In a broad analysis shared via X (formerly Twitter), Alex Thorn, the Head of Firmwide Research astatine Galaxy, delved into the intricacies of the existent Bitcoin marketplace cycle, answering the question “Where Are We In This Bitcoin Cycle?” As Bitcoin trades robustly astir $62,000, with a notable spike to $64.000 yesterday, the crypto scenery is witnessing unprecedented dynamics, marked by a surge successful ETF inflows, strategical acquisitions by firm entities, and a palpable displacement successful capitalist sentiment towards integer assets.

Thorn emphasized however antithetic this rhythm is:

Effectively, the bull runs of 2017 and 2020 hadn’t yet begun astatine this signifier successful Bitcoin’s proviso schedule.

52 days earlier 2nd Halving (9-JUL-16) BTCUSD $455.22 (-59.86% from ATH)

52 days earlier 3rd Halving (11-MAY-20) BTCUSD $6,174 (-68.56% from ATH)

52 days earlier 4th Halving (20-APR-24) BTCUSD $59,330 (-12.16% from ATH)

Why This Bitcoin Cycle Is Different

Central to his investigation is the record-breaking influx of superior into spot Bitcoin ETFs, with Thorn highlighting, “The BTC ETFs took successful a whopping nett $576m of BTC yesterday (Tuesday Feb. 27), with BlackRock unsocial seeing $520m of inflows, its largest ever day.” This important question of funds not lone underscores the increasing organization involvement successful Bitcoin but besides marks a pivotal infinitesimal successful the cryptocurrency’s travel towards mainstream fiscal recognition.

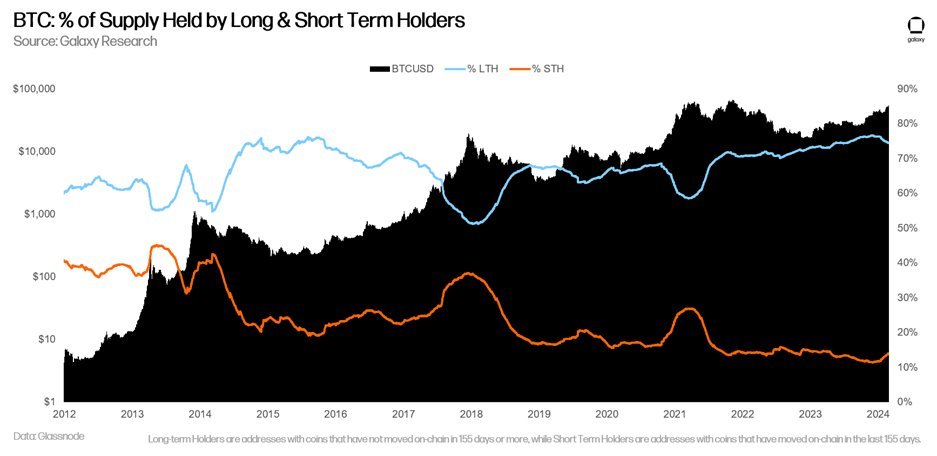

A cardinal facet of Thorn’s investigation is the unwavering spot of Bitcoin’s long-term holder base, which helium estimates to clasp astir 75% of the full BTC supply. “Long-term holders are inactive mostly holding strong,” Thorn notes, emphasizing the community’s resilience and religion successful Bitcoin’s semipermanent worth proposition. This demographic, characterized by their ‘diamond hands’, plays a important relation successful stabilizing the marketplace and buffering against the volatility that often defines the crypto space.

Bitcoin: % of proviso held by HODLers | Source: X @intangiblecoins

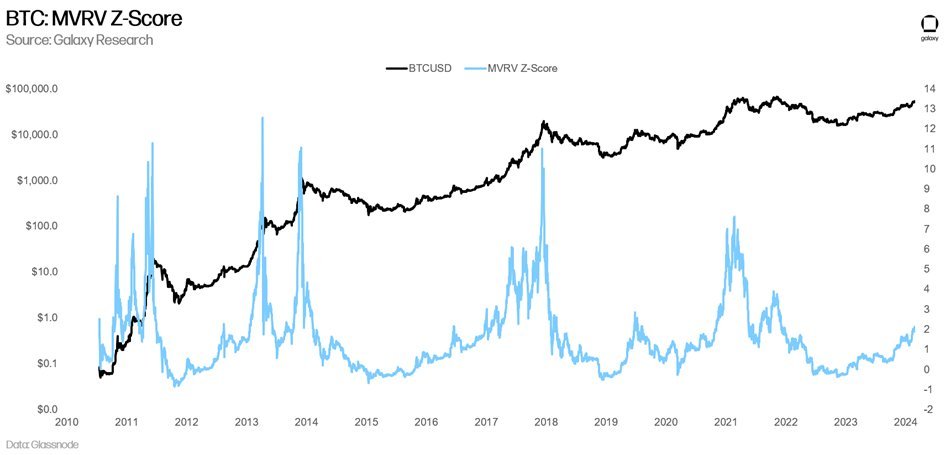

Bitcoin: % of proviso held by HODLers | Source: X @intangiblecoinsThorn further elaborates connected the analytical tools and metrics that supply penetration into Bitcoin’s marketplace behavior. He introduces the MVRV Z-Score, a caller attack to knowing the cyclicality of Bitcoin’s terms enactment by comparing its marketplace worth to its realized value. This metric offers a model into the perceived overvaluation oregon undervaluation of Bitcoin astatine immoderate fixed point. Currently, the MVRV Z-Score is adjacent to 2, portion erstwhile rhythm tops saw the metric spike to 8 (in 2021) oregon adjacent supra 12 (in anterior halving cycles).

Bitcoin MVRV Z-Score | Source: X @intangiblecoins

Bitcoin MVRV Z-Score | Source: X @intangiblecoinsAddressing the speculation astir the acceleration of the Bitcoin cycle, Thorn firmly dispels concerns that the marketplace is prematurely peaking. He argues against the conception that we are “speedrunning the ‘cycle'”, alternatively asserting that the advent of Bitcoin ETFs successful the United States represents a transformative displacement with far-reaching implications. “This clip is different,” Thorn asserts, pointing to the ETFs’ disruption of accepted Bitcoin terms cycles and their interaction connected capitalist behaviour and intra-crypto dynamics.

The Spot Bitcoin ETF Effect

Thorn underscored the transformative interaction of Bitcoin ETFs, positing that we are simply astatine the opening of a important displacement successful however Bitcoin is accessed and invested in, peculiarly by the organization sector. “Despite unthinkable volumes and flows, there’s plentifulness of crushed to judge that the Bitcoin ETF communicative is inactive conscionable getting started,” helium stated, pointing to the untapped imaginable wrong the wealthiness absorption sector.

In their October 2023 study titled “Sizing the Market for the Bitcoin ETF,” Galaxy laid retired a compelling lawsuit for the aboriginal maturation of Bitcoin ETFs. The study highlights that wealthiness managers and fiscal advisors correspond the superior nett caller accessible marketplace for these vehicles, offering a antecedently unavailable avenue for allocating lawsuit superior to BTC exposure.

The magnitude of this untapped marketplace is substantial. According to Galaxy’s research, determination is astir $40 trillion of assets nether absorption (AUM) crossed banks and broker/dealers that has yet to activate entree to spot BTC ETFs. This includes $27.1 trillion managed by broker-dealers, $11.9 trillion by banks, and $9.3 trillion by registered concern advisors, cumulating to a full US Wealth Management AUM of $48.3 trillion arsenic of October 2023. This information underscores the immense imaginable for Bitcoin ETFs to penetrate deeper into the fiscal ecosystem, catalyzing a caller question of concern flows into Bitcoin.

Thorn further speculated connected the upcoming April circular of post-ETF-launch 13F filings, suggesting that these filings mightiness uncover important Bitcoin allocations by immoderate of the largest names successful the concern world. “In April, we volition besides get the archetypal circular of post-ETF-launch 13F filings, and (I’m conscionable guessing here…) we are apt to spot immoderate immense names person allocated to Bitcoin,” Thorn anticipated. This development, helium argues, could make a feedback loop wherever caller platforms and investments thrust higher prices, which successful crook attracts much investment.

The implications of this feedback loop are profound. As much wealthiness absorption platforms statesman to connection entree to Bitcoin ETFs, the influx of caller superior could importantly interaction BTC’s terms dynamics, liquidity, and wide marketplace structure. This modulation represents a cardinal infinitesimal successful the maturation of Bitcoin arsenic an plus class, moving from a speculative concern to a staple successful diversified portfolios managed by fiscal advisors and wealthiness managers.

We Are Still Early

Thorn’s optimism extends beyond the contiguous marketplace indicators to the broader implications of Bitcoin’s integration into the fiscal mainstream. He anticipates a caller all-time precocious for Bitcoin successful the adjacent term, fueled by a operation of factors including the ETFs’ momentum, expanding acceptance of BTC arsenic a morganatic plus class, and the anticipatory buzz surrounding the upcoming halving event. “All this is to say, my reply to that burning question – wherever are we successful the cycle? – is that we haven’t adjacent begun to scope the heights this is apt to go,” helium concludes.

Thorn’s investigation culminates successful a bullish forecast for Bitcoin. As the assemblage stands connected the cusp of the 4th BTC halving, Thorn’s insights connection a compelling imaginativeness of a marketplace poised for unprecedented growth, driven by a confluence of technological innovation, regulatory evolution, and shifting planetary economical currents. “Bitcoin is premier clip now, and portion it mightiness beryllium hard to believe, things are conscionable starting to get exciting,” Thorn declares, capturing the essence of a marketplace astatine the threshold of a caller era.

At property time, BTC traded astatine $62,065.

BTC price, 1-week illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-week illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)