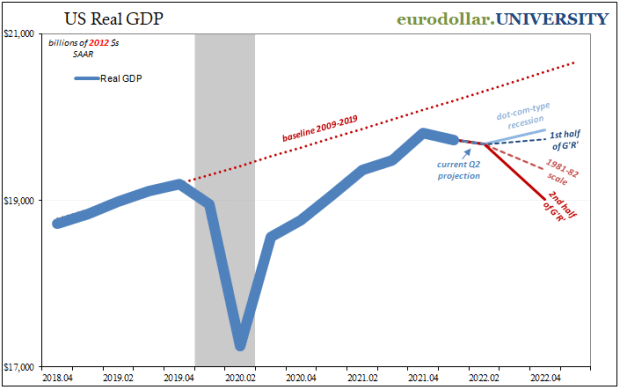

At this constituent successful the podcast, I felt similar I was being a small spot alarmist, and I did conscionable constitute a blog station condemning the “fear hustlers and alarmist pimps,” truthful I utilized the pursuing illustration from Jeff Snider, successful which helium shows we haven’t returned backmost to erstwhile maturation trends and imaginable outcomes of this recession. I expect the result of this recession successful the U.S. to beryllium mostly light, akin to the dot-com-type recession.

Behind each this contention astir the connection “recession,” we are near with the realization that it doesn’t substance anyway. We are going to person a flimsy downturn and instrumentality to the post-Global Financial Crisis mean of debased maturation and debased inflation.

(Source)

(Source)

Bitcoin, The Dollar And Rate Hikes

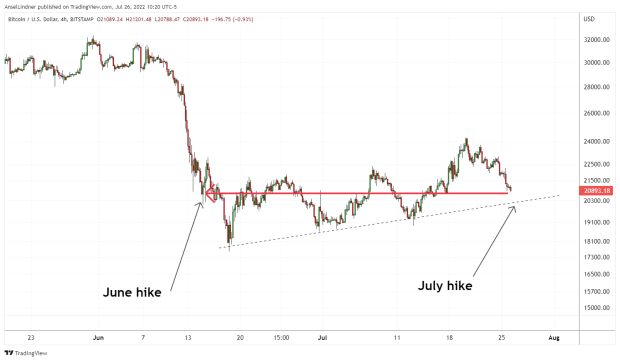

Next, we speech astir bitcoin and complaint hikes. I deliberation it is precise absorbing that, astatine the June 2022 Federal Open Market Committee (FOMC) argumentation announcement of a hike of 75 ground points, bitcoin is astatine precise astir the aforesaid level arsenic today.

To beryllium exact, astatine 2 p.m. ET connected June 15, 2022, the bitcoin terms was $21,505. As I wrote this astatine 11 a.m. ET connected July 27, 2022, the terms was $21,440. Very absorbing that contempt the antagonistic quality astir Bitcoin, and the hawkishness from the Federal Reserve, the bitcoin terms remains highly strong.

(Source)

(Source)

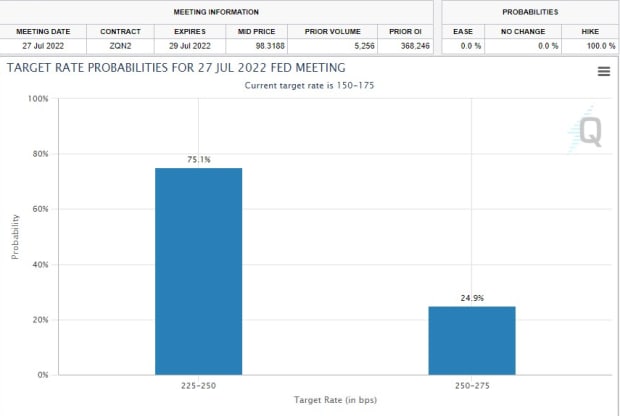

The past representation for this week was the Chicago Mercantile Exchange’s FedWatch Tool (which took our podcast’s name!). At the clip of recording, it was showing a 75% accidental of a 75 bps hike and a 25% accidental of a 100 bps hike.

(Source)

(Source)

That does it for this week. Thanks to the readers and listeners. Don’t hide to cheque retired the Fed Watch Clips channel connected YouTube. If you bask this content, delight subscribe, reappraisal and share!

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)