Bitcoin sunk connected Thursday starring to fears of further downside. Analysts person pinned this connected President Biden's program to modulate the crypto sector.

Samuel Wan • Feb. 18, 2022 astatine 11:30 americium UTC • 2 min read

Samuel Wan • Feb. 18, 2022 astatine 11:30 americium UTC • 2 min read

Thursday saw a renewed diminution for Bitcoin arsenic the starring cryptocurrency plunged to $40,090. A bounce followed, starring to a choky trading scope betwixt $40,300 and $40,900.

Currently, Bitcoin is trading astatine $40,800, down 5% successful the past 24-hours. However, fears are this sell-off could beryllium the commencement of much downside to come.

Bitcoin terms analysis

Bitcoin experienced a 9% plaything to the downside yesterday, having posted a regular precocious of $44,200 successful the aboriginal hours (GMT). The knock-on effect saw a nonaccomplishment of $154 billion from the full crypto marketplace cap.

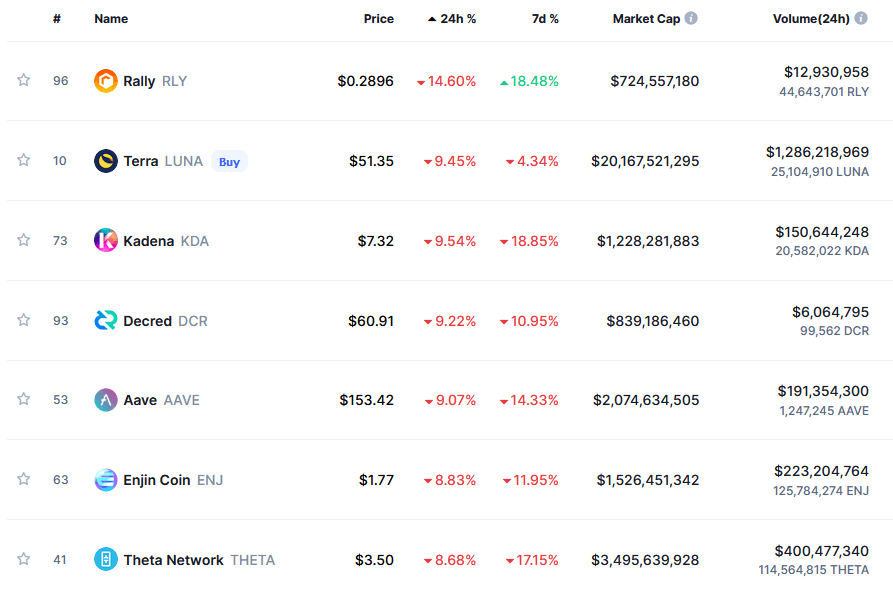

The biggest apical 100 losers implicit the past 24-hours are Rally, down 14.6%, past Terra losing 9.5%, intimately followed by Kadena, besides trading down 9.5%.

Source: CoinMarketCap.com

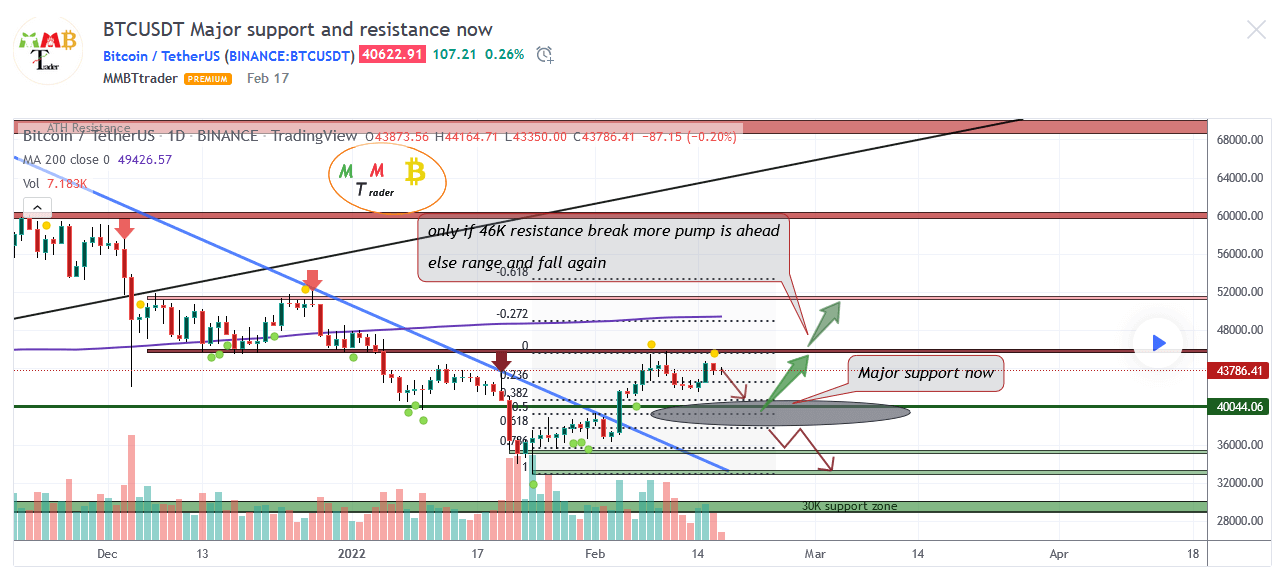

Source: CoinMarketCap.comAnalysis from MMBTtrader connected the marketplace leader, Bitcoin, concludes, arsenic things stand, if large enactment astatine $39,000 – $40,000 holds, the marketplace remains bullish.

Drilling down further, MMBTtrader noted $46,000 was a beardown absorption level, with February 10 seeing a rejection astatine this level.

This latest downtrend takes the marketplace conscionable supra a bearish portion (pictured arsenic a achromatic oval successful the illustration below.) Should Bitcoin participate this zone, MMBTtrader expects further downside, with $35,300 being the adjacent level of support.

Source: TradingView.com

Source: TradingView.com“As we tin spot connected the illustration excessively 46K$ is large absorption for the terms and lone aft a valid breakout to the upside we tin expect much pump present besides 39K-40K is large enactment present and if this enactment remains valid marketplace remains bullish.”

What’s down this?

According to The Motley Fool, this sell-off is attributed to the uncertainty of pending, much onerous U.S regulations.

“The White House appears acceptable to propulsion for regularisation connected the cryptocurrency manufacture and that uncertainty unsocial is spooking investors.”

The latest reports connected this substance authorities President Biden volition contented an enforcement bid adjacent week calling U.S authorities agencies to formulate a nationalist strategy successful respect of regulating cryptocurrencies.

This would besides impact studying cardinal slope integer currencies, including a method valuation connected the applicable implementation of a integer dollar.

The Motley Fool nonfiction concludes by saying though the marketplace has reacted pessimistically, long-term, a nationalist model is simply a affirmative improvement that volition bring wide guidelines connected conducting crypto business.

However, astatine the aforesaid time, it’s unclear whether the existent medication is pro-crypto. Based connected caller dealings, it’s assumed not.

“Companies and investors person been trying to get Congress and regulators to constitute favorable rules for years, but they’ve been warring an uphill conflict truthful far.“

The worst-case script would beryllium a nationalist model that hampers integer currencies, taking distant immoderate benefits of investing successful them.

For now, we await further news.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)