Bitcoin has traded betwixt $30,000 and $50,000 from the commencement of 2022 to date. During that time, the mining manufacture has grown by leaps and bounds, arsenic evidenced by steadily expanding difficulty and good over 200 exahashes (EH) of full computing power. But careless of terms and different metrics, caller blocks and their rewards support coming astatine a gait of astir 900 caller bitcoin mined per time with the existent 6.25 BTC subsidy per block.

So, what are miners doing with their coins amid choppy terms movements and dependable hash complaint growth? For the astir part, they’re inactive holding.

Here’s an overview of the latest miner equilibrium information and trends.

Understanding Mining Data

The bitcoin holdings secured by mining entities are an often-discussed talking constituent connected societal media and by cryptocurrency quality media. Despite predominant misrepresentations astir miners crashing the terms — a taxable to debunk different clip — miner holdings are seldom breached down into their due categories.

Zero-hop and one-hop addresses correspond 2 chiseled groups of mining-related addresses. The archetypal radical consists of addresses that person been straight sent the mining subsidy and transaction fees from a fixed artifact reward — these are the mining entities that person the reward. Sometimes this radical includes self-miners that earned the reward themselves. Other times it represents pools oregon joint-venture mining operations that are obligated to disperse immoderate oregon each of the mining reward to different parties. One-hop addresses are represented by this 2nd radical because, arsenic the sanction implies, their funds are 1 transaction (or hop) distant from the archetypal entity that received the artifact reward.

Differentiating this information is important due to the fact that it clarifies however on-chain behaviour appears versus what mightiness beryllium really happening since some types of code owners bash not stock eventual ownership implicit the aforesaid coins, nor bash spends from their addresses bespeak the aforesaid benignant of behavior. For example, a zero-hop code sending bitcoin to different code could beryllium interpreted arsenic spending oregon selling, erstwhile likelihood are bully that the mining entity is simply transferring payouts to a excavation miner oregon task partner.

Miner Balance Data

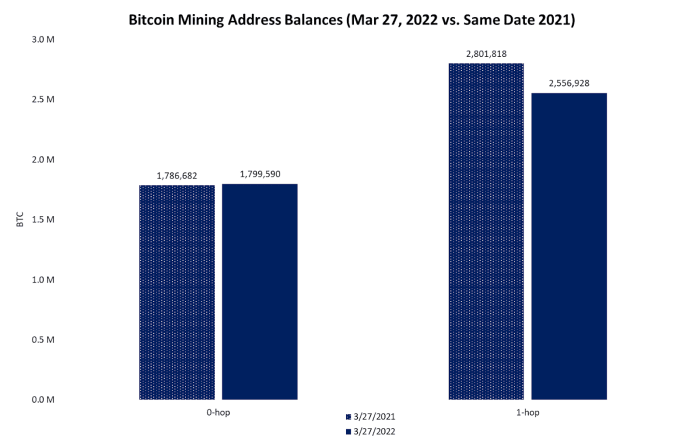

At the clip of writing, on-chain data shows zero-hop addresses holding a full of 1,799,590 BTC and one-hop addresses holding 2,556,928 BTC.

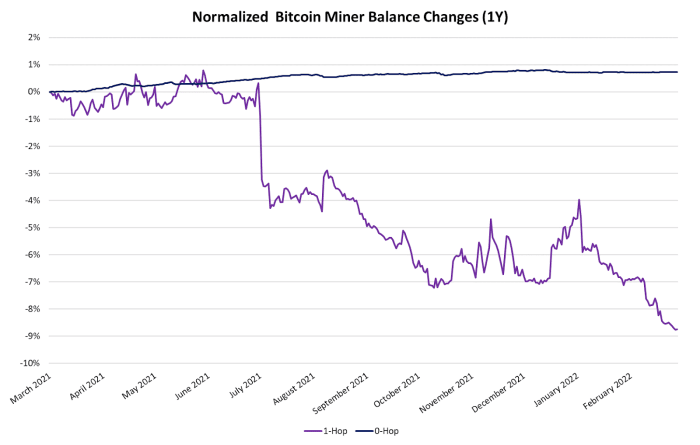

Zero-hop balances person seen an aggregate equilibrium summation of astir 1% implicit the past 12 months. But portion these mining entities are dilatory increasing their holdings, one-hop addresses person been gradually shedding theirs. One-hop addresses saw an aggregate equilibrium alteration of 8% implicit the aforesaid period.

The illustration beneath shows full balances for zero-hop and one-hop addresses from the clip of penning and the aforesaid day 1 twelvemonth prior.

In short, mining entities inactive clasp monolithic amounts of bitcoin, and determination is nary large-scale selling going on, nor has determination been for rather immoderate time. But immoderate miners are gradually selling tiny amounts of bitcoin, apt to hedge vulnerability to terms volatility, to money enlargement efforts oregon different reasons.

But arsenic with each on-chain information analysis, connecting real-world entities to on-chain addresses is ne'er done with implicit certainty. All on-chain information — particularly information sets that purpose to link on-chain addresses with real-world entities — should beryllium interpreted wrong a model of knowing the information is created connected a champion effort and tenable estimation basis.

Adding further discourse to humanities miner holdings data, the illustration beneath visualizes the percent changes successful balances connected zero-hop and one-hop addresses implicit the past 12 months. Put broadside by broadside successful the aforesaid chart, the percent quality is much apparent. But contempt the one-hop equilibrium decrease, this conception of mining entities inactive holds good implicit 2.5 cardinal BTC.

Despite a one-hop equilibrium decrease, this conception of mining entities inactive holds good implicit 2.5 cardinal BTC.

Why Miner Holdings Matter

The information is that not overmuch robust marketplace investigation tin beryllium derived from analyzing miner balances unless thing is incorrect and miners commencement selling en masse. Miners clasp and merchantability disconnected and connected done each benignant of marketplace each twelvemonth long, but their corporate effect connected the terms question of bitcoin is negligible. Consider that, connected average, miners volition gain 900 BTC each time for solving an mean of 144 blocks each 24 hours. At the clip of writing, this magnitude would person a marketplace worth of astir $42 million. FTX, presently the third-largest speech by 24-hour volume, reports $2.4 billion successful regular volume. Even if each satoshi of those regular rewards were sold instantly, the full effect connected the marketplace terms would beryllium hardly noticeable.

Continued accumulation by miners is ever a steadfast signal, however. Mild selling is to beryllium expected arsenic miners grow their operations and instrumentality immoderate profits from their holdings. But miner balances is important information to observe if thing goes incorrect with the market. Given each of the infrastructure costs and operational expenses that miners incur, they are 1 of the astir heavily-leveraged bullish entities successful the full Bitcoin industry. As such, seeing dependable levels of holdings with occasional insignificant fluctuations is good. But if miners, fixed their concern successful the manufacture and infrastructure, commencement selling en masse, thing is astir apt earnestly incorrect with Bitcoin.

Miners that proceed to clasp and accumulate, however, tin marque each different benignant of capitalist consciousness a small safer and a spot much bullish too, adjacent if the terms isn’t trading astatine all-time highs.

Miners Must Be Bullish

Mining is the mechanics for introducing caller proviso to the Bitcoin market, and fixed the important superior and operational expenses incurred by miners, often turning implicit their inventory (i.e., selling bitcoin) is common. Foundry’s Senior Vice President Kevin Zhang, for example, posted connected Twitter astir how, successful 2014, the mining operations helium managed would merchantability 2,000 BTC per period to screen costs.

But contempt this required selling, miners are besides habitual semipermanent holders. And immoderate downward fluctuations successful their aggregate holdings are usually, well, minor. After all, if miners weren’t bullish, it’d beryllium hard for anyone other to be.

This is simply a impermanent station by Zack Voell. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)