In an escalation of planetary economical friction, President Trump’s imposed tariffs person roiled fiscal markets this week, cutting crossed some equities, Bitcoin and cryptocurrencies. Yet a caller memo from Bitwise Asset Management suggests that these headwinds mightiness yet propel Bitcoin to caller heights—regardless of whether Trump’s strategy succeeds oregon fails.

At the opening of the week, the crypto marketplace witnessed a terrible sell-off. Bitcoin declined by astir 5%, portion Ethereum and XRP suffered adjacent sharper losses—17% and 18%, respectively. The contiguous catalyst was Trump’s imposition of a 25% tariff connected astir imports from Canada and Mexico, arsenic good arsenic a 10% tariff connected China. In retaliation, those trading partners announced countermeasures of their own.

The US dollar reacted by jumping much than 1% against large currencies. That, combined with lingering play illiquidity successful crypto markets, triggered a question of forced liquidations arsenic leveraged traders sold into the downdraft. According to Bitwise Chief Investment Officer Matt Hougan, arsenic overmuch arsenic $10 cardinal successful leveraged positions was wiped retired successful what helium described arsenic “the largest liquidation lawsuit successful crypto’s history.”

Despite the melodramatic terms action, Bitwise’s Head of Alpha Strategies, Jeffrey Park, remains optimistic astir Bitcoin’s trajectory. He points to 2 guiding ideas that signifier his bullish thesis: the ‘Triffin Dilemma’ and President Trump’s broader purpose to restructure America’s commercialized dynamics.

The Triffin Dilemma highlights the struggle betwixt a currency serving arsenic a planetary reserve—generating accordant request and overvaluation—and the request to tally persistent commercialized deficits to proviso capable currency abroad. While this presumption allows the US to get cheaply, it besides puts sustained unit connected home manufacturing and exports.

“Trump wants to get escaped of the negatives, but support the positives,” Park explains, suggesting that tariffs whitethorn beryllium a negotiating instrumentality to compel different nations to the table—reminiscent of the 1985 Plaza Accord, which devalued the dollar successful coordination with different large economies.

The Two Scenarios: Bitcoin Wins, Fiat Loses

Park argues that Bitcoin stands to payment nether 2 chiseled outcomes of Trump’s existent commercialized policy:

Scenario 1: Trump Succeeds successful Weakening the Dollar (While Keeping Rates Low)

If Trump tin maneuver a multilateral agreement—akin to a ‘Plaza Accord 2.0’—to trim the dollar’s overvaluation without boosting semipermanent involvement rates, hazard appetite among US investors could surge. In this environment, a non-sovereign plus similar Bitcoin, escaped from superior controls and dilution, would apt pull further inflows. Meanwhile, different nations grappling with the fallout of a weaker dollar mightiness deploy fiscal and monetary stimulus to enactment their economies, perchance driving adjacent much superior toward alternate assets similar Bitcoin.

“If Trump tin bully his mode into the position, there’s nary plus amended positioned than bitcoin. Lower rates volition spark the hazard appetite of US investors, sending prices high. Abroad, countries volition look weakened economies, and volition crook to classical economical stimulus to compensate, starring again to higher bitcoin prices,” Park argues.

Scenario 2: A Prolonged Trade War And Massive Money Printing

If Trump fails to unafraid a broad-based woody and the commercialized warfare grinds on, planetary economical weakness would astir surely invitation extended monetary stimulus from cardinal banks. Historically, specified large-scale liquidity injections person been bullish for Bitcoin, arsenic investors question deflationary and decentralized assets insulated from cardinal slope policies

“And what if helium fails? What if, instead, we get a sustained tariff war? Our high-conviction presumption is the resulting economical weakness volition pb to wealth printing connected a standard larger than we’ve ever seen. And historically, specified stimulus has been extraordinarily bully for bitcoin,” Park says..

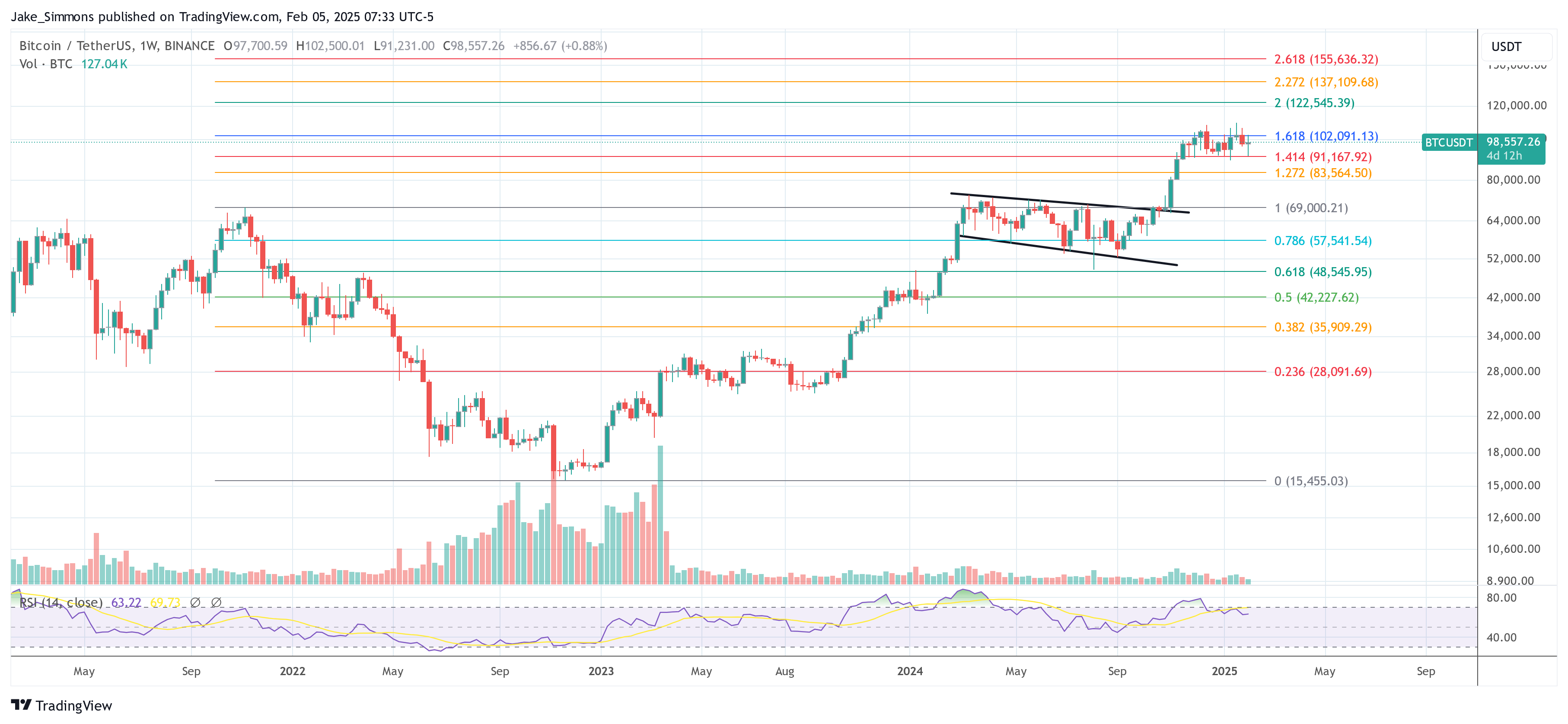

At property time, BTC traded astatine $98,557.

BTC price, 1-week illustration | Source: BTCUSDT connected Tradingview.com

BTC price, 1-week illustration | Source: BTCUSDT connected Tradingview.comFeatured representation created with DALL.E, illustration from TradingView.com

10 months ago

10 months ago

English (US)

English (US)