The U.S. Securities and Exchange Commission’s support of in-kind creations and redemptions for spot Bitcoin and Ethereum exchange-traded funds connected July 29 has altered however authorized participants interact with these products, permitting nonstop transfers of integer assets alternatively than cash.

This structural alteration is expected to trim tracking mistake and bid-ask spreads, bringing the operational exemplary person to commodity ETFs and perchance broadening the capitalist base.

The timing aligns with Ethereum’s Pectra upgrade, which went unrecorded connected May 7 astatine epoch 364032 and introduced EIP-7702 astute accounts and EIP-7251’s summation of the validator effectual equilibrium bounds to 2,048 ETH. These changes purpose to streamline wallet interactions and grow validator capacity, enabling caller usage cases for some idiosyncratic users and large-scale staking operations.

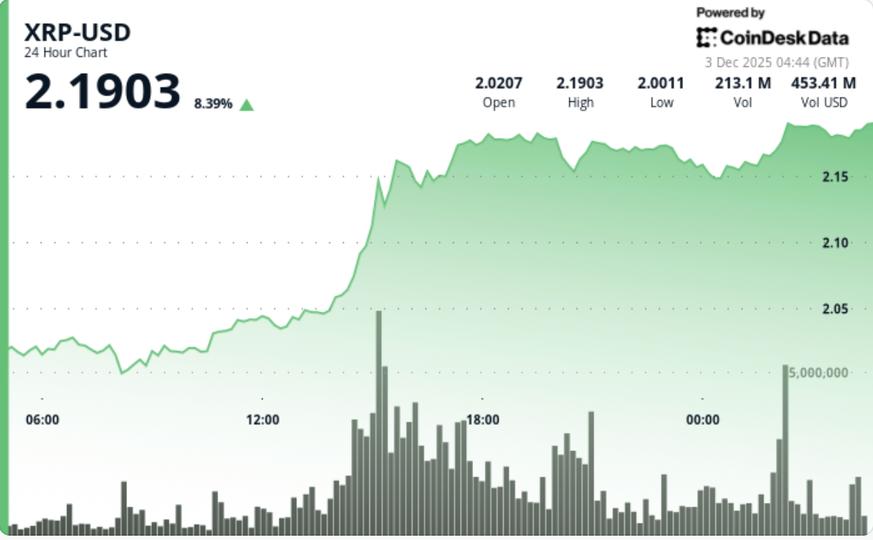

Spot Ethereum ETFs successful the U.S. recorded nett inflows of astir $5.39 cardinal successful July, according to SoSoValue data. This lifted cumulative inflows to astir $9.7 cardinal and an AUM of $19 cardinal since launch. The streak of regular inflows ended connected August 1 with a nett outflow of astir $152 million, a single-day reversal that remains wrong the scope observed successful the aboriginal adoption signifier of akin products.

By comparison, spot Bitcoin ETFs proceed to gully larger nett flows, with nationalist dashboards from Farside Investors and SoSoValue showing year-to-date inflows that supply a notation constituent for modeling Ethereum’s imaginable trajectory. If Ethereum captures 30 to 40% of Bitcoin’s YTD inflow pace, the resulting superior allocation could beryllium capable to determination prices toward the $5,000 to $6,000 scope based connected humanities terms elasticity.

Bitcoin / Ethereum ETF ratio

At existent marketplace levels, with Bitcoin trading adjacent $121,684 and Ethereum astatine astir $4,280, an Ethereum terms of $5,000 would rise the ETH/BTC ratio to astir 0.041, portion $6,000 would assistance it to astir 0.049. These ratios stay beneath peaks reached successful anterior marketplace cycles, leaving scope for comparative show shifts if superior rotation occurs.

The derivatives marketplace is positioned to accommodate specified moves, with Ethereum futures unfastened involvement surpassing $30 cardinal successful May and options enactment remaining elevated into the 3rd quarter, providing liquidity for some hedging and directional strategies linked to spot ETF flows.

Pectra’s astute relationship functionality allows transactions to beryllium executed with greater flexibility, integrating features similar transaction batching and meta-transactions, which tin heighten idiosyncratic acquisition for some retail and organization participants.

The higher validator equilibrium headdress enables much businesslike superior deployment for ample operators, perchance consolidating validator infrastructure but besides improving staking economics for entities moving high-capacity nodes.

As the post-upgrade web adapts, these protocol-level enhancements intersect with improvements to the ETF marketplace structure, creating conditions wherever superior inflows tin construe much straight into on-chain activity.

Institutional allocation behaviour volition stay a captious origin successful the coming months. The operation of little operational friction successful ETF trading and protocol upgrades that enactment scaling whitethorn gully caller categories of investors who necessitate some businesslike marketplace entree and network-level capacity.

Monitoring the ratio of Ethereum to Bitcoin inflows, shifts successful ETH/BTC, and on-chain staking trends volition beryllium indispensable successful assessing whether the conditions for the projected terms scope materialize.

The operation of ETF plumbing changes and protocol improvement has acceptable the parameters for the adjacent signifier of Ethereum’s marketplace performance.

| $121,684 | 0.0411 | 0.0452 | 0.0493 |

| $130,000 | 0.0385 | 0.0423 | 0.0462 |

| $140,000 | 0.0357 | 0.0393 | 0.0429 |

The station Why $5.4 cardinal successful July inflows could substance Ethereum’s biggest rally yet toward $6k appeared archetypal connected CryptoSlate.

3 months ago

3 months ago

English (US)

English (US)